Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Stuffed Toys Manufacturing Co. Required: No later than the class scheduled time on Thursday, October 17, 2019 1) Using the information provided in Exhibit 1;

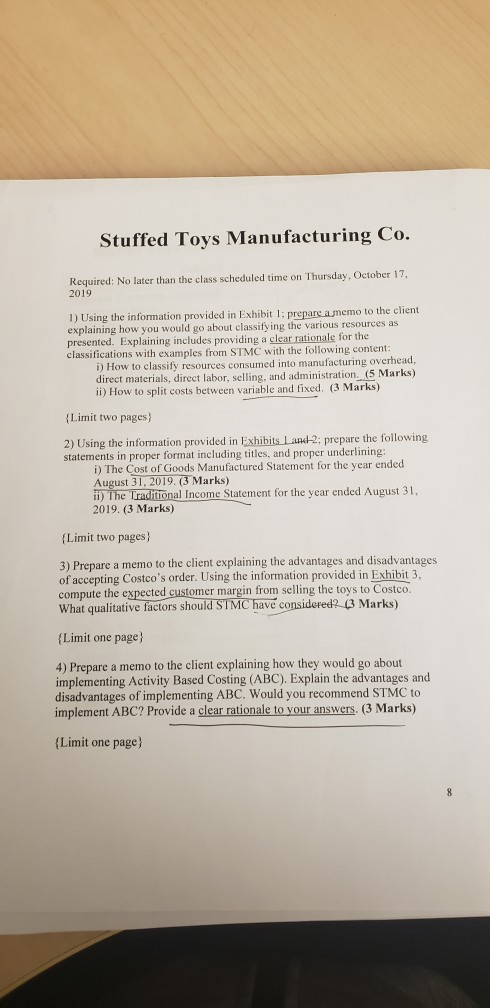

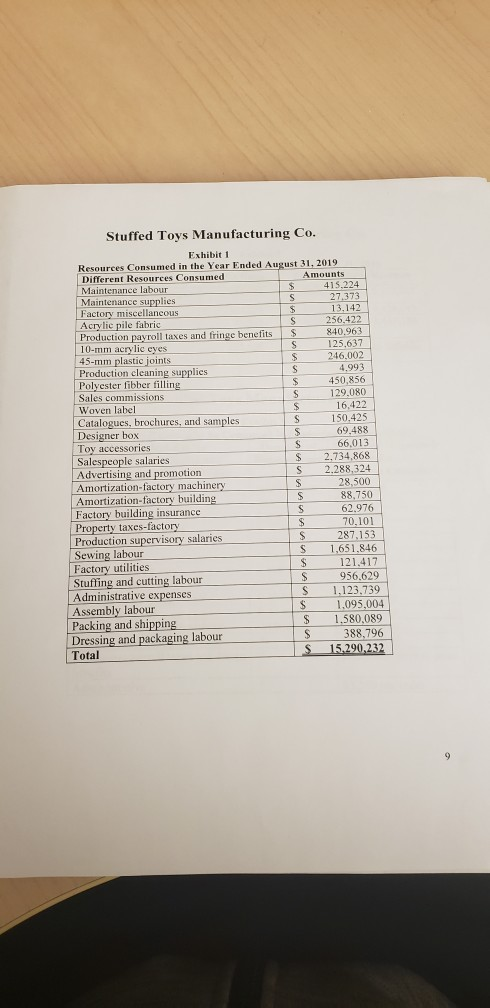

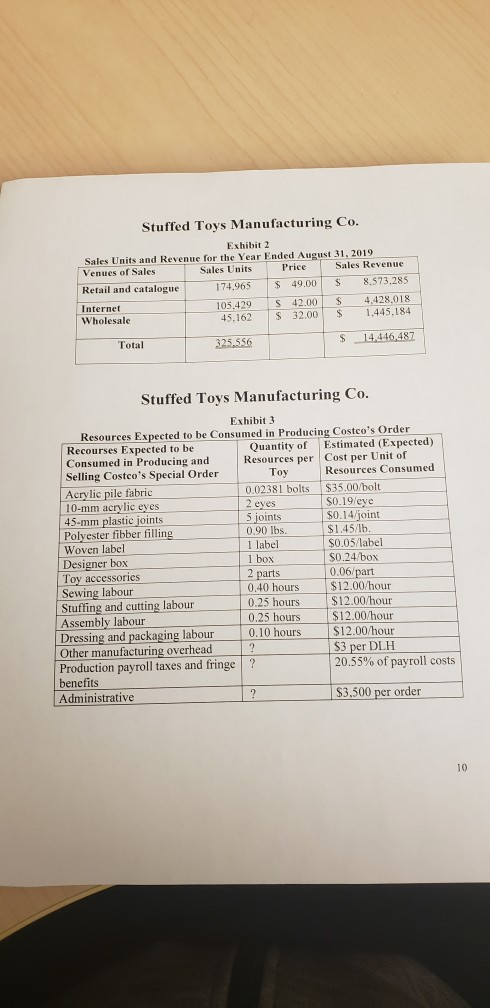

Stuffed Toys Manufacturing Co. Required: No later than the class scheduled time on Thursday, October 17, 2019 1) Using the information provided in Exhibit 1; prepare a memo to the client explaining how you would go about classifying the various resources as presented. Explaining includes providing a clear rationale for the classifications with examples from STMC with the following content: i) How to classify resources consumed into manufacturing overhead, direct materials, direct labor, selling, and administration. (5 Marks) ii) How to split costs between variable and fixed. (3 Marks) {Limit two pages) 2) Using the information provided in Exhibits 1 and 2: prepare the following statements in proper format including titles, and proper underlining: i) The Cost of Goods Manufactured Statement for the year ended August 31, 2019. (3 Marks) ii) The Traditional Income Statement for the year ended August 31, 2019. (3 Marks) (Limit two pages) 3) Prepare a memo to the client explaining the advantages and disadvantages of accepting Costco's order. Using the information provided in Exhibit 3, compute the expected customer margin from selling the toys to Costco. What qualitative factors should STMC have considered? (3 Marks) {Limit one page) 4) Prepare a memo to the client explaining how they would go about implementing Activity Based Costing (ABC). Explain the advantages and disadvantages of implementing ABC. Would you recommend STMC to implement ABC? Provide a clear rationale to your answers. (3 Marks) {Limit one page) Stuffed Toys Manufacturing Co. Exhibiti Resources Consumed in the Year Ended August 31, 2019 Different Resources Consumed Amounts Maintenance labour 415,224 Maintenance supplies 27.373 Factory miscellaneous 13.142 Acrylic pile fabric 256,422 Production payroll taxes and fringe benefits $ 840.963 10-mm acrylic eyes 125.637 45-mm plastic joints 246.002 Production cleaning supplies 4,993 Polyester fibber filling 450,856 Sales commissions 129.080 Woven label 16,422 Catalogues, brochures, and samples S 150,425 Designer box 69,488 Toy accessories 66,013 Salespeople salaries 2,734,868 Advertising and promotion S 2.288,324 Amortization-factory machinery S 28,500 Amortization-factory building S 88,750 Factory building insurance 62.976 Property taxes-factory 70.101 Production supervisory salaries 287.153 Sewing labour S 1,651.846 Factory utilities 121.417 Stufling and cutting labour 956,629 Administrative expenses S 1,123,739 Assembly labour $ 1.095,004 Packing and shipping $ 1,580,089 Dressing and packaging labour S 3 88.796 Total S 15.290.232 S Stuffed Toys Manufacturing Co. Exhibit 2 Sales Units and Revenue for the Year Ended August 31, 2019 Venues of Sales Sales Units Price Sales Revenue Retail and catalogue 174.965 $ 49.00 $ 8.573.285 Internet 105.429 $ 42.00 S 4.428,018 Wholesale 45,162 $ 32.00 $ 1.445.184 Total 325.556 $ 14,446,487 Stuffed Toys Manufacturing Co. Exhibit 3 Resources Expected to be Consumed in Producing Costco's Order Recourses Expected to be Quantity of Estimated (Expected) Consumed in Producing and Resources per Cost per Unit of Selling Costco's Special Order Toy Resources Consumed Acrylic pile fabric 0.02381 bolts $35.00/bolt 10-mm acrylic eyes 2 eyes $0.19/eye 45-mm plastic joints s joints $0.14/joint Polyester fibber filling 0.90 lbs. $1.45/lb. Woven label I label $0.05/label Designer box 1 box S0.24/box Toy accessories 2 parts 0.06 part Sewing labour 0.40 hours $12.00/hour Stuffing and cutting labour 0.25 hours $12.00/hour Assembly labour 0.25 hours $12.00/hour Dressing and packaging labour $12.00/hour Other manufacturing overhead S3 per DLH Production payroll taxes and fringe ? 20.55% of payroll costs benefits Administrative ? $3,500 per order 1? Stuffed Toys Manufacturing Co. Required: No later than the class scheduled time on Thursday, October 17, 2019 1) Using the information provided in Exhibit 1; prepare a memo to the client explaining how you would go about classifying the various resources as presented. Explaining includes providing a clear rationale for the classifications with examples from STMC with the following content: i) How to classify resources consumed into manufacturing overhead, direct materials, direct labor, selling, and administration. (5 Marks) ii) How to split costs between variable and fixed. (3 Marks) {Limit two pages) 2) Using the information provided in Exhibits 1 and 2: prepare the following statements in proper format including titles, and proper underlining: i) The Cost of Goods Manufactured Statement for the year ended August 31, 2019. (3 Marks) ii) The Traditional Income Statement for the year ended August 31, 2019. (3 Marks) (Limit two pages) 3) Prepare a memo to the client explaining the advantages and disadvantages of accepting Costco's order. Using the information provided in Exhibit 3, compute the expected customer margin from selling the toys to Costco. What qualitative factors should STMC have considered? (3 Marks) {Limit one page) 4) Prepare a memo to the client explaining how they would go about implementing Activity Based Costing (ABC). Explain the advantages and disadvantages of implementing ABC. Would you recommend STMC to implement ABC? Provide a clear rationale to your answers. (3 Marks) {Limit one page) Stuffed Toys Manufacturing Co. Exhibiti Resources Consumed in the Year Ended August 31, 2019 Different Resources Consumed Amounts Maintenance labour 415,224 Maintenance supplies 27.373 Factory miscellaneous 13.142 Acrylic pile fabric 256,422 Production payroll taxes and fringe benefits $ 840.963 10-mm acrylic eyes 125.637 45-mm plastic joints 246.002 Production cleaning supplies 4,993 Polyester fibber filling 450,856 Sales commissions 129.080 Woven label 16,422 Catalogues, brochures, and samples S 150,425 Designer box 69,488 Toy accessories 66,013 Salespeople salaries 2,734,868 Advertising and promotion S 2.288,324 Amortization-factory machinery S 28,500 Amortization-factory building S 88,750 Factory building insurance 62.976 Property taxes-factory 70.101 Production supervisory salaries 287.153 Sewing labour S 1,651.846 Factory utilities 121.417 Stufling and cutting labour 956,629 Administrative expenses S 1,123,739 Assembly labour $ 1.095,004 Packing and shipping $ 1,580,089 Dressing and packaging labour S 3 88.796 Total S 15.290.232 S Stuffed Toys Manufacturing Co. Exhibit 2 Sales Units and Revenue for the Year Ended August 31, 2019 Venues of Sales Sales Units Price Sales Revenue Retail and catalogue 174.965 $ 49.00 $ 8.573.285 Internet 105.429 $ 42.00 S 4.428,018 Wholesale 45,162 $ 32.00 $ 1.445.184 Total 325.556 $ 14,446,487 Stuffed Toys Manufacturing Co. Exhibit 3 Resources Expected to be Consumed in Producing Costco's Order Recourses Expected to be Quantity of Estimated (Expected) Consumed in Producing and Resources per Cost per Unit of Selling Costco's Special Order Toy Resources Consumed Acrylic pile fabric 0.02381 bolts $35.00/bolt 10-mm acrylic eyes 2 eyes $0.19/eye 45-mm plastic joints s joints $0.14/joint Polyester fibber filling 0.90 lbs. $1.45/lb. Woven label I label $0.05/label Designer box 1 box S0.24/box Toy accessories 2 parts 0.06 part Sewing labour 0.40 hours $12.00/hour Stuffing and cutting labour 0.25 hours $12.00/hour Assembly labour 0.25 hours $12.00/hour Dressing and packaging labour $12.00/hour Other manufacturing overhead S3 per DLH Production payroll taxes and fringe ? 20.55% of payroll costs benefits Administrative ? $3,500 per order 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started