Answered step by step

Verified Expert Solution

Question

1 Approved Answer

step by step thanks! 12. North Sea Oil has used various forms of financing including long-term debt, preferred shares, and common shares. North Sea fore-

step by step

thanks!

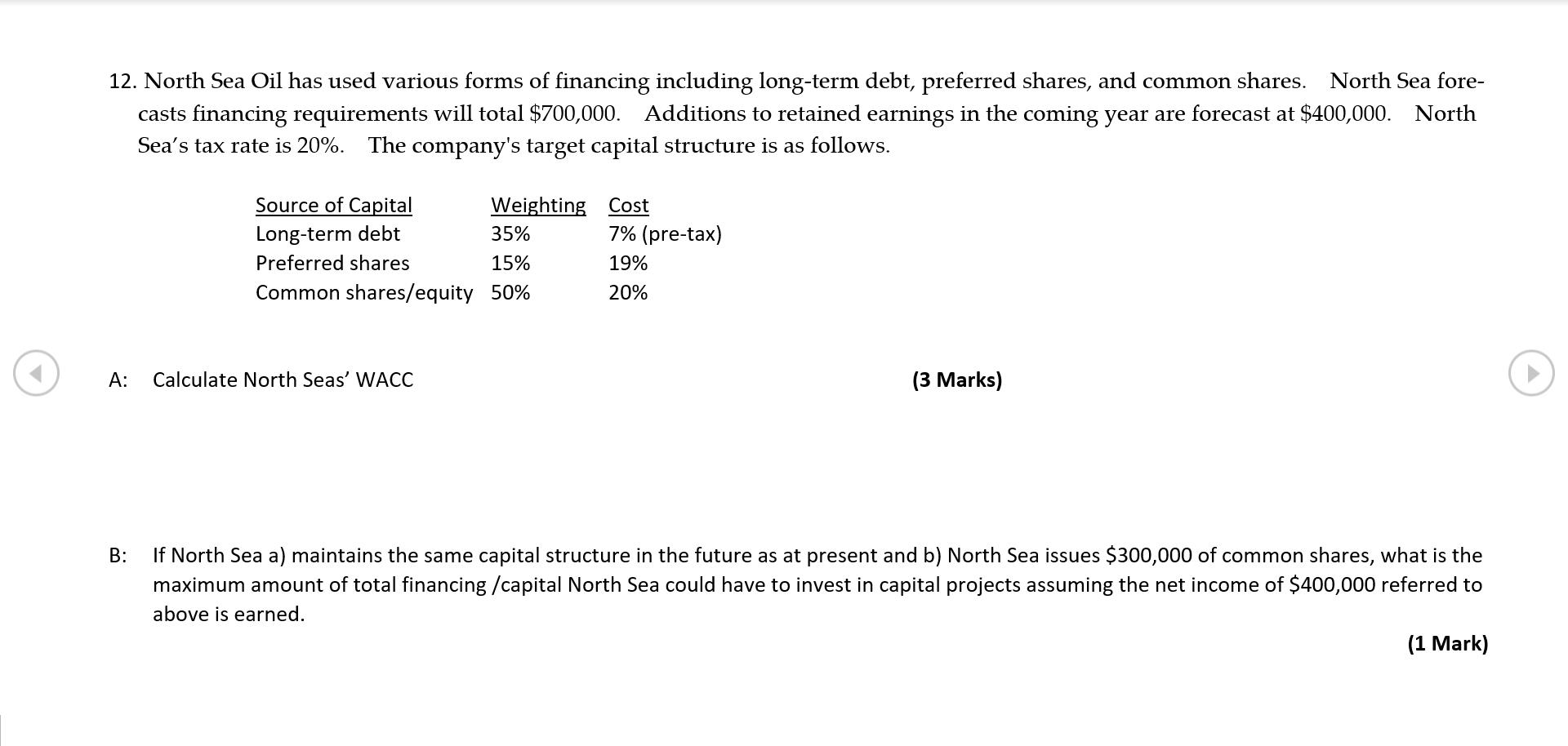

12. North Sea Oil has used various forms of financing including long-term debt, preferred shares, and common shares. North Sea fore- casts financing requirements will total $700,000. Additions to retained earnings in the coming year are forecast at $400,000. North Sea's tax rate is 20%. The company's target capital structure is as follows. Source of Capital Weighting Cost Long-term debt 35% 7% (pre-tax) Preferred shares 15% 19% Common shares/equity 50% 20% A: Calculate North Seas' WACC (3 Marks) B: If North Sea a) maintains the same capital structure in the future as at present and b) North Sea issues $300,000 of common shares, what is the maximum amount of total financing /capital North Sea could have to invest in capital projects assuming the net income of $400,000 referred to above is earned. (1 Mark)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started