Question

Statement of Cash Flows In addition to the information provided from the Trial Balance tab and the information you have the prepared in the Statement

Statement of Cash Flows

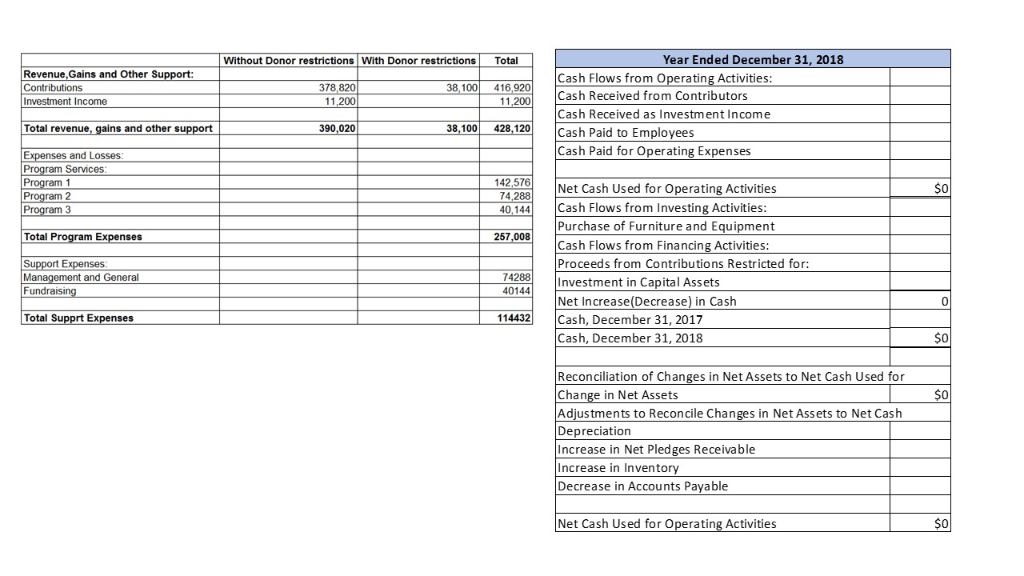

In addition to the information provided from the Trial Balance tab and the information you have the prepared in the Statement of Financial Position and Statement of Activities, use the following information to prepare the Statement of Cash Flows.

a. Your organization had $163,314 of cash on hand at the beginning of the year.

b. During the year, your organization received cash from contributors: $340,800 that was unrestricted and $38,100 that was restricted for the purchase of equipment for the center.

c. It had $11,200 of income earned and received on long-term investments.

d. The organization spent cash of $288,410 on salaries and fringe benefits, $22,000 on the purchase of equipment, and $86,504 for operating expenses.

e. Other pertinent information follows: net pledges receivable increased $6,000, inventory increased $1,000, accounts payable decreased $102,594, and there were no salaries payable at the beginning of the year.

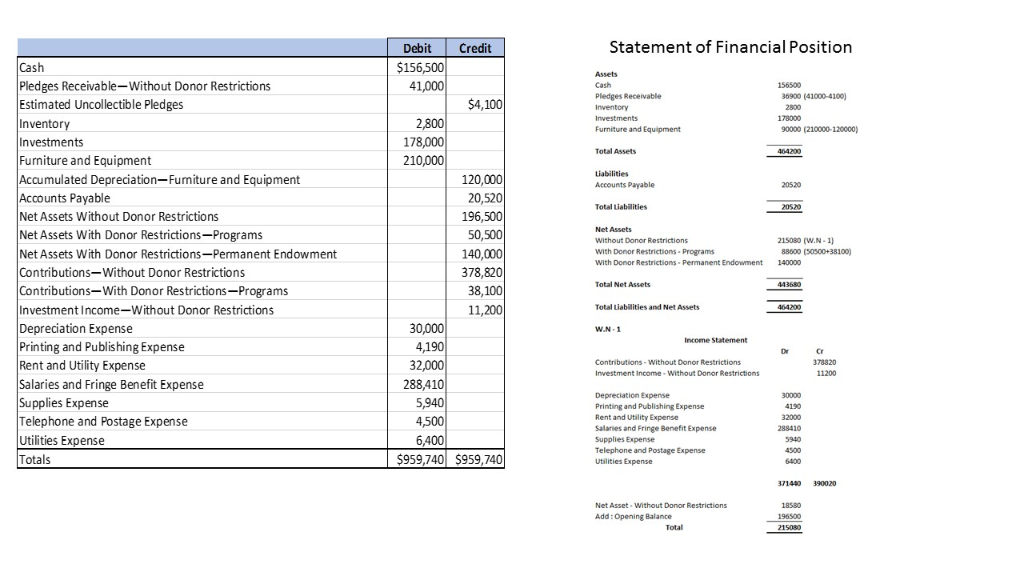

Statement of Financial Position Debit Credit $156,500 Cash Assets Pledges Receivable-Without Donor Restrictions Estimated Uncollectible Pledges 41,000 Cash 56500 Receivable .. 41000-4100) $4,100 2800 Inventory 178000 Inventory Investments Furniture and Equipment Accumulated Depreciation- Fumiture and Equipment Accounts Payable Net Assets Without Donor Restrictions Net Assets With Donor Restrictions-Programs Net Assets With Donor Restrictions-Permanent Endowment Contributions-Without Donor Restrictions Contributions-With Donor Restrictions -Programs Investment Income-Without Donor Restrictions Depreciation Expense Printing and Publis hing Expense Rent and Utility Expense Salaries and Fringe Benefit Expense Supplies Expense Telephone and Postage Expense Utilities Expense Totals 2,800 Investments Furniture and Equipment 90000 (210000-120000) 178,000 210,000 Total Assets 404200 Liabilities 120,000 Accounts Payable 20520 20,520 196,500 Total Liabilities 20520 Net Assets 50,500 215080 (W.N 88000 (50500+38100) nor Restrictions Wwith Donor Restrictions Proarams 140,000 140000 With Donor Restrictions Permanent Endowments 378,820 Total Net Assets 443680 38,100 11,200 Total Liabilities and Net Assets 464200 30,000 4,190 32,000 288,410 5,940 4,500 W.N-1 Income Statement Contributions-Without Donor Restrictions 378820 Investment Income- Without Donor Restrictions 11200 Depreciation Fxnense 30000 Printing and Publishing Expense 4130 288410 Salaries and Fringe Benefit Expense 6,400 $959,740 $959,740 Supplies Expense 5940 Postage Expense Utilities Expense 371440 390020 Without Donor Restrictions: Net Asset 18580 Add:Opening Balance 96500 Total 215080 Year Ended December 31, 2018 Total Without Donor restrictions With Donor restrictions Revenue,Gains and Other Support: Cash Flows from Operating Activities: Cash Received from Contributors Cash Received as Investment Income Cash Paid to Employees Cash Paid for Operating Expenses 38,100 Contributions 378,820 416,920 Investment Income 11.200 11,200 38,100 Total revenue, gains and other support 390,020 428,120 Expenses and Losses Program Services Program 1 Program 2 Program 3 142,576 Net Cash Used for Operating Activities Cash Flows from Investing Activities: Purchase of Furniture and Equipment Cash Flows from Financing Activities: Proceeds from Contributions Restricted for: Investment in Capital Assets Net Increase(Decrease) in Cash Cash, December 31, 2017 Cash, December 31, 2018 S0 74,288 40,144 Total Program Expenses 257,008 Support Expenses Management and General Fundraising 74288 40144 114432 Total Supprt Expenses S0 Reconciliation of Changes in Net Assets to Net Cash Used for Change in Net Assets Adjustments to Reconcile Changes in Net Assets to Net Cash Depreciation Increase in Net Pledges Receivable S0 Increase in Inven tory Decrease in Accounts Payable Net Cash Used for Operating Activities S0 Statement of Financial Position Debit Credit $156,500 Cash Assets Pledges Receivable-Without Donor Restrictions Estimated Uncollectible Pledges 41,000 Cash 56500 Receivable .. 41000-4100) $4,100 2800 Inventory 178000 Inventory Investments Furniture and Equipment Accumulated Depreciation- Fumiture and Equipment Accounts Payable Net Assets Without Donor Restrictions Net Assets With Donor Restrictions-Programs Net Assets With Donor Restrictions-Permanent Endowment Contributions-Without Donor Restrictions Contributions-With Donor Restrictions -Programs Investment Income-Without Donor Restrictions Depreciation Expense Printing and Publis hing Expense Rent and Utility Expense Salaries and Fringe Benefit Expense Supplies Expense Telephone and Postage Expense Utilities Expense Totals 2,800 Investments Furniture and Equipment 90000 (210000-120000) 178,000 210,000 Total Assets 404200 Liabilities 120,000 Accounts Payable 20520 20,520 196,500 Total Liabilities 20520 Net Assets 50,500 215080 (W.N 88000 (50500+38100) nor Restrictions Wwith Donor Restrictions Proarams 140,000 140000 With Donor Restrictions Permanent Endowments 378,820 Total Net Assets 443680 38,100 11,200 Total Liabilities and Net Assets 464200 30,000 4,190 32,000 288,410 5,940 4,500 W.N-1 Income Statement Contributions-Without Donor Restrictions 378820 Investment Income- Without Donor Restrictions 11200 Depreciation Fxnense 30000 Printing and Publishing Expense 4130 288410 Salaries and Fringe Benefit Expense 6,400 $959,740 $959,740 Supplies Expense 5940 Postage Expense Utilities Expense 371440 390020 Without Donor Restrictions: Net Asset 18580 Add:Opening Balance 96500 Total 215080 Year Ended December 31, 2018 Total Without Donor restrictions With Donor restrictions Revenue,Gains and Other Support: Cash Flows from Operating Activities: Cash Received from Contributors Cash Received as Investment Income Cash Paid to Employees Cash Paid for Operating Expenses 38,100 Contributions 378,820 416,920 Investment Income 11.200 11,200 38,100 Total revenue, gains and other support 390,020 428,120 Expenses and Losses Program Services Program 1 Program 2 Program 3 142,576 Net Cash Used for Operating Activities Cash Flows from Investing Activities: Purchase of Furniture and Equipment Cash Flows from Financing Activities: Proceeds from Contributions Restricted for: Investment in Capital Assets Net Increase(Decrease) in Cash Cash, December 31, 2017 Cash, December 31, 2018 S0 74,288 40,144 Total Program Expenses 257,008 Support Expenses Management and General Fundraising 74288 40144 114432 Total Supprt Expenses S0 Reconciliation of Changes in Net Assets to Net Cash Used for Change in Net Assets Adjustments to Reconcile Changes in Net Assets to Net Cash Depreciation Increase in Net Pledges Receivable S0 Increase in Inven tory Decrease in Accounts Payable Net Cash Used for Operating Activities S0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started