Strategic Accounting

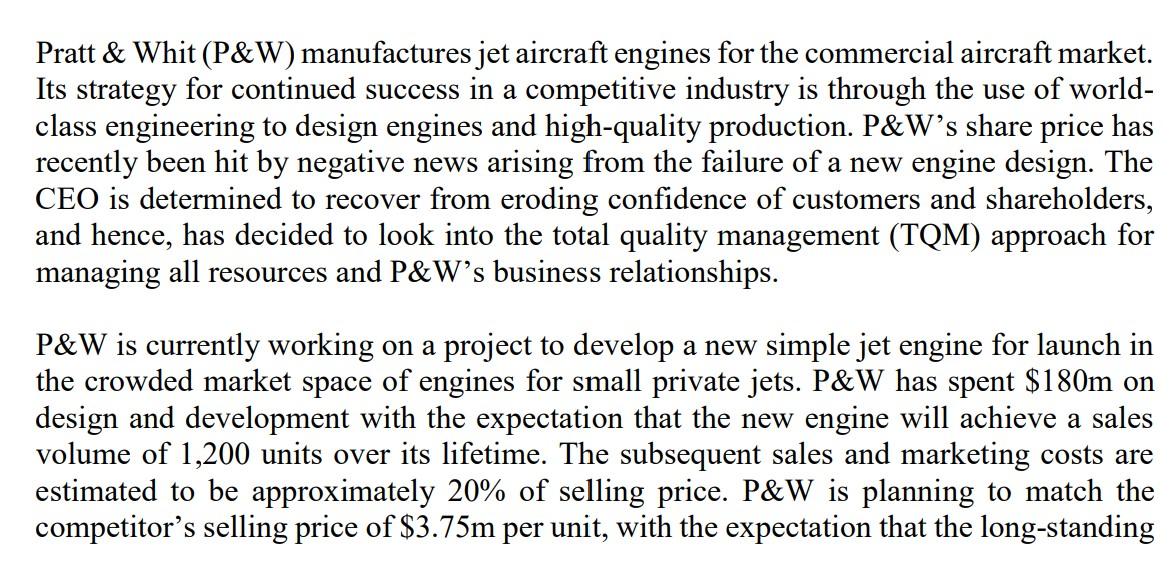

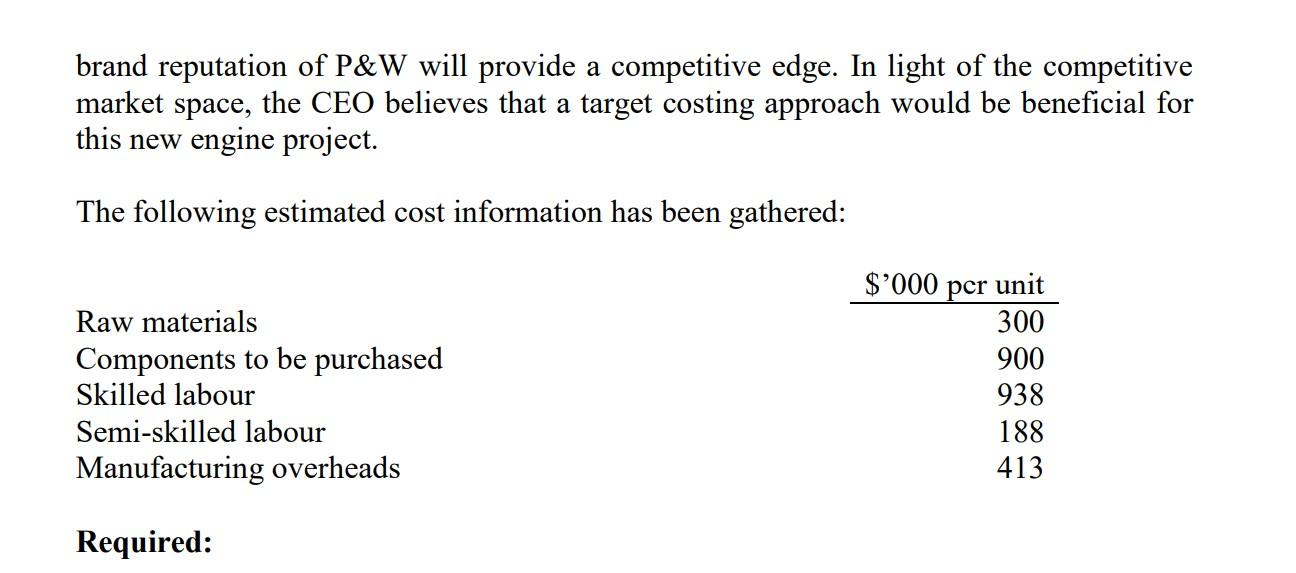

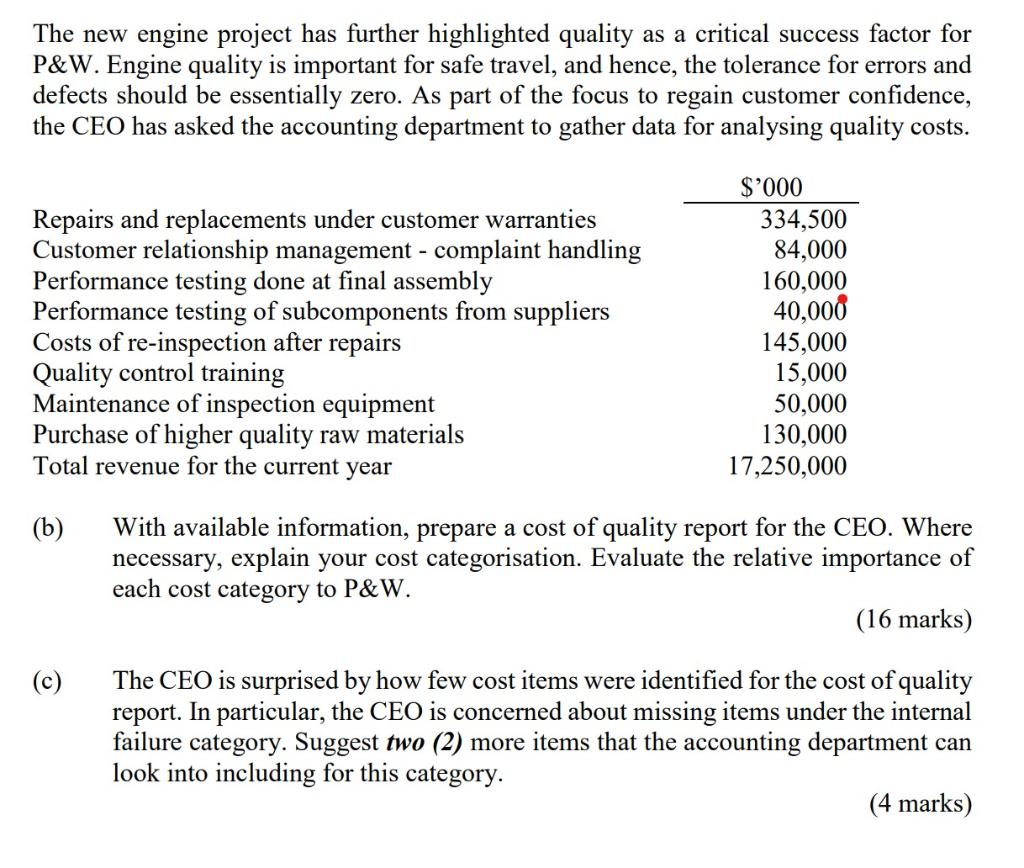

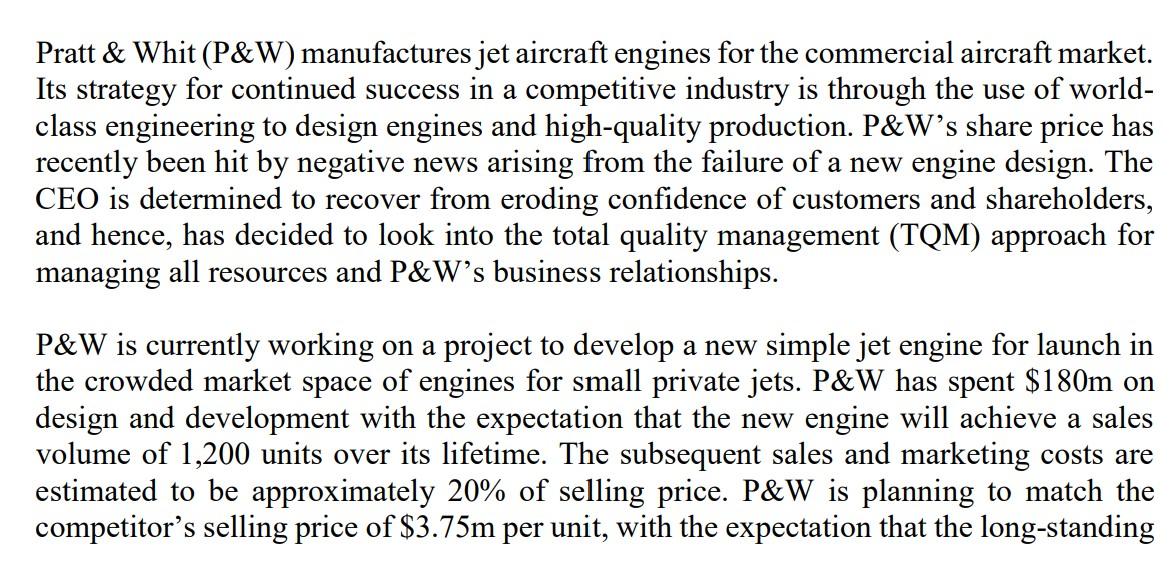

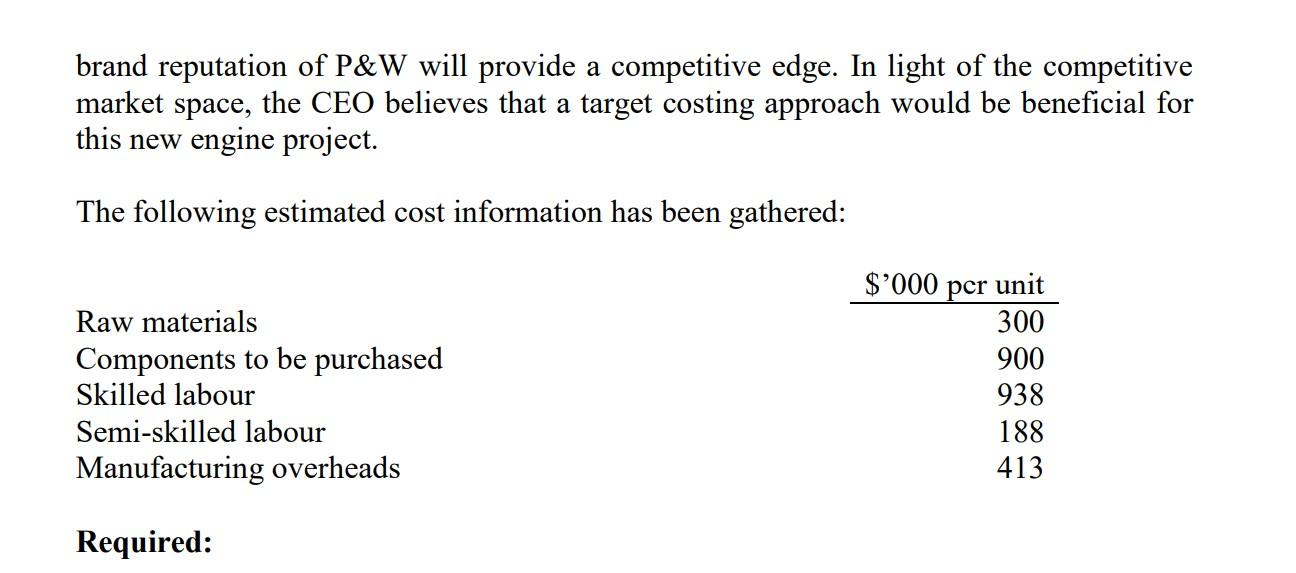

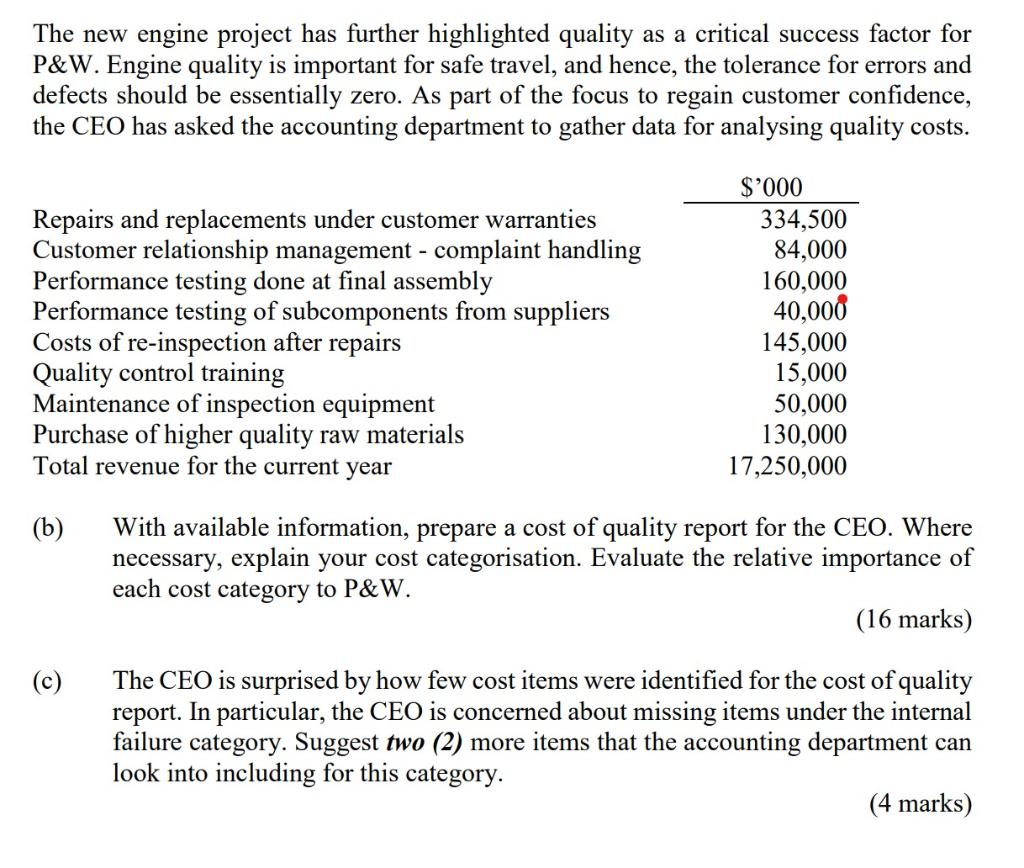

Pratt \& Whit (P&W) manufactures jet aircraft engines for the commercial aircraft market. Its strategy for continued success in a competitive industry is through the use of worldclass engineering to design engines and high-quality production. P&W 's share price has recently been hit by negative news arising from the failure of a new engine design. The CEO is determined to recover from eroding confidence of customers and shareholders, and hence, has decided to look into the total quality management (TQM) approach for managing all resources and P&W 's business relationships. P&W is currently working on a project to develop a new simple jet engine for launch in the crowded market space of engines for small private jets. P&W has spent $180m on design and development with the expectation that the new engine will achieve a sales volume of 1,200 units over its lifetime. The subsequent sales and marketing costs are estimated to be approximately 20% of selling price. P&W is planning to match the competitor's selling price of $3.75m per unit, with the expectation that the long-standing brand reputation of P&W will provide a competitive edge. In light of the competitive market space, the CEO believes that a target costing approach would be beneficial for this new engine project. The following estimated cost information has been gathered: The new engine project has further highlighted quality as a critical success factor for P&W. Engine quality is important for safe travel, and hence, the tolerance for errors and defects should be essentially zero. As part of the focus to regain customer confidence, the CEO has asked the accounting department to gather data for analysing quality costs. (b) With available information, prepare a cost of quality report for the CEO. Where necessary, explain your cost categorisation. Evaluate the relative importance of each cost category to P&W. (16 marks) (c) The CEO is surprised by how few cost items were identified for the cost of quality report. In particular, the CEO is concerned about missing items under the internal failure category. Suggest two (2) more items that the accounting department can look into including for this category. (4 marks) d) Explain to the CEO the trade-offs between using cost of quality and non-financial measures of quality to manage P&W 's TQM initiative. (6 marks) Pratt \& Whit (P&W) manufactures jet aircraft engines for the commercial aircraft market. Its strategy for continued success in a competitive industry is through the use of worldclass engineering to design engines and high-quality production. P&W 's share price has recently been hit by negative news arising from the failure of a new engine design. The CEO is determined to recover from eroding confidence of customers and shareholders, and hence, has decided to look into the total quality management (TQM) approach for managing all resources and P&W 's business relationships. P&W is currently working on a project to develop a new simple jet engine for launch in the crowded market space of engines for small private jets. P&W has spent $180m on design and development with the expectation that the new engine will achieve a sales volume of 1,200 units over its lifetime. The subsequent sales and marketing costs are estimated to be approximately 20% of selling price. P&W is planning to match the competitor's selling price of $3.75m per unit, with the expectation that the long-standing brand reputation of P&W will provide a competitive edge. In light of the competitive market space, the CEO believes that a target costing approach would be beneficial for this new engine project. The following estimated cost information has been gathered: The new engine project has further highlighted quality as a critical success factor for P&W. Engine quality is important for safe travel, and hence, the tolerance for errors and defects should be essentially zero. As part of the focus to regain customer confidence, the CEO has asked the accounting department to gather data for analysing quality costs. (b) With available information, prepare a cost of quality report for the CEO. Where necessary, explain your cost categorisation. Evaluate the relative importance of each cost category to P&W. (16 marks) (c) The CEO is surprised by how few cost items were identified for the cost of quality report. In particular, the CEO is concerned about missing items under the internal failure category. Suggest two (2) more items that the accounting department can look into including for this category. (4 marks) d) Explain to the CEO the trade-offs between using cost of quality and non-financial measures of quality to manage P&W 's TQM initiative. (6 marks)