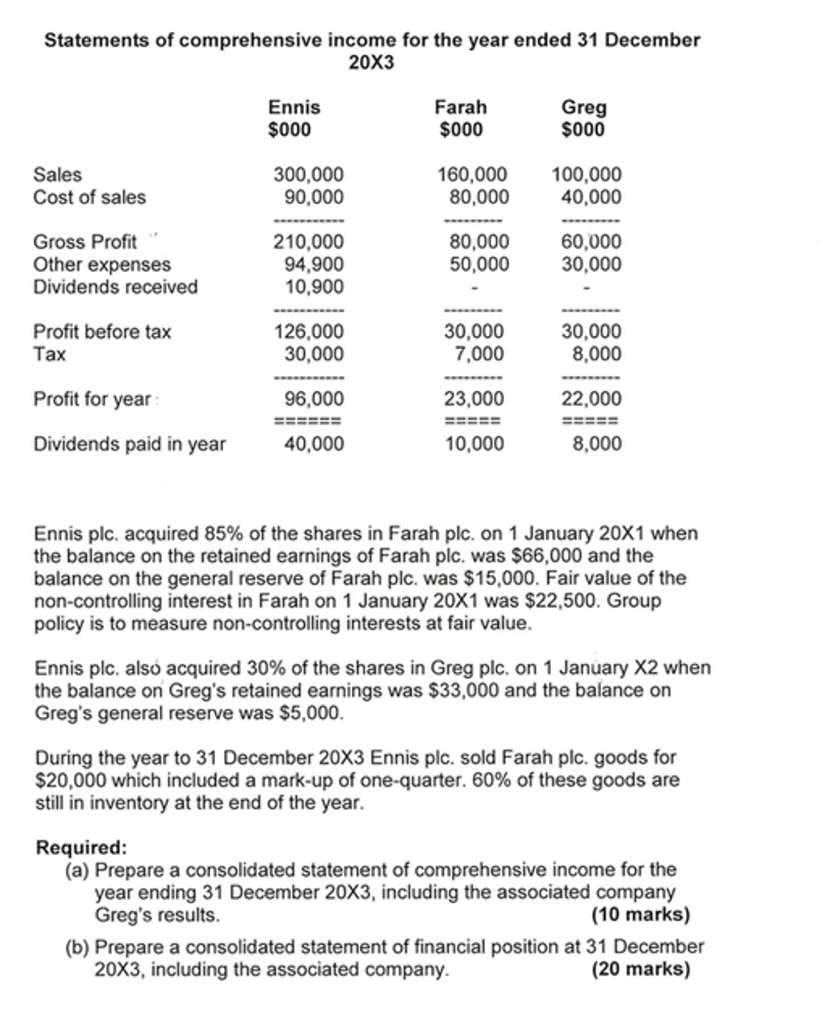

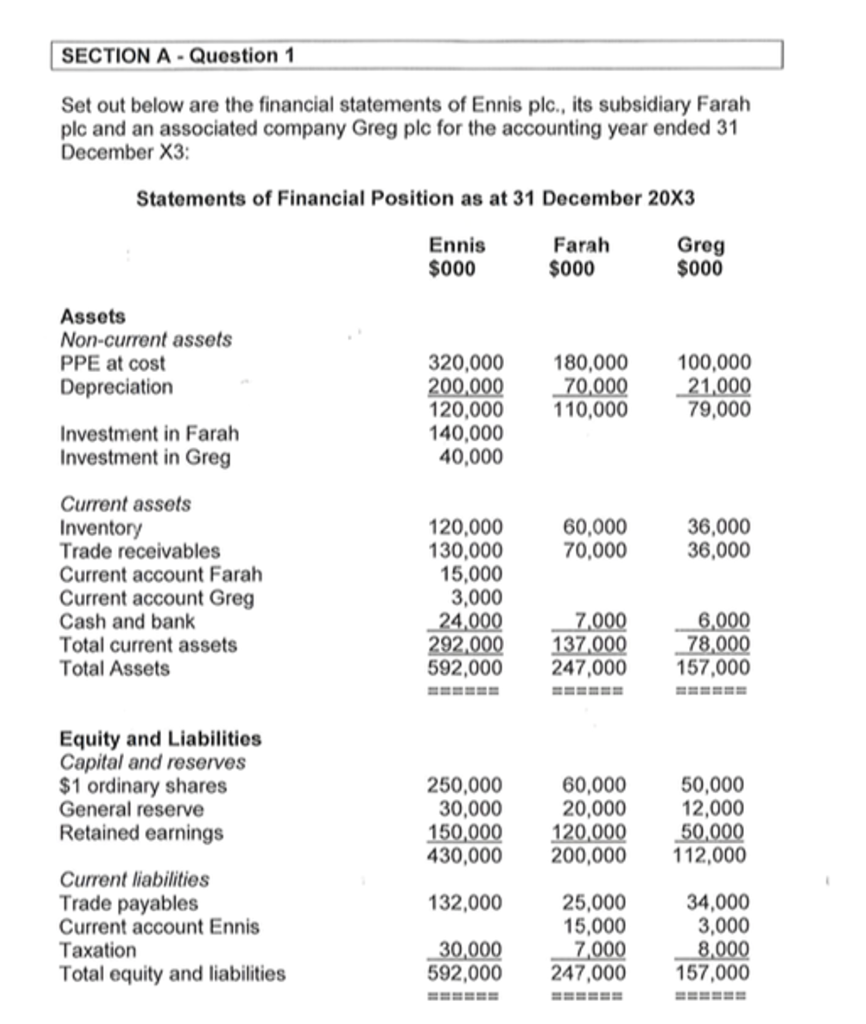

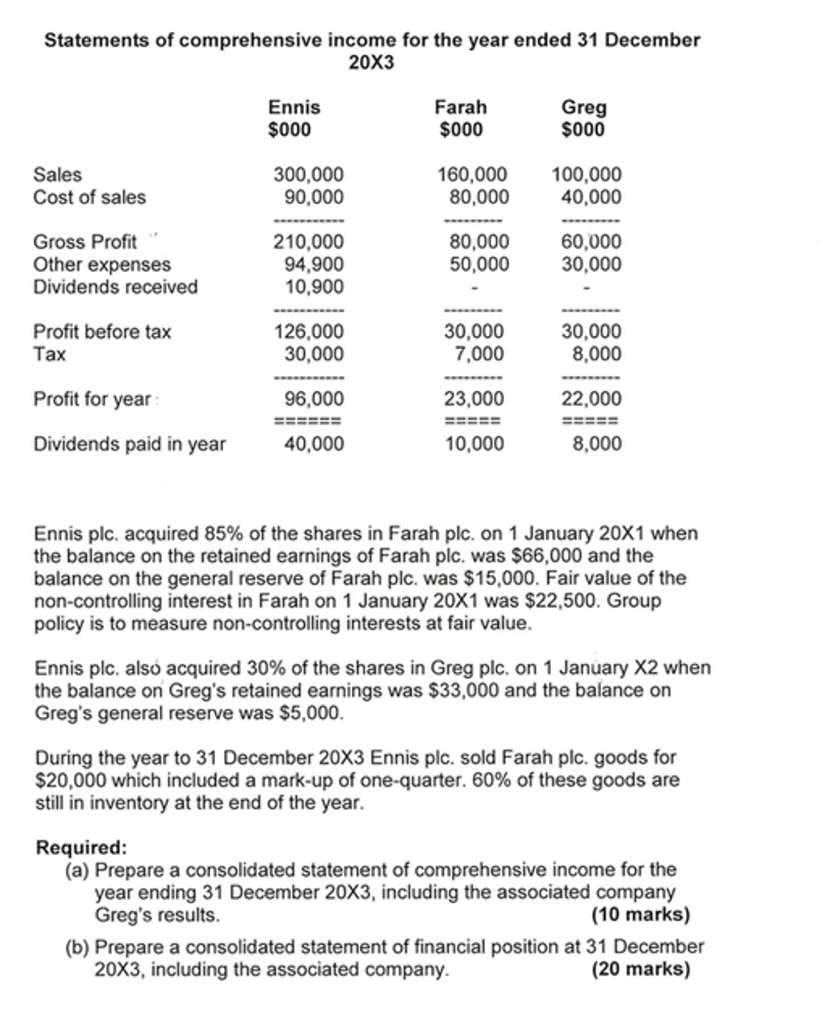

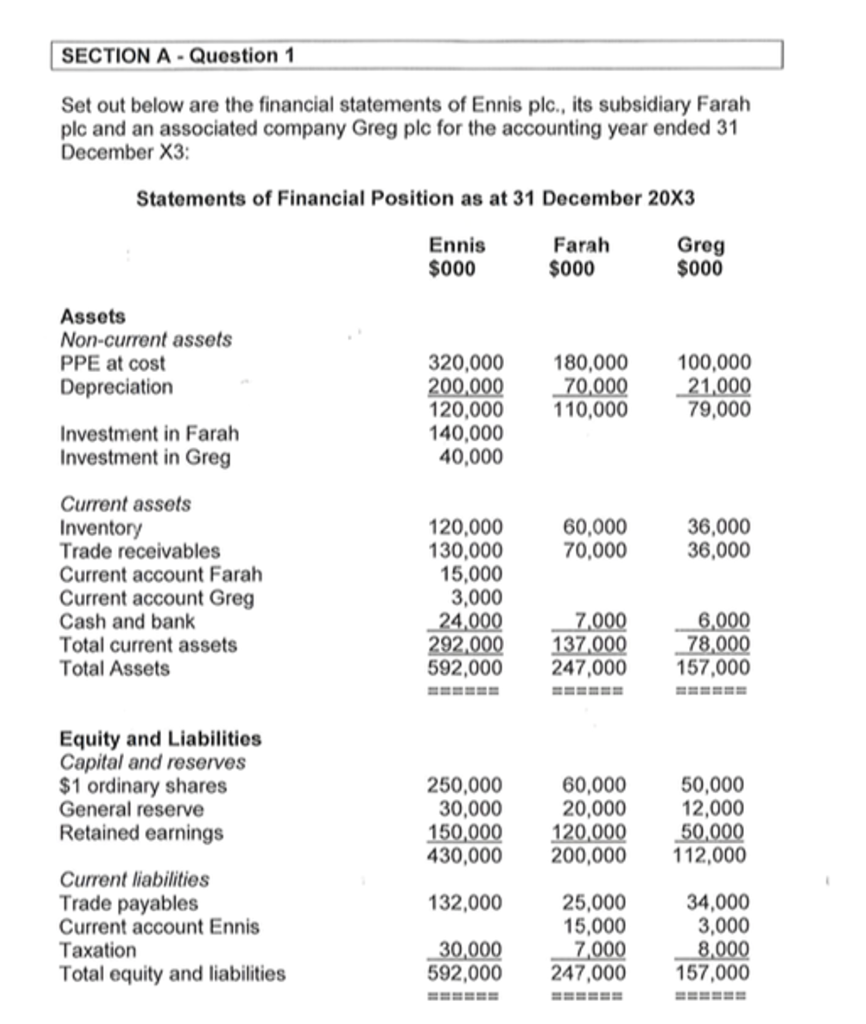

Statements of comprehensive income for the year ended 31 December 20X3 Farah Ennis $000 Greg $000 $000 Sales Cost of sales 300,000 90,000 160,000 80,000 100,000 40,000 Gross Profit Other expenses Dividends received 210,000 94,900 10,900 80,000 50,000 60,000 30,000 Profit before tax Tax 126,000 30,000 30,000 7,000 30.000 8,000 Profit for year 96,000 23,000 22.000 ===== Dividends paid in year 40,000 10,000 8,000 Ennis plc. acquired 85% of the shares in Farah plc. on 1 January 20X1 when the balance on the retained earnings of Farah plc. was $66,000 and the balance on the general reserve of Farah plc. was $15,000. Fair value of the non-controlling interest in Farah on 1 January 20X1 was $22,500. Group policy is to measure non-controlling interests at fair value. Ennis plc. also acquired 30% of the shares in Greg plc. on 1 January x2 when the balance on Greg's retained earnings was $33,000 and the balance on Greg's general reserve was $5,000. During the year to 31 December 20x3 Ennis plc. sold Farah plc.goods for $20,000 which included a mark-up of one-quarter. 60% of these goods are still in inventory at the end of the year. Required: (a) Prepare a consolidated statement of comprehensive income for the year ending 31 December 20X3, including the associated company Greg's results. (10 marks) (b) Prepare a consolidated statement of financial position at 31 December 20X3, including the associated company. (20 marks) SECTION A - Question 1 Set out below are the financial statements of Ennis plc., its subsidiary Farah plc and an associated company Greg plc for the accounting year ended 31 December X3 Statements of Financial Position as at 31 December 20X3 Ennis $000 Farah $000 Greg $000 Assets Non-current assets PPE at cost Depreciation 320,000 200,000 120,000 140,000 40,000 180,000 70,000 110,000 100,000 21,000 79,000 Investment in Farah Investment in Greg 60,000 70,000 36,000 36,000 Current assets Inventory Trade receivables Current account Farah Current account Greg Cash and bank Total current assets Total Assets 120,000 130,000 15,000 3,000 24,000 292,000 592,000 7.000 137.000 247,000 6,000 78,000 157,000 Equity and Liabilities Capital and reserves $1 ordinary shares General reserve Retained earnings 250,000 30,000 150,000 430,000 60,000 20,000 120,000 200,000 50,000 12,000 50,000 112,000 132,000 Current liabilities Trade payables Current account Ennis Taxation Total equity and liabilities 25,000 15,000 7,000 247,000 34,000 3,000 8.000 157,000 30,000 592,000 BEEEEE Statements of comprehensive income for the year ended 31 December 20X3 Farah Ennis $000 Greg $000 $000 Sales Cost of sales 300,000 90,000 160,000 80,000 100,000 40,000 Gross Profit Other expenses Dividends received 210,000 94,900 10,900 80,000 50,000 60,000 30,000 Profit before tax Tax 126,000 30,000 30,000 7,000 30.000 8,000 Profit for year 96,000 23,000 22.000 ===== Dividends paid in year 40,000 10,000 8,000 Ennis plc. acquired 85% of the shares in Farah plc. on 1 January 20X1 when the balance on the retained earnings of Farah plc. was $66,000 and the balance on the general reserve of Farah plc. was $15,000. Fair value of the non-controlling interest in Farah on 1 January 20X1 was $22,500. Group policy is to measure non-controlling interests at fair value. Ennis plc. also acquired 30% of the shares in Greg plc. on 1 January x2 when the balance on Greg's retained earnings was $33,000 and the balance on Greg's general reserve was $5,000. During the year to 31 December 20x3 Ennis plc. sold Farah plc.goods for $20,000 which included a mark-up of one-quarter. 60% of these goods are still in inventory at the end of the year. Required: (a) Prepare a consolidated statement of comprehensive income for the year ending 31 December 20X3, including the associated company Greg's results. (10 marks) (b) Prepare a consolidated statement of financial position at 31 December 20X3, including the associated company. (20 marks) SECTION A - Question 1 Set out below are the financial statements of Ennis plc., its subsidiary Farah plc and an associated company Greg plc for the accounting year ended 31 December X3 Statements of Financial Position as at 31 December 20X3 Ennis $000 Farah $000 Greg $000 Assets Non-current assets PPE at cost Depreciation 320,000 200,000 120,000 140,000 40,000 180,000 70,000 110,000 100,000 21,000 79,000 Investment in Farah Investment in Greg 60,000 70,000 36,000 36,000 Current assets Inventory Trade receivables Current account Farah Current account Greg Cash and bank Total current assets Total Assets 120,000 130,000 15,000 3,000 24,000 292,000 592,000 7.000 137.000 247,000 6,000 78,000 157,000 Equity and Liabilities Capital and reserves $1 ordinary shares General reserve Retained earnings 250,000 30,000 150,000 430,000 60,000 20,000 120,000 200,000 50,000 12,000 50,000 112,000 132,000 Current liabilities Trade payables Current account Ennis Taxation Total equity and liabilities 25,000 15,000 7,000 247,000 34,000 3,000 8.000 157,000 30,000 592,000 BEEEEE