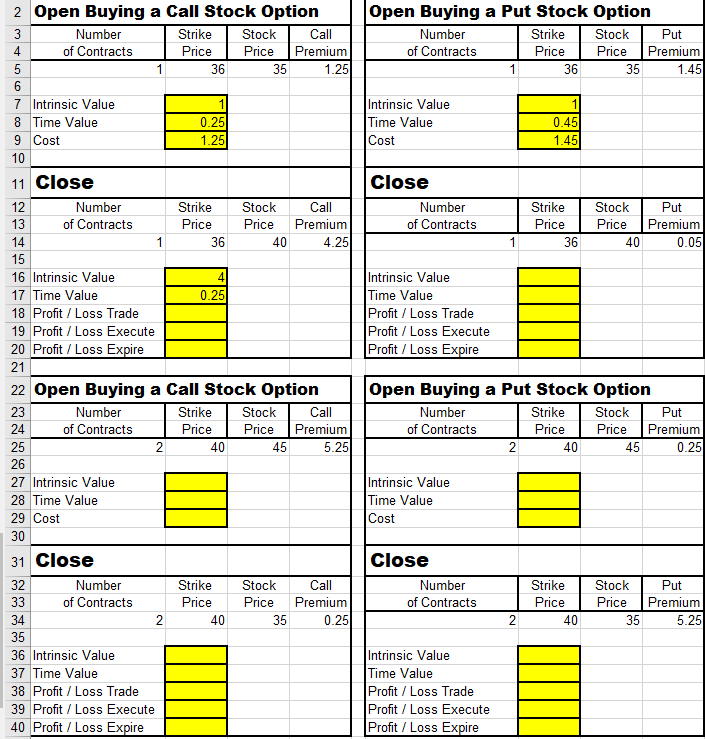

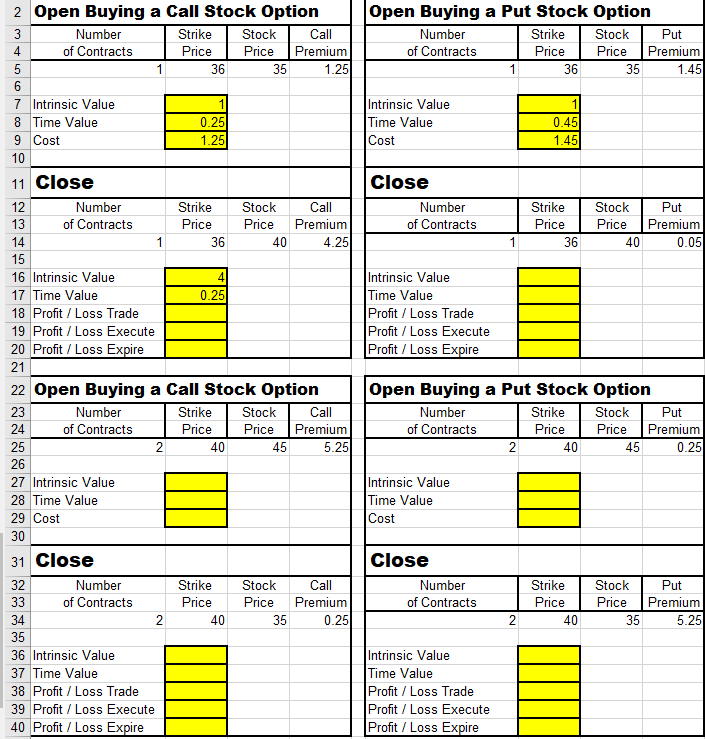

Stock options

Don't know if I even got the ones I filled out correct.

Open Buying a Put Stock Option Number Strike Stock Put of Contracts Price Price Premium 1 36 35 1.45 Intrinsic Value Time Value Cost 1 0.45 1.451 Close Number of Contracts Strike Price 36 Stock Price 40 Put Premium 0.05 1 Intrinsic Value Time Value Profit / Loss Trade Profit / Loss Execute Profit / Loss Expire 2 Open Buying a Call Stock Option 3 Number Strike Stock Call 4 of Contracts Price Price Premium 5 1 36 35 1.251 6 7 Intrinsic Value 1 8 Time Value 0.25 9 Cost 1.25 10 11 Close 12 Number Strike Stock Call 13 of Contracts Price Price Premium 14 1 36 40 4.25 15 16 Intrinsic Value 4 17 Time Value 0.25 18 Profit / Loss Trade 19 Profit / Loss Execute 20 Profit / Loss Expire 21 22 Open Buying a Call Stock Option 23 Number Strike Stock Call 24 of Contracts Price Price Premium 25 2 40 45 5.25 26 27 Intrinsic Value 28 Time Value 29 Cost 30 31 Close 32 Number Strike Stock Call 33 of Contracts Price Price Premium 34 2 40 35 0.25 35 36 Intrinsic Value 37 Time Value 38 Profit / Loss Trade 39 Profit / Loss Execute 40 Profit / Loss Expire Open Buying a Put Stock Option Number Strike Stock Put of Contracts Price Price Premium 2 40 45 0.25 Intrinsic Value Time Value Cost Close Number of Contracts Strike Price 40 Stock Price 35 Put Premium 5.25 2 Intrinsic Value Time Value Profit / Loss Trade Profit / Loss Execute Profit / Loss Expire Open Buying a Put Stock Option Number Strike Stock Put of Contracts Price Price Premium 1 36 35 1.45 Intrinsic Value Time Value Cost 1 0.45 1.451 Close Number of Contracts Strike Price 36 Stock Price 40 Put Premium 0.05 1 Intrinsic Value Time Value Profit / Loss Trade Profit / Loss Execute Profit / Loss Expire 2 Open Buying a Call Stock Option 3 Number Strike Stock Call 4 of Contracts Price Price Premium 5 1 36 35 1.251 6 7 Intrinsic Value 1 8 Time Value 0.25 9 Cost 1.25 10 11 Close 12 Number Strike Stock Call 13 of Contracts Price Price Premium 14 1 36 40 4.25 15 16 Intrinsic Value 4 17 Time Value 0.25 18 Profit / Loss Trade 19 Profit / Loss Execute 20 Profit / Loss Expire 21 22 Open Buying a Call Stock Option 23 Number Strike Stock Call 24 of Contracts Price Price Premium 25 2 40 45 5.25 26 27 Intrinsic Value 28 Time Value 29 Cost 30 31 Close 32 Number Strike Stock Call 33 of Contracts Price Price Premium 34 2 40 35 0.25 35 36 Intrinsic Value 37 Time Value 38 Profit / Loss Trade 39 Profit / Loss Execute 40 Profit / Loss Expire Open Buying a Put Stock Option Number Strike Stock Put of Contracts Price Price Premium 2 40 45 0.25 Intrinsic Value Time Value Cost Close Number of Contracts Strike Price 40 Stock Price 35 Put Premium 5.25 2 Intrinsic Value Time Value Profit / Loss Trade Profit / Loss Execute Profit / Loss Expire