Question

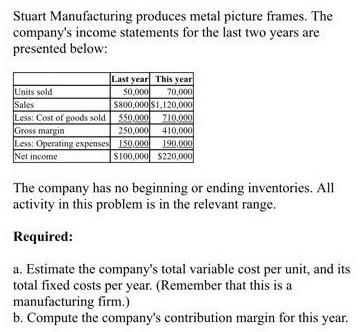

Stuart Manufacturing produces metal picture frames. The company's income statements for the last two years are presented below: Last year This year 50,000 70,000

Stuart Manufacturing produces metal picture frames. The company's income statements for the last two years are presented below: Last year This year 50,000 70,000 $800,000 $1,120,000 Less: Cost of goods sold 550,000 710,000 Gross margin 250,000 410,000 Less: Operating expenses 150,000 190,000 Net income $100,000 $220,000 Units sold Sales The company has no beginning or ending inventories. All activity in this problem is in the relevant range. Required: a. Estimate the company's total variable cost per unit, and its total fixed costs per year. (Remember that this is a manufacturing firm.) b. Compute the company's contribution margin for this year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Requirement a Variable cost per unit 10 Fixed cost per y...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles of Accounting

Authors: Needles, Powers, crosson

11th Edition

1439037744, 978-1133626985, 978-1439037744

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App