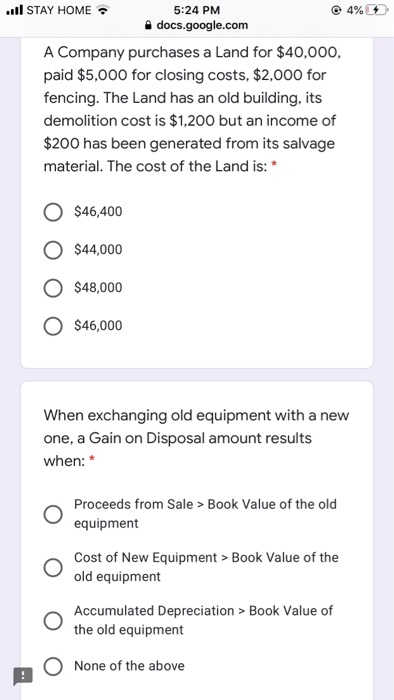

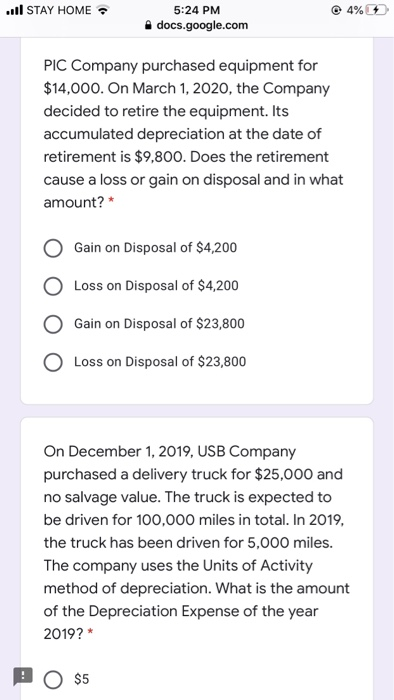

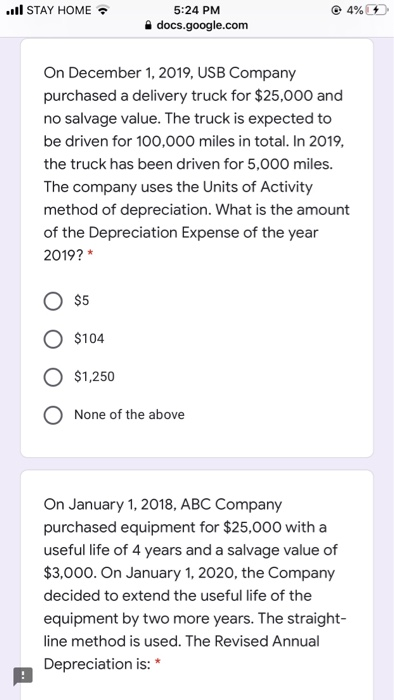

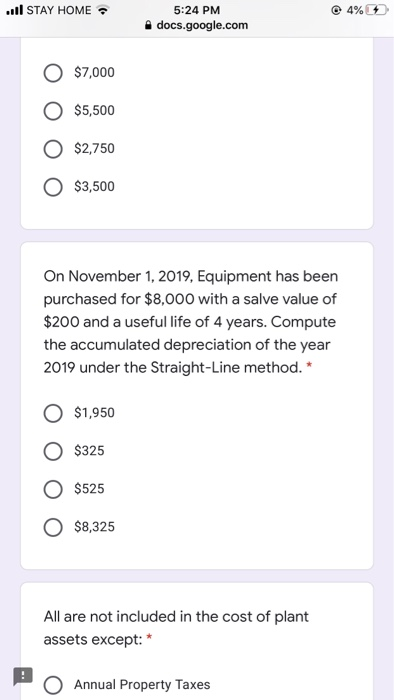

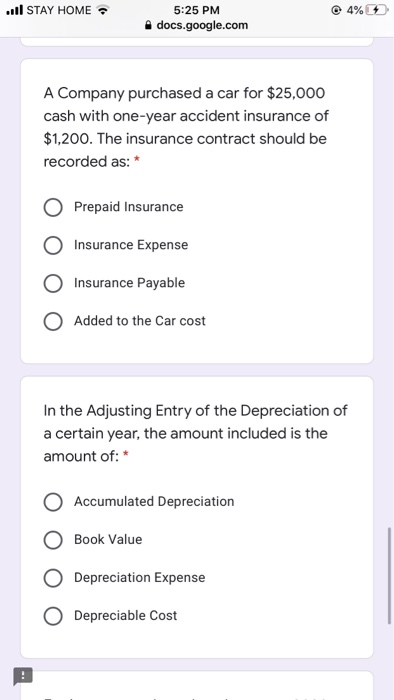

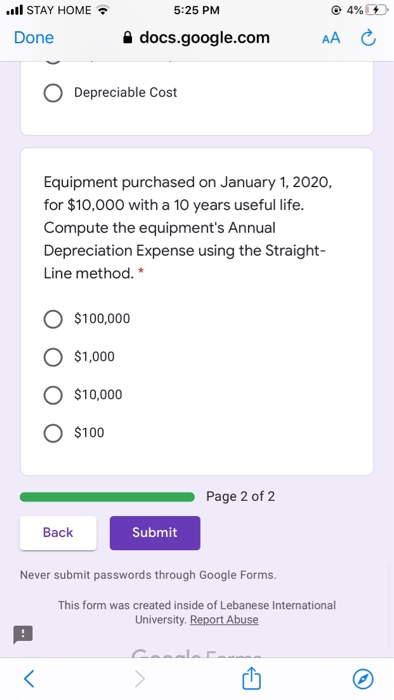

..STAY HOME 5:24 PM 4% .docs.google.com A Company purchases a Land for $40,000, paid $5,000 for closing costs, $2,000 for fencing. The Land has an old building, its demolition cost is $1,200 but an income of $200 has been generated from its salvage material. The cost of the Land is: * 0 $46,400 O $44,000 O $48,000 O $46,000 When exchanging old equipment with a new one, a Gain on Disposal amount results when: * Proceeds from Sale > Book Value of the old equipment Cost of New Equipment > Book Value of the old equipment Accumulated Depreciation > Book Value of the old equipment None of the above .STAY HOME 4% 5:24 PM docs.google.com PIC Company purchased equipment for $14,000. On March 1, 2020, the Company decided to retire the equipment. Its accumulated depreciation at the date of retirement is $9,800. Does the retirement cause a loss or gain on disposal and in what amount? * O Gain on Disposal of $4,200 O Loss on Disposal of $4,200 O Gain on Disposal of $23,800 O Loss on Disposal of $23,800 On December 1, 2019, USB Company purchased a delivery truck for $25,000 and no salvage value. The truck is expected to be driven for 100,000 miles in total. In 2019, the truck has been driven for 5,000 miles. The company uses the Units of Activity method of depreciation. What is the amount of the Depreciation Expense of the year 2019? * P O $5 .. STAY HOME 4% 5:24 PM docs.google.com On December 1, 2019, USB Company purchased a delivery truck for $25,000 and no salvage value. The truck is expected to be driven for 100,000 miles in total. In 2019, the truck has been driven for 5,000 miles. The company uses the Units of Activity method of depreciation. What is the amount of the Depreciation Expense of the year 2019?* O $5 O $104 O $1,250 None of the above On January 1, 2018, ABC Company purchased equipment for $25,000 with a useful life of 4 years and a salvage value of $3,000. On January 1, 2020, the Company decided to extend the useful life of the equipment by two more years. The straight- line method is used. The Revised Annual Depreciation is: * .. STAY HOME 4% 5:24 PM docs.google.com O $7,000 $5,500 0 $2,750 O $3,500 On November 1, 2019, Equipment has been purchased for $8,000 with a salve value of $200 and a useful life of 4 years. Compute the accumulated depreciation of the year 2019 under the Straight-Line method. * O $1,950 O $325 $525 O $8,325 All are not included in the cost of plant assets except: * O Annual Property Taxes ... STAY HOME 4% 5:25 PM docs.google.com A Company purchased a car for $25,000 cash with one-year accident insurance of $1,200. The insurance contract should be recorded as: * O Prepaid Insurance O Insurance Expense O Insurance Payable O Added to the Car cost In the Adjusting Entry of the Depreciation of a certain year, the amount included is the amount of: * O Accumulated Depreciation O Book Value O Depreciation Expense O Depreciable Cost I STAY HOME Done 5:25 PM docs.google.com 4% AA O Depreciable Cost Equipment purchased on January 1, 2020, for $10,000 with a 10 years useful life. Compute the equipment's Annual Depreciation Expense using the Straight- Line method. * 0 $100,000 O $1,000 O $10,000 O $100 Page 2 of 2 Back Submit Never submit passwords through Google Forms. This form was created inside of Lebanese International University. Report Abuse