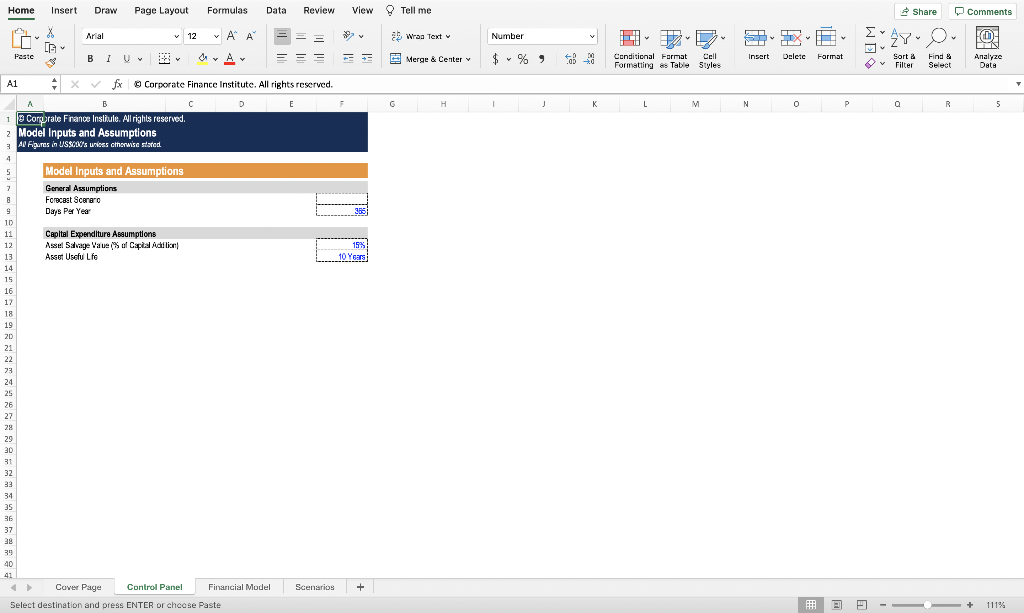

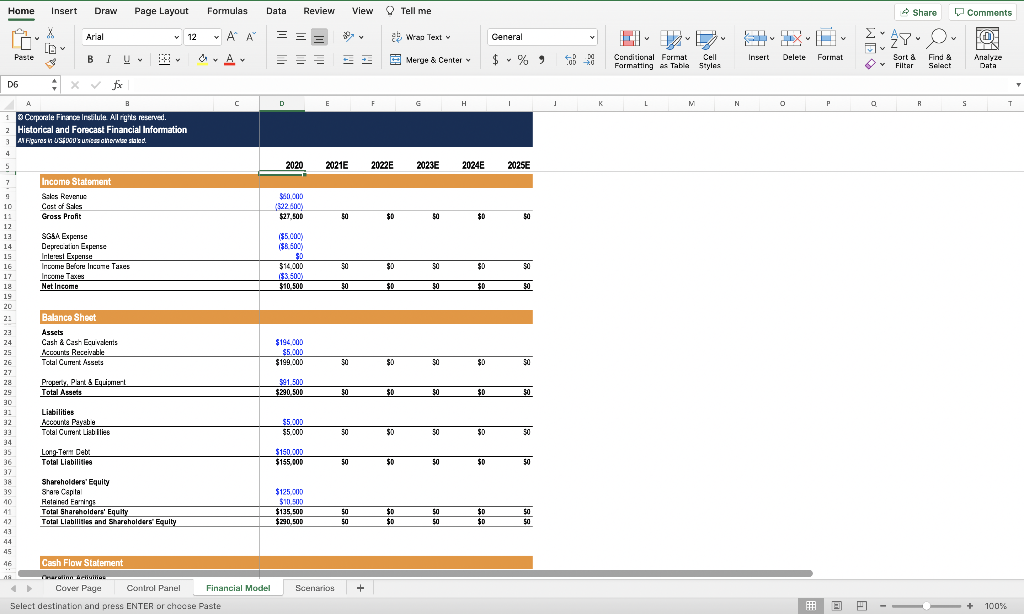

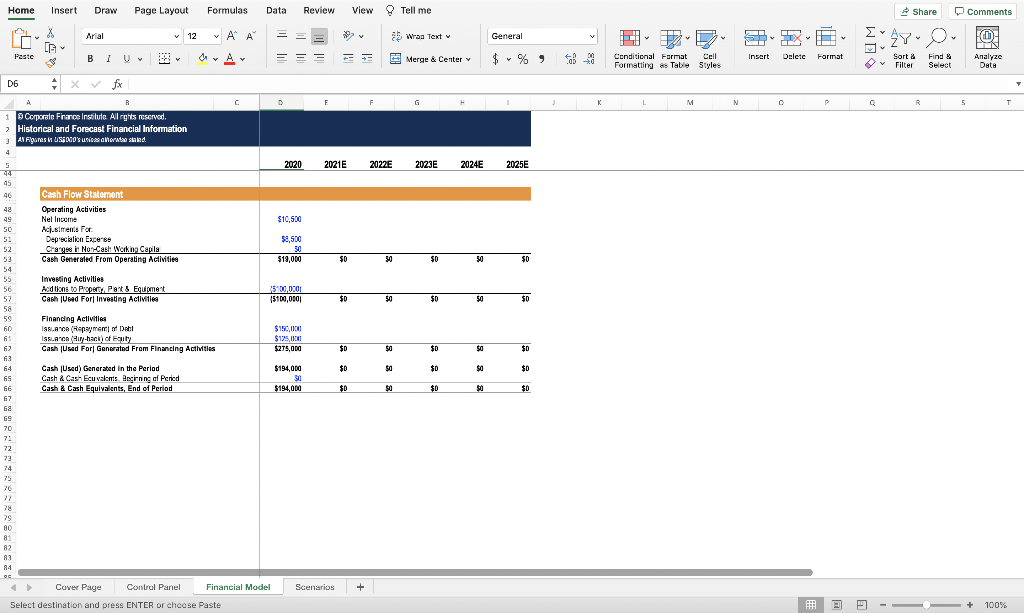

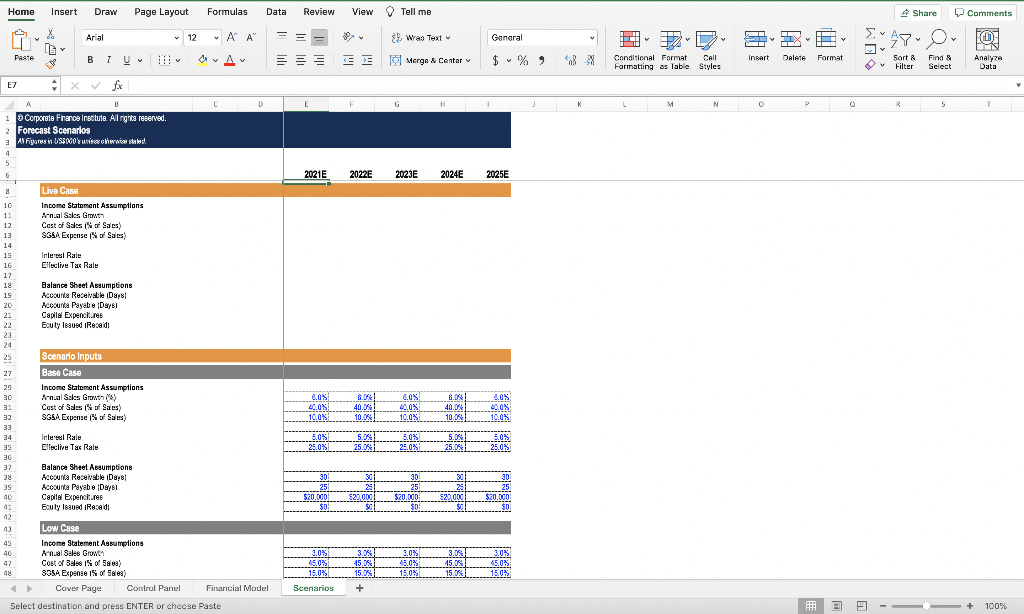

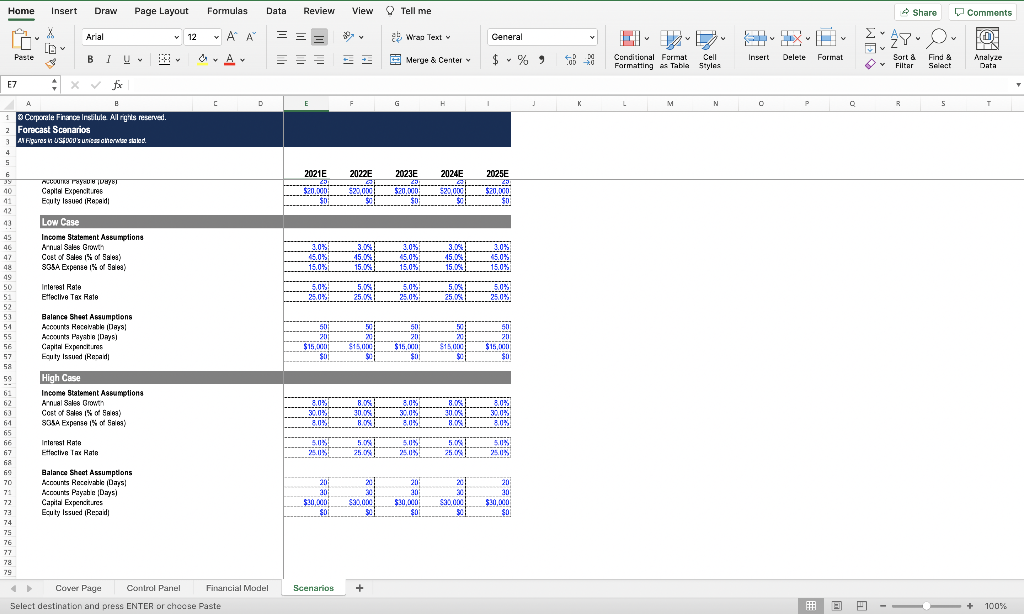

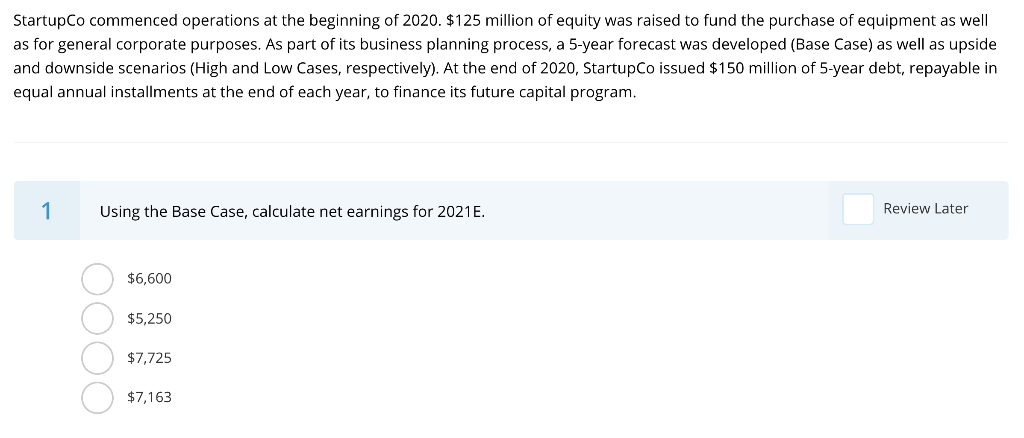

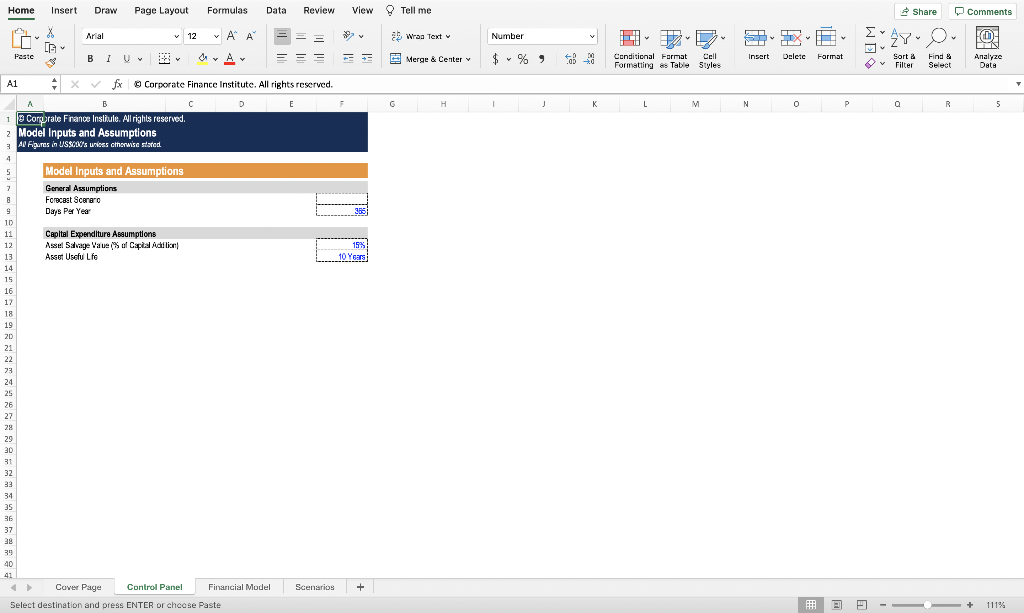

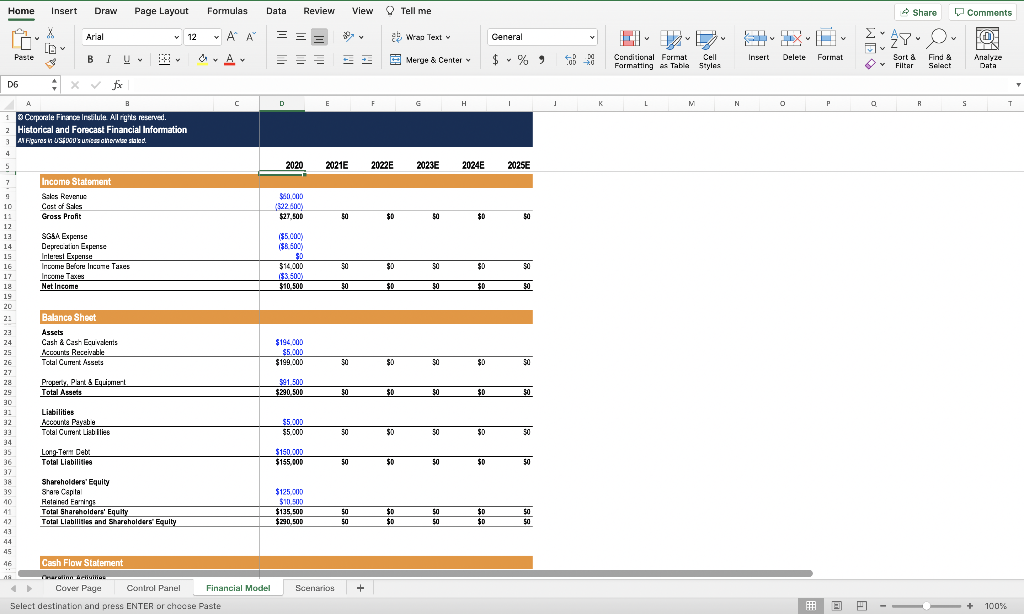

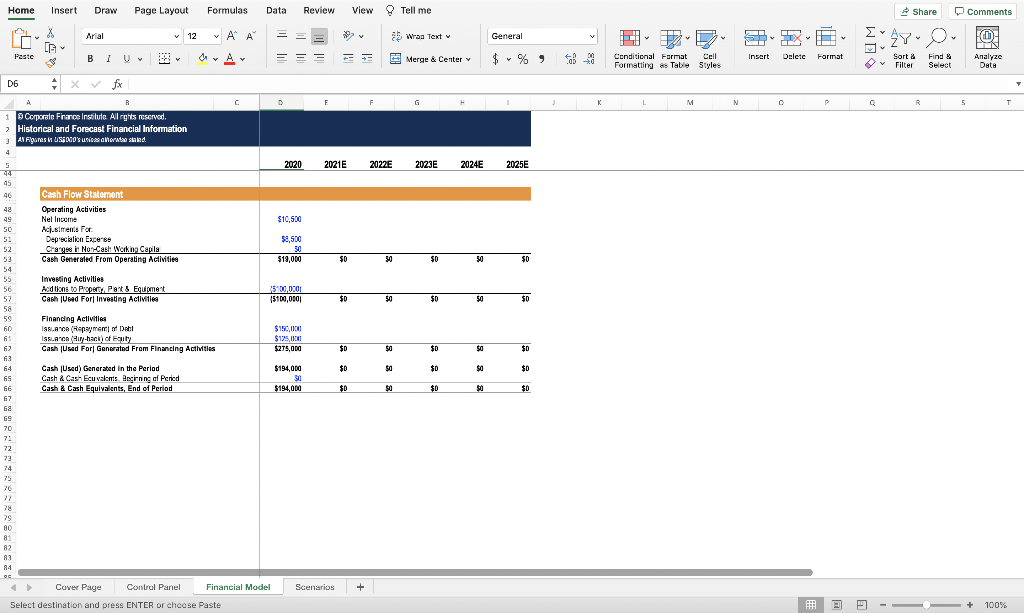

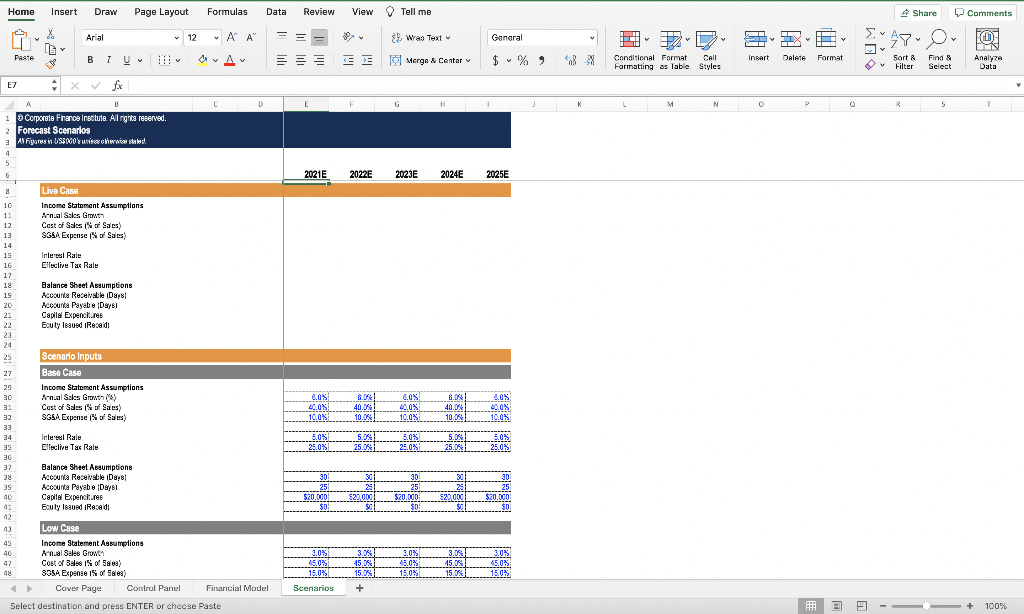

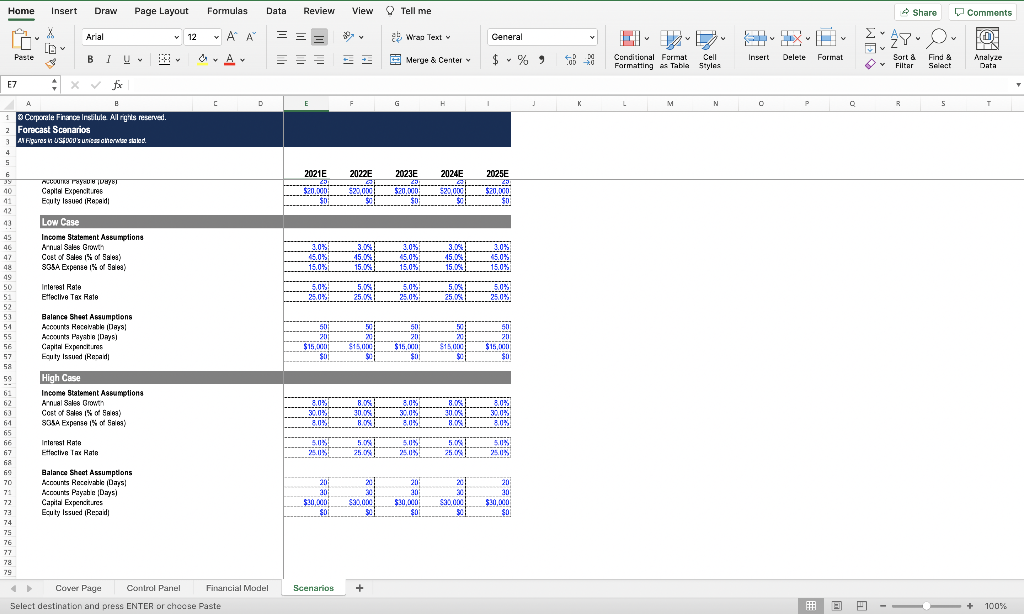

Startup Co commenced operations at the beginning of 2020. $125 million of equity was raised to fund the purchase of equipment as well as for general corporate purposes. As part of its business planning process, a 5-year forecast was developed (Base Case) as well as upside and downside scenarios (High and Low Cases, respectively). At the end of 2020, StartupCo issued $150 million of 5-year debt, repayable in equal annual installments at the end of each year, to finance its future capital program. 1 Using the Base Case, calculate net earnings for 2021E. Review Later $6,600 $5,250 $7,725 $7,163 Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments Arial v 12 Wran Text Number X CG SIX Who @ his Analyze Data Peste B 1 Uv 0A Merge & Center Y $% % Insert Format Delete Conditional Format Cell Formatting Table Styles Sort & Filter Find Select G H K L M N O P 0 R 5 A1 Xfx Corporate Finance Institute. All rights reserved. A C E 1 Corporate Finance Instiule. All rights reserved. 2 Model Inputs and Assumptions 3 Al figures in USSCs unless otherwise stated 4 5 Model Inputs and Assumptions 7 General Assumptions 8 Forecast Scorers 9 Days Per Year 365 10 11 Capital Expenditure Assumptions 12 Assel Salvage Varun (% af Capial Adilian 15% 13 Asset Useful Life 10 Years 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 39 399 40 41 Cover Page Control Panel Financial Model Scenarios + Select destination and press ENTER or choose Paste EP + 111% Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments X Arial 12 = ~ AR Wras Text Ceneral We Or FO Peste BIU $% Insert Merge & Center Format Delete Conditional Format Cell Formatting Table Styles Sort & Filter Analyze v Find & Salact Data DG x x B D E F G H K L M N P O R S T 1 Corporate Finance Instilule. All rights reserved. 2 Historical and Forecast Financial Information 3 All Figures in USOS Wiesbaked 4 5 2020 2021E 2022E 2023E 2024E 2025E Income Statement Sales Resore Cast of Sales Gross Profit $60.000 ($2260 $27,500 30 $D 50 $D $0 7 9 10 11 12 13 14 15 16 17 18 19 20 2: SGSA Expense Deprecation Experise Interest Expense Inome Before lume Income Tax Net Income ($5.COM ($8.60) D $14.000 ($3.500) 310.500 30 $D 30 $D 30 SD 30 $D 30 Balance Sheet Assets Cash & Cash Ecu valents Accounts Receivable Total Current Assets $194.000 $5.000 $199.000 $D 30 $ 30 Propery, Part & Eymer Total Assets 991.500 $290.500 30 $0 w $0 30 Liabilities Accounts Payab Total Current Liabilies $5.000 $5.000 50 $0 30 $D 30 23 24 25 26 27 28 25 30 32 32 33 34 35 36 37 38 35 10 41 42 43 44 45 46 Long-Term Deb: Total Liabilities $150.000 $155.000 50 $0 50 $D 0 Shareholders' Equity SA Capta Heland Fans Total Shareholders' Equity Total Liabilities and Shareholders' Equity $125.000 $10 900 $135,500 $20.500 50 50 $D 0 $D 50 50 $0 $D $D 50 50 Cash Flow Statement Carolina Bellules Cover Page Control Panel Financial Model Scenarios + Select destination and press ENTER or choose Paste E) PD + 100% Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments Arial v 12 v Wraa Text General STX FO X CG Paste B 1 Uv DAY E Insert Y E Merge & Center $ %, Delete Format Conditional Format Cell Formatting es Table Styles Sort & Filter Find Select Analyze Data y D6 xfx B c E F G x L M N P R 5 T 1 Corporate Finance Institute All rights reserved. 2 Historical and Forecast Financial Information 3 All Figures MUSANO's sed. 2020 2021E 2022E 2023E 2024E 2025E 5 44 95 46 $10,500 48 49 50 52 52 Cash Flow Statement Operating Activities Nel Income Acilmente for Depreciation Expe's Changes in Non-Cash Working Capila Cash Generated From Operating Activities $8.500 $19,00 $0 $0 50 $0 54 55 56 57 58 55 Investing Activities Add tions to Properti Pent & Equipment Cash Used Fori Investing Activities 15100,000 15100,000 $D 50 $D 50 $0 Financing Activities IS.ACR (Repayment of Debt ISS.OR (Hry.hack) of Euty Cash Used For Generated From Financing Activities $150,000 $125,000 $275,000 $D $0 $0 $0 $0 $194,000 $0 $0 $0 99 $0 Cash (Used) Generated in the Period Cash & Cash Ecu valmis. Beginning of Period Cash & Cash Equivalents, End of Period $194,000 $0 $0 $0 $0 $0 6 62 63 64 65 66 67 68 GS 70 7: 72 73 74 26 27 78 79 BO 81 82 83 84 OC Cover Page Control Panel Financial Model Scenarios + Select destination and press ENTER or choose Paste Am E --+ 100% Insert Draw Page Layout Home - Formulas Data Review View Tell me Share Comments Arial V 12 ~ A A O 9. Was Text Ganeral v FO O. um Y Paste 1 Uw B OVA Insert DALAT Merge Center Format Conditional Format Call Formatting as Table Styles Sort & Filter Analyze Find & Select Data E7 G M N R S D 1 Corporate Finance Institute. All rights reserved. 2 Forecast Scenarios 3 AN Fiyonas w USANO Www 4 5 2021E 2022E 2023E 2024E 2025E 2 a Live Case 10 Income Statement Assumptions 10 Anal Sales Growth 12 Cast of Sales Sales) 13 SGSA Expense of Sales 14 15 Interest Rate 16 Ellective Tax Rale 17 18 Balance Sheet Assumptions 19 Accounts Receivable Day! 20 Accounts Payabe Deysi 23 Capital Expenditures 22 Euty Issued Resad 23 24 25 Scenario Inputs 27 Base Case 25 Income Statement Assumptions 30 Anal Sales Growth ) 31 Cast of Sales of Sales) 32 SGSA Expense Sales 33 34 Inleres Rule 35 Elfective Tax Rale 36 37 Balance Sheet Assumptions Accounts Receivable 1088 39 Accounts Payabo Duro 40 Capital Expenci.res 4: Euty Issued Reed 12 43 Low Case Income Statement Assumptions 40 Anal Sales Grown 42 Cost of Sale 15 of 5898) 48 SOSA Expense 1558163) Cover Page Control Panel Financial Model Select destination and press ENTER or cheese Paste 6.08 40.0% 10.08 8.0% 40.00% 10.0% B.UN 40.0% 10.08 40.0% 10.04 6.08 40.0% 10.0% 5.05 25.0% 5.06% 25.0x1. % 5.0% 25.0% 5.0831 25.081 . 5.08 25.0% 30 301 30 $20.000 $ $0 $20,000 $20.000 $29.000 $20,000 3.0% 3.0% 3.0% 45.0% 15.0% 3.06 15.0% 15.08 3.0% (5.0% 15.0% 15.01.2015.01 Scenarios + HEP - + 100% Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments Arial 12 = X [ Wras Text Ceneral ~ AR a. Av FO WES Peste BIU $ % Insert Merge & Center Format Delete Conditional Format Cell Formatting Table Styles Sort & Filter Find & Salart Analyze Data E7 X fr D E F G H K M N O B 5 T 1 Corporate Finance Instilule. All rights reserved. 2 Forecast Scenarios A Figures i USEU's une annwise stated 5 2022E 2024E 6 35 40 41 12 43 MUOTIS Pays U/BT Capital Expic.rs Euty Issued Resad 2021E $20.000 $0. $20.000 $0 2023E 2: $20.000 5 $0 $20.000 2025E 20 $20.000 STE Low Case Income Statement Assimptions Anal Sales Growth Cost of Sale 15 of 6) SOSA Expense 155863) 3.08 (6.0%! 15.0% 3.08! 15.0% 15.05 3.08 (5.0% 15.02 3.08 15.0631 15.05 3.05. (5.0% 15.0% Interest Rate Eleclive Tee Rate 50%. 25.0% 5.08 25. 5.0 25.0% 5.08 25.08. 50% 25.0% 45 40 47 48 99 50 51 52 53 54 55 56 57 58 59 Balance Sheet Assumptions Accounts Receivably Accounts Payahn Days Capital Expenceres Bouty Issund Resad 50 2001 $15,000 $0 T 20 $15.000 $1 50 : an 200 $15.000 $0 $15,000 $ 50 2011 $15.00 SU $ 61 62 63 64 65 66 67 68 High Case Income Statement Assumptions Anal Sales Grow Cost of 18 of 69 838A Expense 15 of Sale) 2.08.08 ----...02.2008 8.0% 8. &.0 8.08 8.0% 30.0% 0.0% 32.0. 80% 8 8.02 50 Interest Rate Eacity Tax Hate 5.01% 25.11% 5.11 25.01% 5.08 25.0! 250 5.0% 25.0% Balance Sheet Assumptions Accounts Receivable Days! Accounts Payabc Days) Capital Expenceres Ecuty Issued (Resad 20 20 $20,000 $0 20 30 $30,000 90 20 20 $20,000 $0 20 30 $33,000 $2 20 20 $20,000 $0 70 7: 72 73 74 75 76 77 78 79 Cover Page Control Panel Financial Model Scenarios + Select destination and press ENTER or choose Paste , 100% Startup Co commenced operations at the beginning of 2020. $125 million of equity was raised to fund the purchase of equipment as well as for general corporate purposes. As part of its business planning process, a 5-year forecast was developed (Base Case) as well as upside and downside scenarios (High and Low Cases, respectively). At the end of 2020, StartupCo issued $150 million of 5-year debt, repayable in equal annual installments at the end of each year, to finance its future capital program. 1 Using the Base Case, calculate net earnings for 2021E. Review Later $6,600 $5,250 $7,725 $7,163 Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments Arial v 12 Wran Text Number X CG SIX Who @ his Analyze Data Peste B 1 Uv 0A Merge & Center Y $% % Insert Format Delete Conditional Format Cell Formatting Table Styles Sort & Filter Find Select G H K L M N O P 0 R 5 A1 Xfx Corporate Finance Institute. All rights reserved. A C E 1 Corporate Finance Instiule. All rights reserved. 2 Model Inputs and Assumptions 3 Al figures in USSCs unless otherwise stated 4 5 Model Inputs and Assumptions 7 General Assumptions 8 Forecast Scorers 9 Days Per Year 365 10 11 Capital Expenditure Assumptions 12 Assel Salvage Varun (% af Capial Adilian 15% 13 Asset Useful Life 10 Years 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 39 399 40 41 Cover Page Control Panel Financial Model Scenarios + Select destination and press ENTER or choose Paste EP + 111% Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments X Arial 12 = ~ AR Wras Text Ceneral We Or FO Peste BIU $% Insert Merge & Center Format Delete Conditional Format Cell Formatting Table Styles Sort & Filter Analyze v Find & Salact Data DG x x B D E F G H K L M N P O R S T 1 Corporate Finance Instilule. All rights reserved. 2 Historical and Forecast Financial Information 3 All Figures in USOS Wiesbaked 4 5 2020 2021E 2022E 2023E 2024E 2025E Income Statement Sales Resore Cast of Sales Gross Profit $60.000 ($2260 $27,500 30 $D 50 $D $0 7 9 10 11 12 13 14 15 16 17 18 19 20 2: SGSA Expense Deprecation Experise Interest Expense Inome Before lume Income Tax Net Income ($5.COM ($8.60) D $14.000 ($3.500) 310.500 30 $D 30 $D 30 SD 30 $D 30 Balance Sheet Assets Cash & Cash Ecu valents Accounts Receivable Total Current Assets $194.000 $5.000 $199.000 $D 30 $ 30 Propery, Part & Eymer Total Assets 991.500 $290.500 30 $0 w $0 30 Liabilities Accounts Payab Total Current Liabilies $5.000 $5.000 50 $0 30 $D 30 23 24 25 26 27 28 25 30 32 32 33 34 35 36 37 38 35 10 41 42 43 44 45 46 Long-Term Deb: Total Liabilities $150.000 $155.000 50 $0 50 $D 0 Shareholders' Equity SA Capta Heland Fans Total Shareholders' Equity Total Liabilities and Shareholders' Equity $125.000 $10 900 $135,500 $20.500 50 50 $D 0 $D 50 50 $0 $D $D 50 50 Cash Flow Statement Carolina Bellules Cover Page Control Panel Financial Model Scenarios + Select destination and press ENTER or choose Paste E) PD + 100% Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments Arial v 12 v Wraa Text General STX FO X CG Paste B 1 Uv DAY E Insert Y E Merge & Center $ %, Delete Format Conditional Format Cell Formatting es Table Styles Sort & Filter Find Select Analyze Data y D6 xfx B c E F G x L M N P R 5 T 1 Corporate Finance Institute All rights reserved. 2 Historical and Forecast Financial Information 3 All Figures MUSANO's sed. 2020 2021E 2022E 2023E 2024E 2025E 5 44 95 46 $10,500 48 49 50 52 52 Cash Flow Statement Operating Activities Nel Income Acilmente for Depreciation Expe's Changes in Non-Cash Working Capila Cash Generated From Operating Activities $8.500 $19,00 $0 $0 50 $0 54 55 56 57 58 55 Investing Activities Add tions to Properti Pent & Equipment Cash Used Fori Investing Activities 15100,000 15100,000 $D 50 $D 50 $0 Financing Activities IS.ACR (Repayment of Debt ISS.OR (Hry.hack) of Euty Cash Used For Generated From Financing Activities $150,000 $125,000 $275,000 $D $0 $0 $0 $0 $194,000 $0 $0 $0 99 $0 Cash (Used) Generated in the Period Cash & Cash Ecu valmis. Beginning of Period Cash & Cash Equivalents, End of Period $194,000 $0 $0 $0 $0 $0 6 62 63 64 65 66 67 68 GS 70 7: 72 73 74 26 27 78 79 BO 81 82 83 84 OC Cover Page Control Panel Financial Model Scenarios + Select destination and press ENTER or choose Paste Am E --+ 100% Insert Draw Page Layout Home - Formulas Data Review View Tell me Share Comments Arial V 12 ~ A A O 9. Was Text Ganeral v FO O. um Y Paste 1 Uw B OVA Insert DALAT Merge Center Format Conditional Format Call Formatting as Table Styles Sort & Filter Analyze Find & Select Data E7 G M N R S D 1 Corporate Finance Institute. All rights reserved. 2 Forecast Scenarios 3 AN Fiyonas w USANO Www 4 5 2021E 2022E 2023E 2024E 2025E 2 a Live Case 10 Income Statement Assumptions 10 Anal Sales Growth 12 Cast of Sales Sales) 13 SGSA Expense of Sales 14 15 Interest Rate 16 Ellective Tax Rale 17 18 Balance Sheet Assumptions 19 Accounts Receivable Day! 20 Accounts Payabe Deysi 23 Capital Expenditures 22 Euty Issued Resad 23 24 25 Scenario Inputs 27 Base Case 25 Income Statement Assumptions 30 Anal Sales Growth ) 31 Cast of Sales of Sales) 32 SGSA Expense Sales 33 34 Inleres Rule 35 Elfective Tax Rale 36 37 Balance Sheet Assumptions Accounts Receivable 1088 39 Accounts Payabo Duro 40 Capital Expenci.res 4: Euty Issued Reed 12 43 Low Case Income Statement Assumptions 40 Anal Sales Grown 42 Cost of Sale 15 of 5898) 48 SOSA Expense 1558163) Cover Page Control Panel Financial Model Select destination and press ENTER or cheese Paste 6.08 40.0% 10.08 8.0% 40.00% 10.0% B.UN 40.0% 10.08 40.0% 10.04 6.08 40.0% 10.0% 5.05 25.0% 5.06% 25.0x1. % 5.0% 25.0% 5.0831 25.081 . 5.08 25.0% 30 301 30 $20.000 $ $0 $20,000 $20.000 $29.000 $20,000 3.0% 3.0% 3.0% 45.0% 15.0% 3.06 15.0% 15.08 3.0% (5.0% 15.0% 15.01.2015.01 Scenarios + HEP - + 100% Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments Arial 12 = X [ Wras Text Ceneral ~ AR a. Av FO WES Peste BIU $ % Insert Merge & Center Format Delete Conditional Format Cell Formatting Table Styles Sort & Filter Find & Salart Analyze Data E7 X fr D E F G H K M N O B 5 T 1 Corporate Finance Instilule. All rights reserved. 2 Forecast Scenarios A Figures i USEU's une annwise stated 5 2022E 2024E 6 35 40 41 12 43 MUOTIS Pays U/BT Capital Expic.rs Euty Issued Resad 2021E $20.000 $0. $20.000 $0 2023E 2: $20.000 5 $0 $20.000 2025E 20 $20.000 STE Low Case Income Statement Assimptions Anal Sales Growth Cost of Sale 15 of 6) SOSA Expense 155863) 3.08 (6.0%! 15.0% 3.08! 15.0% 15.05 3.08 (5.0% 15.02 3.08 15.0631 15.05 3.05. (5.0% 15.0% Interest Rate Eleclive Tee Rate 50%. 25.0% 5.08 25. 5.0 25.0% 5.08 25.08. 50% 25.0% 45 40 47 48 99 50 51 52 53 54 55 56 57 58 59 Balance Sheet Assumptions Accounts Receivably Accounts Payahn Days Capital Expenceres Bouty Issund Resad 50 2001 $15,000 $0 T 20 $15.000 $1 50 : an 200 $15.000 $0 $15,000 $ 50 2011 $15.00 SU $ 61 62 63 64 65 66 67 68 High Case Income Statement Assumptions Anal Sales Grow Cost of 18 of 69 838A Expense 15 of Sale) 2.08.08 ----...02.2008 8.0% 8. &.0 8.08 8.0% 30.0% 0.0% 32.0. 80% 8 8.02 50 Interest Rate Eacity Tax Hate 5.01% 25.11% 5.11 25.01% 5.08 25.0! 250 5.0% 25.0% Balance Sheet Assumptions Accounts Receivable Days! Accounts Payabc Days) Capital Expenceres Ecuty Issued (Resad 20 20 $20,000 $0 20 30 $30,000 90 20 20 $20,000 $0 20 30 $33,000 $2 20 20 $20,000 $0 70 7: 72 73 74 75 76 77 78 79 Cover Page Control Panel Financial Model Scenarios + Select destination and press ENTER or choose Paste , 100%