Question

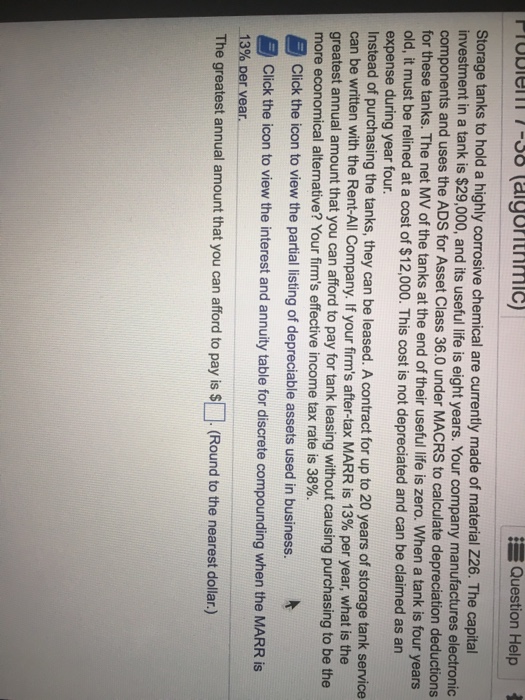

Storage tanks hold a highly corrosive chemical are currently made of material capital investment in a tank is $29,000, and its useful life is eight

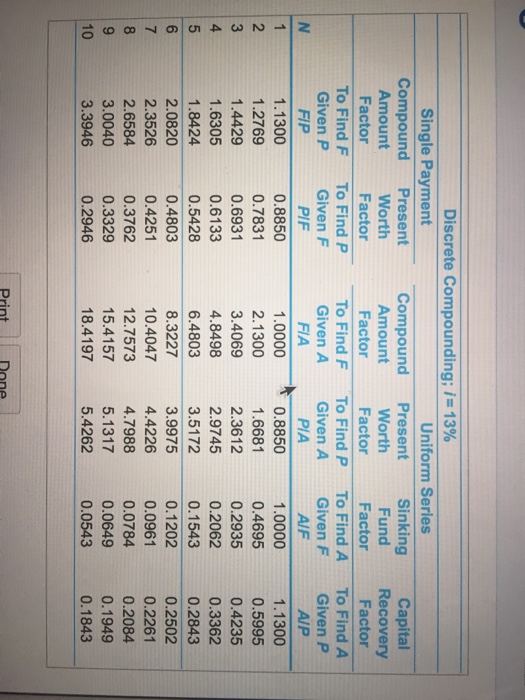

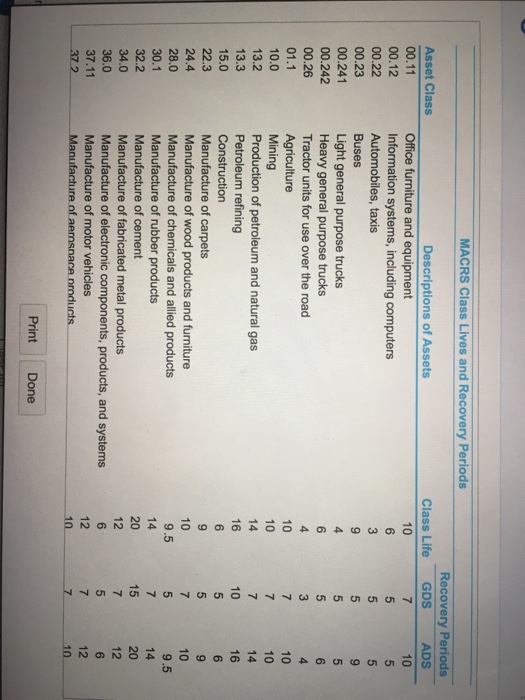

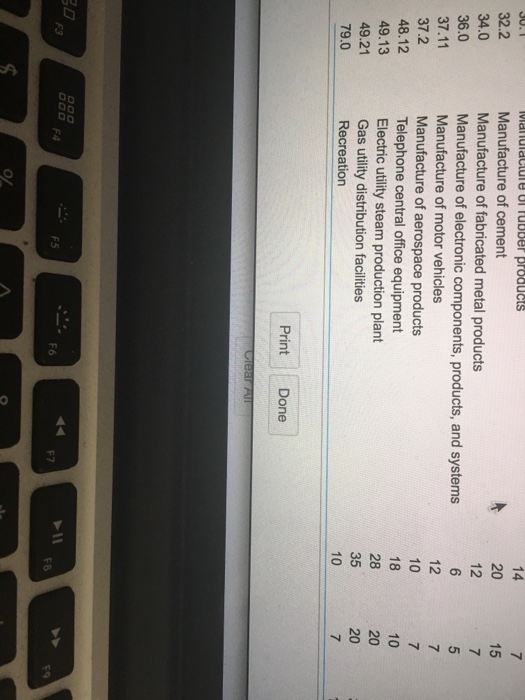

Storage tanks hold a highly corrosive chemical are currently made of material capital investment in a tank is $29,000, and its useful life is eight years. Your company manufactures electronic components and uses the ADS for Asset class 36.0 under MACRS to deductions for these tanks. The net Mv of the tanks at the end of their useful life is zero. When a tank is four years old, it must be relined at a cost of $12,000. This cost is not depreciated and can be claimed as an expense during four. Instead of purchasing the tanks, they can be leased. A contract for up to 20 years of storage tank service can be written with the Rent-All Company. If your firm's after-tax MARR is 13% p year, what is the greatest annual amount that you can afford to pay for tank leasing without causing purchasing to be the more economical alternative? Your firm's effective income tax rate is 38%. E click the icon to view the partial listing of depreciable assets used in business. click the icon to view the interest and annuity table for discrete compounding when the MARR i 13% per year. The greatest annual amount that you can afford to pay is $L. (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started