Question

StartupCo commenced operations at the beginning of 2020. $125 million of equity was raised to fund the purchase of equipment as well as for general

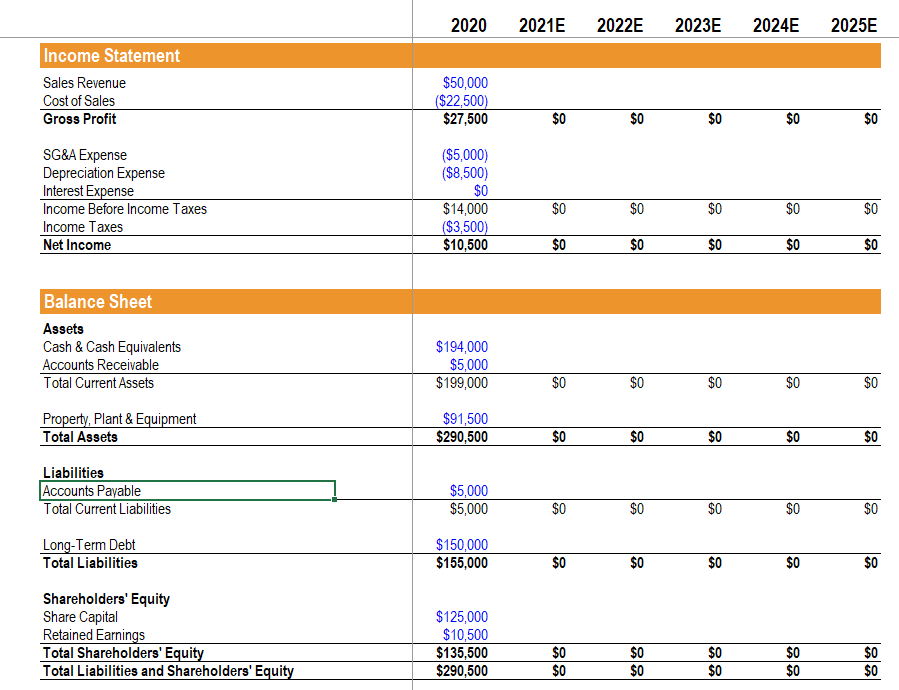

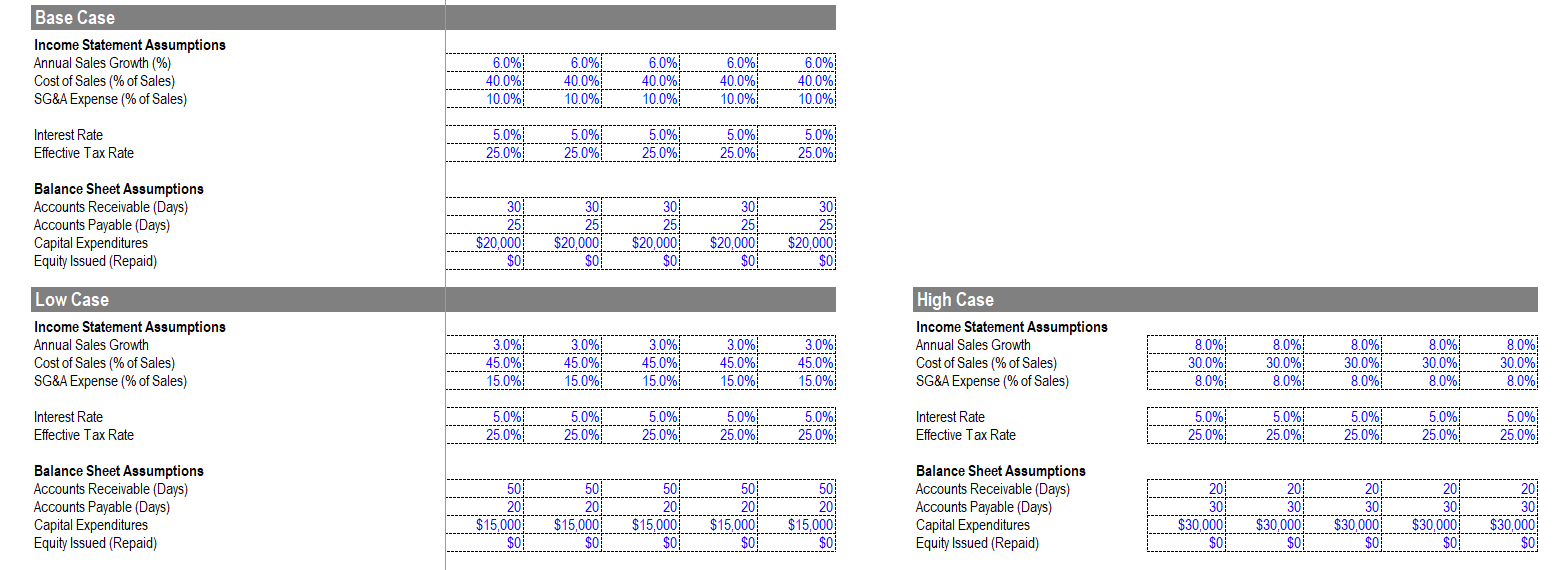

StartupCo commenced operations at the beginning of 2020. $125 million of equity was raised to fund the purchase of equipment as well as for general corporate purposes. As part of its business planning process, a 5-year forecast was developed (Base Case) as well as upside and downside scenarios (High and Low Cases, respectively). At the end of 2020, StartupCo issued $150 million of 5-year debt, repayable in equal annual installments at the end of each year, to finance its future capital program.

Using the Low Case, calculate the interest coverage ratio for 2021E.

0.9x

1.9x

2.7x

0.3x

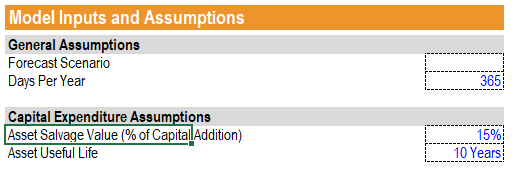

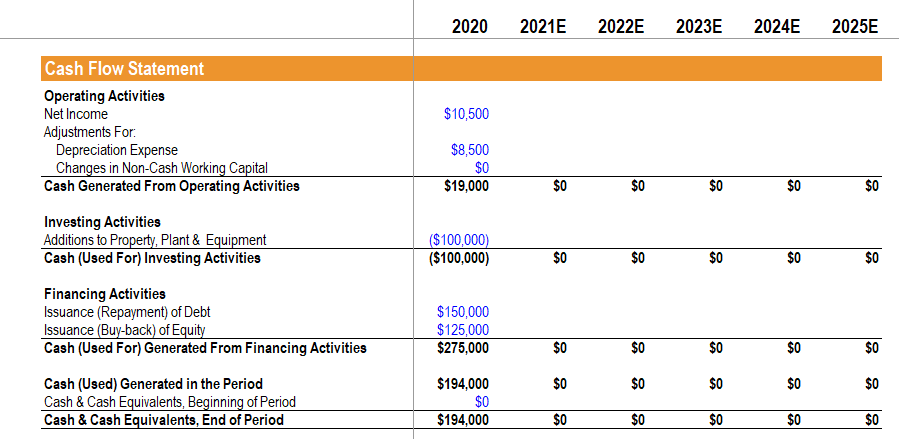

Model Inputs and Assumptions General Assumptions Forecast Scenario Days Per Year 365 Capital Expenditure Assumptions Asset Salvage Value (% of CapitalAddition) Asset Useful Life 15% 10 Years 2020 2021E 2022E 2023E 2024E 2025E Income Statement Sales Revenue Cost of Sales Gross Profit $50,000 ($22,500) $27,500 $0 $0 $0 $0 $0 SG&A Expense Depreciation Expense Interest Expense Income Before Income Taxes Income Taxes Net Income ($5,000) ($8,500) $0 $14,000 ($3,500) $10,500 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Balance Sheet Assets Cash & Cash Equivalents Accounts Receivable Total Current Assets $194,000 $5,000 $199,000 $0 $0 $0 $0 $0 Property, Plant & Equipment Total Assets $91,500 $290,500 $0 $0 $0 $0 $0 Liabilities Accounts Payable Total Current Liabilities $5,000 $5,000 $0 $0 $0 $0 $0 Long-Term Debt Total Liabilities $150,000 $155,000 $0 $0 $0 $0 $ $0 Shareholders' Equity Share Capital Retained Earnings Total Shareholders' Equity Total Liabilities and Shareholders' Equity $125,000 $10,500 $135,500 $290,500 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 2020 2021E 2022E 2023E 2024E 2025E $10,500 Cash Flow Statement Operating Activities Net Income Adjustments For Depreciation Expense Changes in Non-Cash Working Capital Cash Generated From Operating Activities $8,500 $0 $19,000 $0 $0 $0 $0 $0 ($100,000) ($100,000) $0 $0 $0 $0 $0 Investing Activities Additions to Property, Plant & Equipment Cash (Used For) Investing Activities Financing Activities Issuance (Repayment) of Debt Issuance (Buy-back) of Equity Cash (Used For) Generated From Financing Activities $150,000 $125,000 $275,000 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Cash (Used) Generated in the Period Cash & Cash Equivalents, Beginning of Period Cash & Cash Equivalents, End of Period $194,000 $0 $194,000 $0 $0 $0 $0 $0 Base Case Income Statement Assumptions Annual Sales Growth (%) Cost of Sales (% of Sales) SG&A Expense (% of Sales) 6.0% 40.0% 10.0% 6.0% 40.0% 10.0% 6.0% 40.0% 10.0% 6.0% 40.0% 10.0% 6.0% 40.0% 10.0% Interest Rate Effective Tax Rate 5.0% 25.0% 5.0% 25.0% 5.0% 25.0% 5.0% 25.0% 5.0% 25.0% 30 301 30: 30 Balance Sheet Assumptions Accounts Receivable (Days) Accounts Payable (Days) Capital Expenditures Equity Issued (Repaid) $20,000 8868 $20,000 $0 $20,000 $0 $20,000 $0 $20,000 $0 Low Case Income Statement Assumptions Annual Sales Growth Cost of Sales (% of Sales) SG&A Expense % of Sales) 3.0% 3.0% 3.0% 45.0% 15.0% 8.0% 3.0% 45.0% 15.0% High Case Income Statement Assumptions Annual Sales Growth Cost of Sales (% of Sales) SG&A Expense % of Sales) 3.0% 45.0% 15.0% 45.0% 15.0% 45.0% 15.0% 8.0% 30.0% 8.0% 30.0% 8.0% 8.0% 30.0% 8.0% 8.0% 30.0% 8.0% 8.0% 30.0% 8.0% Interest Rate Effective Tax Rate 5.0% 25.0% 5.0% 5.0% 25.0% 5.0% 25.0% 5.0% 25.0% 5.0% 25.0% Interest Rate Effective Tax Rate 5.0% 25.0% 5.0% 25.0% 5.0% 25.0% 5.0% 25.0% 25.0% 50: 50 Balance Sheet Assumptions Accounts Receivable (Days) Accounts Payable (Days) Capital Expenditures Equity Issued (Repaid) 50 20 $15,000 $0 50 20 $15,000 $0 50 20 $15,000 $0 98812 Balance Sheet Assumptions Accounts Receivable (Days) Accounts Payable (Days) Capital Expenditures Equity Issued (Repaid) 20 30 $30,000 $0 20 30 $30,000 $0 20 30 $30,000 $0 20 30 $30,000 $0 $15,000 $0 $30,000 $15,000 $0 8888Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started