Answered step by step

Verified Expert Solution

Question

1 Approved Answer

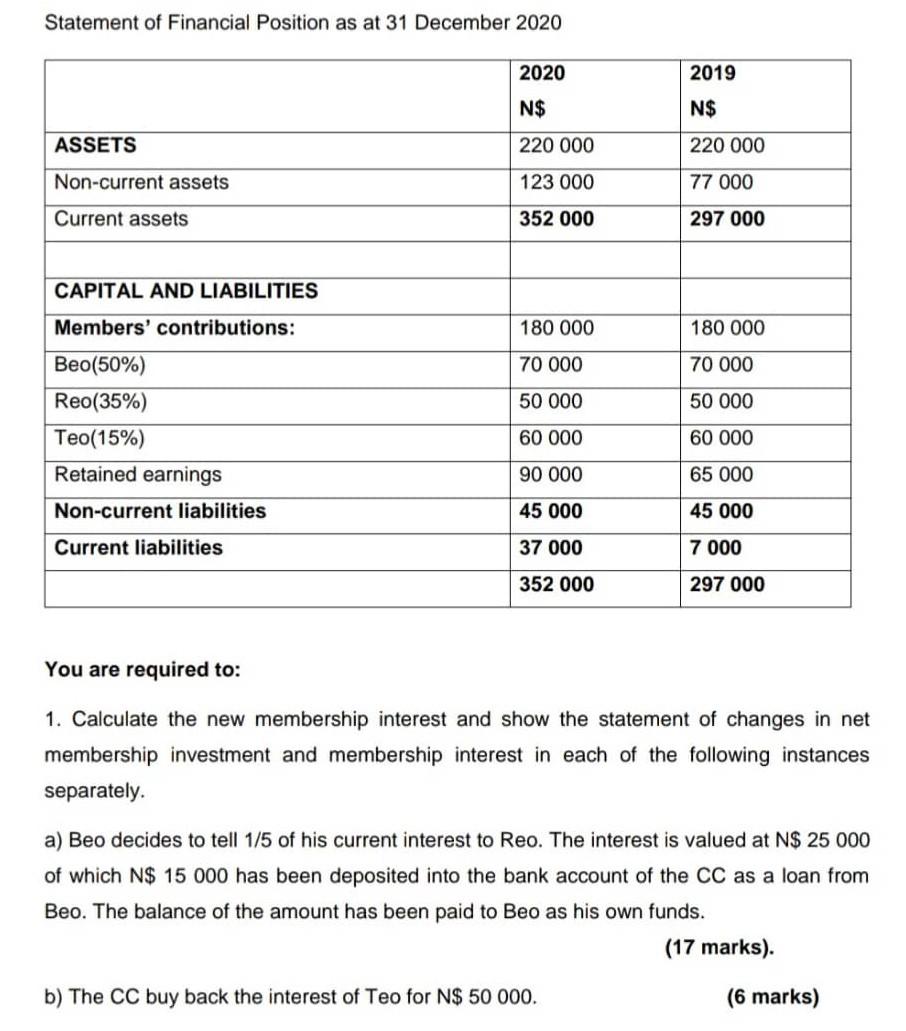

Statement of Financial Position as at 31 December 2020 2020 2019 N$ N$ ASSETS 220 000 220 000 Non-current assets 123 000 77 000 Current

Statement of Financial Position as at 31 December 2020 2020 2019 N$ N$ ASSETS 220 000 220 000 Non-current assets 123 000 77 000 Current assets 352 000 297 000 CAPITAL AND LIABILITIES Members' contributions: 180 000 180 000 70 000 70 000 50 000 50 000 Beo(50%) Reo(35%) Teo(15%) Retained earnings Non-current liabilities 60 000 60 000 90 000 65 000 45 000 45 000 Current liabilities 37 000 7 000 352 000 297 000 You are required to: 1. Calculate the new membership interest and show the statement of changes in net membership investment and membership interest in each of the following instances separately. a) Beo decides to tell 1/5 of his current interest to Reo. The interest is valued at N$ 25 000 of which N$ 15 000 has been deposited into the bank account of the CC as a loan from Beo. The balance of the amount has been paid to Beo as his own funds. (17 marks). b) The CC buy back the interest of Teo for N$ 50 000. (6 marks) c) Erica and Ladia, are planning to open a business, however they are not sure as to the type of enterprise sults them from your knowledge, Is it possible to convert a close corporation into a company? If so, how should they do it

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started