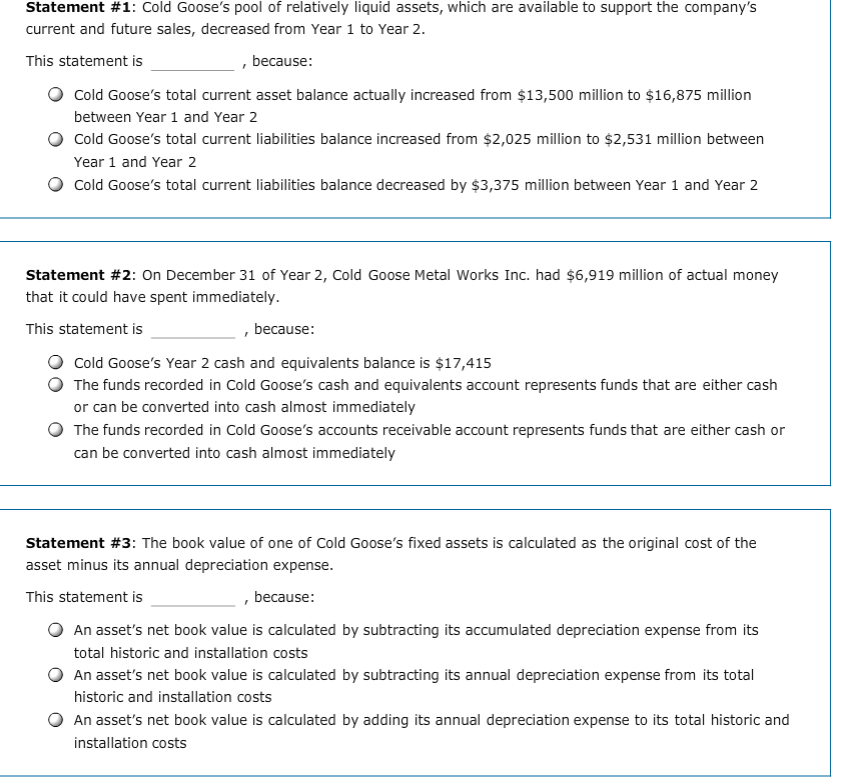

Statement #1: Cold Goose's pool of relatively liquid assets, which are available to support the company's current and future sales, decreased from Year 1 to Year 2. This statement is because , Cold Goose's total current asset balance actually increased from $13,500 million to $16,875 million between Year 1 and Year 2 O Cold Goose's total current liabilities balance increased from $2,025 million to $2,531 million between Year 1 and Year 2 Cold Goose's total current liabilities balance decreased by $3,375 million between Year 1 and Year 2 statement #2: On December 31 of Year 2, Cold Goose Metal Works Inc. had $6,919 million of actual money that it could have spent immediately. This statement is , because: O Cold Goose's Year 2 cash and equivalents balance is $17,415 O The funds recorded in Cold Goose's cash and equivalents account represents funds that are either cash or can be converted into cash almost immediately O The funds recorded in Cold Goose's accounts receivable account represents funds that are either cash or can be converted into cash almost immediately Statement #3: The book value of one of Cold Goose's fixed assets is calculated as the original cost of the asset minus its annual depreciation expense. This statement is , because O An asset's net book value is calculated by subtracting its accumulated depreciation expense from its total historic and installation costs O An asset's net book value is calculated by subtracting its annual depreciation expense from its total historic and installation costs O An asset's net book value is calculated by adding its annual depreciation expense to its total historic and installation costs Statement #1: Cold Goose's pool of relatively liquid assets, which are available to support the company's current and future sales, decreased from Year 1 to Year 2. This statement is because , Cold Goose's total current asset balance actually increased from $13,500 million to $16,875 million between Year 1 and Year 2 O Cold Goose's total current liabilities balance increased from $2,025 million to $2,531 million between Year 1 and Year 2 Cold Goose's total current liabilities balance decreased by $3,375 million between Year 1 and Year 2 statement #2: On December 31 of Year 2, Cold Goose Metal Works Inc. had $6,919 million of actual money that it could have spent immediately. This statement is , because: O Cold Goose's Year 2 cash and equivalents balance is $17,415 O The funds recorded in Cold Goose's cash and equivalents account represents funds that are either cash or can be converted into cash almost immediately O The funds recorded in Cold Goose's accounts receivable account represents funds that are either cash or can be converted into cash almost immediately Statement #3: The book value of one of Cold Goose's fixed assets is calculated as the original cost of the asset minus its annual depreciation expense. This statement is , because O An asset's net book value is calculated by subtracting its accumulated depreciation expense from its total historic and installation costs O An asset's net book value is calculated by subtracting its annual depreciation expense from its total historic and installation costs O An asset's net book value is calculated by adding its annual depreciation expense to its total historic and installation costs