Question

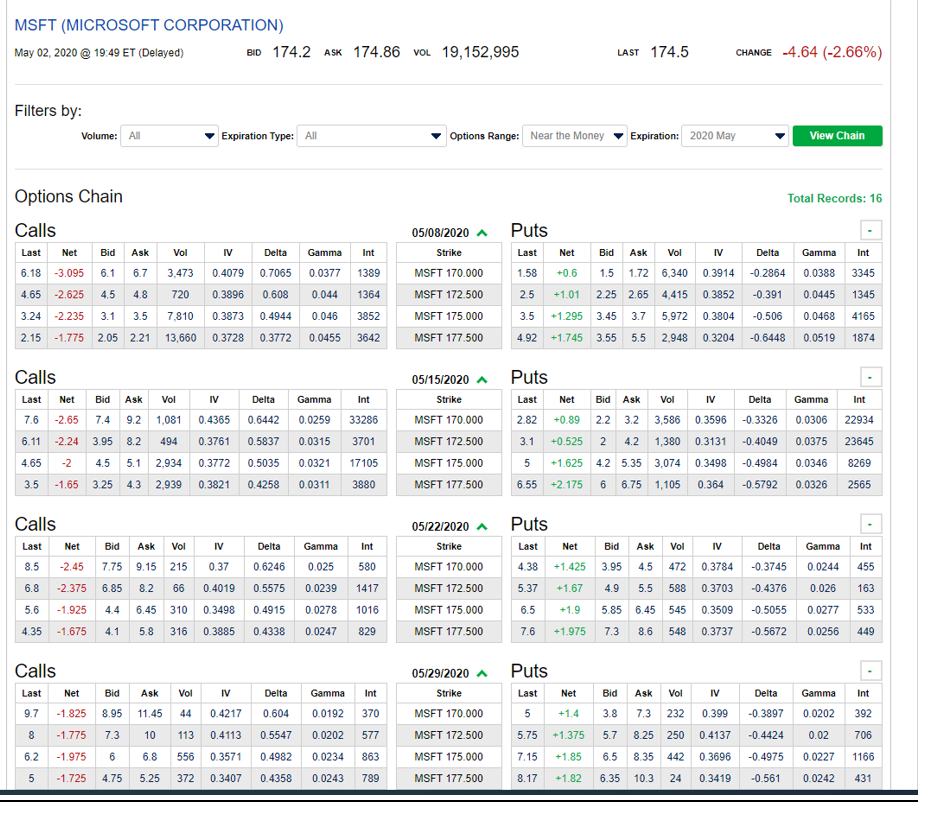

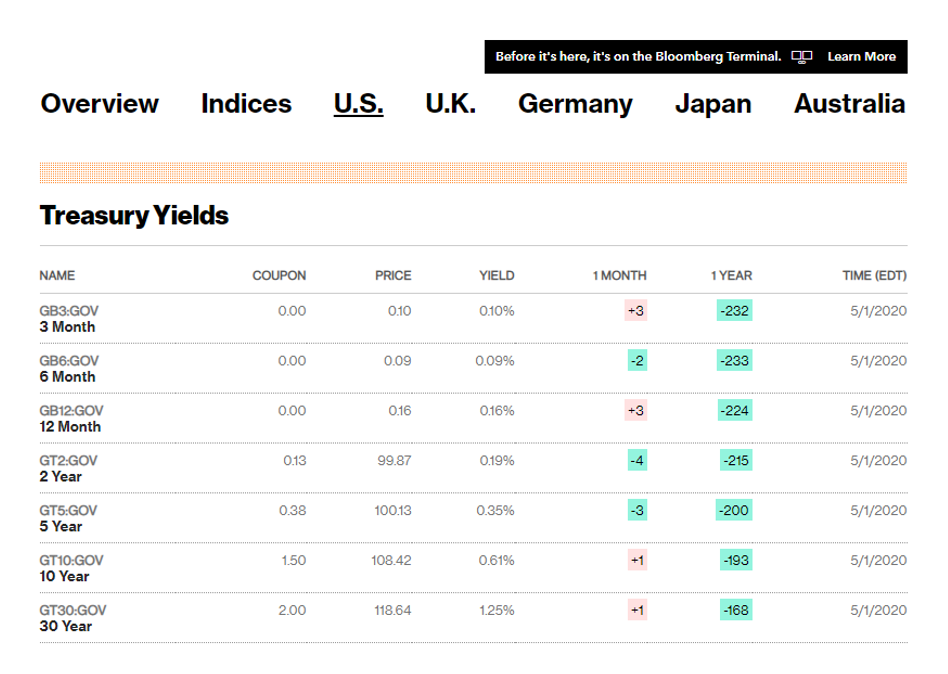

Stock Price: S0 = 174.86 Dated 2-5-2020 Strike Price: K = 172.500 Dated 15-5-2020 Call Price = 8.2 Put Price = 4.2 Time = 13

Stock Price: S0 = 174.86 Dated 2-5-2020

Strike Price: K = 172.500 Dated 15-5-2020

Call Price = 8.2

Put Price = 4.2

Time = 13 Days = 13/252 = 0.0515873 years

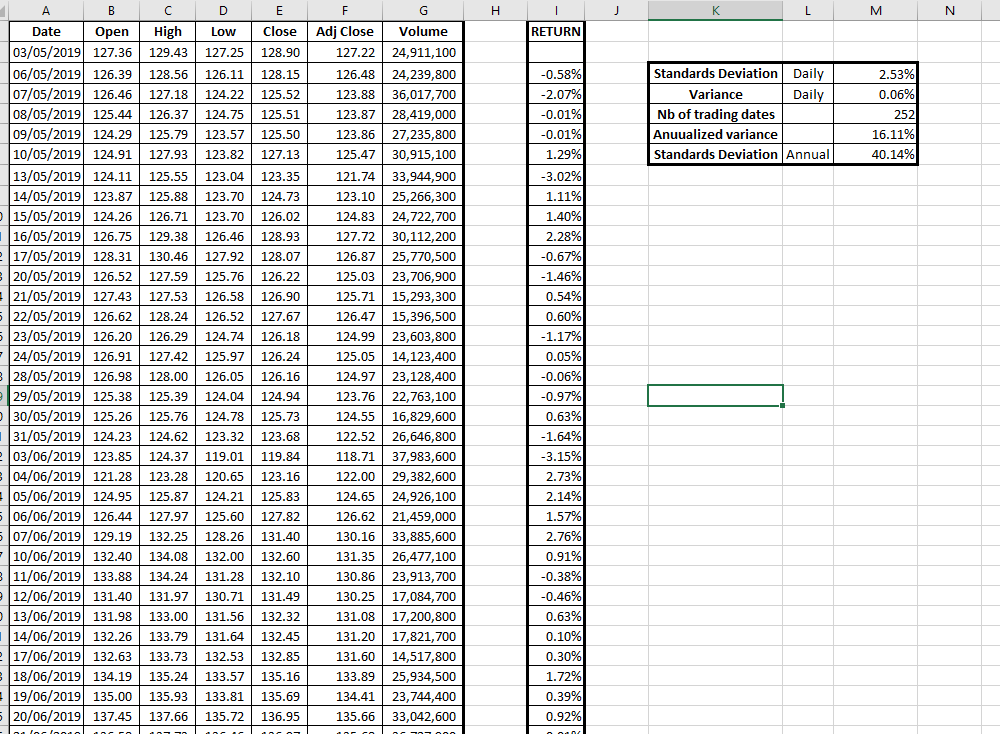

See calculated annualized standard deviation of the daily percentage change in the stock price,

1) Create a Black-Scholes option-pricing model. Using the standard deviation and a risk-free rate found in the photo above,calculate the value of the call options.

2) How do the calculated values compare to the market prices of the options? On the basis of the difference between the price you calculated using historical volatility and the actual price of the option, what do you conclude about expected trends in market volatility?

MSFT (MICROSOFT CORPORATION) May 02, 2020 @ 19:49 ET (Delayed) BID 174.2 ASK 174.86 VOL 19,152,995 LAST 174.5 CHANGE -4.64 (-2.66%) Filters by: Volume: All Expiration Type: All Options Range: Near the Money Expiration: 2020 May v iew Chain Options Chain Total Records: 16 05/08/2020 A Strike Int 3345 MSFT 170.000 Calls Last Net 6.18 -3.095 4.65 -2.625 3.24 -2.235 2.15 -1.775 Bid Ask 6.1 6.7 4.5 4.8 3.1 3.5 2.05 2.21 Vol 3,473 720 7,810 13,660 IV 0.4079 0.3896 0.3873 0.3728 Delta 0.7065 0.608 0.4944 0.3772 Gamma 0.0377 0.044 0.046 0.0455 Int 1389 1364 3852 3642 Puts Last 1.58 2.5 3.5 4.92 MSFT 172.500 Net +0.6 +1.01 +1.295 +1.745 Bid 1.5 2.25 3.45 3.55 Ask 1.72 2.65 3.7 5.5 Voli 6,340 0.3914 4,415 0.3852 5,972 0.3804 2.948 0.3204 Delta -0.2864 -0.391 -0.506 -0.6448 Gamma 0.0388 0.0445 0.0468 0.0519 MSFT 175.000 MSFT 177.500 1345 4165 1874 05/15/2020 Strike Vol 3,586 IV 0.3596 Delta -0.3326 Gamma 0.0306 Int 22934 Calls Last Net 7.6 -2.65 6.11 -2.24 4.65 -2 3.5 -1.65 Bid 7.4 3.95 4.5 3.25 Ask 92 8.2 5.1 4.3 Vol 1,081 494 2,934 2.939 IV Delta 0.43650.6442 0.3761 0.5837 0.3772 0.5035 0.3821 0.4258 Gamma 0.0259 0.0315 0.0321 0.0311 Int 33286 3701 17105 3880 MSFT 170.000 MSFT 172.500 MSFT 175.000 MSFT 177.500 Puts Last Net Bid Ask 2.82 +0.89 2.2 3.2 3.1 +0.525 2 4.2 5 +1.625 4.2 5.35 6.55 +2.175 6 6.75 1,380 3,074 1,105 0.3131 0.3498 0.364 -0.4049 -0.4984 -0.5792 0.0375 0.0346 0.0326 23645 8269 2565 05/22/2020 A Strike Int 455 MSFT 170.000 Calls Last Net 8.5 -2.45 6.8 -2.375 5.6 -1.925 4.35 -1.675 Bid 7.75 6.85 4.4 4.1 Ask 9.15 8.2 6.45 5.8 Vol 215 66 310 316 IV 0.37 0.4019 0.3498 0.3885 Delta 0.6246 0.5575 0.4915 0.4338 Gamma 0.025 0.0239 0.0278 0.0247 Int 580 1417 1016 829 Puts Last 4.38 5.37 6.5 7.6 MSFT 172.500 Net +1.425 +1.67 +1.9 +1.975 Bid 3.95 4.9 5.85 7.3 Ask 4.5 5.5 6.45 8.6 Vol 472 588 545 548 IV 0.3784 0.3703 0.3509 0.3737 Delta -0.3745 -0.4376 -0.5055 -0.5672 Gamma 0.0244 0.026 0.0277 0.0256 163 MSFT 175.000 MSFT 177.500 449 Calls Last Net Bid 9.7 -1.825 8.95 8 -1.775 73 6.2 -1.975 6 5 -1.725 4.75 Ask 11.45 10 .8 5.25 Vol 44 113 556 372 IV 0.4217 0.4113 0.3571 0.3407 Delta 0.604 0.5547 0.4982 0.4358 Gamma 0.0192 0.0202 0.0234 0.0243 Int 370 577 863 789 05/29/2020 Strike MSFT 170.000 MSFT 172.500 MSFT 175.000 MSFT 177.500 Puts Last 5 5.75 7.15 8.17 Net +1.4 +1.375 +1.85 +1.82 Bid 3.8 5.7 6.5 6.35 Ask 7.3 8.25 8.35 10.3 Vol 232 250 442 24 IV 0.399 0.4137 0.3696 0.3419 Delta -0.3897 -0.4424 -0.4975 -0.561 Gamma 0.0202 0.02 0.0227 0.0242 Int 392 706 1166 431 6 Before it's here, it's on the Bloomberg Terminal. 00 Learn More Overview Indices U.S. U.K. Germany Japan Australia Treasury Yields NAME COUPON PRICE YIELD 1 MONTH 1 YEAR TIME (EDT) GB3:GOV 3 Month 0.00 0.10 0.10% +3 -232 5/1/2020 GB6:GOV 6 Month 0.00 0.09 0.09% -233 5/1/2020 GB12:GOV 12 Month 0.00 0.16 0.16% -224 5/1/2020 GT2:GOV 2 Year 0.13 99.87 0.19% -215 5/1/2020 GT5:GOV 5 Year 0.38 100.13 0.35% -200 5/1/2020 GT10:GOV 10 Year 1.50 108.42 0.61% -193 5/1/2020 2.00 118.64 1.25% GT30:GOV 30 Year -168 5/1/2020 M N RETURN Standards Deviation Daily Variance Daily Nb of trading dates Anuualized variance Standards Deviation Annual 2.53% 0.06% 252 16.11% 40.14% 1 A B C D E Date Open High Low Close 03/05/2019 127.36 129.43 127.25 128.90 06/05/2019 126.39 128.56 126.11 | 128.15 07/05/2019 126.46 127.18 124.22 125.52 08/05/2019 125.44 126.37 124.75 125.51 09/05/2019 124.29 125.79 123.57 125.50 10/05/2019 124.91 | 127.93 123.82 127.13 13/05/2019 124.11 | 125.55 123.04 123.35 14/05/2019 123.87 125.88 123.70 124.73 15/05/2019 124.26 126.71 123.70 126.02 16/05/2019 126.75 129.38 126.46 128.93 17/05/2019 128.31 130.46 127.92 128.07 20/05/2019 126.52 127.59 125.76 126.22 21/05/2019 127.43 127.53 126.58 126.90 5 22/05/2019 126.62 128.24 126.52 127.67 523/05/2019 126.20 126.29 124.74 126.18 - 24/05/2019 126.91 | 127.42 125.97 126.24 3 28/05/2019 126.98 128.00 126.05 126.16 29/05/2019 125.38 125.39 124.04 124.94 30/05/2019 125.26 125.76 124.78 125.73 31/05/2019 124.23 124.62 123.32123.68 03/06/2019 123.85 124.37 119.01 | 119.84 04/06/2019 121.28 123.28 120.65 123.16 05/06/2019 124.95 125.87 124.21 | 125.83 5 06/06/2019 126.44 127.97 125.60 127.82 5 07/06/2019 129.19 132.25 128.26 131.40 - 10/06/2019 132.40 134.08 132.00 132.60 11/06/2019 133.88 134.24 131.28 132.10 12/06/2019 131.40 131.97 130.71 131.49 13/06/2019 131.98 133.00 131.56 132.32 14/06/2019 132.26 133.79 131.64 132.45 17/06/2019 132.63 133.73 132.53 132.85 18/06/2019 134.19 135.24 133.57 135.16 19/06/2019 135.00 135.93 133.81 135.69 5 20/06/2019 137.45 | 137.66 | 135.72 136.95 F G Adj Close Volume 127.22 24,911,100 126.48 24,239,800 123.88 36,017,700 123.87 28,419,000 123.86 27,235,800 125.47 30,915,100 121.74 33,944,900 123.10 25,266,300 124.83 24,722,700 127.72 30,112,200 126.87 25,770,500 125.03 23,706,900 125.71 15,293,300 126.47 15,396,500 124.99 | 23,603,800 125.05 14,123,400 124.97 23,128,400 123.76 22,763,100 124.55 16,829,600 122.52 26,646,800 118.71 37,983,600 122.00 29,382,600 124.65 24,926,100 126.62 21,459,000 130.16 33,885,600 131.35 26,477,100 130.86 23.913.700 130.25 17,084,700 131.08 17,200,800 131.20 17,821,700 131.60 14,517,800 133.89 25,934,500 134.41 23,744,400 135.66 33,042,600 -0.58% -2.07% -0.01% -0.01% 1.29% -3.02% 1.11% 1.40% 2.28% -0.67% -1.46% 0.54% 0.60% - 1.17% 0.05% -0.06% -0.97% 0.63% -1.64% -3.15% 2.73% 2.14% 1.57% 2.76% 0.91% -0.38% -0.46% 0.63% 0.10% 0.30% 1.72% 0.39% 0.92% lo c oco oc MSFT (MICROSOFT CORPORATION) May 02, 2020 @ 19:49 ET (Delayed) BID 174.2 ASK 174.86 VOL 19,152,995 LAST 174.5 CHANGE -4.64 (-2.66%) Filters by: Volume: All Expiration Type: All Options Range: Near the Money Expiration: 2020 May v iew Chain Options Chain Total Records: 16 05/08/2020 A Strike Int 3345 MSFT 170.000 Calls Last Net 6.18 -3.095 4.65 -2.625 3.24 -2.235 2.15 -1.775 Bid Ask 6.1 6.7 4.5 4.8 3.1 3.5 2.05 2.21 Vol 3,473 720 7,810 13,660 IV 0.4079 0.3896 0.3873 0.3728 Delta 0.7065 0.608 0.4944 0.3772 Gamma 0.0377 0.044 0.046 0.0455 Int 1389 1364 3852 3642 Puts Last 1.58 2.5 3.5 4.92 MSFT 172.500 Net +0.6 +1.01 +1.295 +1.745 Bid 1.5 2.25 3.45 3.55 Ask 1.72 2.65 3.7 5.5 Voli 6,340 0.3914 4,415 0.3852 5,972 0.3804 2.948 0.3204 Delta -0.2864 -0.391 -0.506 -0.6448 Gamma 0.0388 0.0445 0.0468 0.0519 MSFT 175.000 MSFT 177.500 1345 4165 1874 05/15/2020 Strike Vol 3,586 IV 0.3596 Delta -0.3326 Gamma 0.0306 Int 22934 Calls Last Net 7.6 -2.65 6.11 -2.24 4.65 -2 3.5 -1.65 Bid 7.4 3.95 4.5 3.25 Ask 92 8.2 5.1 4.3 Vol 1,081 494 2,934 2.939 IV Delta 0.43650.6442 0.3761 0.5837 0.3772 0.5035 0.3821 0.4258 Gamma 0.0259 0.0315 0.0321 0.0311 Int 33286 3701 17105 3880 MSFT 170.000 MSFT 172.500 MSFT 175.000 MSFT 177.500 Puts Last Net Bid Ask 2.82 +0.89 2.2 3.2 3.1 +0.525 2 4.2 5 +1.625 4.2 5.35 6.55 +2.175 6 6.75 1,380 3,074 1,105 0.3131 0.3498 0.364 -0.4049 -0.4984 -0.5792 0.0375 0.0346 0.0326 23645 8269 2565 05/22/2020 A Strike Int 455 MSFT 170.000 Calls Last Net 8.5 -2.45 6.8 -2.375 5.6 -1.925 4.35 -1.675 Bid 7.75 6.85 4.4 4.1 Ask 9.15 8.2 6.45 5.8 Vol 215 66 310 316 IV 0.37 0.4019 0.3498 0.3885 Delta 0.6246 0.5575 0.4915 0.4338 Gamma 0.025 0.0239 0.0278 0.0247 Int 580 1417 1016 829 Puts Last 4.38 5.37 6.5 7.6 MSFT 172.500 Net +1.425 +1.67 +1.9 +1.975 Bid 3.95 4.9 5.85 7.3 Ask 4.5 5.5 6.45 8.6 Vol 472 588 545 548 IV 0.3784 0.3703 0.3509 0.3737 Delta -0.3745 -0.4376 -0.5055 -0.5672 Gamma 0.0244 0.026 0.0277 0.0256 163 MSFT 175.000 MSFT 177.500 449 Calls Last Net Bid 9.7 -1.825 8.95 8 -1.775 73 6.2 -1.975 6 5 -1.725 4.75 Ask 11.45 10 .8 5.25 Vol 44 113 556 372 IV 0.4217 0.4113 0.3571 0.3407 Delta 0.604 0.5547 0.4982 0.4358 Gamma 0.0192 0.0202 0.0234 0.0243 Int 370 577 863 789 05/29/2020 Strike MSFT 170.000 MSFT 172.500 MSFT 175.000 MSFT 177.500 Puts Last 5 5.75 7.15 8.17 Net +1.4 +1.375 +1.85 +1.82 Bid 3.8 5.7 6.5 6.35 Ask 7.3 8.25 8.35 10.3 Vol 232 250 442 24 IV 0.399 0.4137 0.3696 0.3419 Delta -0.3897 -0.4424 -0.4975 -0.561 Gamma 0.0202 0.02 0.0227 0.0242 Int 392 706 1166 431 6 Before it's here, it's on the Bloomberg Terminal. 00 Learn More Overview Indices U.S. U.K. Germany Japan Australia Treasury Yields NAME COUPON PRICE YIELD 1 MONTH 1 YEAR TIME (EDT) GB3:GOV 3 Month 0.00 0.10 0.10% +3 -232 5/1/2020 GB6:GOV 6 Month 0.00 0.09 0.09% -233 5/1/2020 GB12:GOV 12 Month 0.00 0.16 0.16% -224 5/1/2020 GT2:GOV 2 Year 0.13 99.87 0.19% -215 5/1/2020 GT5:GOV 5 Year 0.38 100.13 0.35% -200 5/1/2020 GT10:GOV 10 Year 1.50 108.42 0.61% -193 5/1/2020 2.00 118.64 1.25% GT30:GOV 30 Year -168 5/1/2020 M N RETURN Standards Deviation Daily Variance Daily Nb of trading dates Anuualized variance Standards Deviation Annual 2.53% 0.06% 252 16.11% 40.14% 1 A B C D E Date Open High Low Close 03/05/2019 127.36 129.43 127.25 128.90 06/05/2019 126.39 128.56 126.11 | 128.15 07/05/2019 126.46 127.18 124.22 125.52 08/05/2019 125.44 126.37 124.75 125.51 09/05/2019 124.29 125.79 123.57 125.50 10/05/2019 124.91 | 127.93 123.82 127.13 13/05/2019 124.11 | 125.55 123.04 123.35 14/05/2019 123.87 125.88 123.70 124.73 15/05/2019 124.26 126.71 123.70 126.02 16/05/2019 126.75 129.38 126.46 128.93 17/05/2019 128.31 130.46 127.92 128.07 20/05/2019 126.52 127.59 125.76 126.22 21/05/2019 127.43 127.53 126.58 126.90 5 22/05/2019 126.62 128.24 126.52 127.67 523/05/2019 126.20 126.29 124.74 126.18 - 24/05/2019 126.91 | 127.42 125.97 126.24 3 28/05/2019 126.98 128.00 126.05 126.16 29/05/2019 125.38 125.39 124.04 124.94 30/05/2019 125.26 125.76 124.78 125.73 31/05/2019 124.23 124.62 123.32123.68 03/06/2019 123.85 124.37 119.01 | 119.84 04/06/2019 121.28 123.28 120.65 123.16 05/06/2019 124.95 125.87 124.21 | 125.83 5 06/06/2019 126.44 127.97 125.60 127.82 5 07/06/2019 129.19 132.25 128.26 131.40 - 10/06/2019 132.40 134.08 132.00 132.60 11/06/2019 133.88 134.24 131.28 132.10 12/06/2019 131.40 131.97 130.71 131.49 13/06/2019 131.98 133.00 131.56 132.32 14/06/2019 132.26 133.79 131.64 132.45 17/06/2019 132.63 133.73 132.53 132.85 18/06/2019 134.19 135.24 133.57 135.16 19/06/2019 135.00 135.93 133.81 135.69 5 20/06/2019 137.45 | 137.66 | 135.72 136.95 F G Adj Close Volume 127.22 24,911,100 126.48 24,239,800 123.88 36,017,700 123.87 28,419,000 123.86 27,235,800 125.47 30,915,100 121.74 33,944,900 123.10 25,266,300 124.83 24,722,700 127.72 30,112,200 126.87 25,770,500 125.03 23,706,900 125.71 15,293,300 126.47 15,396,500 124.99 | 23,603,800 125.05 14,123,400 124.97 23,128,400 123.76 22,763,100 124.55 16,829,600 122.52 26,646,800 118.71 37,983,600 122.00 29,382,600 124.65 24,926,100 126.62 21,459,000 130.16 33,885,600 131.35 26,477,100 130.86 23.913.700 130.25 17,084,700 131.08 17,200,800 131.20 17,821,700 131.60 14,517,800 133.89 25,934,500 134.41 23,744,400 135.66 33,042,600 -0.58% -2.07% -0.01% -0.01% 1.29% -3.02% 1.11% 1.40% 2.28% -0.67% -1.46% 0.54% 0.60% - 1.17% 0.05% -0.06% -0.97% 0.63% -1.64% -3.15% 2.73% 2.14% 1.57% 2.76% 0.91% -0.38% -0.46% 0.63% 0.10% 0.30% 1.72% 0.39% 0.92% lo c oco ocStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started