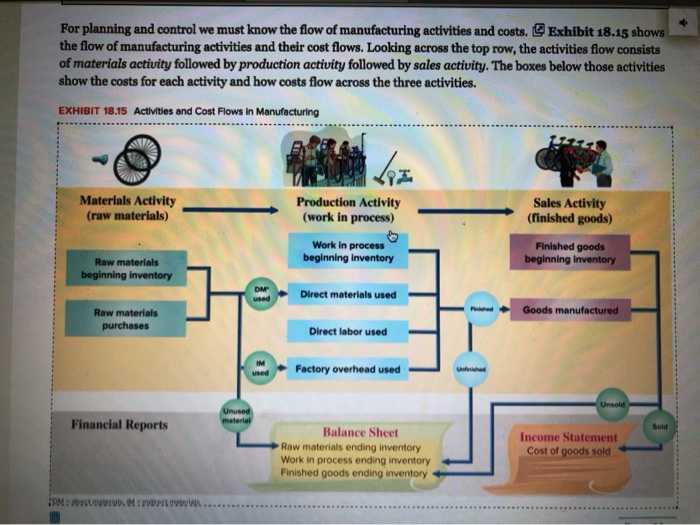

Study Exhibit 18.15. For this team problem, each member of your team will describe the flow depicted by one of the circles in the Exhibit. There are 7 circles: DM used, IM used, unused material, finished, unfinished, unsold, and sold. For the circle that you select, clearly describe the flow that it represents, making sure to explain where it comes from, where it goes, and why. Note: your team will analyze in total just 3 or 4 of the circles, depending on how many members you have; you can safely ignore the others. For full credit, be sure to: 1. Clearly explain how the dollar amount represented by your circle is calculated. 2. Clearly explain why it is added to the activity (or financial statement) to which it flows. 3. Reply to at least two of your teammates' solution posts, providing substantive feedback that either affirms their solution, or offers suggestions, additional information, or alternative solutions. The deadline for feedback to teammates is 24 hours after the solution submission deadline. For planning and control we must know the flow of manufacturing activities and costs. Exhibit 18.15 shows the flow of manufacturing activities and their cost flows. Looking across the top row, the activities flow consists of materials activity followed by production activity followed by sales activity. The boxes below those activities show the costs for each activity and how costs flow across the three activities. EXHIBIT 18.15 Activities and Cost Flows in Manufacturing A E Materials Activity (raw materials) Production Activity (work in process) Sales Activity (finished goods) Work in process beginning Inventory Finished goods beginning Inventory Raw materials beginning inventory DM Direct materials used Goods manufactured Raw materials purchases Direct labor used Factory overhead used Financial Reports Balance Sheet Raw materials ending inventory Work in process ending inventory Finished goods ending inventory Income Statement Cost of goods sold IP: STOVI. Min . Page 663 Materials Activity The left side of Exhibit 18.15 shows the flow of raw materials. Manufacturers usually start a period with some beginning raw materials inventory left over from the previous period. The company then acquires more raw materials in the current period. Adding these purchases to beginning inventory gives total raw materials available for use in production. These raw materials are then either used in production in the current period or remain in raw materials inventory at the end of the period for use in future periods. Production Activity The middle section of Exhibit 18.15 describes production activity. The following factors and their costs come together in production. Beginning work in process inventory, that is, the costs of partially complete products from the prior period. Direct materials, direct labor, and factory overhead incurred in the current period. The production activity that takes place in the period results in products that are either finished or not finished at the end of the period. The cost of finished products makes up the cost of goods manufactured for the current period. The cost of goods manufactured is the total cost of making and finishing products in the period. That amount is included on the income statement in the computation of cost of goods sold, as we showed in Exhibit 18.14. Unfinished products are identified as ending work in process inventory. The cost of unfinished products consists of raw materials, direct labor, and factory overhead and is reported on the current period's balance sheet. The costs of both finished goods manufactured and work in process are product costs. Sales Activity The far right side of Exhibit 18.15 shows what happens to the finished goods: The cost of the beginning inventory of finished goods plus the cost of the newly completed units (goods manufactured) equals total finished goods available for sale in the current period. As they are sold, the cost of finished products sold is! reported on the income statement as cost of goods sold. The cost of any finished products not sold in the period is reported as a current asset, finished goods inventory, on the current period's balance sheet