Statement of Cash Flows

Indirect Method

Assignment

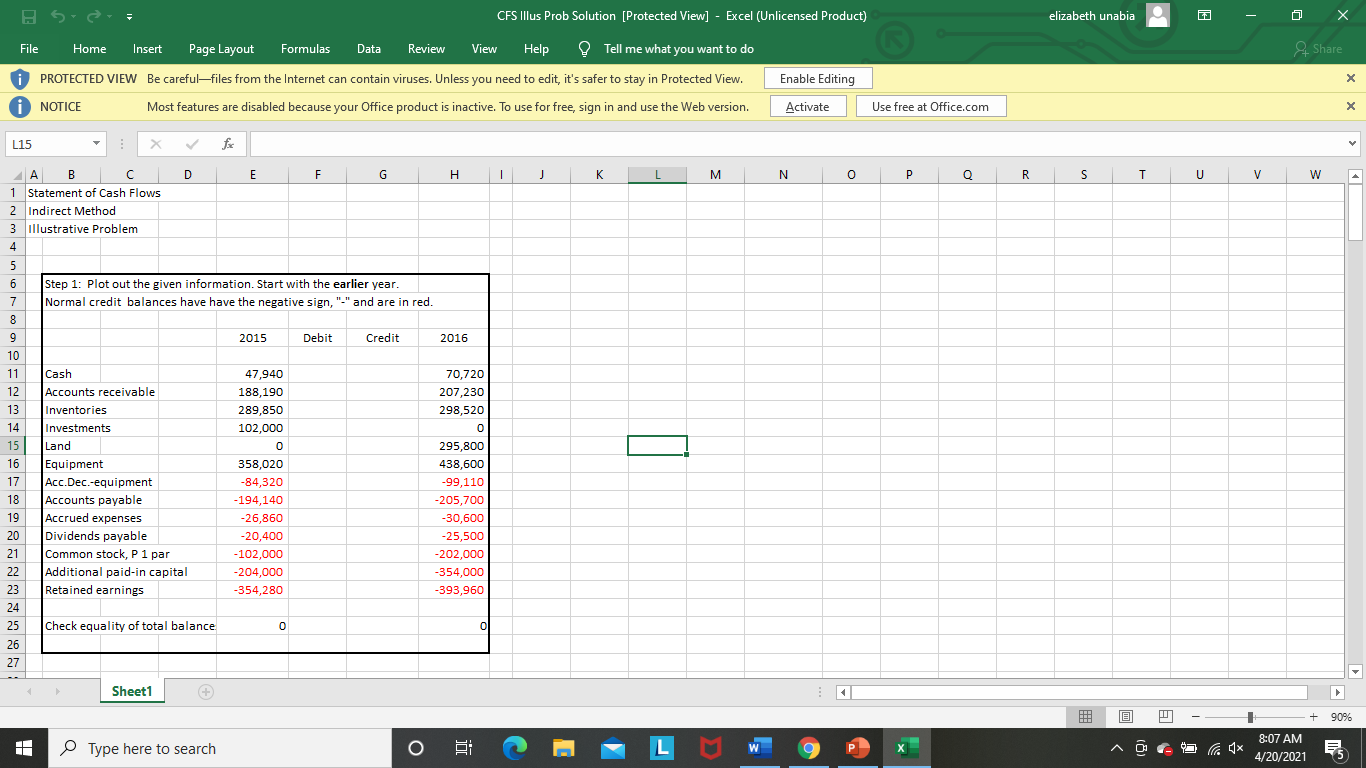

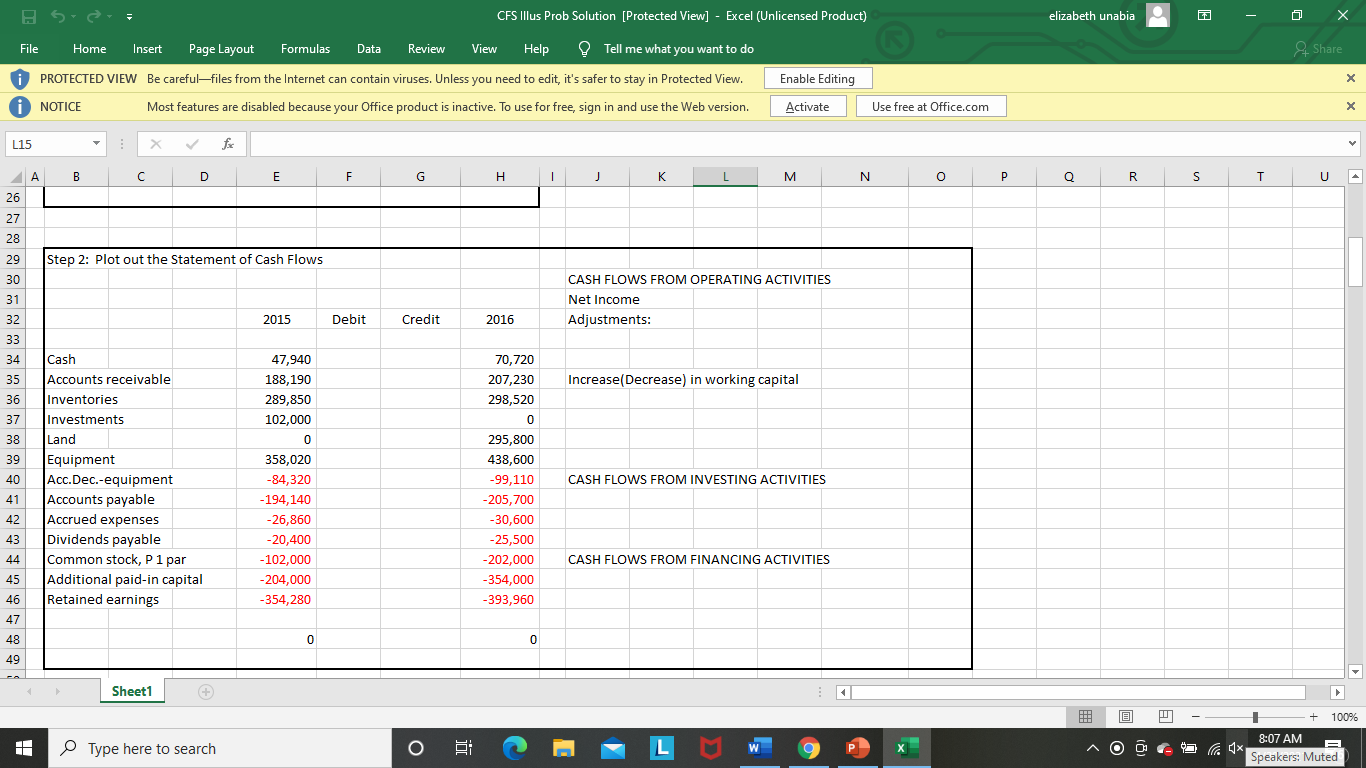

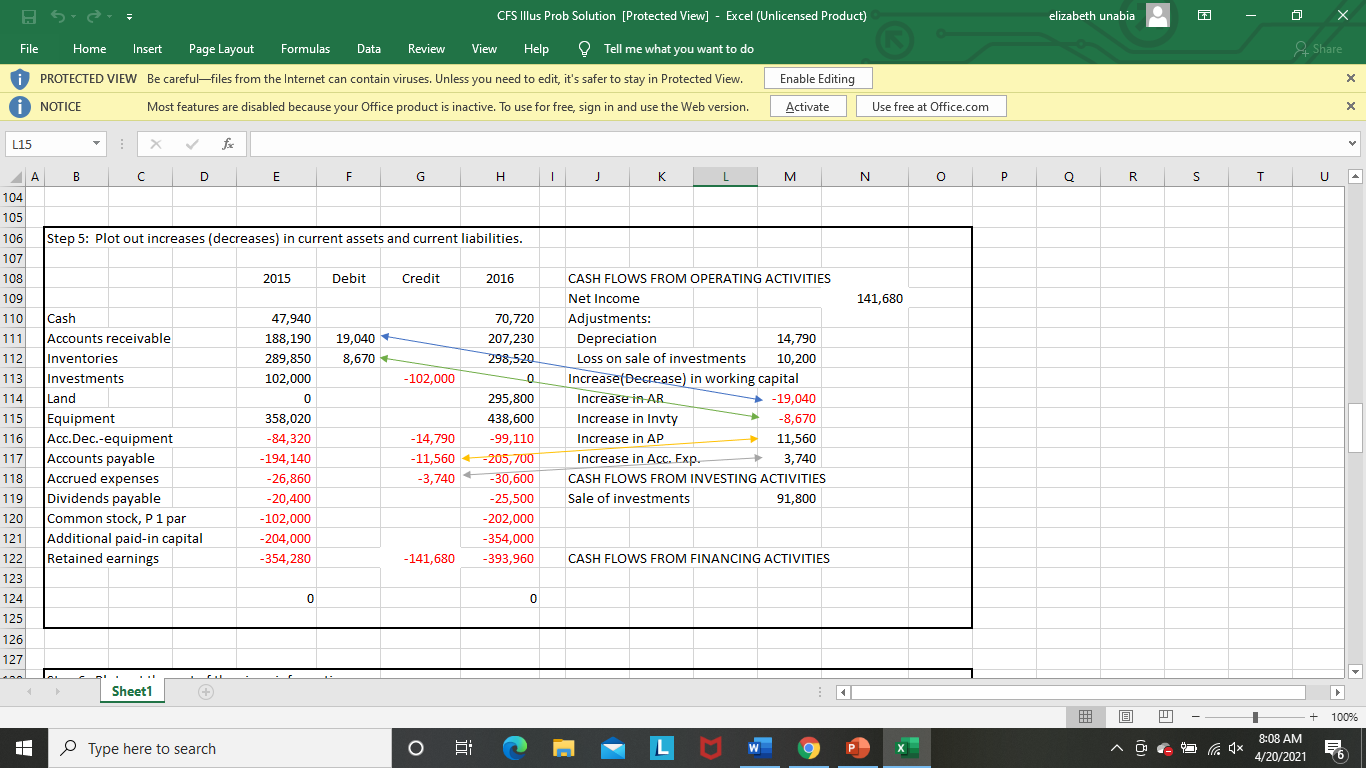

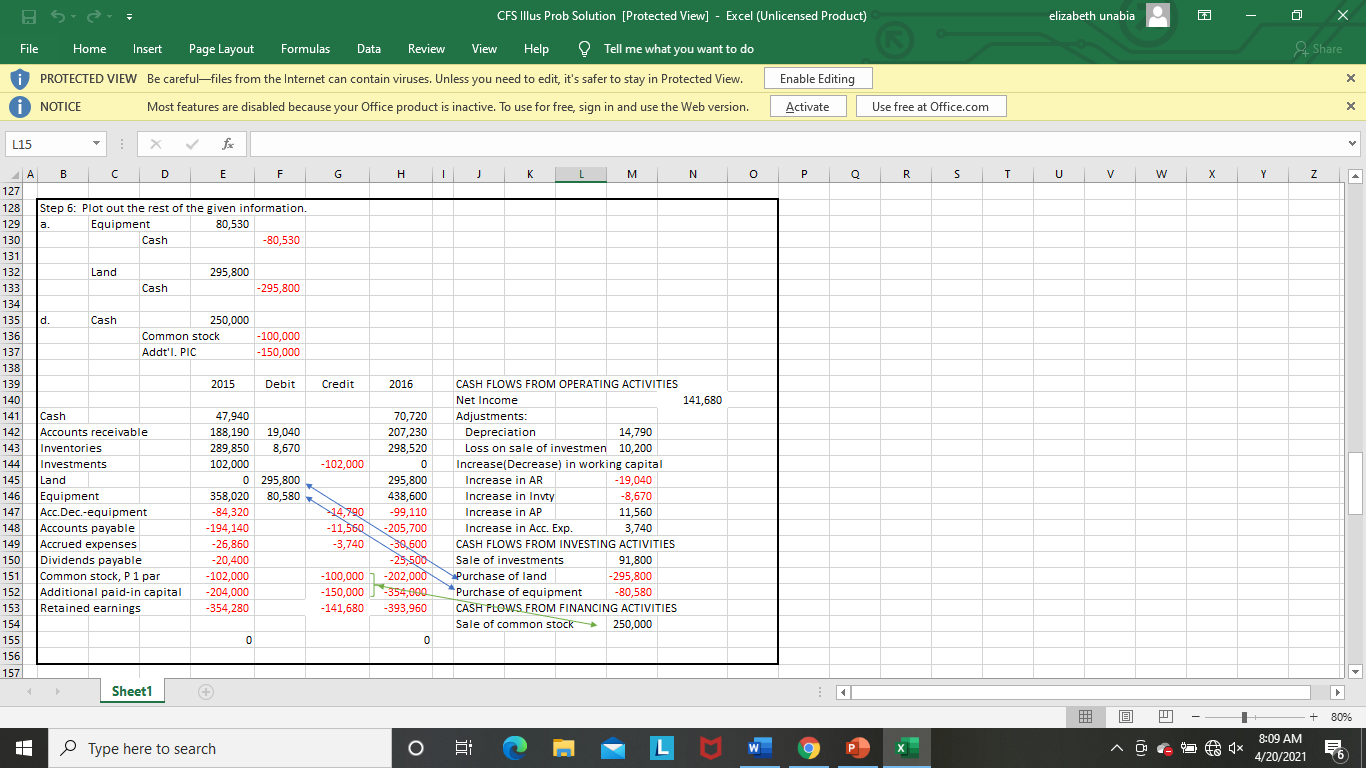

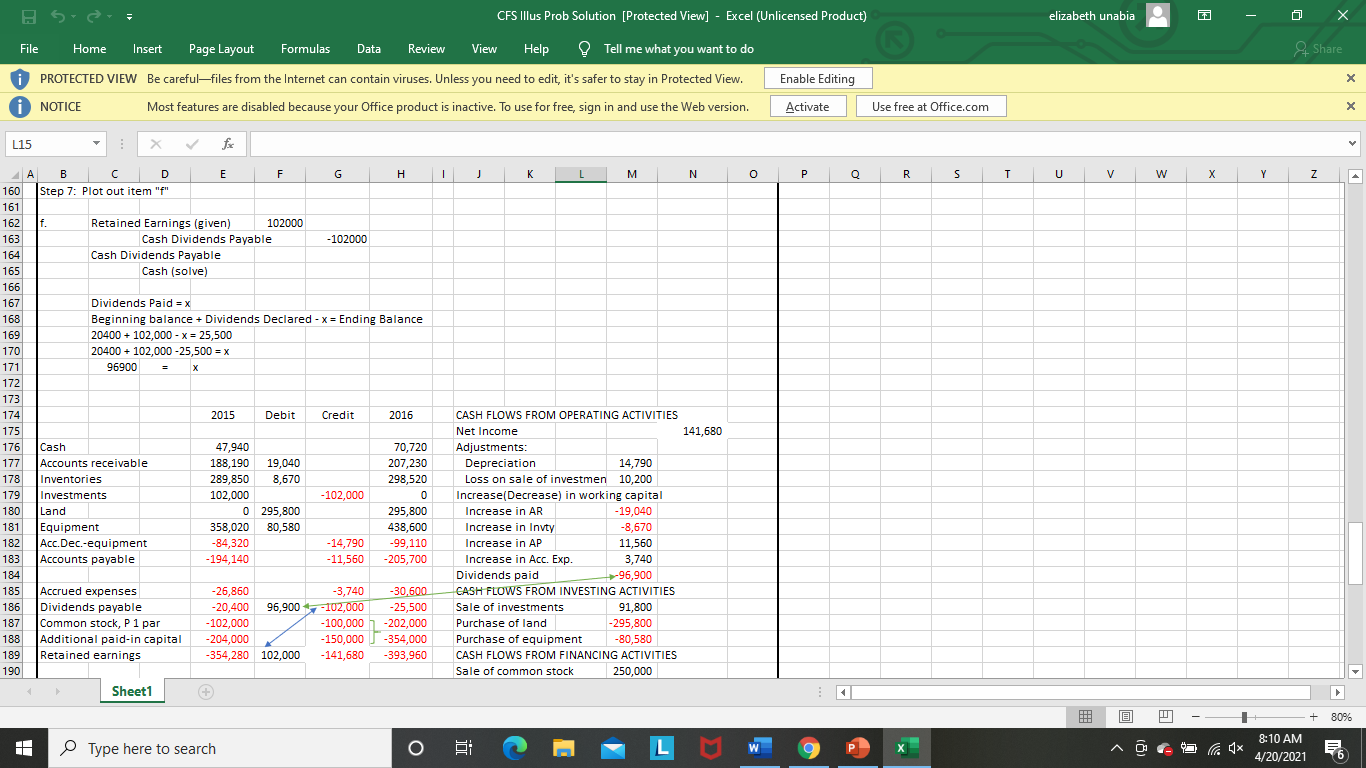

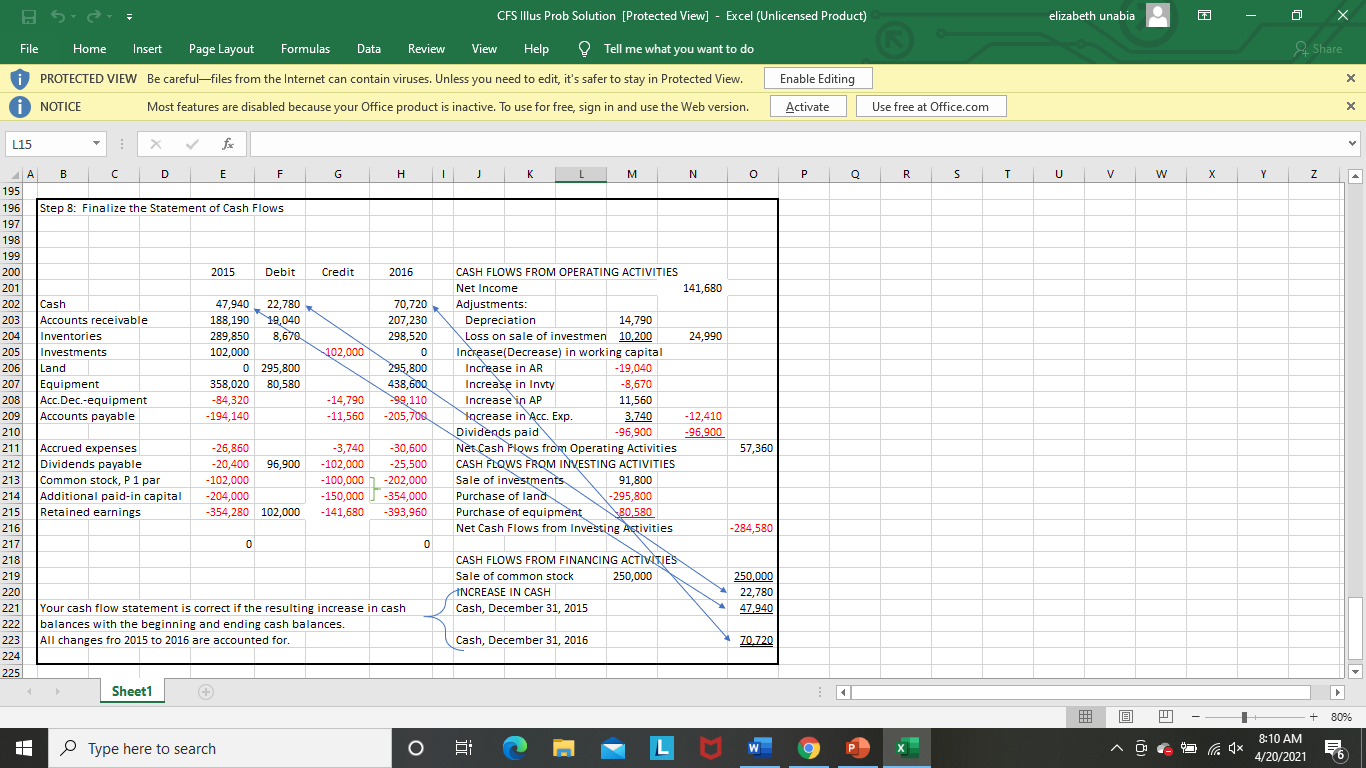

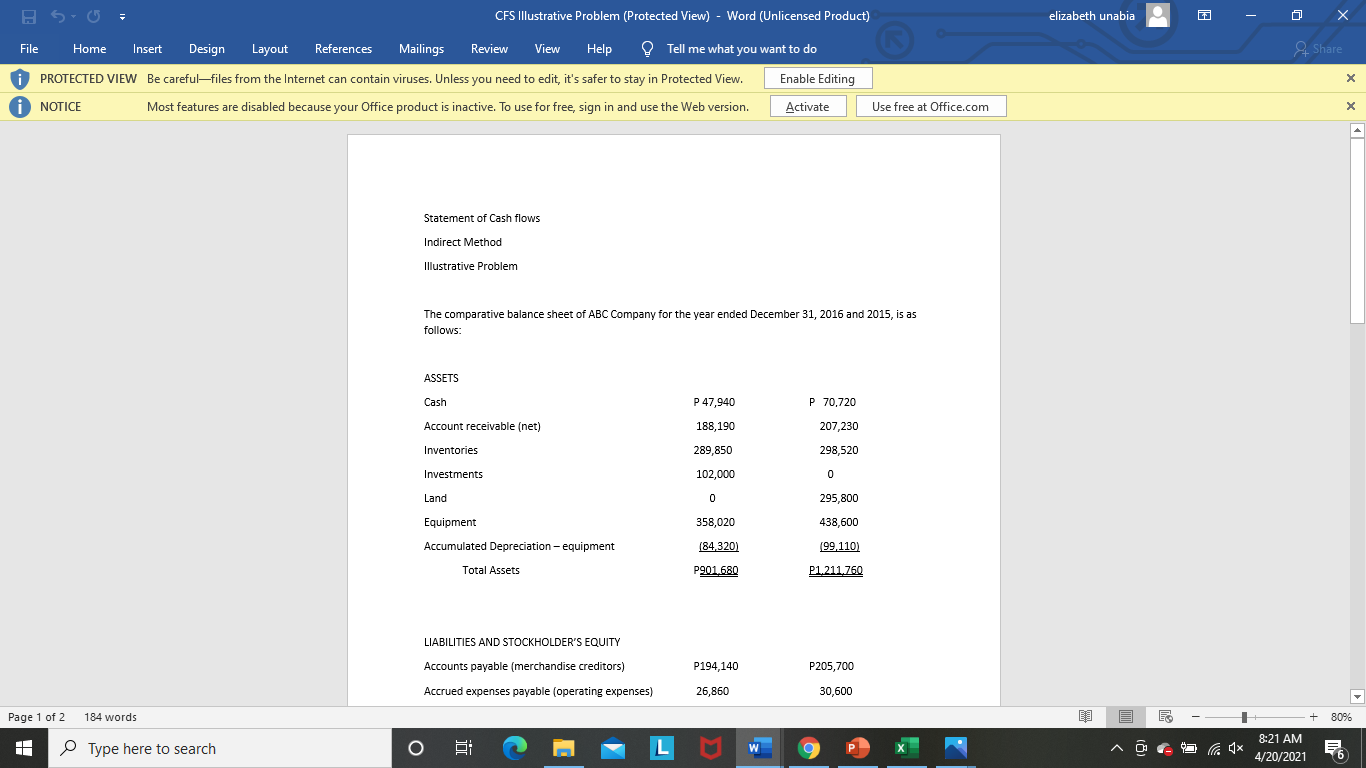

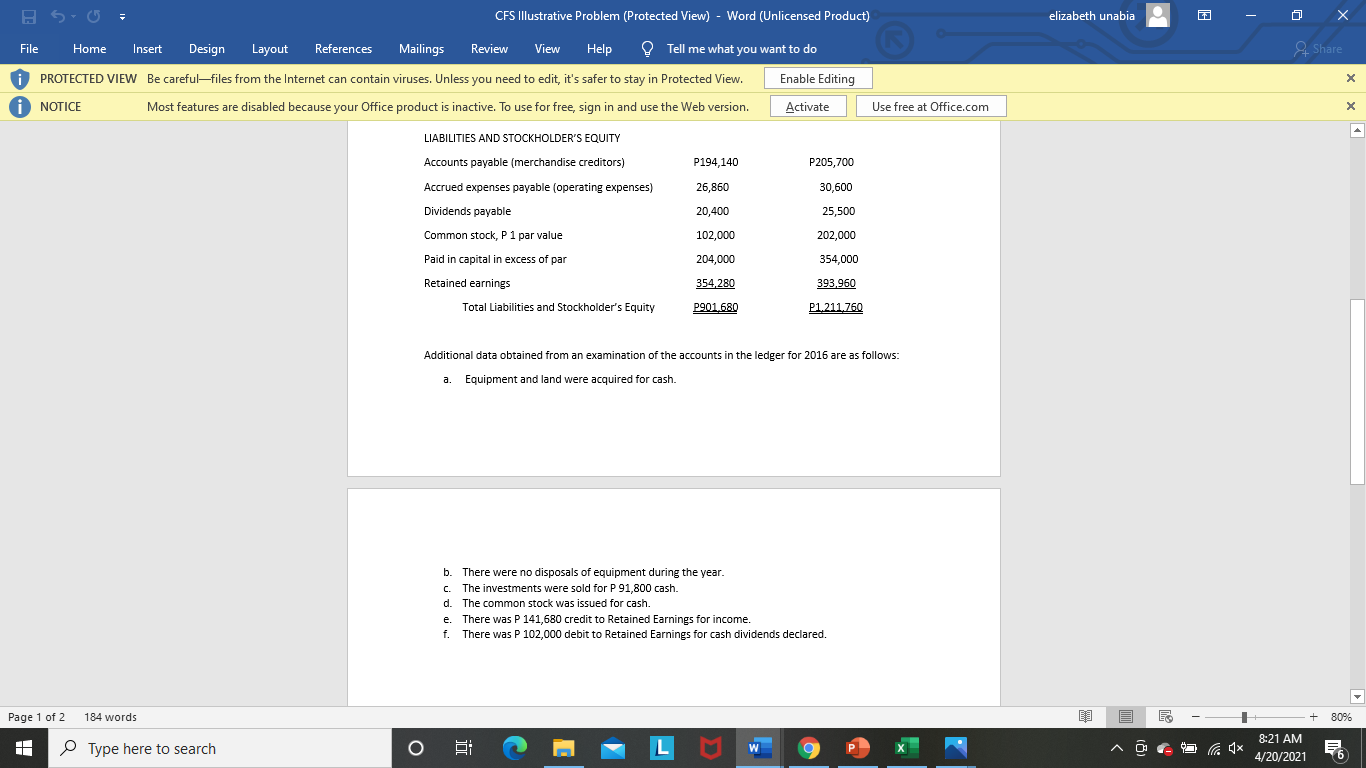

The comparative balance sheet of Aragorn Company for the year ended December 31, 2016 and 2015, is as follows:

Dec. 31, 2015Dec. 2016

ASSETS

CashP360,920P443,240

Account receivable (net)592,200665,280

Inventories1,022,560887,880

Prepaid expenses25,20031,640

Land302,400302,400

Buildings1,134,000 1,713,600

Accumulated Depreciation - buildings(414,540)(466,200)

Machinery and equipment781,200781,200

Acc. Dep - machinery and equipment (191,520) (214,200)

Patents112,000106,960

Total AssetsP3,724,420P4,251,800

LIABILITIES AND STOCKHOLDER'S EQUITY

Accounts payable (merchandise creditors)P927,080P837,480

Dividends payable 25,20032,760

Salaries payable87,08078,960

Mortgage note payable0224,000

Bonds payable390,0000

Common stock, P 1 par value50,400200,400

Paid in capital in excess of par126,000366,000

Retained earnings 2,118,6602,512,200

Total Liabilities and Stockholder's EquityP3,724,420P4,251,800

Additional data obtained from an examination of the accounts in the ledger for 2016 are as follows:

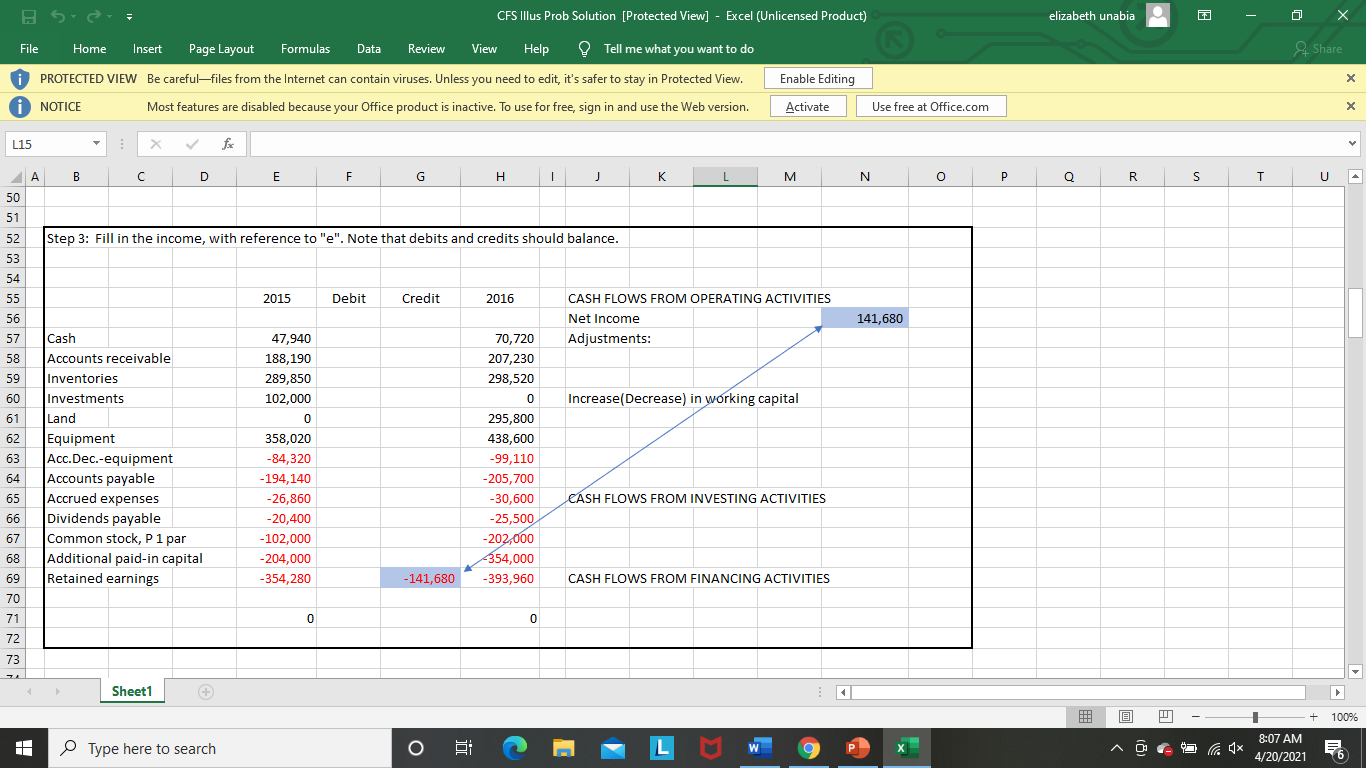

a.Net income, P 524,580.

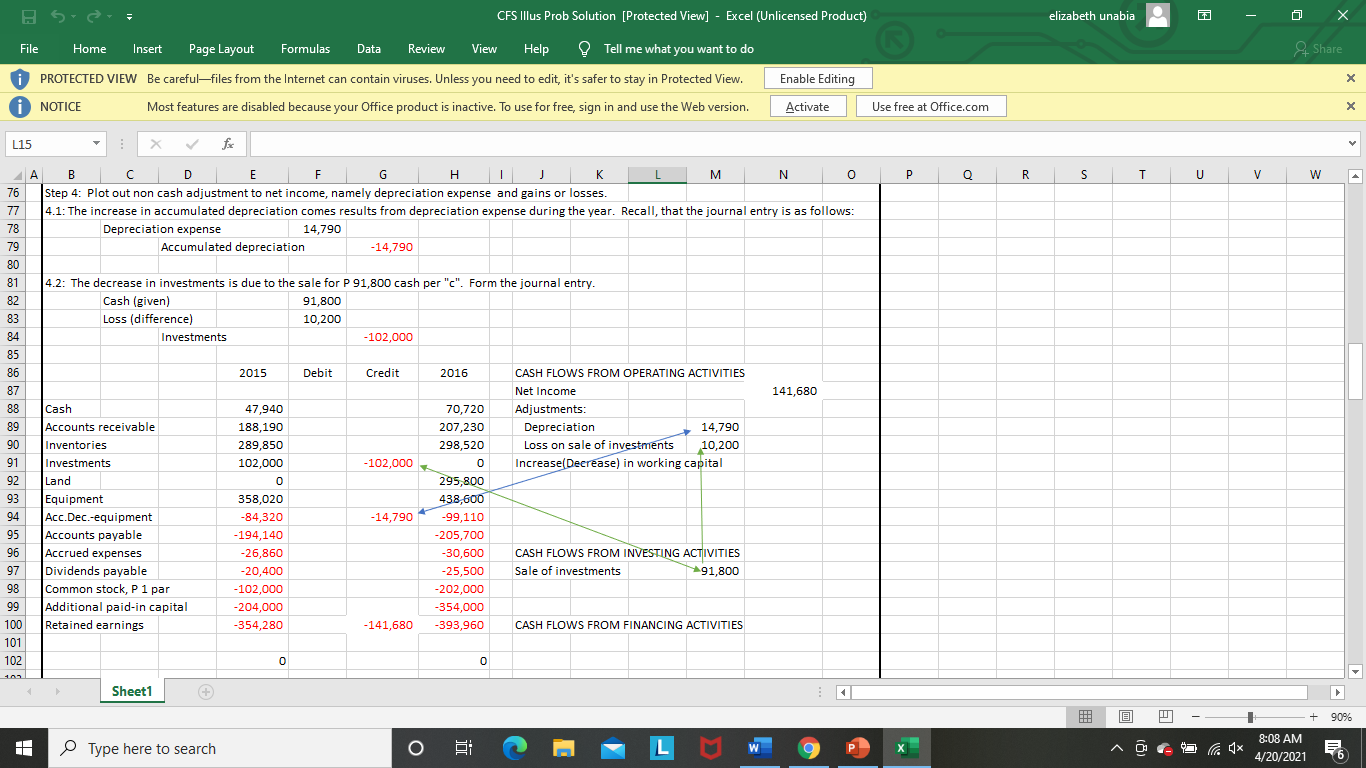

b.Depreciation expense reported on the income statement:buildings, P 51,660; machinery and equipment, P 22,680.

c.Patent amortization reported on the income statement, P 5,040.

d.A building was constructed for P 579,600.

e.A mortgage note of P 224,000 was issued for cash.

f.30,000 shares of common stock were issued at P 13 in exchange for bonds payable.

g.Cash dividends declared, P 131,040.

CFS Illus Prob Solution [Protected View] - Excel (Unlicensed Product) elizabeth unabia X File Home Insert Page Layout Formulas Data Review View Help Tell me what you want to do Share i PROTECTED VIEW Be careful-files from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View. Enable Editing X i NOTICE Most features are disabled because your Office product is inactive. To use for free, sign in and use the Web version. Activate Use free at Office.com X L15 X v fx A B C D E F G H J K L M N 0 P Q R S T U V W 1 Statement of Cash Flows 2 Indirect Method 3 Illustrative Problem Step 1: Plot out the given information. Start with the earlier year. Normal credit balances have have the negative sign, "-" and are in red. 2015 Debit Credit 2016 10 11 Cash 47,940 70,720 12 Accounts receivable 188,190 207,230 13 nventories 289,850 298,520 14 nvestments 102,000 0 15 Land 295,800 16 Equipment 858,020 438,600 17 Acc.Dec.-equipment -84,320 99,110 18 Accounts payable -194,140 205,700 19 Accrued expenses -26,860 30,600 20 Dividends payable -20,400 25,500 21 Common stock, P 1 par -102,000 -202,000 22 Additional paid-in capital -204,000 354,000 23 Retained earnings -354,280 -393,960 24 25 Check equality of total balance 0 26 27 Sheet1 + + 90% w 9 P 8:07 AM Type here to search O Ei X 4/20/2021CFS Illus Prob Solution [Protected View] - Excel (Unlicensed Product) elizabeth unabia X File Home Insert Page Layout Formulas Data Review View Help Tell me what you want to do Share PROTECTED VIEW Be careful-files from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View. Enable Editing X i NOTICE Most features are disabled because your Office product is inactive. To use for free, sign in and use the Web version. Activate Use free at Office.com X L15 X V A B C D E F G H K L M N O P Q R S T U 26 27 28 29 Step 2: Plot out the Statement of Cash Flows 30 CASH FLOWS FROM OPERATING ACTIVITIES 31 Net Income 32 2015 Debit Credit 2016 Adjustments: 33 34 Cash 47,940 70,720 35 Accounts receivable 188,190 207,230 Increase(Decrease) in working capital 36 Inventories 289,850 298,520 37 Investments 102,000 38 Land 295,800 39 Equipment 358,020 438,600 40 Acc.Dec.-equipment -84,320 -99,110 CASH FLOWS FROM INVESTING ACTIVITIES 41 Accounts payable -194,140 -205,700 42 Accrued expenses -26,860 -30,600 43 Dividends payable -20,400 -25,500 44 Common stock, P 1 par -102,000 -202,000 CASH FLOWS FROM FINANCING ACTIVITIES 45 Additional paid-in capital -204,000 -354,000 46 Retained earnings -354,280 -393,960 47 48 0 0 49 Sheet1 + + 100% 8:07 AM Type here to search O W 9 P X Speakers: MutedCFS Illus Prob Solution [Protected View] - Excel (Unlicensed Product) elizabeth unabia X File Home Insert Page Layout Formulas Data Review View Help Tell me what you want to do Share PROTECTED VIEW Be careful-files from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View. Enable Editing X i NOTICE Most features are disabled because your Office product is inactive. To use for free, sign in and use the Web version. Activate Use free at Office.com X L15 X V A B C D E F G H 1 J K L M N O P Q R S T U 50 51 52 Step 3: Fill in the income, with reference to "e". Note that debits and credits should balance. 53 54 55 2015 Debit Credit 2016 CASH FLOWS FROM OPERATING ACTIVITIES 56 Net Income 141,680 57 Cash 47,940 70,720 Adjustments: 58 Accounts receivable 188,190 207,230 59 Inventories 289,850 298,520 60 Investments 102,000 0 Increase(Decrease) in working capital 61 and 295,800 62 Equipment 358,020 438,600 63 Acc.Dec.-equipment -84,320 -99,110 64 Accounts payable -194,140 -205,700 65 Accrued expenses -26,860 -30,600 CASH FLOWS FROM INVESTING ACTIVITIES 66 Dividends payable -20,400 -25,500 67 Common stock, P 1 par 102,000 -202,000 68 Additional paid-in capital -204,000