Answered step by step

Verified Expert Solution

Question

1 Approved Answer

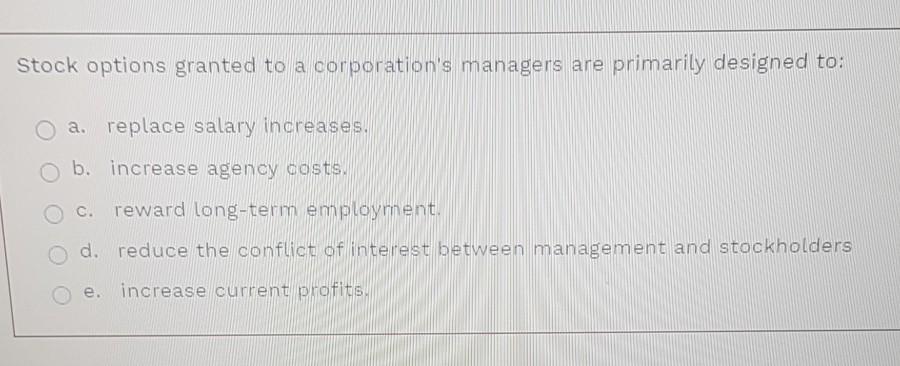

Stock options granted to a corporation's managers are primarily designed to: a. replace salary increases, b. increase agency costs. C. reward long-term employment. d. reduce

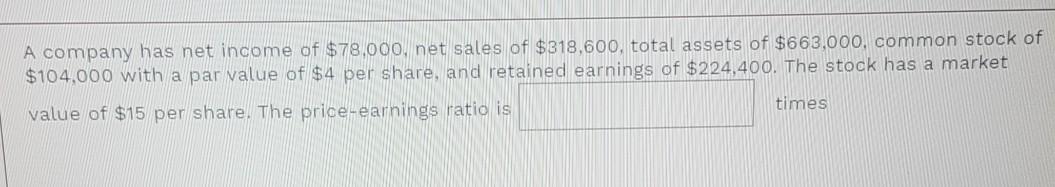

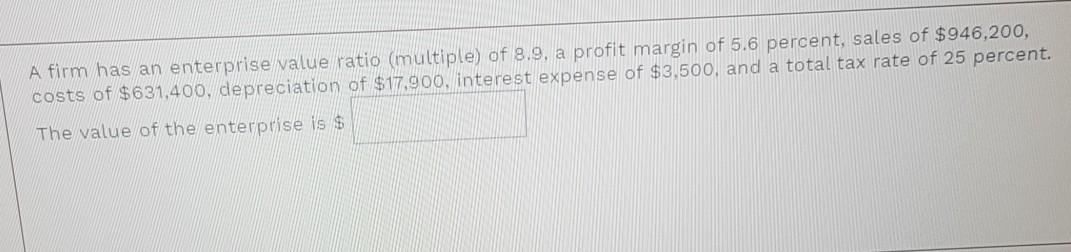

Stock options granted to a corporation's managers are primarily designed to: a. replace salary increases, b. increase agency costs. C. reward long-term employment. d. reduce the conflict of interest between management and stockholders e. increase current profits. A company has net income of $78,000, net sales of $318,600, total assets of $663,000. common stock of $104,000 with a par value of $4 per share, and retained earnings of $224,400. The stock has a market value of $15 per share. The price-earnings ratio is times A firm has an enterprise value ratio (multiple) of 8.9, a profit margin of 5.6 percent, sales of $946,200, costs of $631,400, depreciation of $17.900, interest expense of $3,500, and a total tax rate of 25 percent. The value of the enterprise is $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started