Answered step by step

Verified Expert Solution

Question

1 Approved Answer

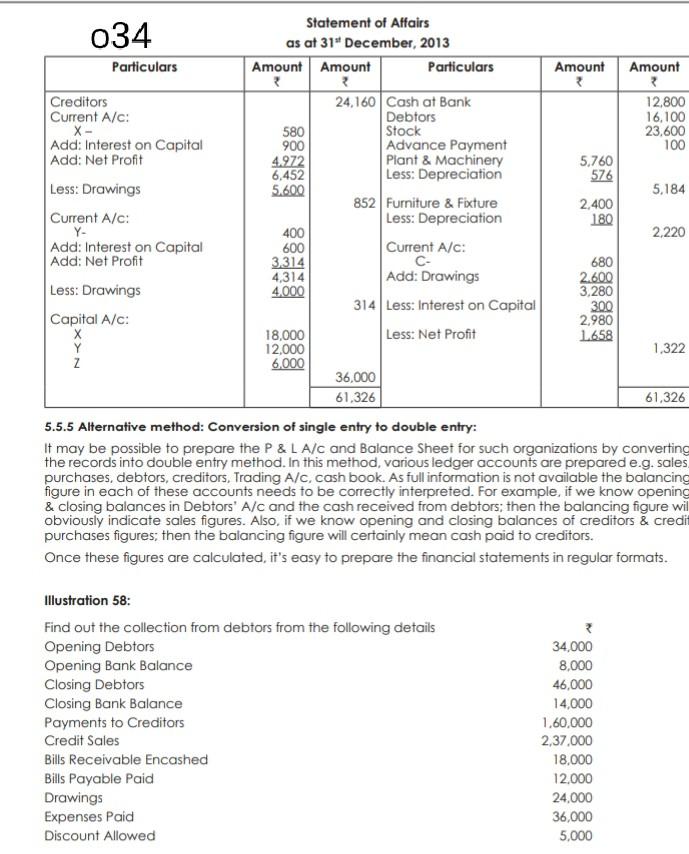

Statement of Affairs 034 as at 31 December, 2013 Particulars Amount Amount Particulars Amount Amount Creditors 24,160 Cash at Bank 12.800 Current A/c: Debtors 16,100

Statement of Affairs 034 as at 31" December, 2013 Particulars Amount Amount Particulars Amount Amount Creditors 24,160 Cash at Bank 12.800 Current A/c: Debtors 16,100 X- 580 Stock 23.600 Add: Interest on Capital 900 Advance Payment 100 Add: Net Profit 4.972 Plant & Machinery 5,760 6,452 Less: Depreciation 576 Less: Drawings 5.600 5.184 852 Furniture & Fixture 2,400 Current A/c: Less: Depreciation 180 Y- 400 2.220 Add: Interest on Capital 600 Current A/c: Add: Net Profit 3,314 C- 680 4,314 Add: Drawings 2.600 Less: Drawings 4,000 3,280 314 Less: Interest on Capital 300 Capital A/C: 2.980 X 18,000 Less: Net Profit 1658 Y 12,000 1.322 z 6,000 36.000 61,326 61,326 5.5.5 Alternative method: Conversion of single entry to double entry: It may be possible to prepare the P & L A/C and Balance Sheet for such organizations by converting the records into double entry method. In this method, various ledger accounts are prepared e.g. sales purchases, debtors, creditors, Trading A/C, cash book. As full information is not available the balancing figure in each of these accounts needs to be correctly interpreted. For example, if we know opening & closing balances in Debtors' A/c and the cash received from debtors; then the balancing figure wil obviously indicate sales figures. Also, if we know opening and closing balances of creditors & credi purchases figures; then the balancing figure will certainly mean cash paid to creditors. Once these figures are calculated, it's easy to prepare the financial statements in regular formats. Illustration 58: Find out the collection from debtors from the following details Opening Debtors Opening Bank Balance Closing Debtors Closing Bank Balance Payments to Creditors Credit Sales Bills Receivable Encashed Bills Payable Paid Drawings Expenses Paid Discount Allowed 34,000 8,000 46,000 14,000 1,60,000 2,37,000 18,000 12.000 24.000 36,000 5,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started