Question

Subject Accounting Four-year income schedule (several intercompany transactions) Intercompany transactions between Pew Corporation and Sat Corporation, its 80 percent-owned subsidiary. from January 2011, when Pew

Subject Accounting Four-year income schedule (several intercompany transactions) Intercompany transactions between Pew Corporation and Sat Corporation, its 80 percent-owned subsidiary. from January 2011, when Pew acquired its controlling interest, to December 31, 2014, are summarized as follows: 2011 Pew sold inventory items that cost $60,000 to Sat for $80,000. Sat sold $60,000 of these inventory items in 2011 and $20,000 of them in 2012. 2012 Pew sold inventory items that cost $30,000 to Sat for $40,000. All of these items were sold by Sat during 2013. 2013 Sat sold land with a book value of $40,000 to Pew at its fair market value of $55,000. This land is to be used as a future plant site by Pew. 2013 Pew sold equipment with a four-year remaining useful life to Sat on January 1 for $80,000. This equipment had a book value of $50,000 at the time of sale and was still in use by Sat at December 31, 2014. 2014 Sat purchased $100,000 par of Pews 10% bonds in the bond market for $106,000 on January 2, 2014. These bonds had a book value of $98,000 when acquired by Sat and mature on January 1, 2018.

REQUIRED: Compute Pews net income (and the controlling share of consolidated net income) for each of the years 2011 through 2014. A schedule with columns for each year is suggested as the most efficient approach to solve of this problem. (Use straight-line depreciation and amortization and take a full years depreciation on the equipment sold to Sat in 2013.)

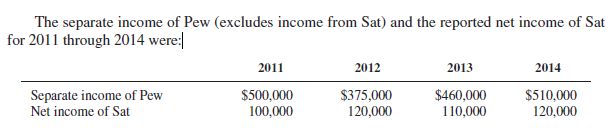

The separate income of Pew (excludes income from Sat) and the reported net income of Sat for 2011 through 2014 were

The separate income of Pew (excludes income from Sat) and the reported net income of Sat for 2011 through 2014 were Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started