Statistics Question Question A, B, C

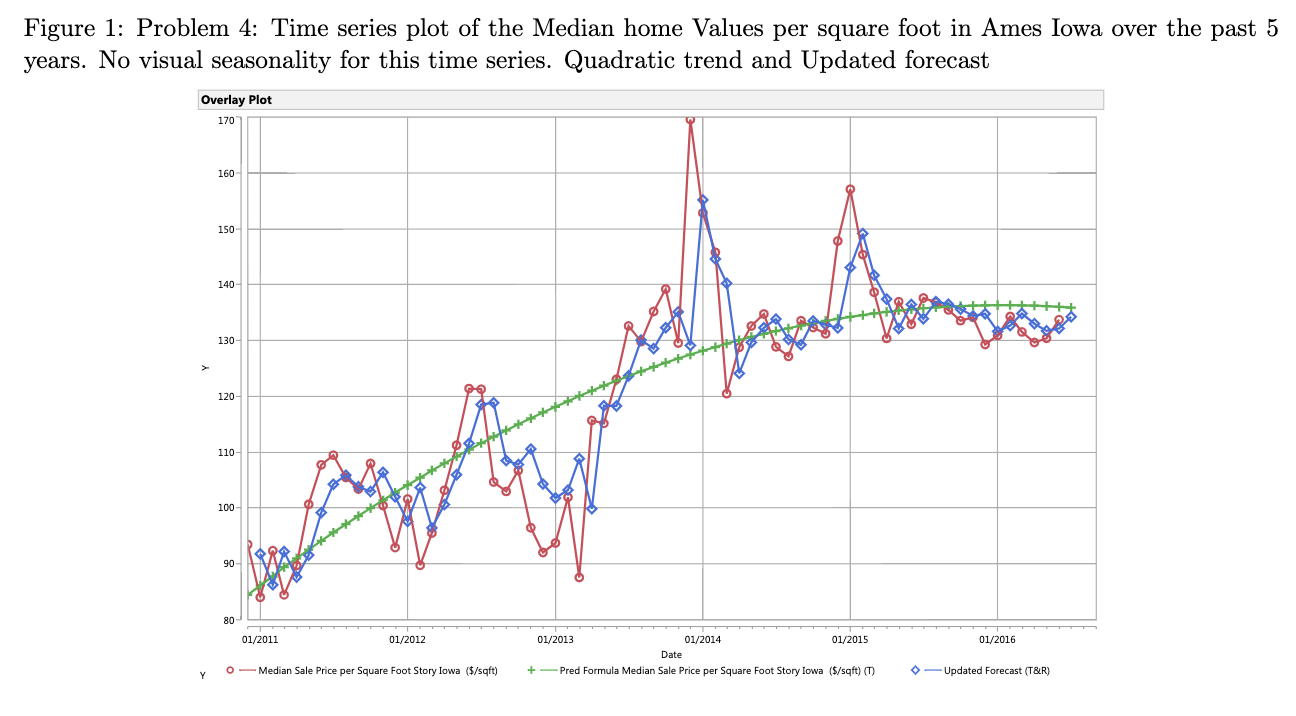

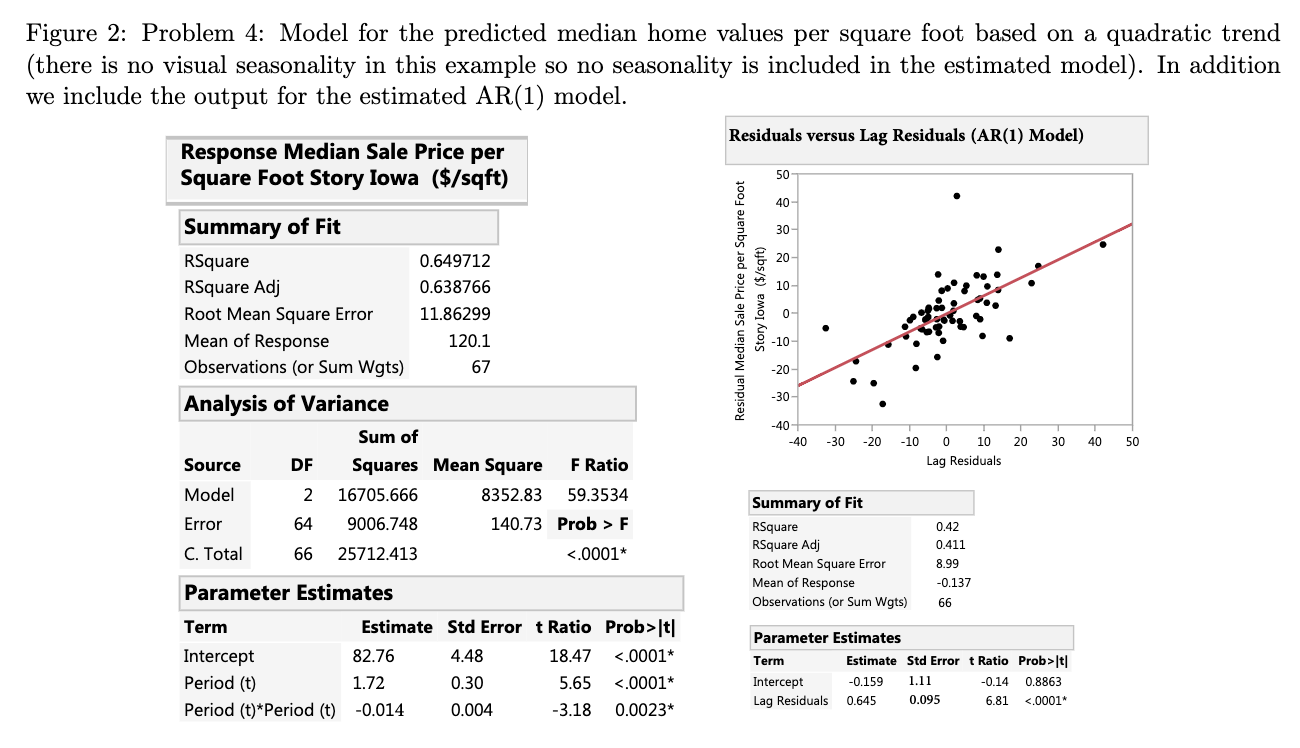

Zillow is a home and real estate marketplace that aims to assist homeowners, home buyers, sellers, renters, real estate agents, mortgage professionals, landlords, and property managers locate and share information about homes, real estate, and mortgages. Zillow uses a priority formula to estimate home and rental housing market value, termed a Zestimate, using its database of over 110 million homes in the United States. The Zestimate is calculated from public and user submitted data. In this example we look at Zillow's estimated median sales price of homes in Ames, Iowa recorded in $ per square foot. Figure (1) is the time series plot by month of the Median home sales price in Ames ($/sqft) over the past 5 plus years. The rst data entry is in December of 2010. The last data entry is in June of 2016. The vertical lines signify January. Figure (2) shows the predicted sales price of home based on a quadratic trend (there is no visual seasonality in this example so no seasonality is included in the estimated model). In addition we include the output for the estimated AR(1) model. (a) What is the predicted median sales price for Ames homes ($/sqft) for June 2016 based on the model accounting for trend? Show all your work to receive full credit. (b) What is the predicted median sales price for Ames homes ($/sqft) for July 2016 based on the model accounting for trend? Show all your work to receive full credit. (0) In J une of 2016 the median sales price for Ames homes ($/sqft) was 133 ($/sqft). Find the residual median home value per square foot. Figure 1: Problem 4: Time series plot of the Median home Values per square foot in Ames Iowa over the past 5 years. No visual seasonality for this time series. Quadratic trend and Updated forecast Overlay Plot 170 160 150 140- 130- 120- 110 100- 90 80- 01/2011 01/2012 01/2013 01/2014 01/2015 01/2016 Date O - Median Sale Price per Square Foot Story Iowa ($/sqft) -Pred Formula Median Sale Price per Square Foot Story Iowa ($/sqft) (1) - Updated Forecast (T&R)Figure 2: Problem 4: Model for the predicted median home values per square foot based on a quadratic trend (there is no visual seasonality in this example so no seasonality is included in the estimated model). In addition we include the output for the estimated AR(1) model. Residuals versus Lag Residuals (AR(1) Model) Response Median Sale Price per Square Foot Story Iowa ($/sqft) 50 40- Summary of Fit 30 RSquare 0.649712 20 RSquare Adj 0.638766 10- Story Iowa ($/sqft) Residual Median Sale Price per Square Foot Root Mean Square Error 11.86299 0 - Mean of Response 120.1 -10 Observations (or Sum Wgts) 67 20 Analysis of Variance -30 -40 Sum of -40 -30 -20 -10 0 10 30 40 50 Source DF Squares Mean Square F Ratio Lag Residuals Model 2 16705.666 8352.83 59.3534 Summary of Fit Error 64 9006.748 140.73 Prob > F RSquare 0.42 C. Total 66 25712.413 <.0001 rsquare adj root mean square error parameter estimates of response observations sum wgts term estimate std t ratio prob>|t| Parameter Estimates Intercept 82.76 4.48 18.47 <.0001 term estimate std error t ratio prob>/t| Period (t) 1.72 0.30 5.65 <.0001 intercept period lag residuals>