Question

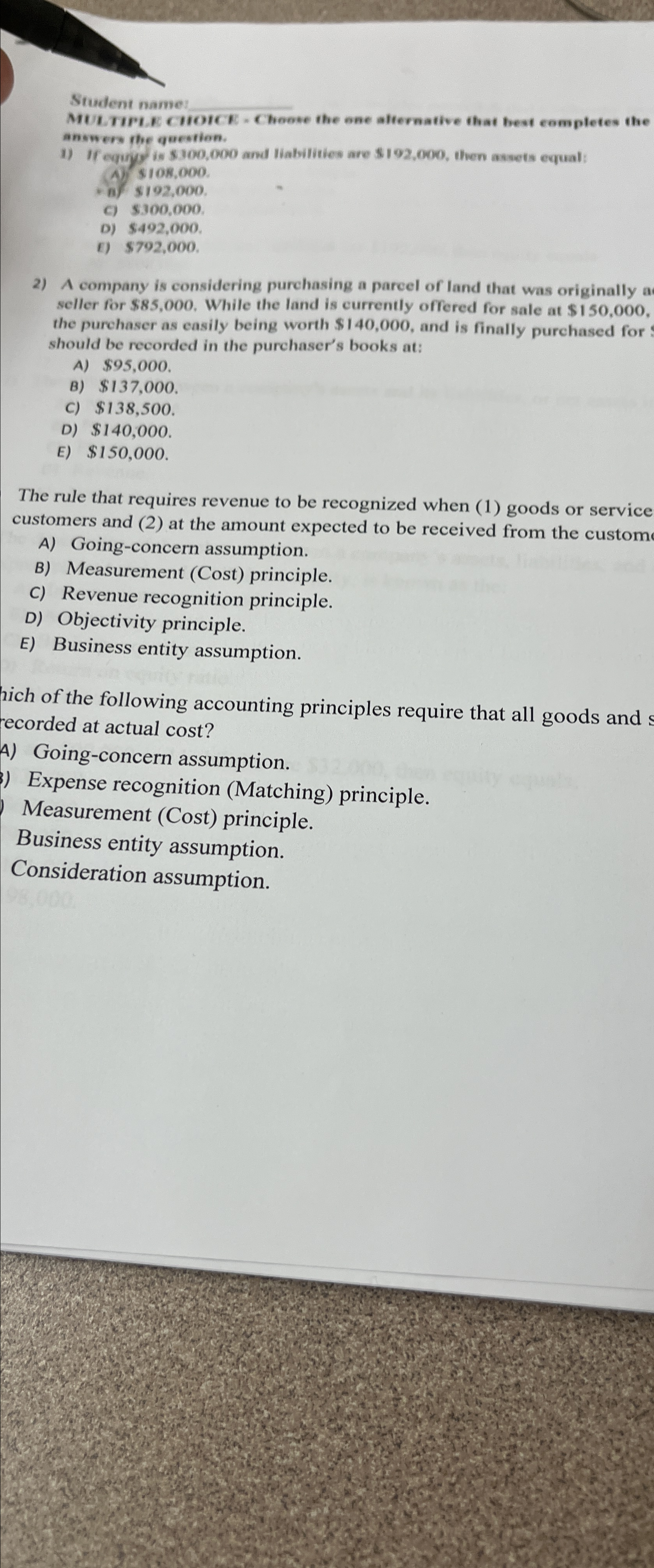

Student name anser the que:tion. If equyy is $300,000 and liabilities are $102,000 , then assets equal: A) $108,000 n) $192,000 c) 5300,000

Student name\ anser the que:tion.\ If equyy is

$300,000and liabilities are

$102,000, then assets equal:\ A)

$108,000\ n)

$192,000\ c) 5300,000 .\ D)

$492,000.\ r)

$792,000.\ A company is considering purchasing a parcel of land that was originally a seller for

$85,000. While the land is currently offered for sale at

$150,000, the purchaser as casily being worth

$140,000, and is finally purchased for should be recorded in the purchaser's books at:\ A)

$95,000.\ B)

$137,000.\ C)

$138,500.\ D)

$140,000.\ E)

$150,000.\ The rule that requires revenue to be recognized when (1) goods or service customers and (2) at the amount expected to be received from the custom\ A) Going-concern assumption.\ B) Measurement (Cost) principle.\ C) Revenue recognition principle.\ D) Objectivity principle.\ E) Business entity assumption.\ hich of the following accounting principles require that all goods and s recorded at actual cost?\ A) Going-concern assumption.\ Expense recognition (Matching) principle.\ Measurement (Cost) principle.\ Business entity assumption.\ Consideration assumption.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started