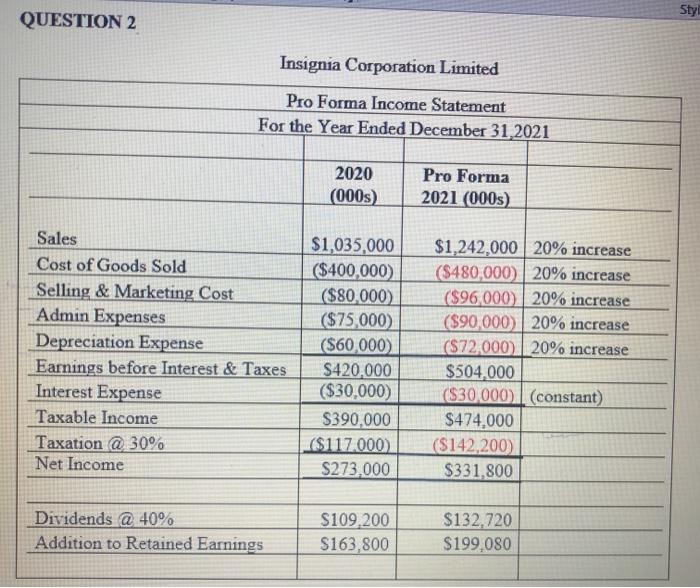

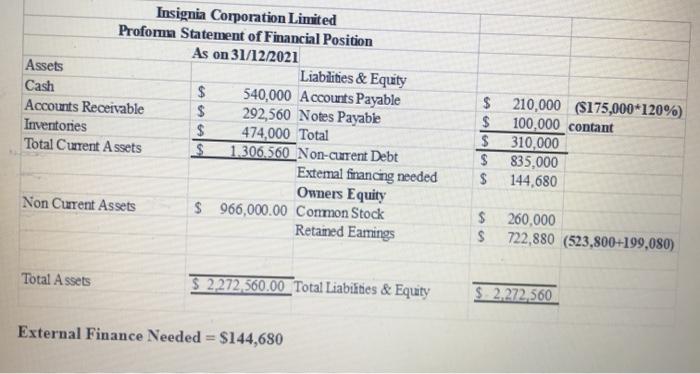

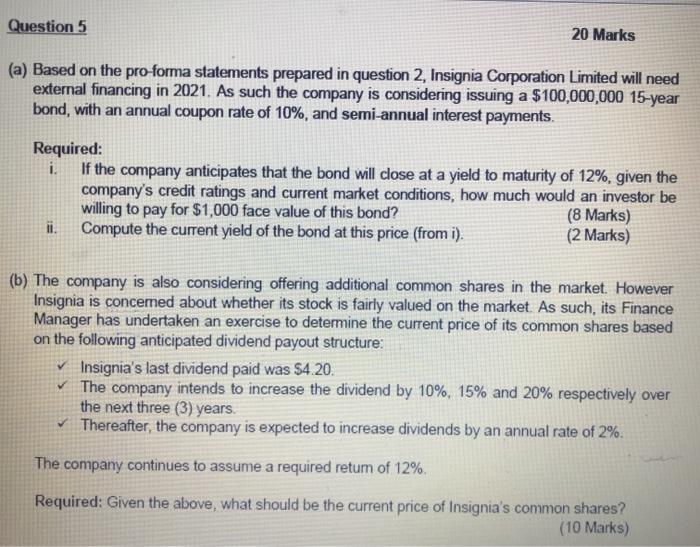

Styl QUESTION 2 Insignia Corporation Limited Pro Forma Income Statement For the Year Ended December 31,2021 2020 (000s) Pro Forma 2021 (000s) Sales Cost of Goods Sold Selling & Marketing Cost Admin Expenses Depreciation Expense Earnings before Interest & Taxes Interest Expense Taxable Income Taxation @ 30% Net Income $1,035,000 ($400,000) ($80,000) ($75,000 ($60,000) $420,000 ($30,000) $390,000 ($117.000) $273.000 $1,242,000 20% increase ($480,000) 20% increase ($96,000) | 20% increase ($90,000 20% increase ($72,000 20% increase $504,000 ($30,000 (constant) $474,000 ($142,200 $331,800 Dividends a 40% Addition to Retained Earnings $109,200 S163.800 $132,720 $199,080 Insignia Corporation Limited Profom Statement of Financial Position As on 31/12/2021 Assets Liabilities & Equity Cash $ 540,000 Accounts Payable Accounts Receivable $ 292,560 Notes Payable Inventories $ 474,000 Total Total Current Assets $ 1.306,560 Non-curent Debt Extemal financing needed Owners Equity Non Curent Assets $ 966,000.00 Common Stock Retained Eatings $ $ $ $ $ 210,000 ($175,000*120%) 100,000 contant 310,000 835,000 144.680 $ $ 260,000 722,880 (523,800+199,080) Total Assets $ 2,272,560.00 Total Liabilities & Equity $ 2.272.560 External Finance Needed = $144,680 Question 5 20 Marks (a) Based on the proforma statements prepared in question 2 Insignia Corporation Limited will need external financing in 2021. As such the company is considering issuing a $100,000,000 15-year bond, with an annual coupon rate of 10%, and semi-annual interest payments. Required: i. If the company anticipates that the bond will close at a yield to maturity of 12%, given the company's credit ratings and current market conditions, how much would an investor be willing to pay for $1,000 face value of this bond? (8 Marks) li. Compute the current yield of the bond at this price (from i). (2 Marks) (b) The company is also considering offering additional common shares in the market. However Insignia is concerned about whether its stock is fairly valued on the market. As such, its Finance Manager has undertaken an exercise to determine the current price of its common shares based on the following anticipated dividend payout structure: Insignia's last dividend paid was $4.20. The company intends to increase the dividend by 10%, 15% and 20% respectively over the next three (3) years. Thereafter, the company is expected to increase dividends by an annual rate of 2%. The company continues to assume a required retum of 12%. Required: Given the above, what should be the current price of Insignia's common shares? (10 Marks)