Steps Included Please

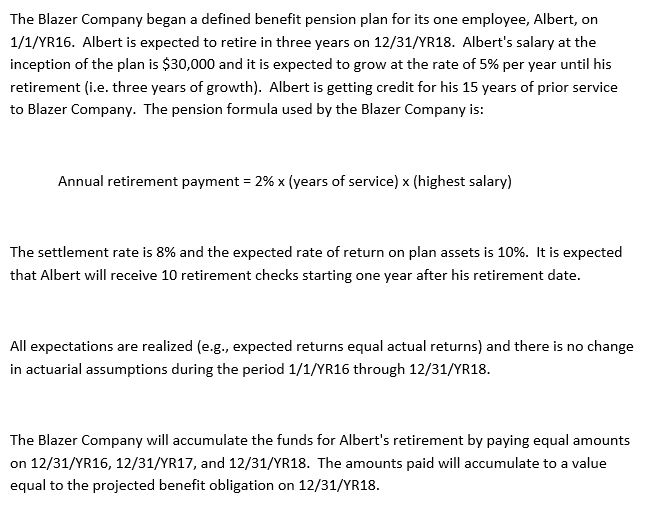

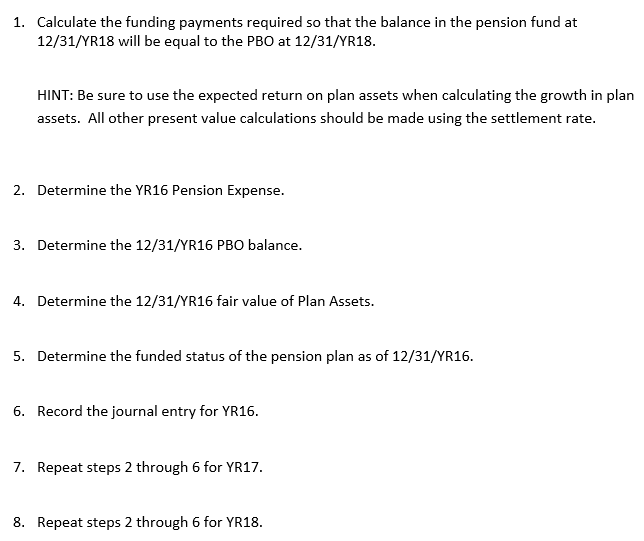

The Blazer Company began a defined benefit pension plan for its one employee, Albert, on 1/1/YR16. Albert is expected to retire in three years on 12/31/YR18. Albert's salary at the inception of the plan is $30,000 and it is expected to grow at the rate of 5% per year until his retirement (i.e. three years of growth). Albert is getting credit for his 15 years of prior service to Blazer Company. The pension formula used by the Blazer Company is: Annual retirement payment = 2% x(years of service) x (highest salary) The settlement rate is 8% and the expected rate of return on plan assets is 10%. It is expected that Albert will receive 10 retirement checks starting one year after his retirement date. All expectations are realized (e.g., expected returns equal actual returns) and there is no change in actuarial assumptions during the period 1/1/YR16 through 12/31/YR18. The Blazer Company will accumulate the funds for Albert's retirement by paying equal amounts on 12/31/YR16, 12/31/YR17, and 12/31/YR18. The amounts paid will accumulate to a value equal to the projected benefit obligation on 12/31/YR18. 1. Calculate the funding payments required so that the balance in the pension fund at 12/31/YR18 will be equal to the PBO at 12/31/YR18. HINT: Be sure to use the expected return on plan assets when calculating the growth in plan assets. All other present value calculations should be made using the settlement rate. 2. Determine the YR16 Pension Expense. 3. Determine the 12/31/YR16 PBO balance. 4. Determine the 12/31/YR16 fair value of Plan Assets. 5. Determine the funded status of the pension plan as of 12/31/YR16. 6. Record the journal entry for YR16. 7. Repeat steps 2 through 6 for YR17. 8. Repeat steps 2 through 6 for YR18. The Blazer Company began a defined benefit pension plan for its one employee, Albert, on 1/1/YR16. Albert is expected to retire in three years on 12/31/YR18. Albert's salary at the inception of the plan is $30,000 and it is expected to grow at the rate of 5% per year until his retirement (i.e. three years of growth). Albert is getting credit for his 15 years of prior service to Blazer Company. The pension formula used by the Blazer Company is: Annual retirement payment = 2% x(years of service) x (highest salary) The settlement rate is 8% and the expected rate of return on plan assets is 10%. It is expected that Albert will receive 10 retirement checks starting one year after his retirement date. All expectations are realized (e.g., expected returns equal actual returns) and there is no change in actuarial assumptions during the period 1/1/YR16 through 12/31/YR18. The Blazer Company will accumulate the funds for Albert's retirement by paying equal amounts on 12/31/YR16, 12/31/YR17, and 12/31/YR18. The amounts paid will accumulate to a value equal to the projected benefit obligation on 12/31/YR18. 1. Calculate the funding payments required so that the balance in the pension fund at 12/31/YR18 will be equal to the PBO at 12/31/YR18. HINT: Be sure to use the expected return on plan assets when calculating the growth in plan assets. All other present value calculations should be made using the settlement rate. 2. Determine the YR16 Pension Expense. 3. Determine the 12/31/YR16 PBO balance. 4. Determine the 12/31/YR16 fair value of Plan Assets. 5. Determine the funded status of the pension plan as of 12/31/YR16. 6. Record the journal entry for YR16. 7. Repeat steps 2 through 6 for YR17. 8. Repeat steps 2 through 6 for YR18