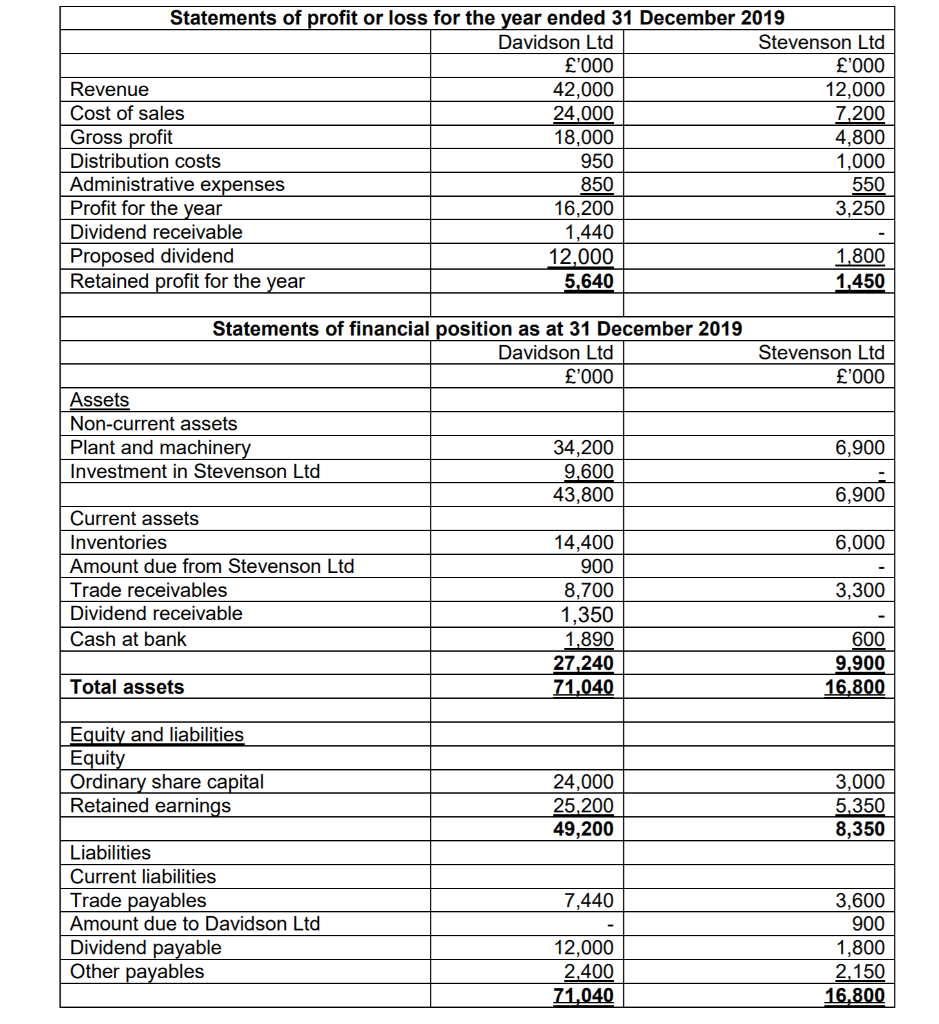

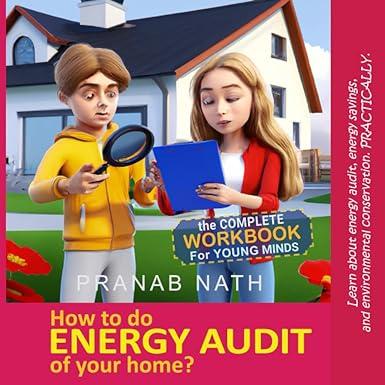

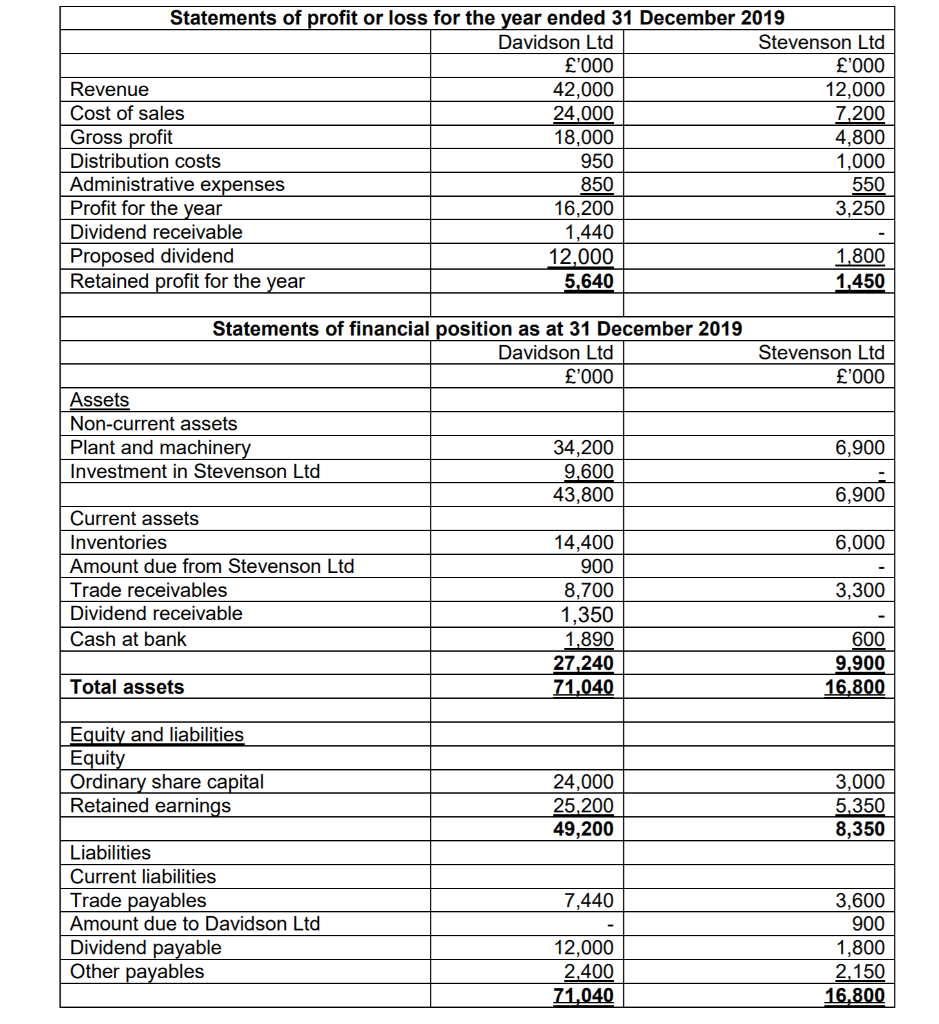

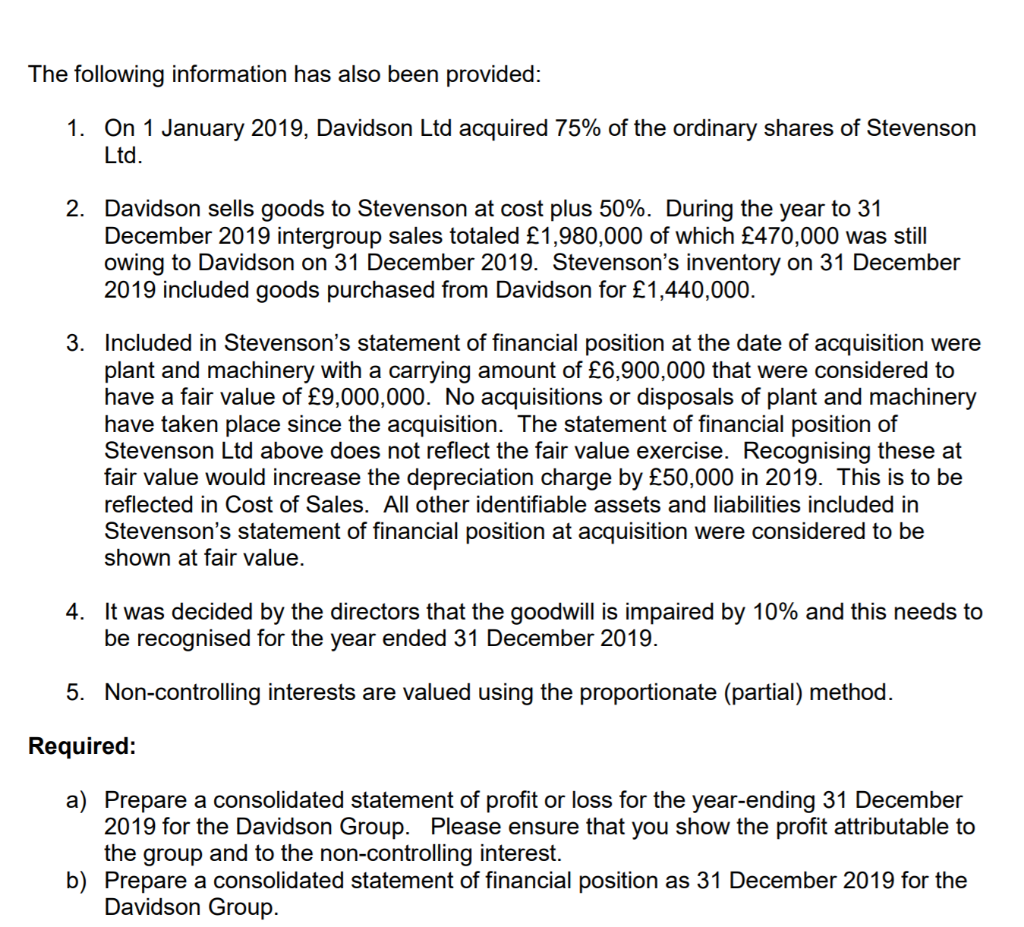

Statements of profit or loss for the year ended 31 December 2019 Davidson Ltd Stevenson Ltd '000 '000 Revenue 42,000 12,000 Cost of sales 24,000 7,200 Gross profit 18,000 4,800 Distribution costs 950 1,000 | Administrative expenses 850 550 Profit for the year 16.200 3,250 Dividend receivable 1,440 Proposed dividend 12,000 1.800 Retained profit for the year 5,640 1.450 Stevenson Ltd '000 6,900 6,900 Statements of financial position as at 31 December 2019 Davidson Ltd '000 Assets Non-current assets Plant and machinery 34,200 Investment in Stevenson Ltd 9,600 43,800 Current assets Inventories 14,400 Amount due from Stevenson Ltd 900 Trade receivables 8,700 | Dividend receivable 1,350 Cash at bank 1,890 27.240 Total assets 71,040 6,000 3,300 600 9,900 16.800 Equity and liabilities Equity Ordinary share capital Retained earnings 24,000 25,200 49,200 3,000 5,350 8,350 7,440 Liabilities Current liabilities Trade payables Amount due to Davidson Ltd Dividend payable Other payables 12,000 2.400 71.040 3,600 900 1,800 2,150 16,800 The following information has also been provided: 1. On 1 January 2019, Davidson Ltd acquired 75% of the ordinary shares of Stevenson Ltd. 2. Davidson sells goods to Stevenson at cost plus 50%. During the year to 31 December 2019 intergroup sales totaled 1,980,000 of which 470,000 was still owing to Davidson on 31 December 2019. Stevenson's inventory on 31 December 2019 included goods purchased from Davidson for 1,440,000. 3. Included in Stevenson's statement of financial position at the date of acquisition were plant and machinery with a carrying amount of 6,900,000 that were considered to have a fair value of 9,000,000. No acquisitions or disposals of plant and machinery have taken place since the acquisition. The statement of financial position of Stevenson Ltd above does not reflect the fair value exercise. Recognising these at fair value would increase the depreciation charge by 50,000 in 2019. This is to be reflected in Cost of Sales. All other identifiable assets and liabilities included in Stevenson's statement of financial position at acquisition were considered to be shown at fair value. 4. It was decided by the directors that the goodwill is impaired by 10% and this needs to be recognised for the year ended 31 December 2019. 5. Non-controlling interests are valued using the proportionate (partial) method. Required: a) Prepare a consolidated statement of profit or loss for the year-ending 31 December 2019 for the Davidson Group. Please ensure that you show the profit attributable to the group and to the non-controlling interest. b) Prepare a consolidated statement of financial position as 31 December 2019 for the Davidson Group. Statements of profit or loss for the year ended 31 December 2019 Davidson Ltd Stevenson Ltd '000 '000 Revenue 42,000 12,000 Cost of sales 24,000 7,200 Gross profit 18,000 4,800 Distribution costs 950 1,000 | Administrative expenses 850 550 Profit for the year 16.200 3,250 Dividend receivable 1,440 Proposed dividend 12,000 1.800 Retained profit for the year 5,640 1.450 Stevenson Ltd '000 6,900 6,900 Statements of financial position as at 31 December 2019 Davidson Ltd '000 Assets Non-current assets Plant and machinery 34,200 Investment in Stevenson Ltd 9,600 43,800 Current assets Inventories 14,400 Amount due from Stevenson Ltd 900 Trade receivables 8,700 | Dividend receivable 1,350 Cash at bank 1,890 27.240 Total assets 71,040 6,000 3,300 600 9,900 16.800 Equity and liabilities Equity Ordinary share capital Retained earnings 24,000 25,200 49,200 3,000 5,350 8,350 7,440 Liabilities Current liabilities Trade payables Amount due to Davidson Ltd Dividend payable Other payables 12,000 2.400 71.040 3,600 900 1,800 2,150 16,800 The following information has also been provided: 1. On 1 January 2019, Davidson Ltd acquired 75% of the ordinary shares of Stevenson Ltd. 2. Davidson sells goods to Stevenson at cost plus 50%. During the year to 31 December 2019 intergroup sales totaled 1,980,000 of which 470,000 was still owing to Davidson on 31 December 2019. Stevenson's inventory on 31 December 2019 included goods purchased from Davidson for 1,440,000. 3. Included in Stevenson's statement of financial position at the date of acquisition were plant and machinery with a carrying amount of 6,900,000 that were considered to have a fair value of 9,000,000. No acquisitions or disposals of plant and machinery have taken place since the acquisition. The statement of financial position of Stevenson Ltd above does not reflect the fair value exercise. Recognising these at fair value would increase the depreciation charge by 50,000 in 2019. This is to be reflected in Cost of Sales. All other identifiable assets and liabilities included in Stevenson's statement of financial position at acquisition were considered to be shown at fair value. 4. It was decided by the directors that the goodwill is impaired by 10% and this needs to be recognised for the year ended 31 December 2019. 5. Non-controlling interests are valued using the proportionate (partial) method. Required: a) Prepare a consolidated statement of profit or loss for the year-ending 31 December 2019 for the Davidson Group. Please ensure that you show the profit attributable to the group and to the non-controlling interest. b) Prepare a consolidated statement of financial position as 31 December 2019 for the Davidson Group