Answered step by step

Verified Expert Solution

Question

1 Approved Answer

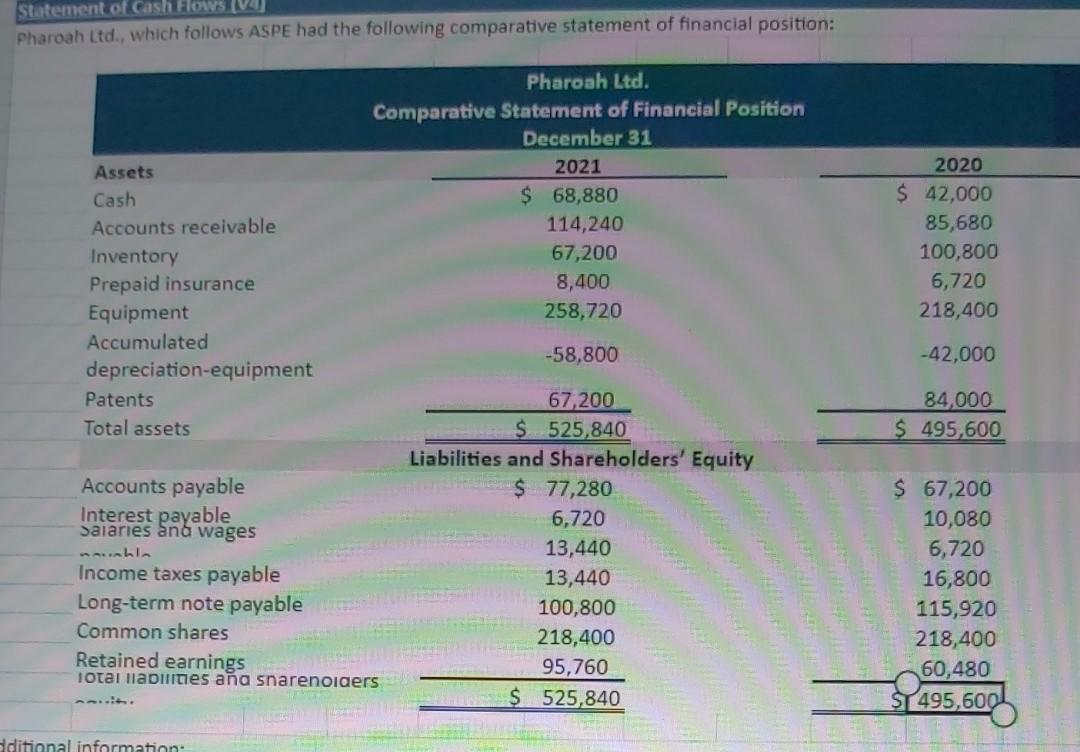

Statement of Cash Flows V2 Pharoah Ltd., which follows ASPE had the following comparative statement of financial position: Assets Cash Accounts receivable Inventory Prepaid insurance

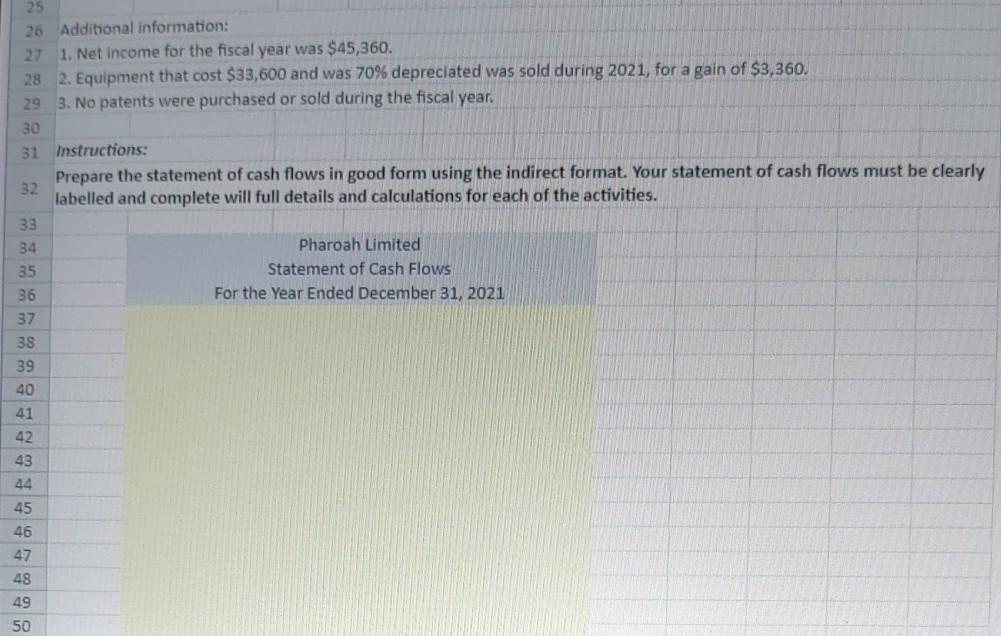

Statement of Cash Flows V2 Pharoah Ltd., which follows ASPE had the following comparative statement of financial position: Assets Cash Accounts receivable Inventory Prepaid insurance Equipment Accumulated depreciation equipment Patents Total assets Pharoah Ltd. Comparative Statement of Financial Position December 31 2021 $ 68,880 114,240 67,200 8,400 258,720 2020 $ 42,000 85,680 100,800 6,720 218,400 -58,800 -42,000 84,000 $ 495,600 Accounts payable Interest payable Saiaries ana wages 67,200 S525,840 Liabilities and Shareholders' Equity $ 77,280 6,720 13,440 13,440 100,800 218,400 95,760 $ 525,840 Income taxes payable Long-term note payable Common shares Retained earnings Total liabilities ana snarenoiders $ 67,200 10,080 6,720 16,800 115,920 218,400 60,480 ST 495,600 Editional information: 26 Additional information: 27 1. Net income for the fiscal year was $45,360. 28 2. Equipment that cost $33,600 and was 70% depreciated was sold during 2021, for a gain of $3,360, 29 3. No patents were purchased or sold during the fiscal year. 30 31 Instructions: Prepare the statement of cash flows in good form using the indirect format. Your statement of cash flows must be clearly 32 labelled and complete will full details and calculations for each of the activities. 33 34 Pharoah Limited 35 Statement of Cash Flows 36 For the Year Ended December 31, 2021 37 38 39 40 41 42 43 44 45 46 47 48 49 50

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started