Answered step by step

Verified Expert Solution

Question

1 Approved Answer

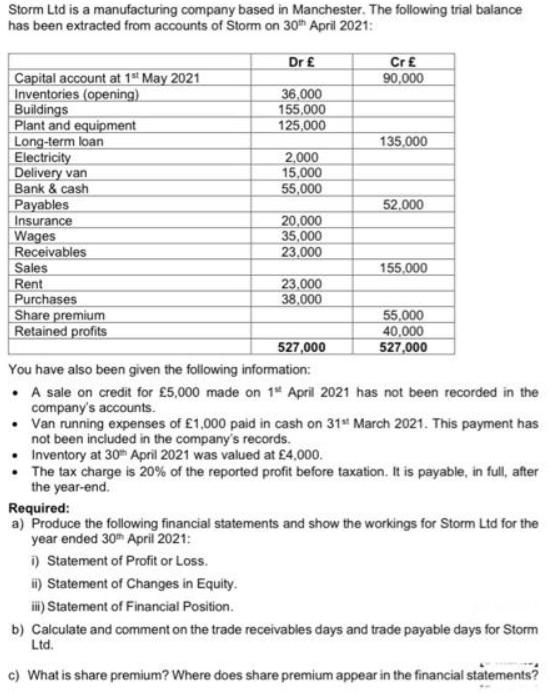

Storm Ltd is a manufacturing company based in Manchester. The following trial balance has been extracted from accounts of Storm on 30th April 2021:

Storm Ltd is a manufacturing company based in Manchester. The following trial balance has been extracted from accounts of Storm on 30th April 2021: Capital account at 1st May 2021 Inventories (opening) Buildings Plant and equipment Long-term loan Electricity Delivery van Bank & cash Payables Insurance Wages Receivables Sales Rent Purchases Share premium Retained profits Dr 36,000 155,000 125,000 2,000 15,000 55,000 20,000 35,000 23,000 23,000 38,000 ii) Statement of Changes in Equity. iii) Statement of Financial Position. Cr 90,000 135,000 52,000 155,000 55,000 40,000 527,000 527,000 You have also been given the following information: A sale on credit for 5,000 made on 1st April 2021 has not been recorded in the company's accounts. Van running expenses of 1,000 paid in cash on 31st March 2021. This payment has not been included in the company's records. Inventory at 30th April 2021 was valued at 4,000. The tax charge is 20% of the reported profit before taxation. It is payable, in full, after the year-end. Required: a) Produce the following financial statements and show the workings for Storm Ltd for the year ended 30th April 2021: i) Statement of Profit or Loss. b) Calculate and comment on the trade receivables days and trade payable days for Storm Ltd. c) What is share premium? Where does share premium appear in the financial statements?

Step by Step Solution

★★★★★

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

The answer provided below has been developed in a clear step by step man...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started