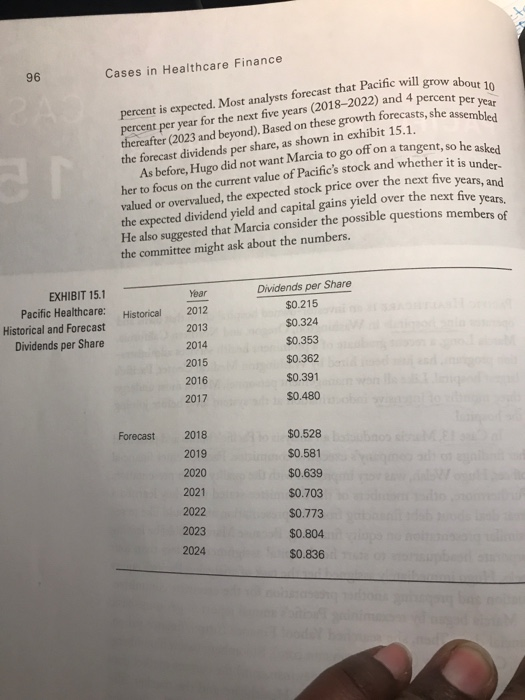

Stock Valuation 1. What is the estimated value of Pacific Healthcare stock on December 31, 2017? b. Is the stock underpriced or overpriced? c. If investors estimate that Pacific Healthcare will grow about 10 percent per year for the next five a. years (2018-2022), what constant growth rate (2023+) are they using to actually price the stock? (Hint: What constant growth rate (2023+) produces an actual December 31, 2017, stock price of $8?) 2. What is the estimated value on December 31, 2018, 2019, 2020, 2021, and 2022, assuming that the stock is in equilibrium? 3. Assume that the stock is in equilibrium and E(Po Po; that is, the current stock price equals the expected value that you calculated in Question 1a. a. What are the estimated dividend yield, capital gains yield, and total return for 2018, 2019, 2020 2021, and 2022? b. Why do the estimated dividend yield and capital gains yield change every year? c. What do you notice about the estimated total return? d. What is the estimated dividend yield and capital gains yield after 2022? No additional calculations are required e. Why are investors interested in the relationship between dividend yield and capital gains yield? 4. At its next quarterly meeting, the Federal Reserve Board may increase the money supply, which could cause a fall in the risk-free rate and required rate of return on the market. On the other hand, a new administration may be in power after the next election, and this could cause an increase in investors' risk aversion and hence a higher risk-free rate and required rate of return on the market. Pacific Healthcare will soon sign several new lucrative contracts that could increase the expected constant growth rate nonconstant growth rate, or current dividend (Do). Pacific Healthcare also has plans to stabilize revenues and profits in several of its large hospitals and this could cause the beta coefficient to decline. For these reasons, Marcia wants to know the sensitivity of the December 31, 2017, estimated value of Pacific Healthcare stock to changes in each model variable a. Graph the December 31, 2017, estimated value of Pacific Healthcare stock at +/-10%, 20%, and 30% changes in each of the model variables (six lines on the graph, one for each variable) To which variables is the estimated value most sensitive? b. 5. In your opinion, what are three key learning points from this case? C HEALTHCARE (B) PACIFIC STOCK VALUATION CASE PACIFIC HEALTHCARE 1s an investor hospitals in Washington, Oregon, and Northern California. operats a recent graduate of a prominent health services administra- Marcia I tion program, est hospital. Like all new management personnel, Marcia must undergo has just been hired by Washington Medical Center, Pacific's nths of intensive indoctrination at the system level before joining In Case 13, Marcia conduced an analyisof Psi' bond anded her findings to the company's executive committee. Pacific's chief financial officer, Hugo Welsh, was very impressed with the quality of her presentation. Furthermore, other members of the committee stated that they learned a great deal about debt financing from the presentation and would like to see the hospita a similar presentation on equity financing. Because Marcia would be leaving corporate headquarters to start her hospital assignment in less than four weeks, Hugo immediately assigned her the task of analyzing Pacific's equity situation and preparing another presentation for the executive committee. Marcia began by reexamining Pacific's annual report to get some basic financial data. Then, she searched Yahoo! Finance (http://finance yahoo. com), CNNMoney (http://money.cnn.com), Bloomberg (www.bloomberg com), and MSN Money (http://money.msn.com) for current market data as well as analysts' forecasts for Pacific Healthcare and the market. She scovered that Pacific's stock is currently (December 31,2017) selling for 38 per share,current dividend is $0.480 per share (paid on December 31, 2017), and beta coefficient is 1.2. In addition, she learned that the yield on long-term Treasury bonds is 5.0 percent and that a market return of 11 o Foundation of ACHE, 2018. Reproduction without permission is prohibited. 96 Cases in Healthcare Finance percent is expected. Most analysts forecast that Pacific will grow abou percent per year for the next five years (2018-2022) and 4 percent thereafter (2023 and beyond). Based on these growth forecasts, she assemdlal the forecast dividends per share, as shown in exhibit 15.1. t that Pacific will grow about 10 year her to focus on the current value of Pacific's stock and whether it is und valued or overvalued, the expected stock price over the next five As before, Hugo did not want Marcia to go off on a tangent, so he er- years, and the expected dividend yield and capital gains yield over the next five years He also suggested that Marcia consider the possible questions members the committee might ask about the numbers. EXHIBIT 15.1 Dividends per Share Year Pacific Healthcare: Historical 2012 2013 2014 2015 2016 2017 $0.215 $0.324 $0.353 $0.362 $0.391 $0.480 Historical and Forecast Dividends per Share Forecast2018 2019 2020 2021 2022 2023 2024 $0.528 $0.581 $0.639 $0.703 $0.773 $0.804 $0.836