Answered step by step

Verified Expert Solution

Question

1 Approved Answer

stion 7 Jet PCO owns a 90% interest in s Co, purchased at a time when the book values of S recorded assets and liabilities

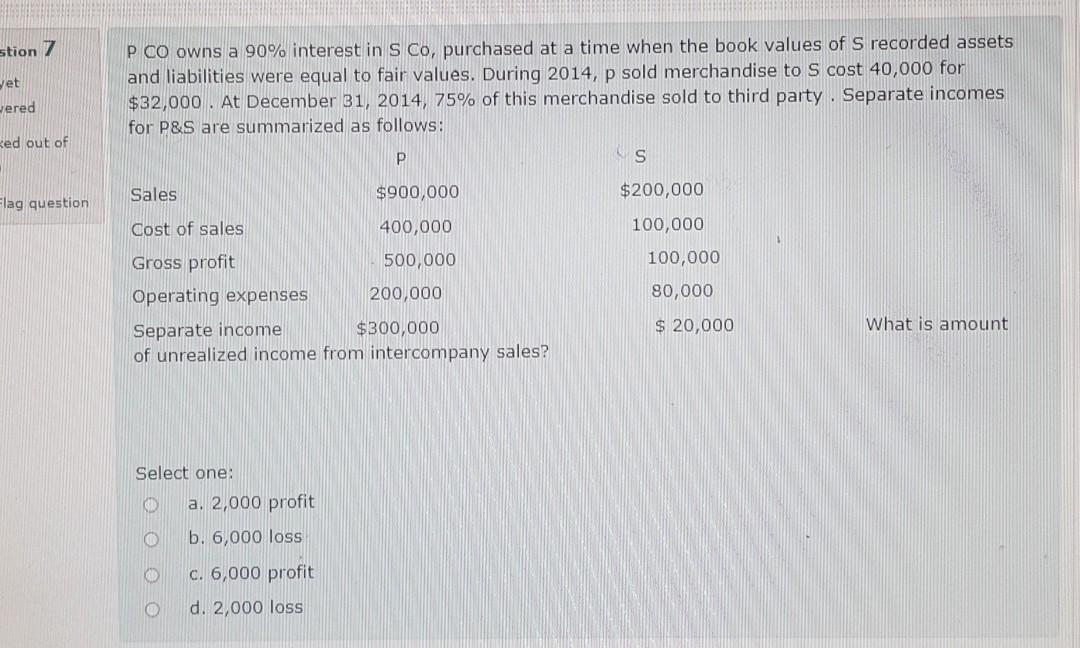

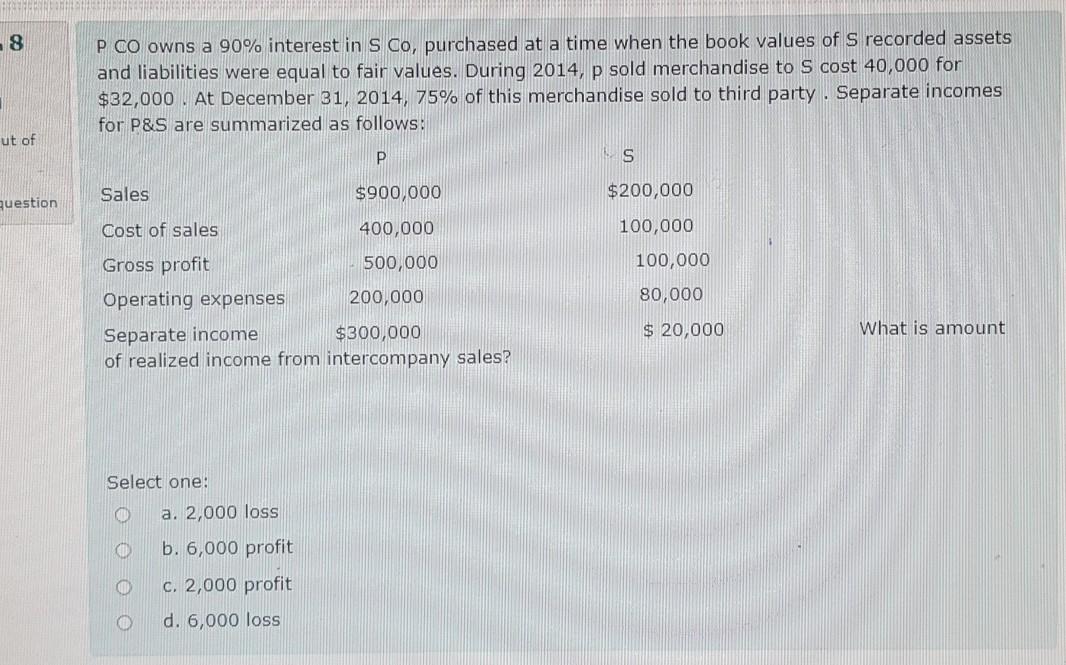

stion 7 Jet PCO owns a 90% interest in s Co, purchased at a time when the book values of S recorded assets and liabilities were equal to fair values. During 2014, p sold merchandise to S cost 40,000 for $32,000 . At December 31, 2014, 75% of this merchandise sold to third party . Separate incomes for P&s are summarized as follows: wered sed out of P S Sales $900,000 $200,000 Flag question Cost of sales 400,000 100,000 Gross profit 500,000 100,000 80,000 Operating expenses 200,000 Separate income $300,000 of unrealized income from intercompany sales? $ 20,000 What is amount Select one: a. 2,000 profit b. 6,000 loss C. 6,000 profit d. 2,000 loss 8 PCO owns a 90% interest in s Co, purchased at a time when the book values of S recorded assets and liabilities were equal to fair values. During 2014, p sold merchandise to S cost 40,000 for $32,000 At December 31, 2014, 75% of this merchandise sold to third party . Separate incomes for P&S are summarized as follows: ut of P S Sales $900,000 $200,000 question Cost of sales 400,000 100,000 Gross profit 500,000 100,000 Operating expenses 200,000 80,000 $ 20,000 What is amount Separate income $300,000 of realized income from intercompany sales? Select one: a. 2,000 loss 0 b. 6,000 profit c. 2,000 profit d. 6,000 loss

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started