Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Grizzly Bear Winery (GBW) is a small winery in Portland, OR. Kerry Smith is the CEO and President of the Board of Directors, which

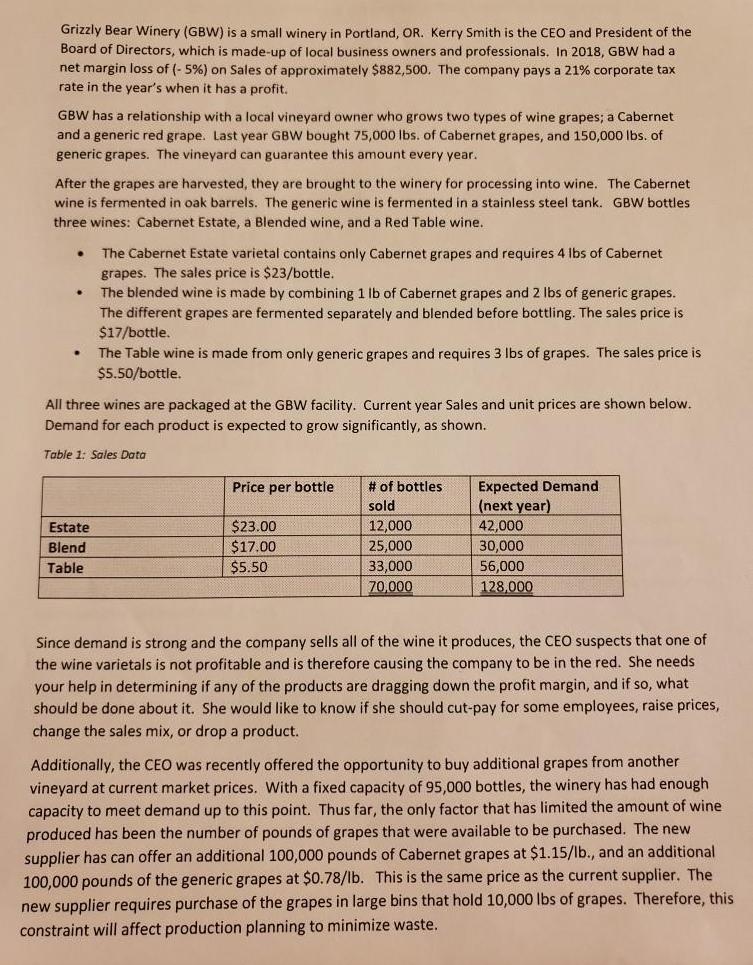

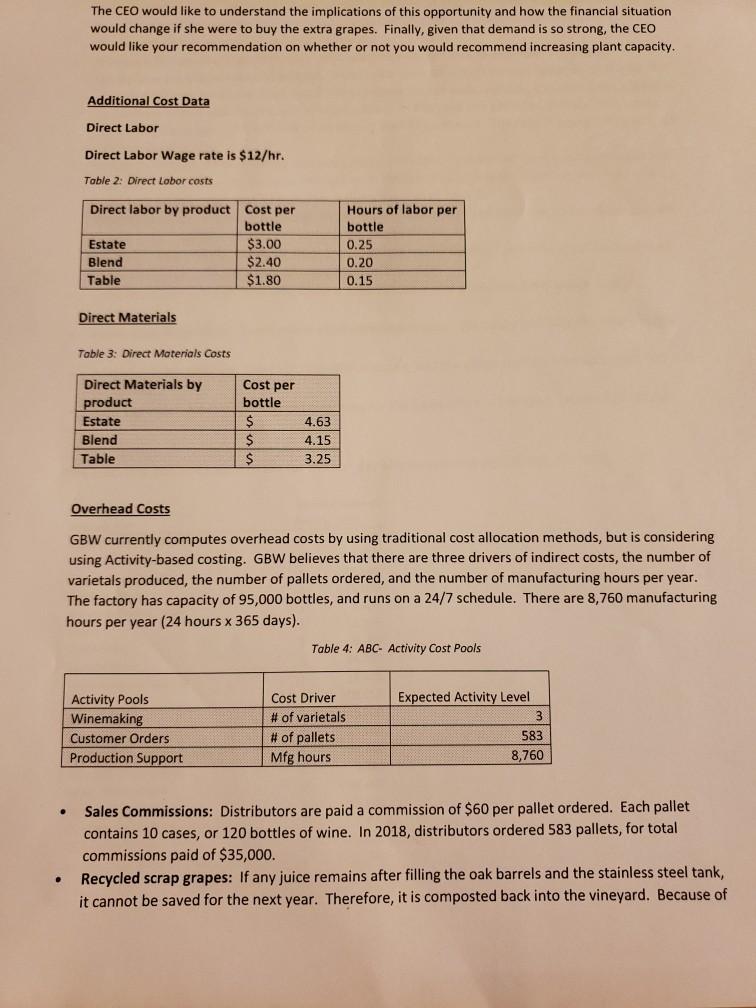

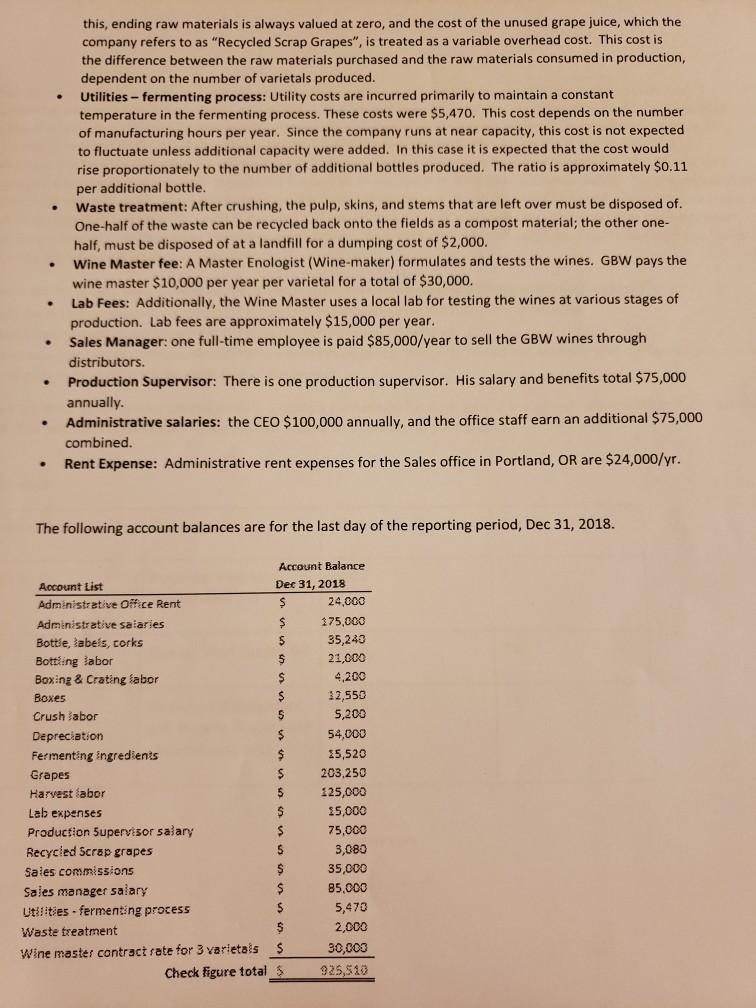

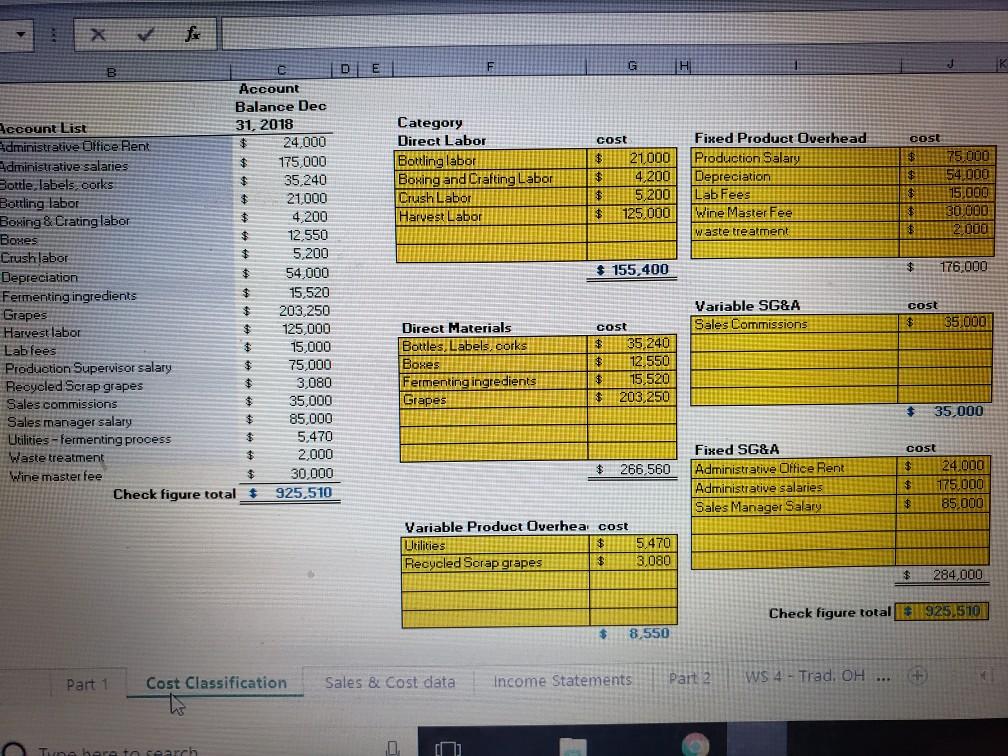

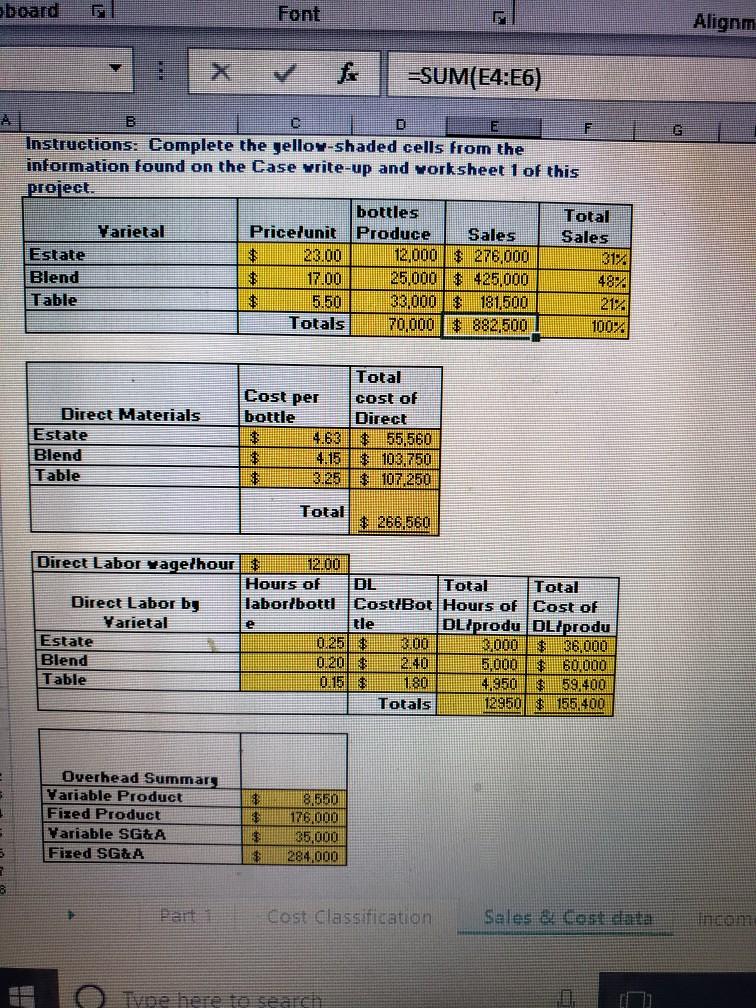

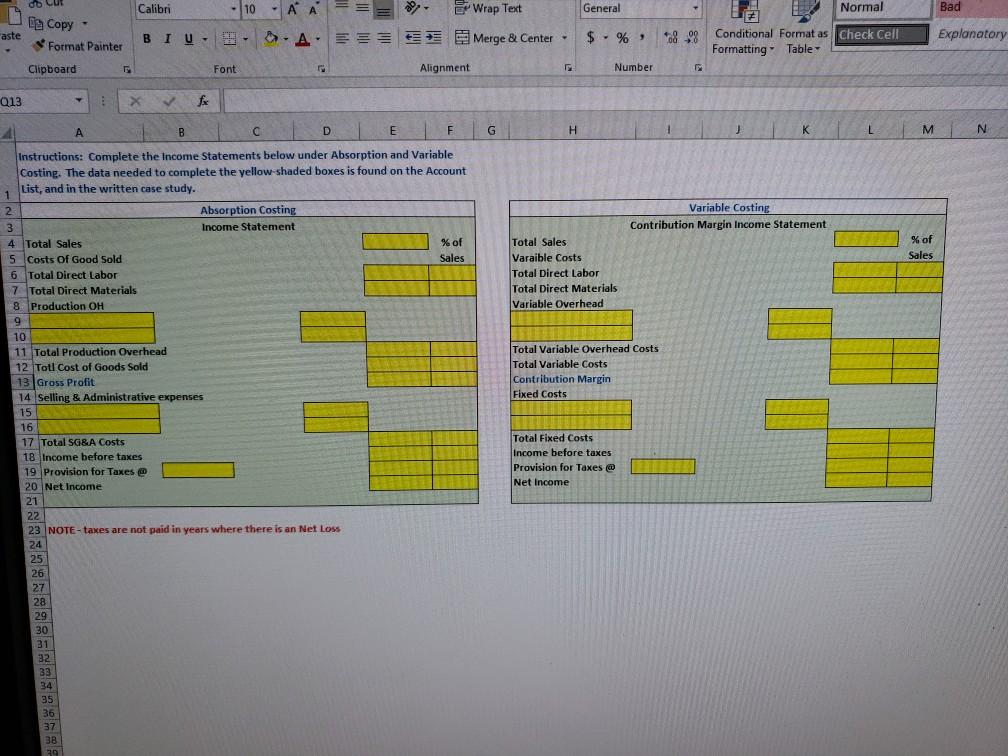

Grizzly Bear Winery (GBW) is a small winery in Portland, OR. Kerry Smith is the CEO and President of the Board of Directors, which is made-up of local business owners and professionals. In 2018, GBW had a net margin loss of (- 5%) on Sales of approximately $882,500. The company pays a 21% corporate tax rate in the year's when it has a profit. GBW has a relationship with a local vineyard owner who grows two types of wine grapes; a Cabernet and a generic red grape. Last year GBW bought 75,000 lbs. of Cabernet grapes, and 150,000 lbs. of generic grapes. The vineyard can guarantee this amount every year. After the grapes are harvested, they are brought to the winery for processing into wine. The Cabernet wine is fermented in oak barrels. The generic wine is fermented in a stainless steel tank. GBW bottles three wines: Cabernet Estate, a Blended wine, and a Red Table wine. The Cabernet Estate varietal contains only Cabernet grapes and requires 4 lbs of Cabernet grapes. The sales price is $23/bottle. The blended wine is made by combining 1 lb of Cabernet grapes and 2 Ibs of generic grapes. The different grapes are fermented separately and blended before bottling. The sales price is $17/bottle. The Table wine is made from only generic grapes and requires 3 Ibs of grapes. The sales price is $5.50/bottle. All three wines are packaged at the GBW facility. Current year Sales and unit prices are shown below. Demand for each product is expected to grow significantly, as shown. Table 1: Sales Data # of bottles Expected Demand (next year) 42,000 30,000 56,000 128,000 Price per bottle sold Estate $23.00 12,000 $17.00 $5.50 Blend 25,000 33,000 70,000 Table Since demand is strong and the company sells all of the wine it produces, the CEO suspects that one of the wine varietals is not profitable and is therefore causing the company to be in the red. She needs your help in determining if any of the products are dragging down the profit margin, and if so, what should be done about it. She would like to know if she should cut-pay for some employees, raise prices, change the sales mix, or drop a product. Additionally, the CEO was recently offered the opportunity to buy additional grapes from another vineyard at current market prices. With a fixed capacity of 95,000 bottles, the winery has had enough capacity to meet demand up to this point. Thus far, the only factor that has limited the amount of wine produced has been the number of pounds of grapes that were available to be purchased. The new supplier has can offer an additional 100,000 pounds of Cabernet grapes at $1.15/lb., and an additional 100,000 pounds of the generic grapes at $0.78/lb. This is the same price as the current supplier. The new supplier requires purchase of the grapes in large bins that hold 10,000 lbs of grapes. Therefore, this constraint will affect production planning to minimize waste. The CEO would like to understand the implications of this opportunity and how the financial situation would change if she were to buy the extra grapes. Finally, given that demand is so strong, the CEO would like your recommendation on whether or not you would recommend increasing plant capacity. Additional Cost Data Direct Labor Direct Labor Wage rate is $12/hr. Table 2: Direct Lobor costs Direct labor by product Cost per Hours of labor per bottle bottle $3.00 $2.40 Estate 0.25 Blend 0.20 Table $1.80 0.15 Direct Materials Toble 3: Direct Materials Costs Direct Materials by product Cost per bottle Estate $4 4.63 Blend 4.15 Table 3.25 Overhead Costs GBW currently computes overhead costs by using traditional cost allocation methods, but is considering using Activity-based costing. GBW believes that there are three drivers of indirect costs, the number of varietals produced, the number of pallets ordered, and the number of manufacturing hours per year. The factory has capacity of 95,000 bottles, and runs on a 24/7 schedule. There are 8,760 manufacturing hours per year (24 hours x 365 days). Table 4: ABC- Activity Cost Pools Cost Driver Expected Activity Level Activity Pools Winemaking # of varietals 3 # of pallets Mfg hours Customer Orders 583 Production Support 8,760 Sales Commissions: Distributors are paid a commission of $60 per pallet ordered. Each pallet contains 10 cases, or 120 bottles of wine. In 2018, distributors ordered 583 pallets, for total commissions paid of $35,000. Recycled scrap grapes: If any juice remains after filling the oak barrels and the stainless steel tank, it cannot be saved for the next year. Therefore, it is composted back into the vineyard. Because of this, ending raw materials is always valued at zero, and the cost of the unused grape juice, which the company refers to as "Recycled Scrap Grapes", is treated as a variable overhead cost. This cost is the difference between the raw materials purchased and the raw materials consumed in production, dependent on the number of varietals produced. Utilities - fermenting process: Utility costs are incurred primarily to maintain a constant temperature in the fermenting process. These costs were $5,470. This cost depends on the number of manufacturing hours per year. Since the company runs at near capacity, this cost is not expected to fluctuate unless additional capacity were added. In this case it is expected that the cost would rise proportionately to the number of additional bottles produced. The ratio is approximately $0.11 per additional bottle. Waste treatment: After crushing, the pulp, skins, and stems that are left over must be disposed of. One-half of the waste can be recycled back onto the fields as a compost material; the other one- half, must be disposed of at a landfill for a dumping cost of $2,000. Wine Master fee: A Master Enologist (Wine-maker) formulates and tests the wines. GBW pays the wine master $10,000 per year per varietal for a total of $30,000. Lab Fees: Additionally, the Wine Master uses a local lab for testing the wines at various stages of production. Lab fees are approximately $15,000 per year. Sales Manager: one full-time employee is paid $85,000/year to sell the GBW wines through distributors. Production Supervisor: There is one production supervisor. His salary and benefits total $75,000 annually. Administrative salaries: the CEO $100,000 annually, and the office staff earn an additional $75,000 combined. Rent Expense: Administrative rent expenses for the Sales office in Portland, OR are $24,000/yr. The following account balances are for the last day of the reporting period, Dec 31, 2018. Account Balance Account List Dec 31, 2018 Administrative Office Rent $ 24,000 Administrative salaries 175,000 Bottle, labels, corks 35,240 21,000 Bottling labor Boxing & Crating fabor 4,200 Boxes 12,550 Crush labor 5,200 Depreciation 54,000 Fermenting ingredients 25,520 Grapes 203.250 Harvest fabor 125,000 Lab expenses 15,000 Production Supervisor salary 75,000 Recycled Scrap grapes 3,080 Sales commissions 35,000 Sales manager salary 85,000 Utilities - fermenting process 5,470 2,000 Waste treatment Wine master contract rate for 3 varietais $ Check figure total $ 30,000 925,510 D H Account Balance Dec Category Account List Administrative Office Rent Administrative salaries 31, 2018 24,000 Direct Labor cost Fixed Product Overhead cost 175,000 35.240 21,000 Botling labor Boxing and Crafting Labor Crush Labor Harvest Labor 21.000 Production Salary 4,200 5.200 125,000 Depreciation Lab Fees Wine Master Fee $75.000 54.000 15.000 Sottle, labels, corks Bottling labor Boxing & Cratinglabor Boxes Crushlabor Depreciation Fermenting ingredients Grapes Harvest labor 4,200 12,550 5,200 30.000 2000 waste treatment 24 54,000 $ 155,400 176.000 15,520 203,250 125,000 15,000 24 Variable SG&A cost 24 Sales Commissions 35,000 Direct Materials Bottles, Labels corks Boxes Fermenting ingredients Grapes %24 cost 3 35,240 12,550 15,520 203 250 Labfees 24 Production Supervisor salary Recycled Scrap grapes Sales commissions Sales manager salary Utilities - fermenting process Waste treatment 75.000 3,080 35,000 85.000 35,000 5.470 2,000 30,000 Fixed SG&A cost 24.000 175.000 266,560 Administrative Office Rent Wine master fee 24 Administrative salaries Sales Manager Salary Check figure total 925,510 85,000 Variable Product Overhea cost $5470 3.080 Utilities Recycled Sorap grapes 284.000 Check figure total 925,510 8,550 Cost Classification Income Statements Part 2 wS 4- Trad. OH .. (+) Part 1 Sales & Cost data Tune hera to search board Font Alignm -SUM(E4:E6) Instructions: Complete the gellow-shaded cells from the information found on the Case vrite-up and worksheet 1 of this project. bottles Total Sales Yarietal Priceunit Produce Sales Estate 23.00 12,000 $ 276,000 25,000 $ 425,000 33,000 $ 181,500 70,000 $ 882,500 31% 48% 21% 100% Blend Table 17.00 5.50 Totals Total Cost per bottle cost of Direct Materials Estate Direct 4.63 $55,560 $103,750 $ 107.250 Blend 4.15 3.25 Table Total $ 266,560 Direct Labor vagethour S 12.00 Hours of labor/bottl CostBot Hours of Cost of DL Total Total Direct Labor by DL/produ DL/produ 3.000 $ 36, 000 5,000 Varietal tle 025 0.20 $ 0.15 $ Estate 3.00 2.40 180 Blend $ 60,000 4,950 $ 59,400 12950 $ 155 400 Table Totals Overhead Summary Variable Product Fized Product Variable SG&A 8,550 176,000 35,000 in Fized SG&A 284,000 Part 1 Cost Classification Sales & Cost data Incom O Type here to searcn do Cut -10 A A EWrap Text Calibri General Normal Bad E Copy - aste +9 09 Conditional Format as Check Cell Formatting- Table - A- E== EE E Merge & Center - $- % , Explanatory BIU- Format Painter Clipboard Font Alignment Number Q13 A B D G H K Instructions: Complete the Income Statements below under Absorption and Variable Costing. The data needed to complete the yellow-shaded boxes is found on the Account List, and in the written case study. 2. Absorption Costing Variable Costing 3. Income Statement Contribution Margin Income Statement Total Sales % of 4 Total Sales 5 Costs Of Good Sold 6 Total Direct Labor 7 Total Direct Materials 8 Production OH % of Sales Varaible Costs Sales Total Direct Labor Total Direct Materials Variable Overhead 6. 10 11 Total Production Overhead 12 Totl Cost of Goods Sold 13 Gross Profit 14 Selling & Administrative expenses Total Variable Overhead Costs Total Variable Costs Contribution Margin Fixed Costs 15 16 17 Total SG&A Costs 18 Income before taxes 19 Provision for Taxes @ 20 Net Income Total Fixed Costs Income before taxes Provision for Taxes @ Net Income 21 22 23 NOTE-taxes are not paid in years where there is an Net Loss 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38

Step by Step Solution

★★★★★

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started