Answered step by step

Verified Expert Solution

Question

1 Approved Answer

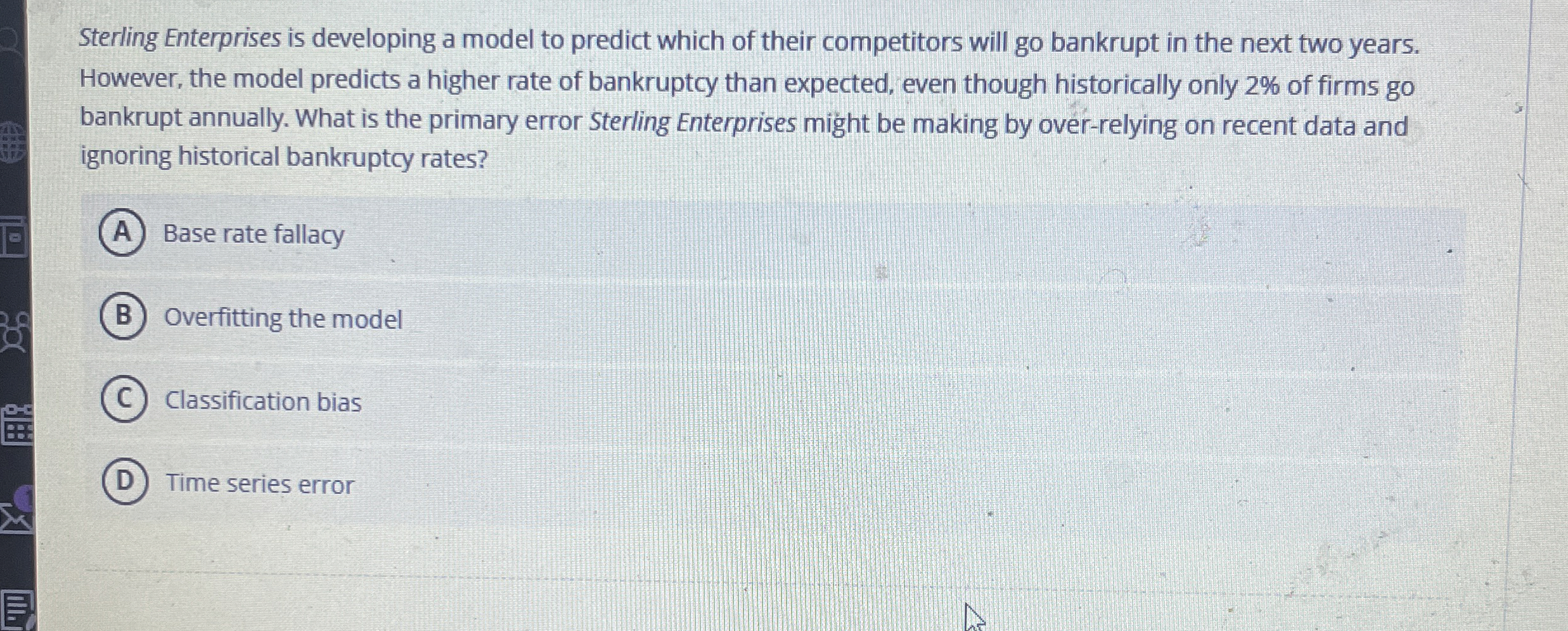

Sterling Enterprises is developing a model to predict which of their competitors will go bankrupt in the next two years. However, the model predicts a

Sterling Enterprises is developing a model to predict which of their competitors will go bankrupt in the next two years.

However, the model predicts a higher rate of bankruptcy than expected, even though historically only of firms go

bankrupt annually. What is the primary error Sterling Enterprises might be making by overrelying on recent data and

ignoring historical bankruptcy rates?

Base rate fallacy

Overfitting the model

Classification bias

Time series error

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started