Answered step by step

Verified Expert Solution

Question

1 Approved Answer

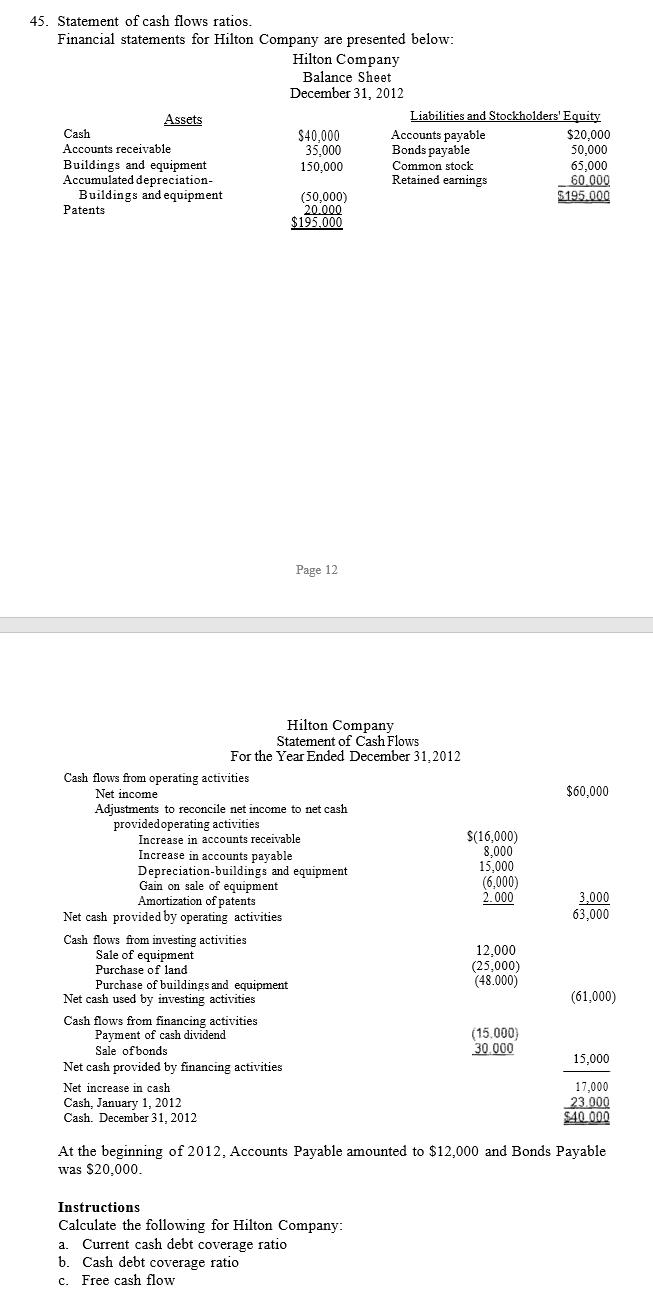

45. Statement of cash flows ratios. Financial statements for Hilton Company are presented below: Hilton Company Balance Sheet December 31, 2012 Liabilities and Stockholders'

45. Statement of cash flows ratios. Financial statements for Hilton Company are presented below: Hilton Company Balance Sheet December 31, 2012 Liabilities and Stockholders' Equity $20,000 50,000 65,000 60 000 $195.000 Assets $40.000 35.000 Accounts payable Bonds payable Cash Accounts receivable Buildings and equipment Accumulated depreciation- Buildings and equipment 150,000 Common stock Retained earnings (50,000) 20.000 $195.000 Patents Page 12 Hilton Company Statement of Cash Flows For the Year Ended December 31,2012 Cash flows from operating activities Net income $60,000 Adjustments to reconcile net income to net cash providedoperating activities Increase in accounts receivable Increase in accounts payable Depreciation-buildings and equipment Gain on sale of equipment Amortization of patents S(16,000) 8,000 15,000 (6,000) 2. 000 3,000 63,000 Net cash provided by operating activities Cash flows from investing activities Sale of equipment 12,000 (25,000) (48.000) Purchase of land Purchase of buildings and equipment Net cash used by investing activities (61,000) Cash flows from financing activities Payment of cash dividend Sale ofbonds Net cash provided by financing activities (15.000) 30.000 15,000 17,000 23.000 $40 000 Net increase in cash Cash, January 1, 2012 Cash. December 31, 2012 At the beginning of 2012, Accounts Payable amounted to $12,000 and Bonds Payable was $20,000. Instructions Calculate the following for Hilton Company: Current cash debt coverage ratio Cash debt coverage ratio c. Free cash flow a. b.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Hilton Company a Current cash debt coverage ratio Net cash provided by opera...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started