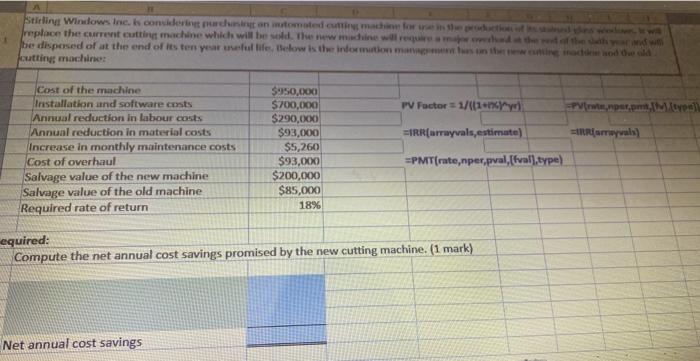

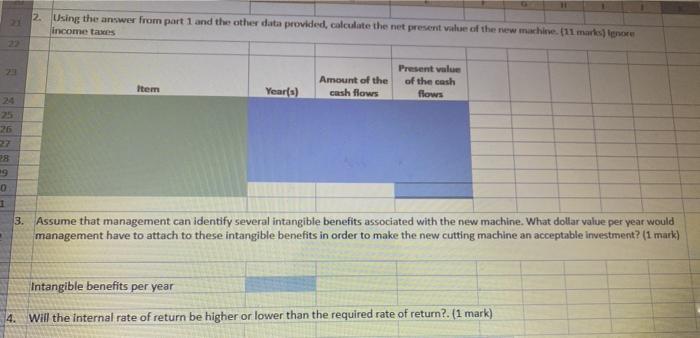

Stirling Windows Ine considering machinery an tomated cutting machine for the replace the current cutting machine which will be sold the man wird be dispersed of at the end of its ten year neful life. Below is the information maison et de la cutting machines PV Factor = 1/(161) EPVw, npar, Mue) SIRR(arrayals, estimate) Parals) Cost of the machine Installation and software costs Annual reduction in labour costs Annual reduction in material costs Increase in monthly maintenance costs Cost of overhaul Salvage value of the new machine Salvage value of the old machine Required rate of return $950,000 $700,000 $290,000 $93,000 $5,260 $93,000 $200,000 $85,000 18% =PMT(rate, nper,pval,[fval), type) equired: Compute the net annual cost savings promised by the new cutting machine. (1 mark) Net annual cost savings 2. Using the answer from part 1 and the other data provided, calculate the net present value of the new machine (11 marks) tenore income taxes Present value of the cash flows Item Amount of the cash flows Year(s) 25 26 9 0 3. Assume that management can identify several intangible benefits associated with the new machine. What dollar value per year would management have to attach to these intangible benefits in order to make the new cutting machine an acceptable investment? (1 mark) Intangible benefits per year 4. Will the internal rate of return be higher or lower than the required rate of return?. (1 mark) Stirling Windows Ine considering machinery an tomated cutting machine for the replace the current cutting machine which will be sold the man wird be dispersed of at the end of its ten year neful life. Below is the information maison et de la cutting machines PV Factor = 1/(161) EPVw, npar, Mue) SIRR(arrayals, estimate) Parals) Cost of the machine Installation and software costs Annual reduction in labour costs Annual reduction in material costs Increase in monthly maintenance costs Cost of overhaul Salvage value of the new machine Salvage value of the old machine Required rate of return $950,000 $700,000 $290,000 $93,000 $5,260 $93,000 $200,000 $85,000 18% =PMT(rate, nper,pval,[fval), type) equired: Compute the net annual cost savings promised by the new cutting machine. (1 mark) Net annual cost savings 2. Using the answer from part 1 and the other data provided, calculate the net present value of the new machine (11 marks) tenore income taxes Present value of the cash flows Item Amount of the cash flows Year(s) 25 26 9 0 3. Assume that management can identify several intangible benefits associated with the new machine. What dollar value per year would management have to attach to these intangible benefits in order to make the new cutting machine an acceptable investment? (1 mark) Intangible benefits per year 4. Will the internal rate of return be higher or lower than the required rate of return?. (1 mark)