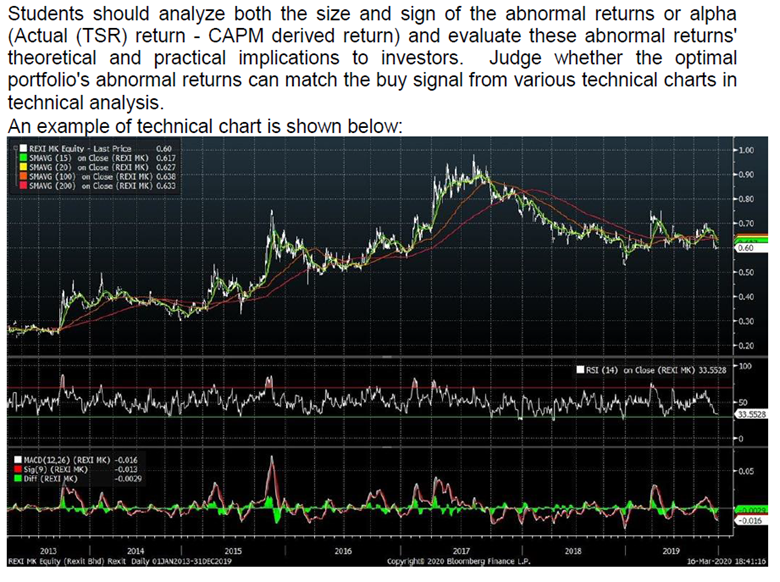

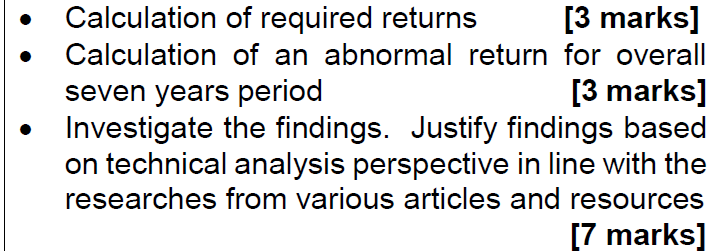

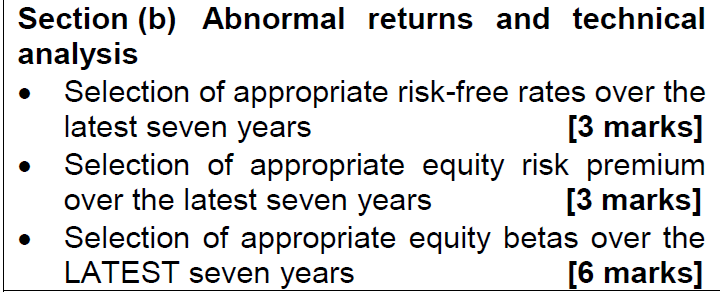

Students may obtain the "risk-free rate" from BNM (Bank Negara Malaysia) website or Bloomberg. Students may justify their risk-free rate choices (either 3-month, 6-month, 9-month, or 1-year) that used for estimation. A country's risk-free rate may obtain from Bloomberg. Students may calculate the appropriate "equity risk premium" from the formula: (Rm- Rf). Kindly be noted that you may need to calculate it yourselves. Students may refer to Chapter 5 (Modern Portfolio Concepts) of the main reference - Fundamentals of investing (14th ed.) by Smart and Zutter, and other supplementary readings in the WBLE for more guidance. Students may calculate the most appropriate equity beta for the overall 7-year period. The 7-year beta will represent a general market risk estimate. Use the CAPM [E(Ri) = Rf+ Bi(E(RM) - RA)] to calculate the "required" (or benchmark) returns. The required returns should incorporate the risk-free rate changes, the equity risk premium, and the equity beta over the seven years.Students should analyze both the size and sign of the abnormal returns or alpha (Actual (TSR) return - CAPM derived return} and evaluate these abnormal returns' theoretical and practical implications to investors. Judge whether the optimal portfolio's abnormal returns can match the buy signal from various technical charts in technical analysis. An exam-Ie of technical chart is shovm below: ........ Calculation of required returns [3 marks] Calculation of an abnormal return for overall seven years period [3 marks] Investigate the findings. Justify findings based on technical analysis perspective in line with the researches from various articles and resources [7 marks] Section (b) Abnormal returns and technical analysis 0 Selection of appropriate risk-free rates over the latest seven years [3 marks] 0 Selection of appropriate equity risk premium over the latest seven years [3 marks] 0 Selection of appropriate equity betas over the LATEST seven years [6 marks] Using the share price returns calculated for your allocated company in Part {a} in conjunction with the targeted return predicted by the CAPM, determine the abnormal returns (extra or excess returns) earned over the seven years of the shares. Investigate your results or ndings. Your findings may justify from a technical analysis perspective, in line with the facts and gures from various researches, articles, and resources on your selected shares. [25 marks]