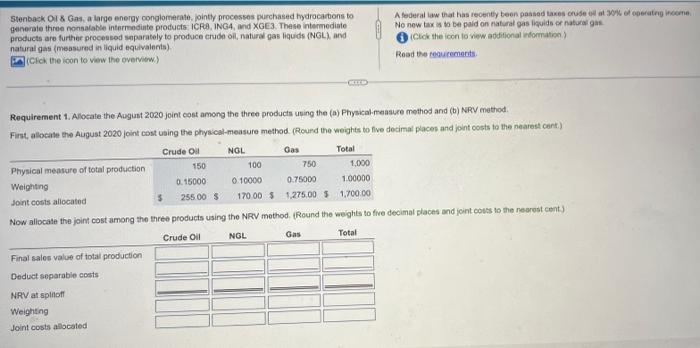

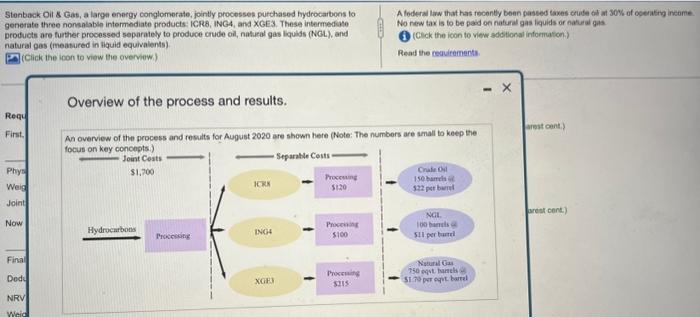

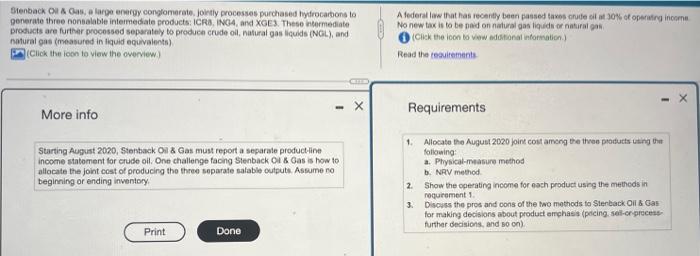

Stenback OI 8 Gas, a large energy conglomerale, jointly processes purchased hydrocartons to generale three nonsalable intermediate products. ICF8., ING4, and XGE3. These intermediale A foderal law that has recently been passed taxes cruse ell at ably ed operater income. products are further processod soparately to produce cruce oil, natura gas liquids (NGL), and No new tax is to be paid on naturat gas liguids or naturat gas. natural gas (messured in liquid equivalents). iCtck the icon to view additional ieformation.) Clak the icon to view the overviow.) Road te requremerits. Requirement 1. Allocate the August 2020 joint cost among the three products using the (a) Physical-rreasure method and (b) NRV method. Fint, alocale the August 2020 joint cost using the physical-measure method. (Rourd the weights to five decimal places and joint costs to the nearest cart) Stenback Oil Gas, a large energy conglomerate, jointly processes purchased hydrocarbons to A foderal law that has foconty been pasted taxes crute of at 30% of operativ ineome. generate three nonsalable intermediate products: ICR8, ING4, and XGE3. These intermedose No new tax is to be padd on natural gas liquids or natural gas. products are further processed separately to produce orude oil, natural gas liquils (NCL), and (Cick the icon to view additional information.) natural ges (meabured in Hiquid equivalents) (Click the icon to view the overview) Read the ceavitements. Overview of the process and results. ReaL First. Bienback OM a Gas, a Large energy congromerate, jokily processes porchased hydrocarbons to generate three nonsalable intemediate products: ICRB, INC4, and XGE3. These intermediate products are further processed separately to produce crude oil, natural gas liquds (NCL), and notural gas (measured in liquid equivalents) A federat lew that has recentily been passed taxos renute of at 30% of operairy income No new tax is to be nad on natural gas liquedr or natural gah (Click the ioon to view the overview) (Ciek the icon to vew edostonal infortration.) More info Requirements Starting August 2080, Stentack Oil 8 Gas must report a separale productline 1. Allosate the August 2020 joint cost ameng the then poducts uaing the following: income statoment for crude oil. One challenge facing Stenback Oi 8 Gas is how to allocate the joint cost of producing the three separate salable outputs. Assume no a. Physical-measure method beginning or ending inventory. b. NRV method 2. Show the operating income for each product using the methods in roqurement 1. 3. Disoves the pros and cons of the two mothods to Sterback Oil 5 Cas for making decisions about product anchass (pacing sel-cr-prscess further decisions, and so on)