Question

Students are required to use Excel Spreadsheet to complete this assessment. All the reports must be generated using Excel functions. Transactions completed during the year

Students are required to use Excel Spreadsheet to complete this assessment.

All the reports must be generated using Excel functions. Transactions completed during the year ended 30 June 2019 for Johnson & Co are summarised as follows:-

Transactions completed during the year ended 30 June 2019 are summarised below (ignore GST):

1. Collections on accounts receivable totalled $51 820

2. Consulting fees of $55 720 were receivable during the year. Clients are invoiced after services are provided and are given 30 days in which to pay.

3. Rent paid in advance was $9120 4. Office supplies were purchased during the year for $240 in cash & $260 on credit

5. Johnson withdrew $16000 for private use

6. Salary payments amounted to $19 960, of which $260 was for salaries accrued to the end of the year ending 30 June 2019

7. Advertising totalling $2100 was purchased on credit

8. Electricity expense of $2250 was paid

9. Accounts payable of $1800 were paid

The following additional information should be considered for adjusting entries:

1. Unused office supplies on hand at the end of the year totalled $480

2. Depreciation on the furniture and equipment is $2900

3. Salaries earned but not paid amount to $740

4. Rent paid in advance in transaction 3. Rent for 6 months of $4560 was paid in advance on 1 August and 1 February.

Required:

1. Prepare an Income Statement, A Statement of Changes in Equity and A Balance Sheet

2. Evaluate the financial performance of the Company.

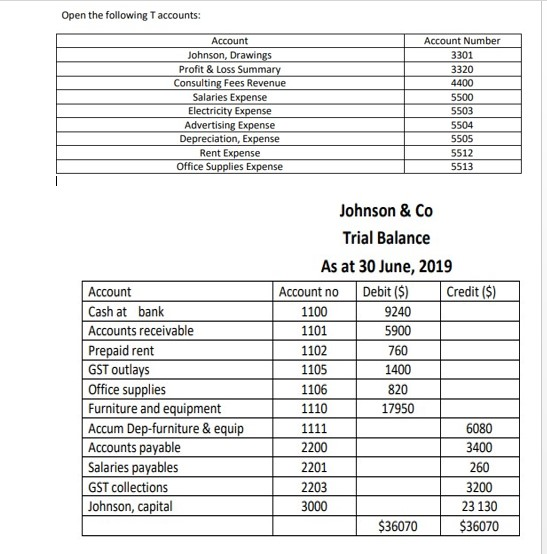

Open the following T accounts: Account Johnson, Drawings Profit & Loss Summary Consulting Fees Revenue Salaries Expense Electricity Expense Advertising Expense Depreciation, Expense Rent Expense Office Supplies Expense Account Number 3301 3320 4400 5500 5503 5504 5505 5512 5513 Account Cash at bank Accounts receivable Prepaid rent GST outlays Office supplies Furniture and equipment Accum Dep-furniture & equip Accounts payable Salaries payables GST collections Johnson, capital Johnson & Co Trial Balance As at 30 June, 2019 Account no Debit ($) Credit ($) 1100 9240 1101 5900 1102 760 1105 1400 1106 820 1110 17950 1111 6080 2200 3400 2201 260 2203 3200 3000 23 130 $36070 $36070Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started