Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Steel Surgical Instruments, Inc. had pretax financial income of $6,500,000 in 2025. Steel Surgical has recently declared a plan for selling the company over the

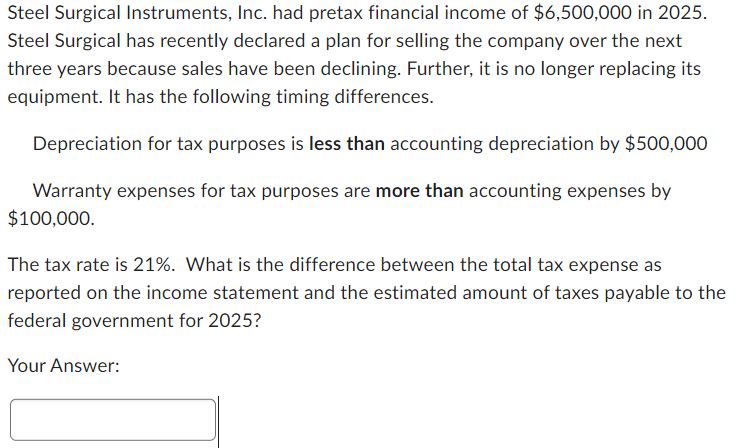

Steel Surgical Instruments, Inc. had pretax financial income of $6,500,000 in 2025. Steel Surgical has recently declared a plan for selling the company over the next three years because sales have been declining. Further, it is no longer replacing its equipment. It has the following timing differences. Depreciation for tax purposes is less than accounting depreciation by $500,000 Warranty expenses for tax purposes are more than accounting expenses by $100,000. The tax rate is 21%. What is the difference between the total tax expense as reported on the income statement and the estimated amount of taxes payable to the federal government for 2025 ? Your

Steel Surgical Instruments, Inc. had pretax financial income of $6,500,000 in 2025. Steel Surgical has recently declared a plan for selling the company over the next three years because sales have been declining. Further, it is no longer replacing its equipment. It has the following timing differences. Depreciation for tax purposes is less than accounting depreciation by $500,000 Warranty expenses for tax purposes are more than accounting expenses by $100,000. The tax rate is 21%. What is the difference between the total tax expense as reported on the income statement and the estimated amount of taxes payable to the federal government for 2025 ? Your Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started