Answered step by step

Verified Expert Solution

Question

1 Approved Answer

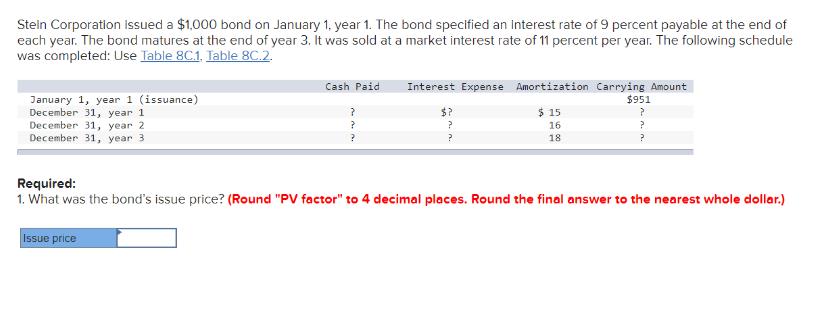

Stein Corporation issued a $1,000 bond on January 1, year 1. The bond specified an Interest rate of 9 percent payable at the end

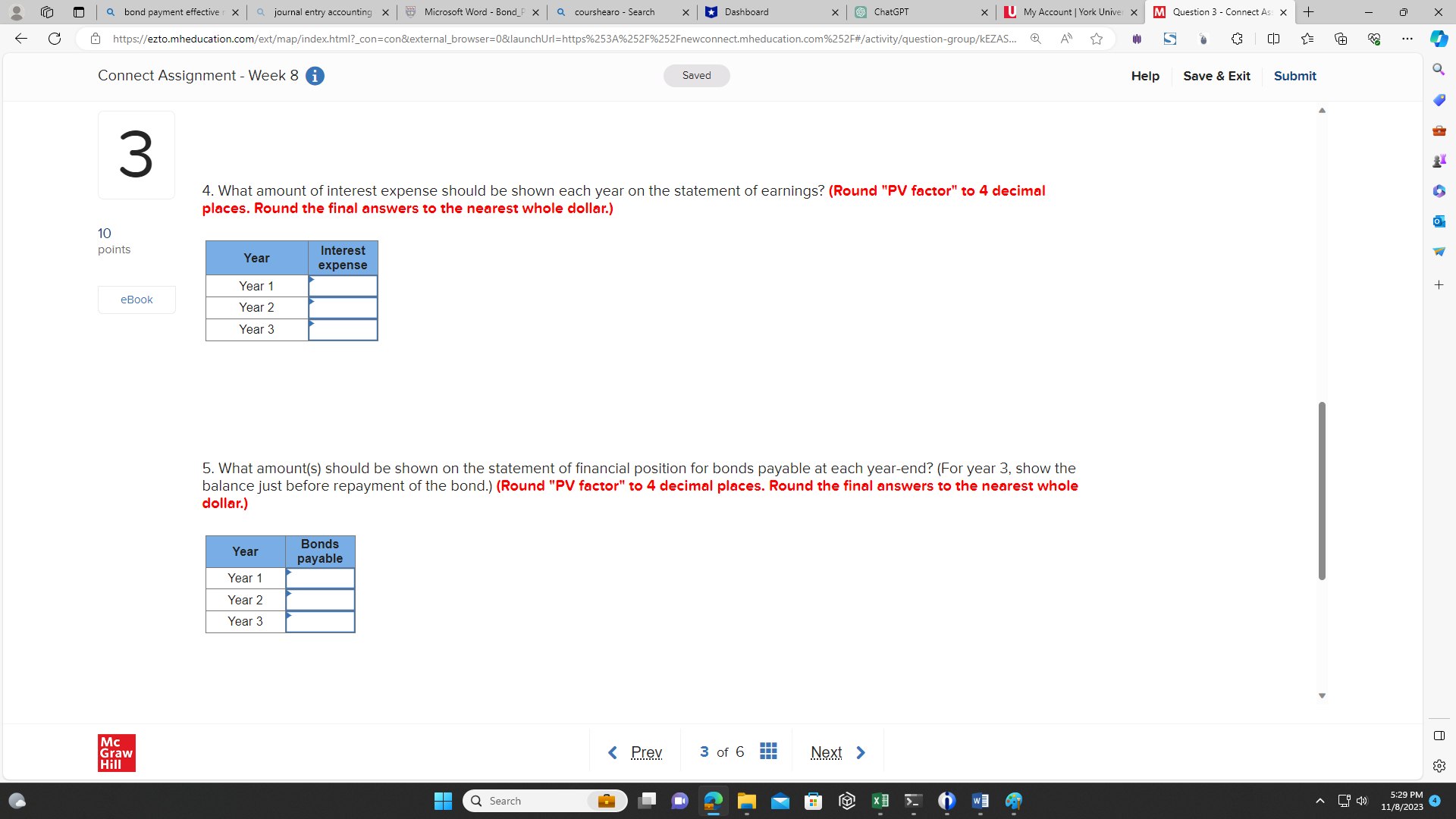

Stein Corporation issued a $1,000 bond on January 1, year 1. The bond specified an Interest rate of 9 percent payable at the end of each year. The bond matures at the end of year 3. It was sold at a market interest rate of 11 percent per year. The following schedule was completed: Use Table 8C.1, Table 8C.2. January 1, year 1 (issuance) December 31, year 1 December 31, year 2 December 31, year 3 Cash Paid Interest Expense Amortization Carrying Amount $951 ? ? $ 15 ? 16 18 Required: 1. What was the bond's issue price? (Round "PV factor" to 4 decimal places. Round the final answer to the nearest whole dollar.) Issue price Q bond payment effective Qjournal entry accounting X Microsoft Word - Bond P X Q courshearo - Search Dashboard ChatGPT U My Account | York Univer Question 3 - Connect Ass X + https://ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/question-group/KEZAS... 3 Connect Assignment - Week 8 i Saved Help Save & Exit Submit 3 10 points 4. What amount of interest expense should be shown each year on the statement of earnings? (Round "PV factor" to 4 decimal places. Round the final answers to the nearest whole dollar.) Year Interest expense eBook Year 1 Year 2 Year 3 Mc Graw Hill 5. What amount(s) should be shown on the statement of financial position for bonds payable at each year-end? (For year 3, show the balance just before repayment of the bond.) (Round "PV factor" to 4 decimal places. Round the final answers to the nearest whole dollar.) Year Bonds payable Year 1 Year 2 Year 3 Q Search < Prev 3 of 6 Next > + + 5:29 PM X 11/8/2023 O

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started