Question

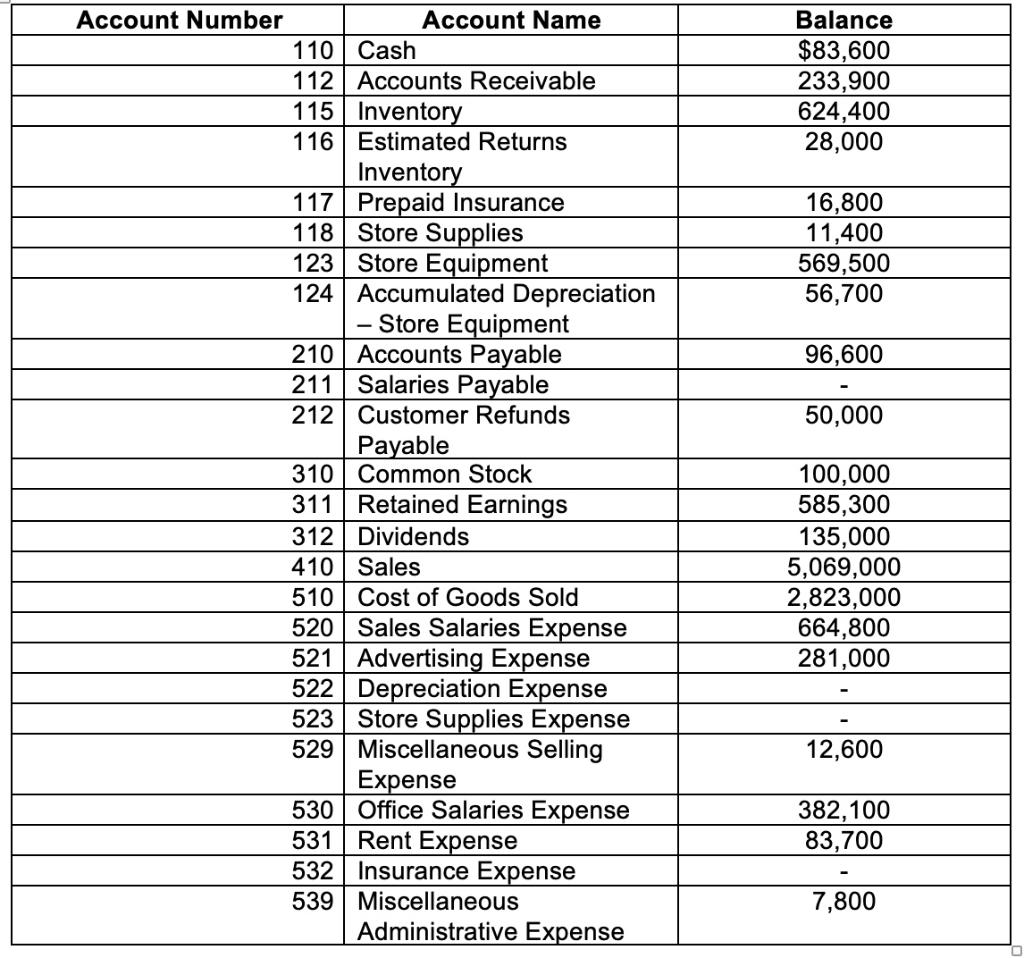

Subik Industries is a retail business that uses the perpetual inventory system. The account balances for Subik Industries as of October 1, 2022 (unless otherwise

Subik Industries is a retail business that uses the perpetual inventory system. The account balances for Subik Industries as of October 1, 2022 (unless otherwise indicated) are as follows:

During October, the last month of the fiscal year, the following transactions were completed:

Oct. 1. Paid rent for October, $5,000.

2. Sold merchandise on account to Korman Co., terms n/15, FOB shipping point, $68,500. The cost of the goods sold was $41,000.

3. Purchased merchandise on account from Martin Co., terms 2/10, n/30, FOB shipping point, $36,000.

4. Paid freight on purchase of October 3, $600.

7. Received $22,300 cash from Halstad Co. on account.

10. Sold merchandise with a list price of $61,500 to customers who used Visa. The cost of the goods sold was $32,000.

13. Paid for merchandise purchased on October 3.

15. Paid advertising expense for last half of October, $11,000.

17. Received cash from sale on October 2.

19. Purchased merchandise for cash, $18,700.

19. Paid $33,450 to Buttons Co. on account.

20. Paid Korman Co. a cash refund of $13,230 for returned merchandise from sale of May 2. The cost of the returned merchandise was $8,000.

21. Sold merchandise on account to Crescent Co, terms n/eom, FOB shipping point, $110,000. The cost of the goods sold was $70,000.

21. For the convenience of Crescent Co., paid freight on sale of October 21, $2,300.

21. Received $42,900 cash from Gee Co. on account.

21. Purchased merchandise on account from Osterman Co., terms 1/10, n/30, FOB destination, $88,000.

24. Returned damaged merchandise purchased on October 21, receiving a credit memo from the seller for $5,000.

26. Refunded cash on sales made for cash, $7,500. The cost of the merchandise returned was $4,800.

28. Paid sales salaries of $56,000 and office salaries of $29,000.

29. Purchased store supplies for cash, $2,400.

30. Sold merchandise on account to Turner Co., terms n/30, FOB shipping point, $78,750. The cost of the goods sold was $47,000.

31. Received cash from sale of October 21 plus freight.

31. Paid for purchase of October 21, less return of October 24.

Instructions

1. Post the balances from October 1 into T-accounts

2. Journalize the transactions for October in the general journal tab. Leave a space between each transaction.

3. Post the journal entries into T-accounts, and calculate the balance in each account.

4. Prepare an unadjusted trial balance.

5. Prepare the adjusting entries using the following information (and leave a space between each transaction):

a) Inventory on hand on October 31 is $570,000.

b) Insurance expired during the year is $12,000.

c) Store supplies on hand on October 31 is $4,000.

d) Depreciation for the year is $14,000.

e) Accrued sales salaries on October 31 are $7,000.

f) Accrued office salaries on October 31 are $6,600.

g) The adjustment for customer returns and allowances is $60,000 for sales and $35,000 for cost of goods sold.

6. Post the adjusting entries into T-accounts, and calculate the adjusted balance in each account.

7. Prepare an adjusted trial balance.

8. Prepare a multiple-step income statement, a statement of stockholders equity, and a balance sheet.

9. Prepare the closing entries. Leave a space between each entry.

10. Post the closing entries into T-accounts, and calculate the balance in each account.

11. Prepare a post-closing trial balance.

Check Figures:

Cash balance at 10/31: $93,640

Gross profit: $2,334,970

Net income: $752,570

Total liabilities and stockholders equity: $1,468,890

\begin{tabular}{|r|l|c|} \hline \multicolumn{1}{|c|}{ Account Number } & \multicolumn{1}{|c|}{ Account Name } & Balance \\ \hline 110 & Cash & $83,600 \\ \hline 112 & Accounts Receivable & 233,900 \\ \hline 115 & Inventory & 624,400 \\ \hline 116 & Estimated Returns Inventory & 28,000 \\ \hline 117 & Prepaid Insurance & 16,800 \\ \hline 118 & Store Supplies & 11,400 \\ \hline 123 & Store Equipment & 569,500 \\ \hline 124 & Accumulated Depreciation - Store Equipment & 56,700 \\ \hline 210 & Accounts Payable & 96,600 \\ \hline 211 & Salaries Payable & \\ \hline 212 & Customer Refunds Payable & 50,000 \\ \hline 310 & Common Stock & 100,000 \\ \hline 311 & Retained Earnings & 585,300 \\ \hline 312 & Dividends & 135,000 \\ \hline 410 & Sales & 5,069,000 \\ \hline 510 & Cost of Goods Sold & 2,823,000 \\ \hline 520 & Sales Salaries Expense & 664,800 \\ \hline 521 & Advertising Expense & 281,000 \\ \hline 522 & Depreciation Expense & \\ \hline 523 & Store Supplies Expense & \\ \hline 529 & Miscellaneous Selling Expense & 12,600 \\ \hline 530 & Office Salaries Expense & 382,100 \\ \hline 531 & Rent Expense \\ \hline 532 & Insurance Expense & 83,700 \\ \hline 539 & Miscellaneous Administrative Expense & \\ \hline \end{tabular} \begin{tabular}{|r|l|c|} \hline \multicolumn{1}{|c|}{ Account Number } & \multicolumn{1}{|c|}{ Account Name } & Balance \\ \hline 110 & Cash & $83,600 \\ \hline 112 & Accounts Receivable & 233,900 \\ \hline 115 & Inventory & 624,400 \\ \hline 116 & Estimated Returns Inventory & 28,000 \\ \hline 117 & Prepaid Insurance & 16,800 \\ \hline 118 & Store Supplies & 11,400 \\ \hline 123 & Store Equipment & 569,500 \\ \hline 124 & Accumulated Depreciation - Store Equipment & 56,700 \\ \hline 210 & Accounts Payable & 96,600 \\ \hline 211 & Salaries Payable & \\ \hline 212 & Customer Refunds Payable & 50,000 \\ \hline 310 & Common Stock & 100,000 \\ \hline 311 & Retained Earnings & 585,300 \\ \hline 312 & Dividends & 135,000 \\ \hline 410 & Sales & 5,069,000 \\ \hline 510 & Cost of Goods Sold & 2,823,000 \\ \hline 520 & Sales Salaries Expense & 664,800 \\ \hline 521 & Advertising Expense & 281,000 \\ \hline 522 & Depreciation Expense & \\ \hline 523 & Store Supplies Expense & \\ \hline 529 & Miscellaneous Selling Expense & 12,600 \\ \hline 530 & Office Salaries Expense & 382,100 \\ \hline 531 & Rent Expense \\ \hline 532 & Insurance Expense & 83,700 \\ \hline 539 & Miscellaneous Administrative Expense & \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started