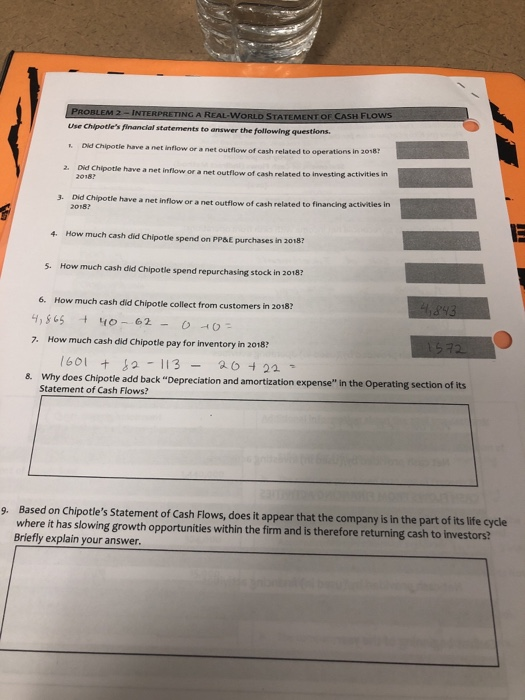

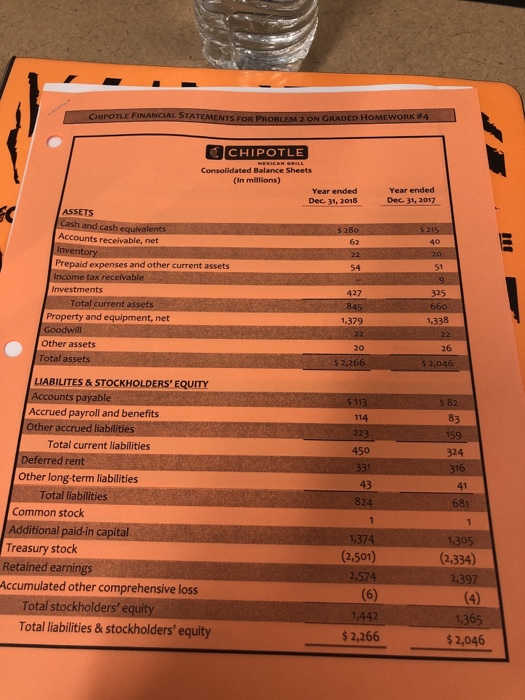

STATEMENT OF CASH F Use Chlpotle's financial statements to answer the following questions. . Did Chipotie have a net inflow or a net outflow of cash relat ed to operations in 2018 2. Did Chipotle have a net inflow or a net outflow of cash related to inwesting activities in 3. Did Chipotle have a net inflow or a net outflow of cash related to financing activities in 2018? 4. How much cash did Chipotle spend on PP&E purchases in 2018? s. How much cash did Chipotle spend repurchasing stock in 2018? 6. How much cash did Chipotle collect from customers in 2018? 7. How much cash did Chipotle pay for inventory in 2018? 6o1 11326 22 why does Chipotle add back "Depreciation and amortization expense" in the Operating section of its Statement of Cash Flows? a. Based on Chipotle's Statement of Cash Flows, does it appear that the company is in the part of its life cycle where it has slowing growth opportunities within the firm and is therefore returning cash to investors? Briefly explain your answer g. CHPOTLEFINANCIALSTATEMENTS FOR PROBLEM 2 ON GRADED HOMEWORK *4 CHIPOTLE (in millions) Year ended Dec. 31, 2018 Year ended Dec. 31, 2017 ASSETS 40 Accounts receivable, net Inventory Prepaid expenses and other current assets 62 51 54 427 325 Investments Total current assets Property and equipment, net 1,379 1,338 20 26 ther assets Total assets $ 2,266 5 2,046 LIABILITES & STOCKHOLDERS Accounts payable Accrued payroll and benefits Other accrued liabilities EQUITY 114 223 450 s 82 83 159 324 31 Total current liabilities Deferred rent Other long-term liabilities 43 824 41 681 Total liabilities Common stock Additional paid-in capital Treasury stock Retained earnings Accumulated other comprehensive loss (2,501) 2,574 (2,334) 2,397 Total stockholders' equity Total liabilities &stockholders' equity 1,442 $2,266 $2,046 STATEMENT OF CASH F Use Chlpotle's financial statements to answer the following questions. . Did Chipotie have a net inflow or a net outflow of cash relat ed to operations in 2018 2. Did Chipotle have a net inflow or a net outflow of cash related to inwesting activities in 3. Did Chipotle have a net inflow or a net outflow of cash related to financing activities in 2018? 4. How much cash did Chipotle spend on PP&E purchases in 2018? s. How much cash did Chipotle spend repurchasing stock in 2018? 6. How much cash did Chipotle collect from customers in 2018? 7. How much cash did Chipotle pay for inventory in 2018? 6o1 11326 22 why does Chipotle add back "Depreciation and amortization expense" in the Operating section of its Statement of Cash Flows? a. Based on Chipotle's Statement of Cash Flows, does it appear that the company is in the part of its life cycle where it has slowing growth opportunities within the firm and is therefore returning cash to investors? Briefly explain your answer g. CHPOTLEFINANCIALSTATEMENTS FOR PROBLEM 2 ON GRADED HOMEWORK *4 CHIPOTLE (in millions) Year ended Dec. 31, 2018 Year ended Dec. 31, 2017 ASSETS 40 Accounts receivable, net Inventory Prepaid expenses and other current assets 62 51 54 427 325 Investments Total current assets Property and equipment, net 1,379 1,338 20 26 ther assets Total assets $ 2,266 5 2,046 LIABILITES & STOCKHOLDERS Accounts payable Accrued payroll and benefits Other accrued liabilities EQUITY 114 223 450 s 82 83 159 324 31 Total current liabilities Deferred rent Other long-term liabilities 43 824 41 681 Total liabilities Common stock Additional paid-in capital Treasury stock Retained earnings Accumulated other comprehensive loss (2,501) 2,574 (2,334) 2,397 Total stockholders' equity Total liabilities &stockholders' equity 1,442 $2,266 $2,046