Question

Straight-Line Method Norris Corporation issued $2,000,000 in 10.5 percent, 10-year bonds on February 1, 2014, at 104. Semiannual interest payment dates are January 31 and

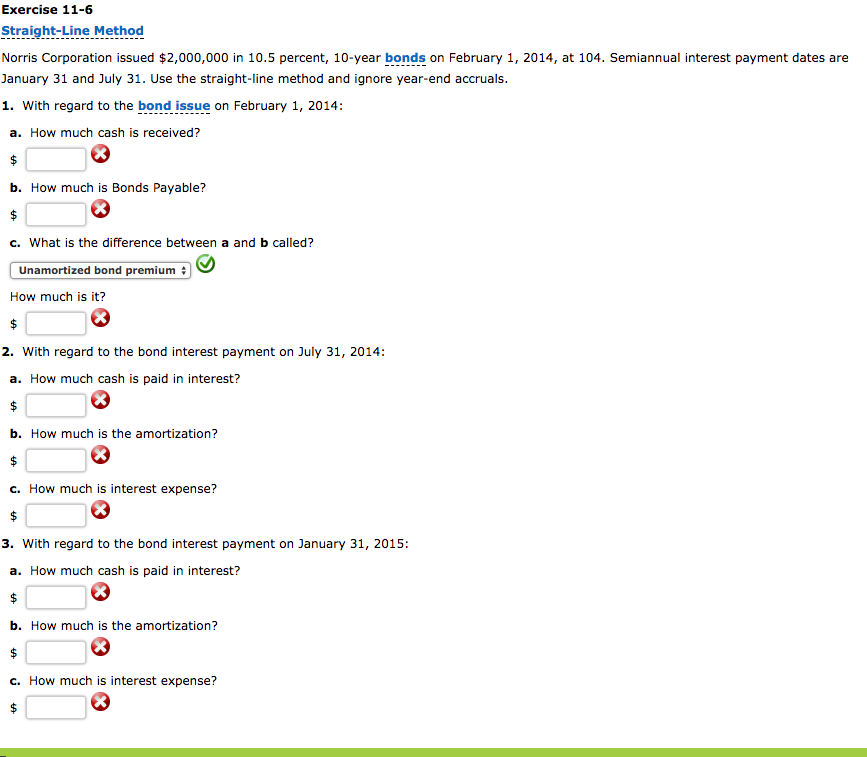

Straight-Line Method

Norris Corporation issued $2,000,000 in 10.5 percent, 10-year bonds on February 1, 2014, at 104. Semiannual interest payment dates are January 31 and July 31. Use the straight-line method and ignore year-end accruals.

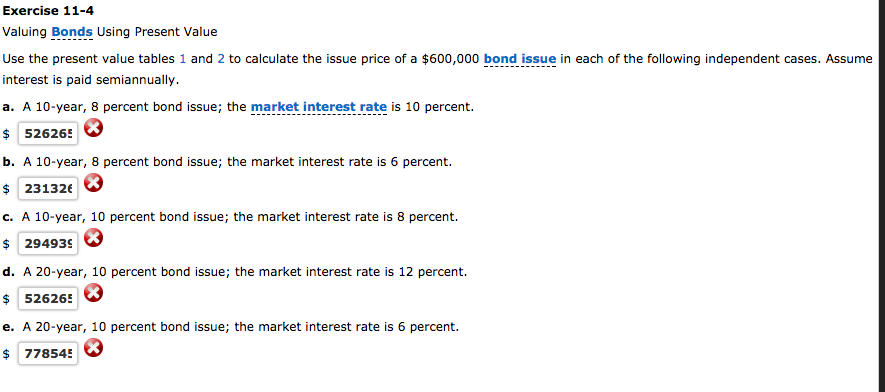

Valuing Bonds Using Present Value

Use the present value tables 1 and 2 to calculate the issue price of a $600,000 bond issue in each of the following independent cases. Assume interest is paid semiannually.

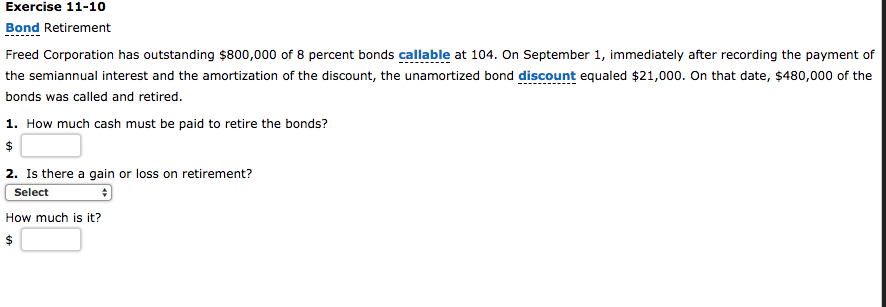

Bond Retirement

Freed Corporation has outstanding $800,000 of 8 percent bonds callable at 104. On September 1, immediately after recording the payment of the semiannual interest and the amortization of the discount, the unamortized bond discount equaled $21,000. On that date, $480,000 of the bonds was called and retired.

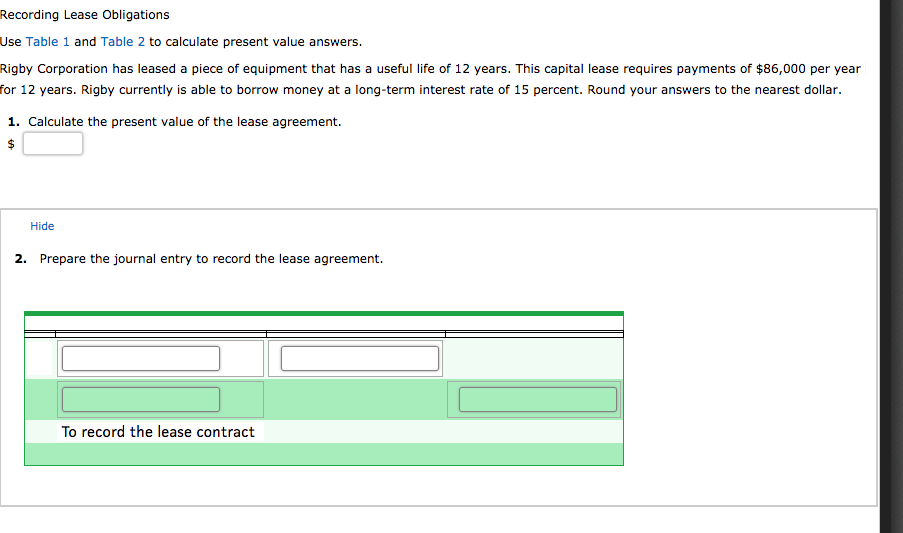

Recording Lease Obligations

Use Table 1 and Table 2 to calculate present value answers.

Rigby Corporation has leased a piece of equipment that has a useful life of 12 years. This capital lease requires payments of $86,000 per year for 12 years. Rigby currently is able to borrow money at a long-term interest rate of 15 percent. Round your answers to the nearest dollar.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started