Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Stellenbosch Laboratories Ltd manufactures and distributes a wide range of general pharmaceutical products. Selected audited data for the reporting period ended 31 December 2014

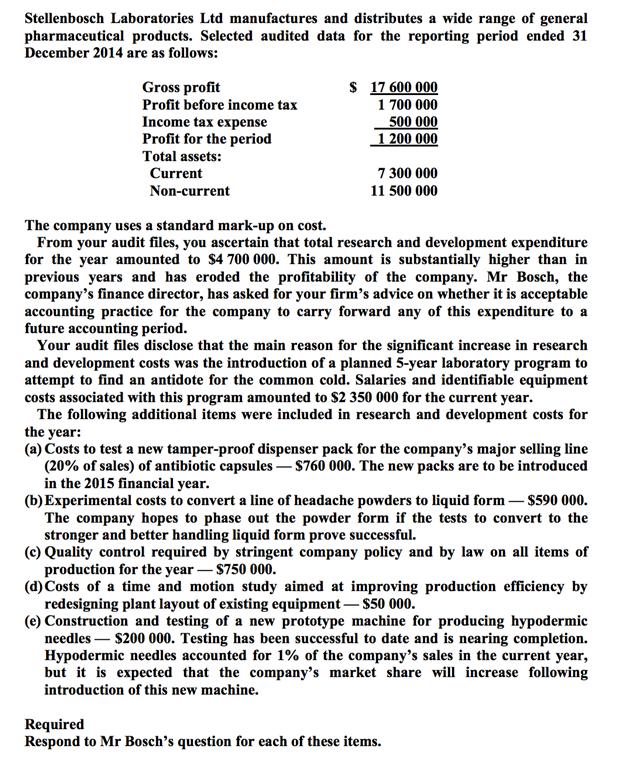

Stellenbosch Laboratories Ltd manufactures and distributes a wide range of general pharmaceutical products. Selected audited data for the reporting period ended 31 December 2014 are as follows: $ 17 600 000 1 700 000 500 000 1 200 000 Gross profit Profit before income tax Income tax expense Profit for the period Total assets: Current 7 300 000 Non-current 11 500 000 The company uses a standard mark-up on cost. From your audit files, you ascertain that total research and development expenditure for the year amounted to $4 700 000. This amount is substantially higher than in previous years and has eroded the profitability of the company. Mr Bosch, the company's finance director, has asked for your firm's advice on whether it is acceptable accounting practice for the company to carry forward any of this expenditure to a future accounting period. Your audit files disclose that the main reason for the significant increase in research and development costs was the introduction of a planned 5-year laboratory program to attempt to find an antidote for the common cold. Salaries and identifiable equipment costs associated with this program amounted to $2 350 000 for the current year. The following additional items were included in research and development costs for the year: (a) Costs to test a new tamper-proof dispenser pack for the company's major selling line (20% of sales) of antibiotic capsules S760 000. The new packs are to be introduced in the 2015 financial year. (b) Experimental costs to convert a line of headache powders to liquid form-$590 000. The company hopes to phase out the powder form if the tests to convert to the stronger and better handling liquid form prove successful. (c) Quality control required by stringent company policy and by law on all items of production for the year-$750 000. (d) Costs of a time and motion study aimed at improving production efficiency by redesigning plant layout of existing equipment- $50 000. (e) Construction and testing of a new prototype machine for producing hypodermic needles $200 000. Testing has been successful to date and is nearing completion. Hypodermic needles accounted for 1% of the company's sales in the current year, but it is expected that the company's market share will increase following introduction of this new machine. Required Respond to Mr Bosch's question for each of these items.

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

The outlays must be analyzed using the following factors Technical feasibility Intention to complete ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started