Stryker Corporation: in-sourcing PCBs 1. Use the projections provided in the case to compute incremental cash flows for the PCB project, as well as its NPV, IRR, and payback period. 2. Compare this proposal to Options #1 and #2.

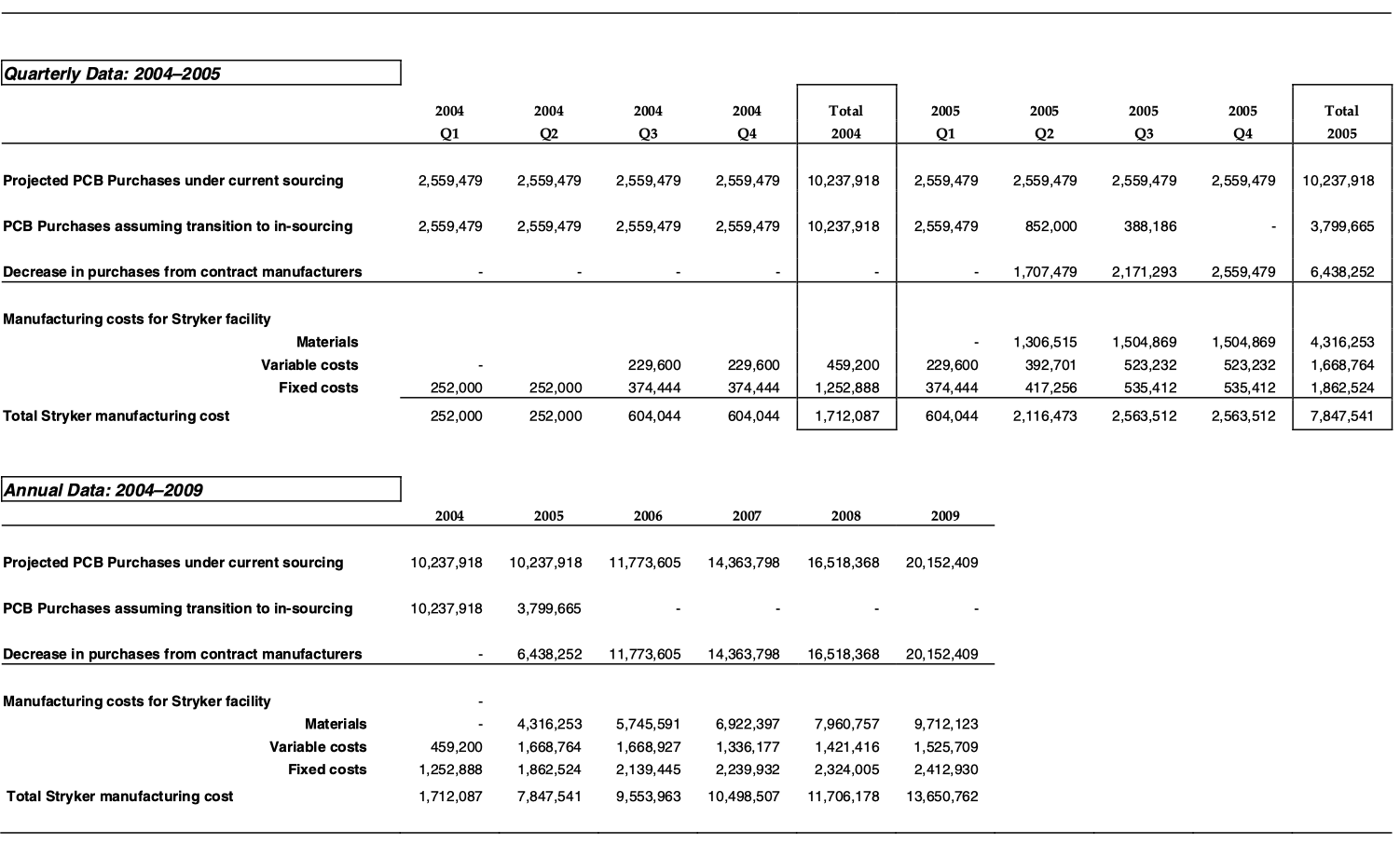

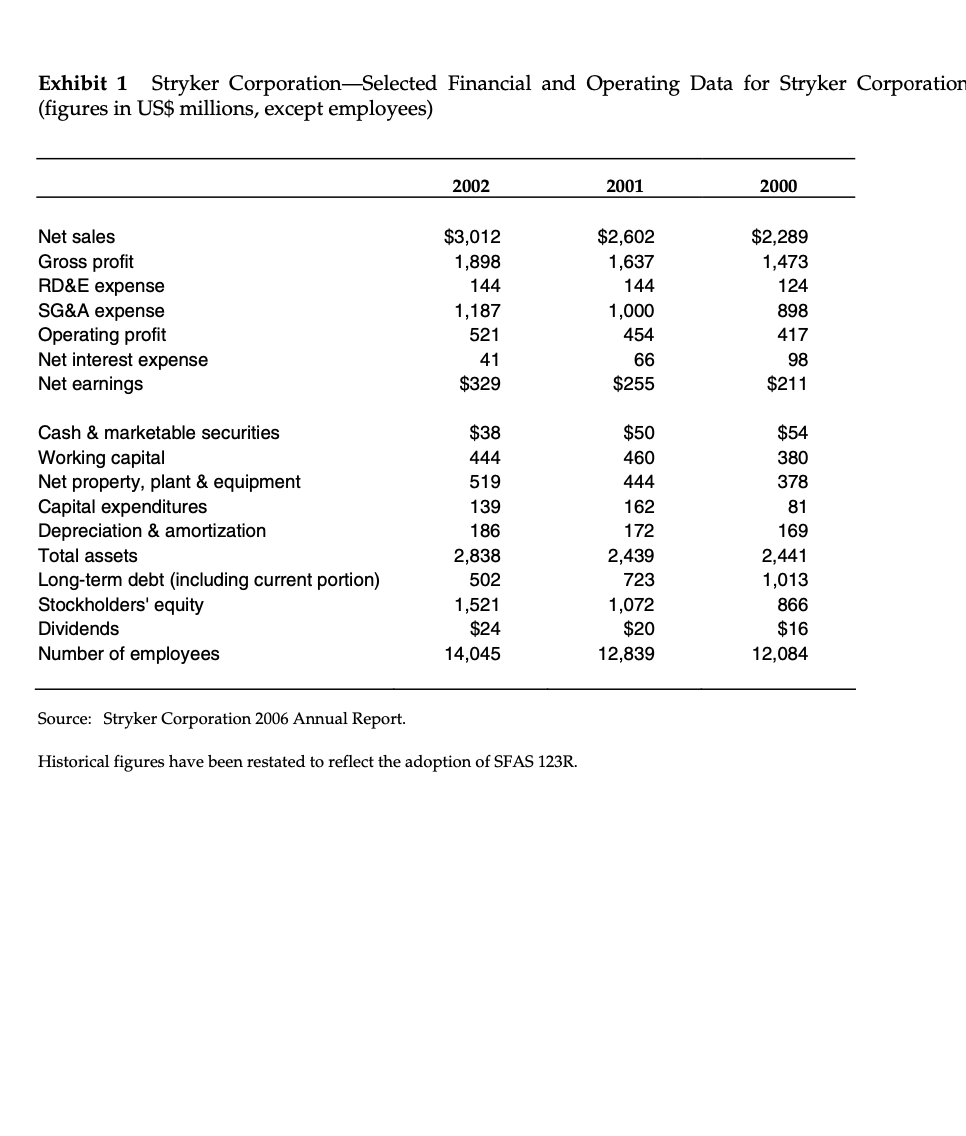

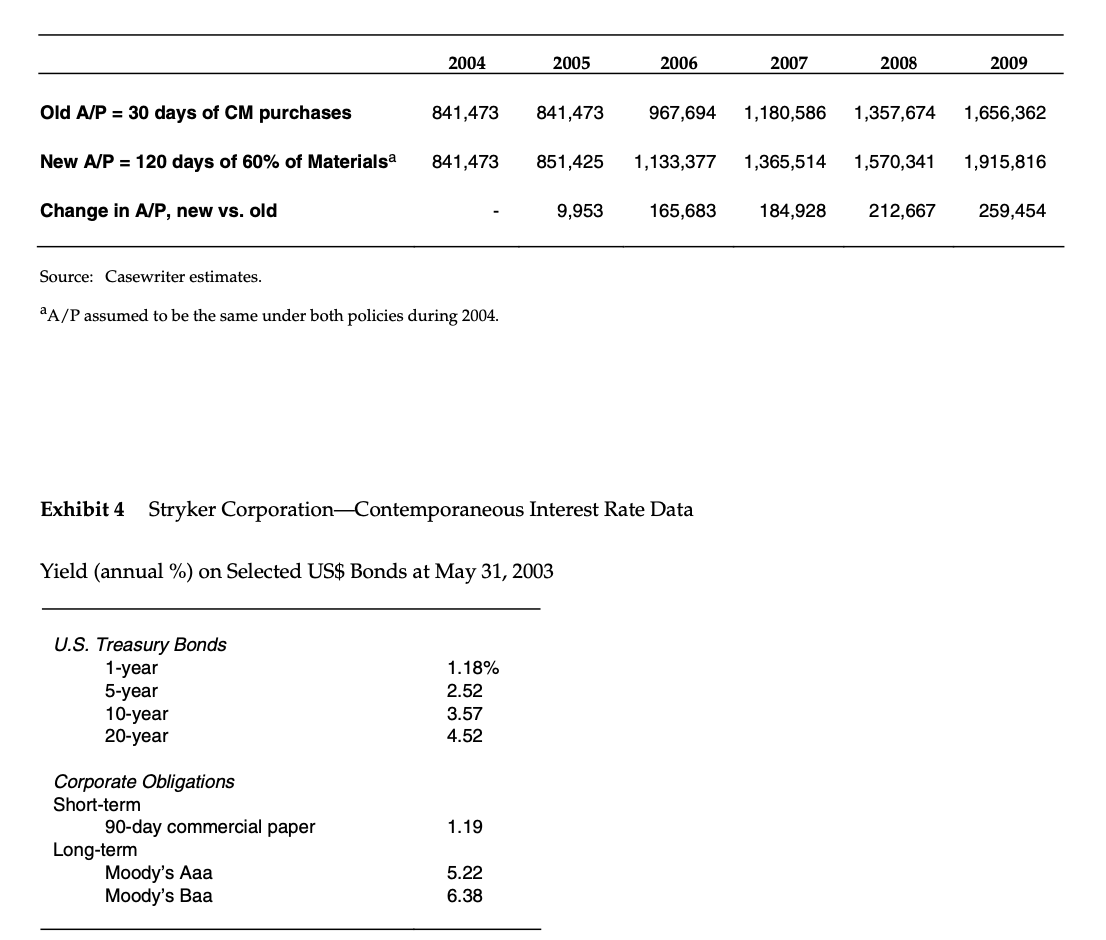

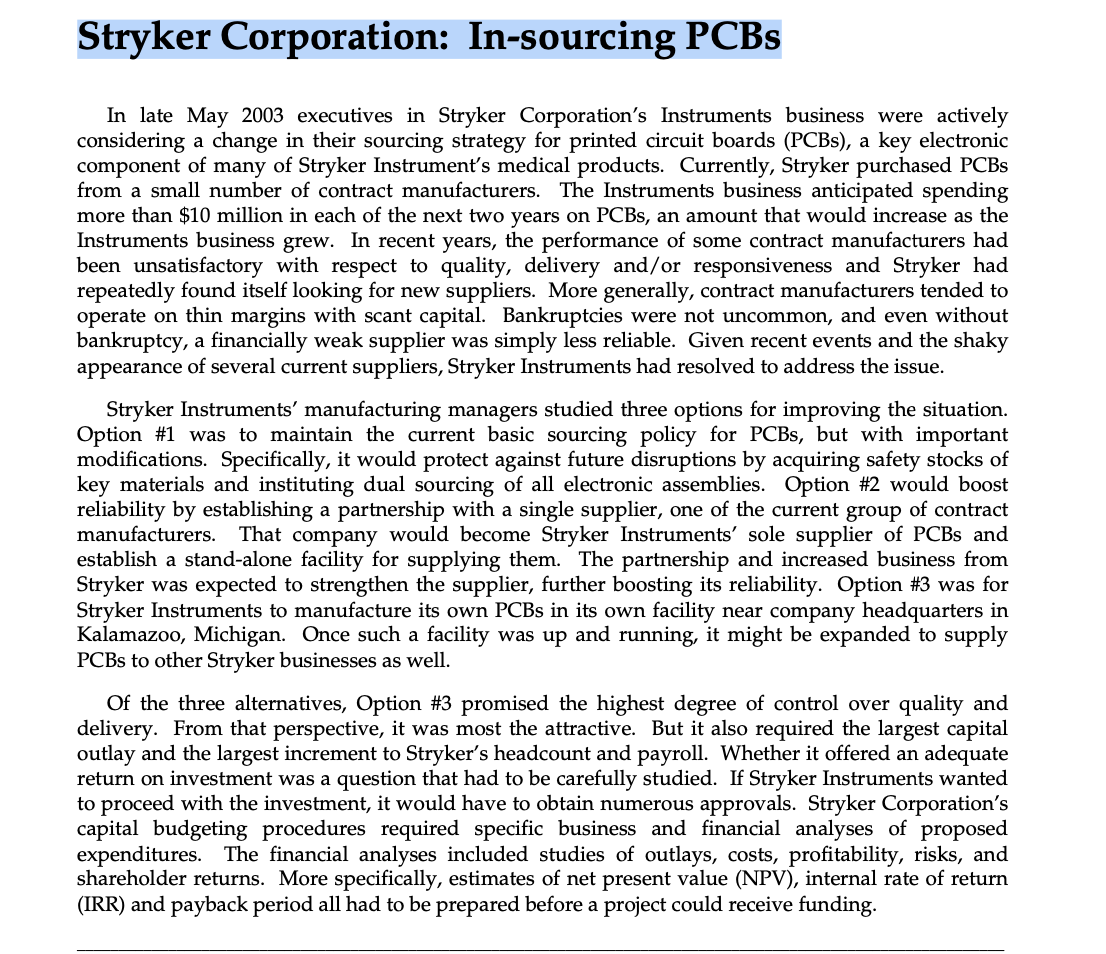

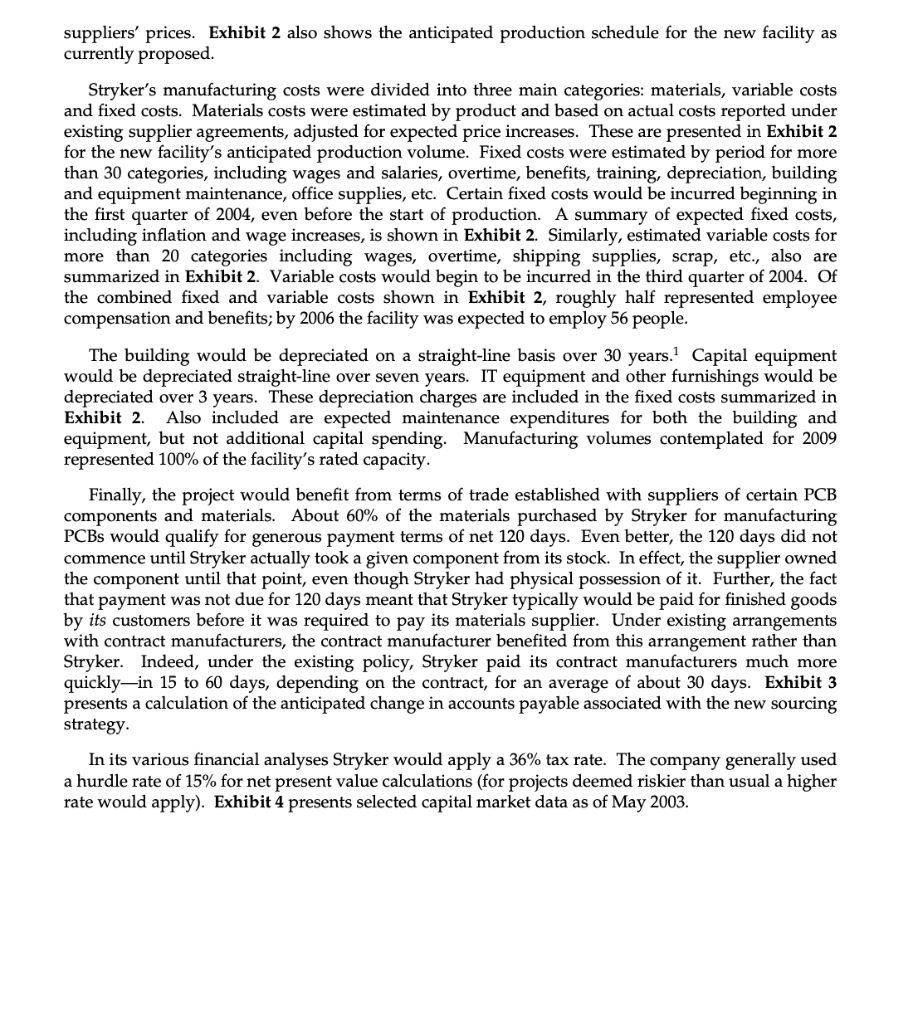

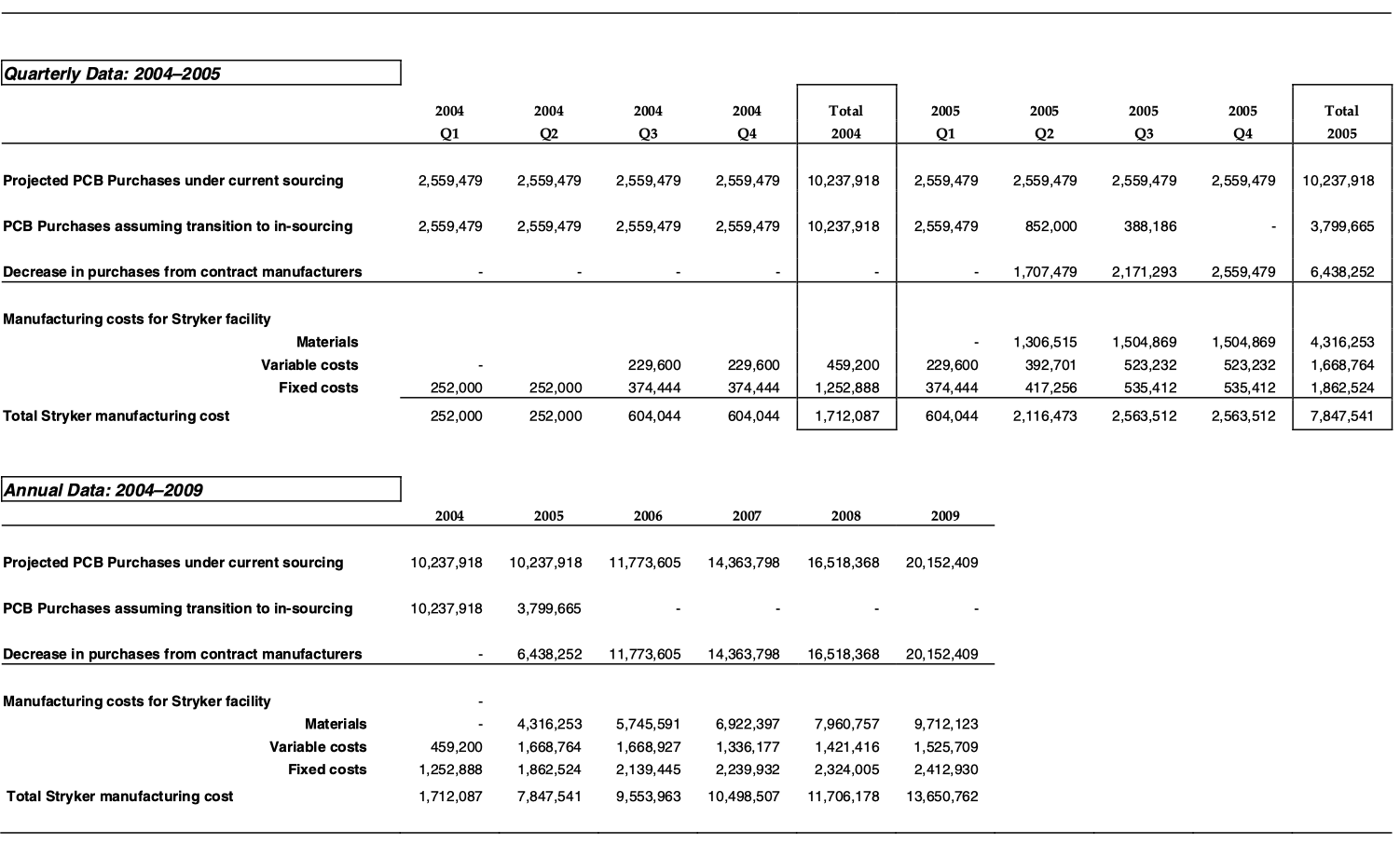

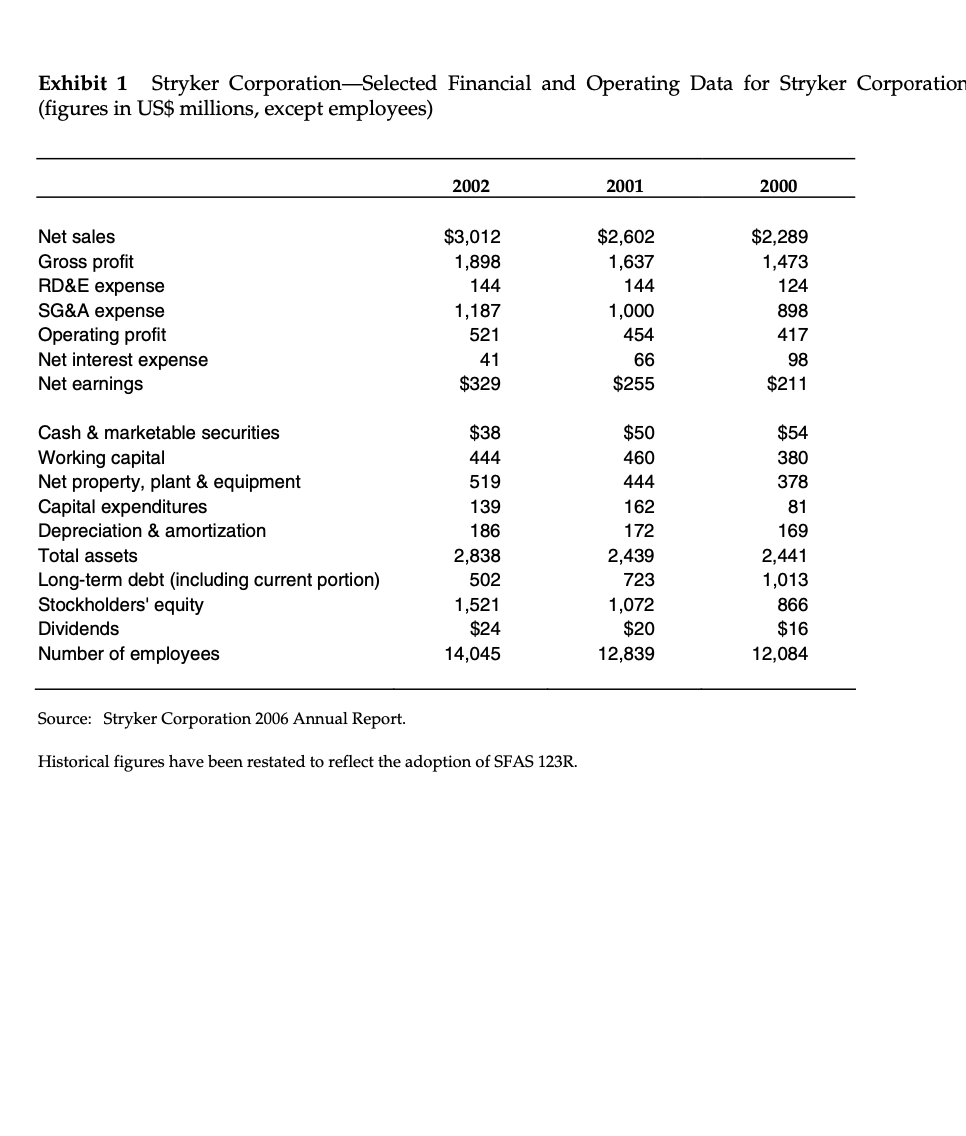

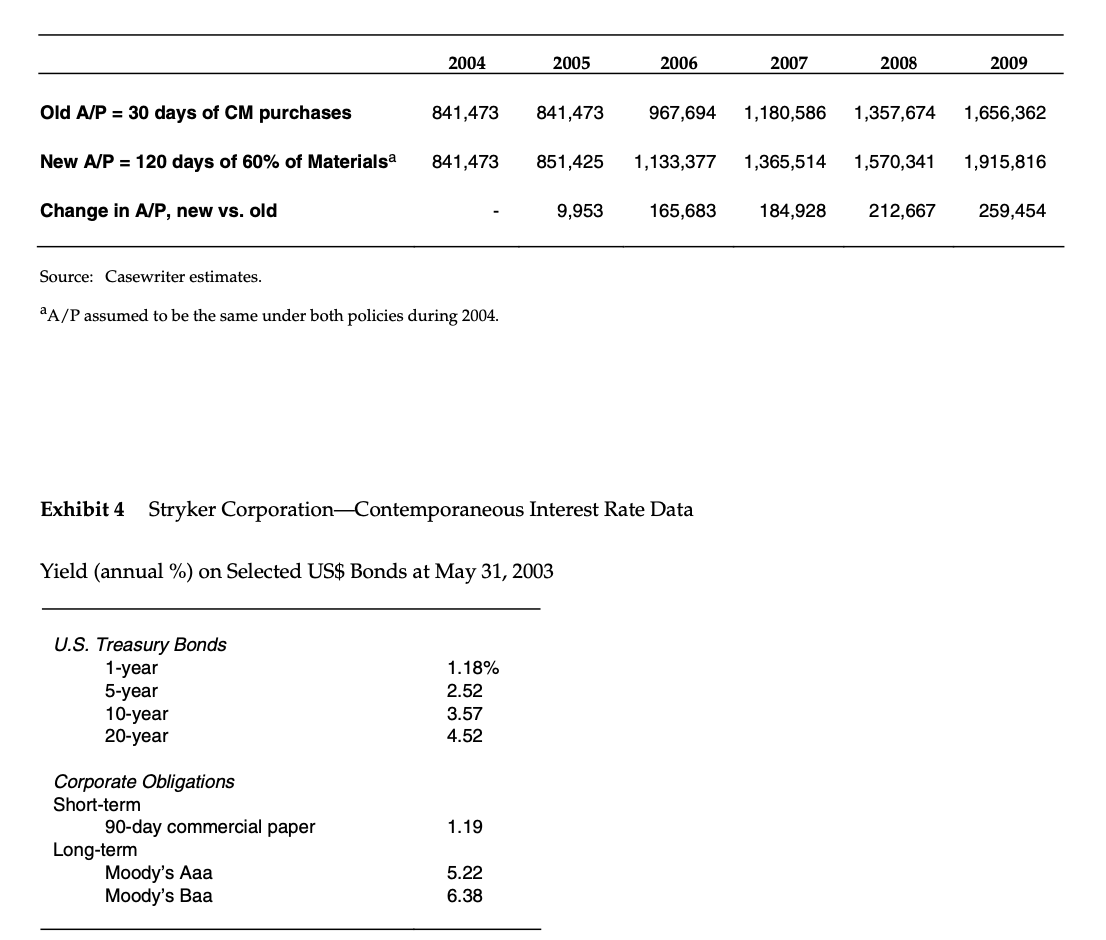

Quarterly Data: 2004-2005 Exhibit 1 Stryker Corporation-Selected Financial and Operating Data for Stryker Corporatio (figures in US\$ millions, except employees) Source: Stryker Corporation 2006 Annual Report. Historical figures have been restated to reflect the adoption of SFAS 123R. C 1 C Source: Casewriter estimates. aA/P assumed to be the same under both policies during 2004. Exhibit 4 Stryker Corporation-Contemporaneous Interest Rate Data Yield (annual \%) on Selected US\$ Bonds at May 31, 2003 In late May 2003 executives in Stryker Corporation's Instruments business were actively considering a change in their sourcing strategy for printed circuit boards (PCBs), a key electronic component of many of Stryker Instrument's medical products. Currently, Stryker purchased PCBs from a small number of contract manufacturers. The Instruments business anticipated spending more than $10 million in each of the next two years on PCBs, an amount that would increase as the Instruments business grew. In recent years, the performance of some contract manufacturers had been unsatisfactory with respect to quality, delivery and/or responsiveness and Stryker had repeatedly found itself looking for new suppliers. More generally, contract manufacturers tended to operate on thin margins with scant capital. Bankruptcies were not uncommon, and even without bankruptcy, a financially weak supplier was simply less reliable. Given recent events and the shaky appearance of several current suppliers, Stryker Instruments had resolved to address the issue. Stryker Instruments' manufacturing managers studied three options for improving the situation. Option #1 was to maintain the current basic sourcing policy for PCBs, but with important modifications. Specifically, it would protect against future disruptions by acquiring safety stocks of key materials and instituting dual sourcing of all electronic assemblies. Option #2 would boost reliability by establishing a partnership with a single supplier, one of the current group of contract manufacturers. That company would become Stryker Instruments' sole supplier of PCBs and establish a stand-alone facility for supplying them. The partnership and increased business from Stryker was expected to strengthen the supplier, further boosting its reliability. Option #3 was for Stryker Instruments to manufacture its own PCBs in its own facility near company headquarters in Kalamazoo, Michigan. Once such a facility was up and running, it might be expanded to supply PCBs to other Stryker businesses as well. Of the three alternatives, Option #3 promised the highest degree of control over quality and delivery. From that perspective, it was most the attractive. But it also required the largest capital outlay and the largest increment to Stryker's headcount and payroll. Whether it offered an adequate return on investment was a question that had to be carefully studied. If Stryker Instruments wanted to proceed with the investment, it would have to obtain numerous approvals. Stryker Corporation's capital budgeting procedures required specific business and financial analyses of proposed expenditures. The financial analyses included studies of outlays, costs, profitability, risks, and shareholder returns. More specifically, estimates of net present value (NPV), internal rate of return (IRR) and payback period all had to be prepared before a project could receive funding. suppliers' prices. Exhibit 2 also shows the anticipated production schedule for the new facility as currently proposed. Stryker's manufacturing costs were divided into three main categories: materials, variable costs and fixed costs. Materials costs were estimated by product and based on actual costs reported under existing supplier agreements, adjusted for expected price increases. These are presented in Exhibit 2 for the new facility's anticipated production volume. Fixed costs were estimated by period for more than 30 categories, including wages and salaries, overtime, benefits, training, depreciation, building and equipment maintenance, office supplies, etc. Certain fixed costs would be incurred beginning in the first quarter of 2004 , even before the start of production. A summary of expected fixed costs, including inflation and wage increases, is shown in Exhibit 2. Similarly, estimated variable costs for more than 20 categories including wages, overtime, shipping supplies, scrap, etc., also are summarized in Exhibit 2. Variable costs would begin to be incurred in the third quarter of 2004. Of the combined fixed and variable costs shown in Exhibit 2, roughly half represented employee compensation and benefits; by 2006 the facility was expected to employ 56 people. The building would be depreciated on a straight-line basis over 30 years. 1 Capital equipment would be depreciated straight-line over seven years. IT equipment and other furnishings would be depreciated over 3 years. These depreciation charges are included in the fixed costs summarized in Exhibit 2. Also included are expected maintenance expenditures for both the building and equipment, but not additional capital spending. Manufacturing volumes contemplated for 2009 represented 100% of the facility's rated capacity. Finally, the project would benefit from terms of trade established with suppliers of certain PCB components and materials. About 60% of the materials purchased by Stryker for manufacturing PCBs would qualify for generous payment terms of net 120 days. Even better, the 120 days did not commence until Stryker actually took a given component from its stock. In effect, the supplier owned the component until that point, even though Stryker had physical possession of it. Further, the fact that payment was not due for 120 days meant that Stryker typically would be paid for finished goods by its customers before it was required to pay its materials supplier. Under existing arrangements with contract manufacturers, the contract manufacturer benefited from this arrangement rather than Stryker. Indeed, under the existing policy, Stryker paid its contract manufacturers much more quickly-in 15 to 60 days, depending on the contract, for an average of about 30 days. Exhibit 3 presents a calculation of the anticipated change in accounts payable associated with the new sourcing strategy. In its various financial analyses Stryker would apply a 36% tax rate. The company generally used a hurdle rate of 15% for net present value calculations (for projects deemed riskier than usual a higher rate would apply). Exhibit 4 presents selected capital market data as of May 2003. Quarterly Data: 2004-2005 Exhibit 1 Stryker Corporation-Selected Financial and Operating Data for Stryker Corporatio (figures in US\$ millions, except employees) Source: Stryker Corporation 2006 Annual Report. Historical figures have been restated to reflect the adoption of SFAS 123R. C 1 C Source: Casewriter estimates. aA/P assumed to be the same under both policies during 2004. Exhibit 4 Stryker Corporation-Contemporaneous Interest Rate Data Yield (annual \%) on Selected US\$ Bonds at May 31, 2003 In late May 2003 executives in Stryker Corporation's Instruments business were actively considering a change in their sourcing strategy for printed circuit boards (PCBs), a key electronic component of many of Stryker Instrument's medical products. Currently, Stryker purchased PCBs from a small number of contract manufacturers. The Instruments business anticipated spending more than $10 million in each of the next two years on PCBs, an amount that would increase as the Instruments business grew. In recent years, the performance of some contract manufacturers had been unsatisfactory with respect to quality, delivery and/or responsiveness and Stryker had repeatedly found itself looking for new suppliers. More generally, contract manufacturers tended to operate on thin margins with scant capital. Bankruptcies were not uncommon, and even without bankruptcy, a financially weak supplier was simply less reliable. Given recent events and the shaky appearance of several current suppliers, Stryker Instruments had resolved to address the issue. Stryker Instruments' manufacturing managers studied three options for improving the situation. Option #1 was to maintain the current basic sourcing policy for PCBs, but with important modifications. Specifically, it would protect against future disruptions by acquiring safety stocks of key materials and instituting dual sourcing of all electronic assemblies. Option #2 would boost reliability by establishing a partnership with a single supplier, one of the current group of contract manufacturers. That company would become Stryker Instruments' sole supplier of PCBs and establish a stand-alone facility for supplying them. The partnership and increased business from Stryker was expected to strengthen the supplier, further boosting its reliability. Option #3 was for Stryker Instruments to manufacture its own PCBs in its own facility near company headquarters in Kalamazoo, Michigan. Once such a facility was up and running, it might be expanded to supply PCBs to other Stryker businesses as well. Of the three alternatives, Option #3 promised the highest degree of control over quality and delivery. From that perspective, it was most the attractive. But it also required the largest capital outlay and the largest increment to Stryker's headcount and payroll. Whether it offered an adequate return on investment was a question that had to be carefully studied. If Stryker Instruments wanted to proceed with the investment, it would have to obtain numerous approvals. Stryker Corporation's capital budgeting procedures required specific business and financial analyses of proposed expenditures. The financial analyses included studies of outlays, costs, profitability, risks, and shareholder returns. More specifically, estimates of net present value (NPV), internal rate of return (IRR) and payback period all had to be prepared before a project could receive funding. suppliers' prices. Exhibit 2 also shows the anticipated production schedule for the new facility as currently proposed. Stryker's manufacturing costs were divided into three main categories: materials, variable costs and fixed costs. Materials costs were estimated by product and based on actual costs reported under existing supplier agreements, adjusted for expected price increases. These are presented in Exhibit 2 for the new facility's anticipated production volume. Fixed costs were estimated by period for more than 30 categories, including wages and salaries, overtime, benefits, training, depreciation, building and equipment maintenance, office supplies, etc. Certain fixed costs would be incurred beginning in the first quarter of 2004 , even before the start of production. A summary of expected fixed costs, including inflation and wage increases, is shown in Exhibit 2. Similarly, estimated variable costs for more than 20 categories including wages, overtime, shipping supplies, scrap, etc., also are summarized in Exhibit 2. Variable costs would begin to be incurred in the third quarter of 2004. Of the combined fixed and variable costs shown in Exhibit 2, roughly half represented employee compensation and benefits; by 2006 the facility was expected to employ 56 people. The building would be depreciated on a straight-line basis over 30 years. 1 Capital equipment would be depreciated straight-line over seven years. IT equipment and other furnishings would be depreciated over 3 years. These depreciation charges are included in the fixed costs summarized in Exhibit 2. Also included are expected maintenance expenditures for both the building and equipment, but not additional capital spending. Manufacturing volumes contemplated for 2009 represented 100% of the facility's rated capacity. Finally, the project would benefit from terms of trade established with suppliers of certain PCB components and materials. About 60% of the materials purchased by Stryker for manufacturing PCBs would qualify for generous payment terms of net 120 days. Even better, the 120 days did not commence until Stryker actually took a given component from its stock. In effect, the supplier owned the component until that point, even though Stryker had physical possession of it. Further, the fact that payment was not due for 120 days meant that Stryker typically would be paid for finished goods by its customers before it was required to pay its materials supplier. Under existing arrangements with contract manufacturers, the contract manufacturer benefited from this arrangement rather than Stryker. Indeed, under the existing policy, Stryker paid its contract manufacturers much more quickly-in 15 to 60 days, depending on the contract, for an average of about 30 days. Exhibit 3 presents a calculation of the anticipated change in accounts payable associated with the new sourcing strategy. In its various financial analyses Stryker would apply a 36% tax rate. The company generally used a hurdle rate of 15% for net present value calculations (for projects deemed riskier than usual a higher rate would apply). Exhibit 4 presents selected capital market data as of May 2003