Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Storm, Inc. purchased the following available-for-sale securities during 20Y9, its first year of operations: Name Number of Shares Cost Dust Devil, Inc. 1,200 $34,080

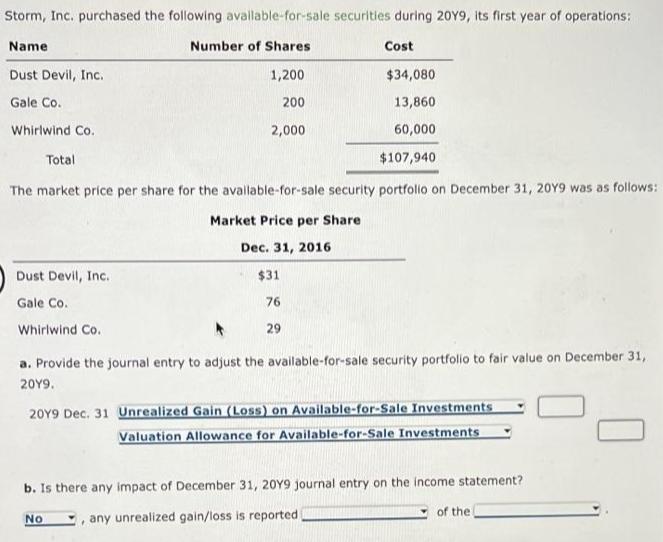

Storm, Inc. purchased the following available-for-sale securities during 20Y9, its first year of operations: Name Number of Shares Cost Dust Devil, Inc. 1,200 $34,080 Gale Co. 200 13,860 Whirlwind Co. 2,000 60,000 Total $107,940 The market price per share for the available-for-sale security portfolio on December 31, 20Y9 was as follows: Market Price per Share Dec. 31, 2016 Dust Devil, Inc. $31 Gale Co. 76 Whirlwind Co. 29 a. Provide the journal entry to adjust the available-for-sale security portfolio to fair value on December 31, 20Y9. 20Y9 Dec. 31 Unrealized Gain (Loss) on Available-for-Sale Investments Valuation Allowance for Available-for-Sale Investments b. Is there any impact of December 31, 20Y9 journal entry on the income statement? of the No , any unrealized gain/loss is reported

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Answer a Date Particulars Debit Credit 20Y9 Dec 31 Va...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started