(Subject- Islamic Finance & Banking) Please write detailed Answers given at the end of this case.

(Subject- Islamic Finance & Banking) Please write detailed Answers given at the end of this case.

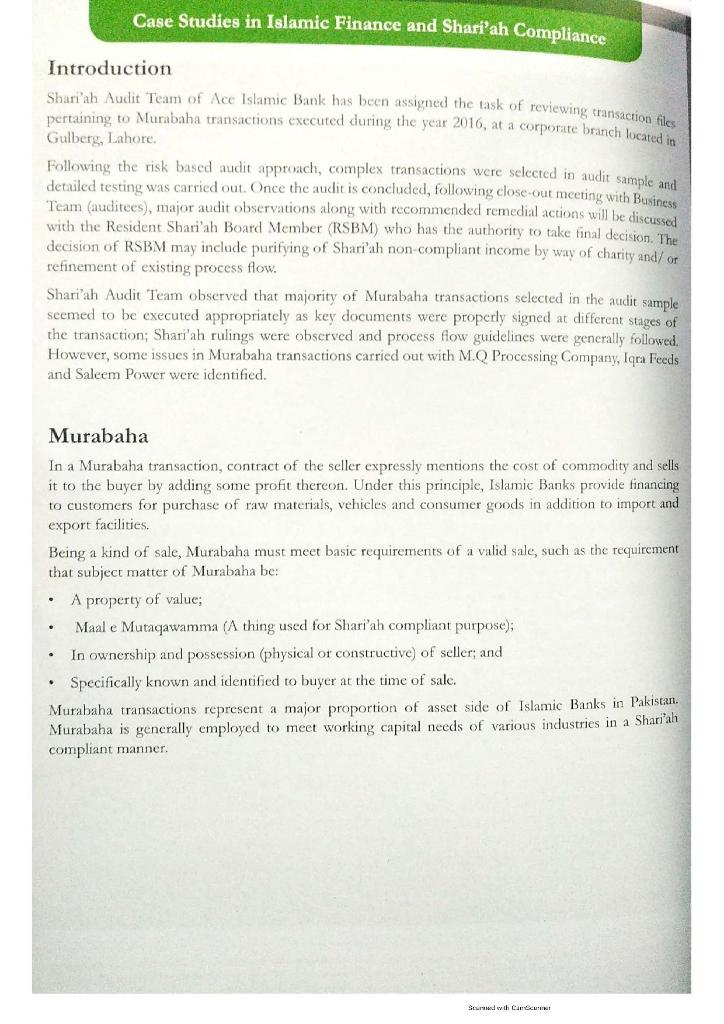

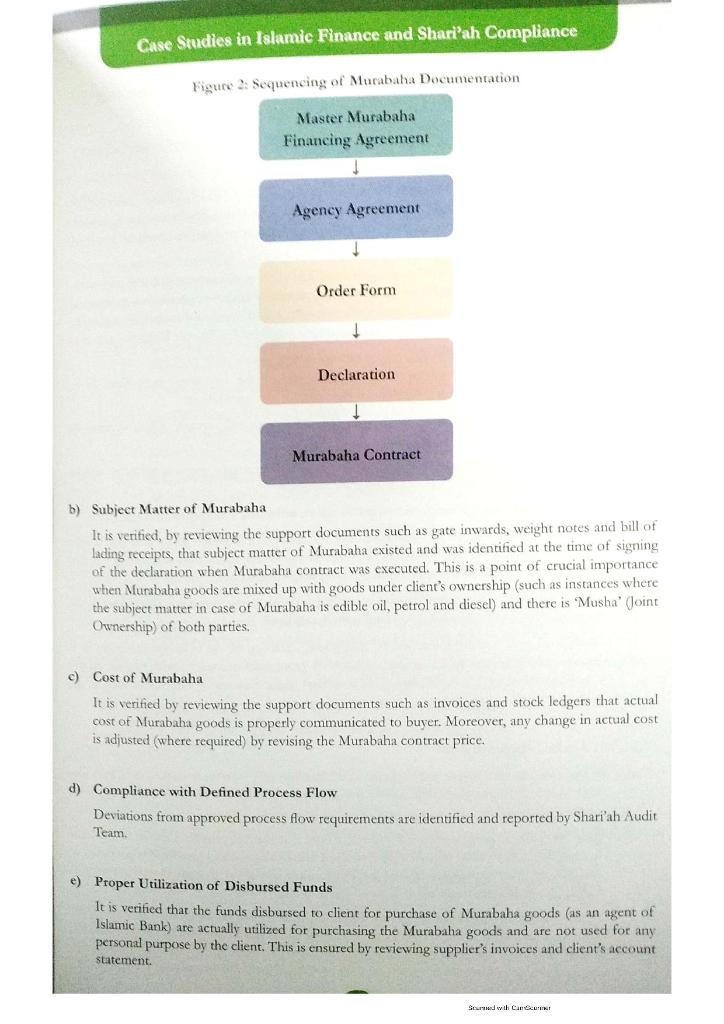

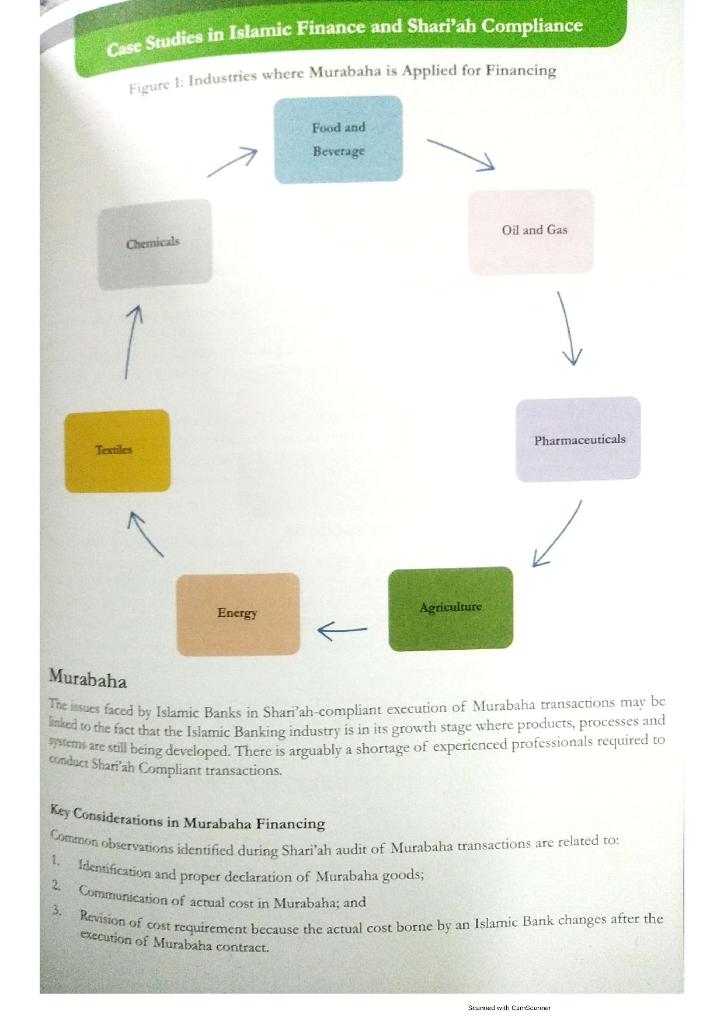

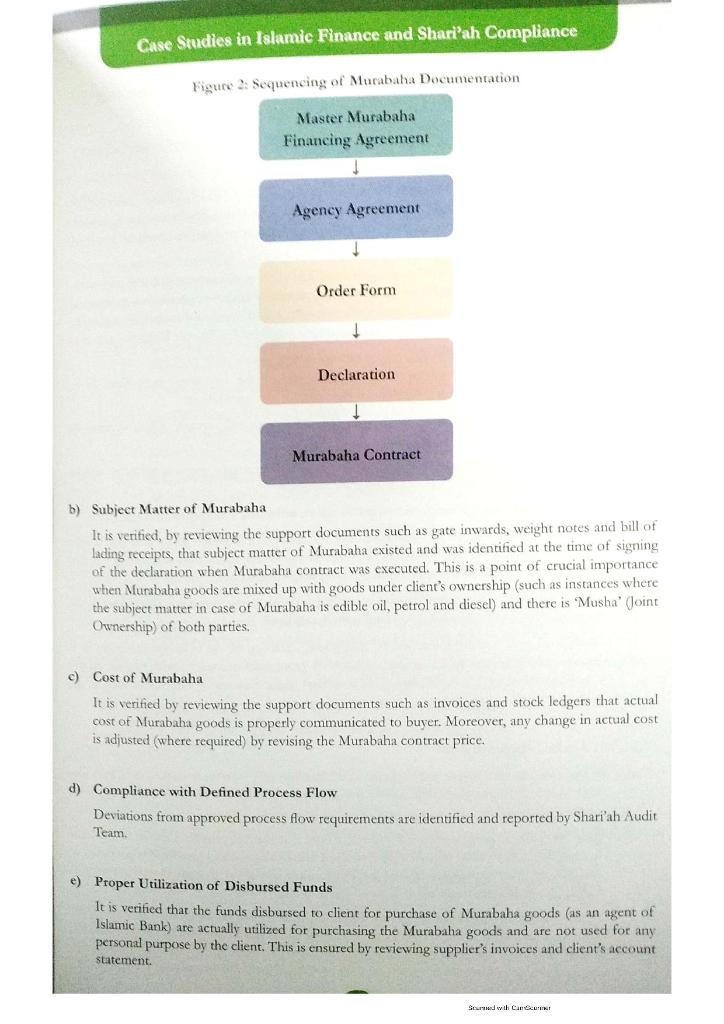

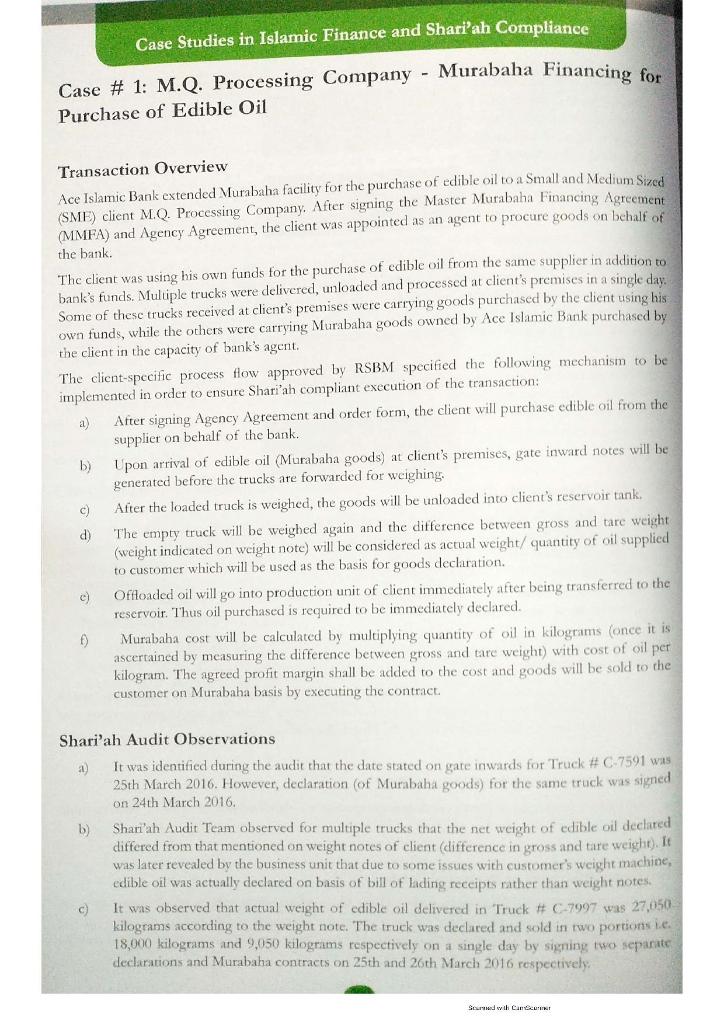

Case Studies in Islamic Finance and Shari'ah Compliance Shari'ah Audit of Murabaha Based Transactions Asfand Zubair Malik Abstract Shari'ah Audit is an independent review of financial and operational information of the bank. It is conducted by qualified professionals to express an opinion on the bank's compliance with Shari'ah guidelines and principles. Shari'ah Auditors suggest remedial/consequential measures if non-compliance is observed. A separate Shari'ah Audit Department is usually present in Islamic Financial Institutions which conducts Shari'ah audits in conformity with Shari'ah rules and principles, guidelines and instructions issued by the Shari'ah Supervisory Board, Resident Shari'ah Board Member (RSBM) of the bank, and according to directives issued by the Central Bank. Murabaha based transactions represent a significant proportion of asset side of Islamic Banks in Pakistan. Several issues are encountered in Shari'ah compliant execution of Murabaha transactions undertaken to meet diverse financing needs of SME and corporate clients. These issues are screened out by an effective Shari'ah audit review of Murabaha transactions. Continuous improvement and product re-structuring is required since it is often argued that Islamic banking products are yet in the developmental phase of their life cycle. For this purpose, product development & Shari'ah compliance functions of Islamic Banks continuously take input from Shari'ah Audit Department to resolve practical issues and implernentation gaps that are identified during the audit exercise. The case study is focused on Shariah compliance issues identified and problems encountered during Shari'ah audit of Murabaha transactions . Issues related to identification and proper declaration of goods , identification of cost in Import Murabaha transactions and Murabaha transactions involving change in actual cost of goods (borne by the bank) once the same are sold to customers, will be discussed in this case study. Keywords: Murabaha, Shari'ah Supervisory Board, Sharah Audit De Theo depicted in the study is but names have bect did for the purpose of content in Anyumlar on and personlig ur dad is mentidental. Some material al location and is Mind Mated as Team Lead Sash Radit & Acy Department of Men Bank Suwih Cancun Case Studies in Islamic Finance and Shari'ah Compliance Introduction Shari'ah Audit Team of Ace Islamic Bank has been assigned the task of reviewing transaction files pertaining to Murabaha transactions executed during the year 2016, at a corporate branch located in Gulberg, Lahore Following the risk based audit approach, complex transactions were selected in audit sample and detailed testing was carried out. Once the auditis concluded, following close-out meeting with Business Team (auditees), major audit observations along with recommended remedial actions will be discussed with the Resident Shari'ah Board Member (RSBM) who has the authority to take final decision. The decision of RSBM may include purifying of Shari'ah non-compliant income by way of charity and/or refinement of existing process flow. Shari'ah Audit Team observed that majority of Murabaha transactions selected in the audit sample seemed to be executed appropriately as key documents were properly signed at different stages of the transaction; Shari'ah rulings were observed and process flow guidelines were generally followed. However, some issues in Murabaha transactions carried out with M.Q Processing Company, Iqra Feeds and Saleem Power were identified. Murabaha In a Murabaha transaction, contract of the seller expressly mentions the cost of commodity and sells it to the buyer by adding some profit thereon. Under this principle, Islamic Banks provide financing to customers for purchase of raw materials, vehicles and consumer goods in addition to import and export facilities. Being a kind of sale, Murabaha must meet basic requirements of a valid sale, such as the requirement that subject matter of Murabaha be: A property of value; Maal e Mutaqawamma (A thing used for Shari'ah compliant purpose); In ownership and possession (physical or constructive) of seller; and Specifically known and identified to buyer at the time of sale. Murabaha transactions represent a major proportion of asset side of Islamic Banks in Pakistan. Murabaha is generally employed to meet working capital needs of various industries in a Shari'ah compliant manner. . . Serwih Cancer Case Studies in Islamic Finance and Shari'ah Compliance Figure 1: Industries where Murabaha is Applied for Financing Food and Beverage Oil and Gas Chemicals Pharmaceuticals Textiles Energy Agriculture Murabaha The issues faced by Islamic Banks in Shari'ah-compliant execution of Murabaha transactions may be linked to the fact that the Islamic Banking industry is in its growth stage where products, processes and antes are still being developed. There is arguably a shortage of experienced professionals required to conda Shari'ah Compliant transactions. 1 Key Considerations in Murabaha Financing Comenon observations identified during Shari'ah audit of Murabaha transactions are related to: proper declaration of Murabaha goods; Communication of actual cost in Murabaha; and 3. Revision of cost requirement because the actual cost borne by an Islamic Bank changes after the Identification 2 execution of Murabaha contract. Swth Cance Case Studies in Islamic Finance and Shari'ah Compliance The customer in Murabaha mostly purchases goods directly from the supplier (as an agent of an Islamic Bank). As a result, goods mostly arrive at customer's premises where they are stored. It is a pre-requisite for a valid Murabaha contract, that the goods must be existent at the time of sale. Hence, it must be ensured that Murabaha goods are declared in a timely manner and are not consumed by the customer before the signing of Murabaha contract and execution of sale. In addition, identification of goods at the time of sale requires that the goods purchased by the customer as an agent of the Islamic Bank must be separately stored in customer's premises before the execution of Murabaha contract. For the transactions where separate storage is not possible, percentage ownership in goods of an Islamic Bank must be disclosed in the declaration so that risk of each party is identified. Communication of actual cost in a Murabaha transaction is one of the requirements of Shari'ah for the validity of the contract. Similarly, adjustment/revision of Murabaha contract price is a Shari'ah pre requisite for such transactions when the seller becomes aware of any changes in cost actually borne by him (for purchase of goods after the goods are sold to the ultimate customer(s). In other words, when the actual cost of Murabaha goods borne by the seller changes the seller gets any discount for the purchase of goods (for onward sale to ultimate buyer), he must adjust the changes by way of adjusting total Murabaha contract price. Islamic Banks draft specific process flows for each client after taking into account a number of factors such as subject matter of Murabaha, storage, supplier's location & delivery mechanism, client's business processes and minimum inventory holding period. This is done to ensure smooth flow and Shari'ah compliant execution of Murabaha transactions since business specific circumstances and processes vary from client to client. Checkpoints in Murabaha Transactions Shari'ah Audit Team members focus on a number of checkpoints while reviewing Murabaha transactions. A client specific review mechanism is adopted since the type of support documents (such as gate inwards, bill of lading (B/L) receipts, invoices, etc.) and related checkpoints may vary from one clicnt to another. Some of the common points that are normally taken into consideration during review of Murabaha transactions are as follows: a) Proper Sequencing of Documents It is verified by the audit team that Murabaha documents such as Master Murabaha Financing Agreement (MMFA), agency agreement, order form, declaration and Murabaha contract are executed in a sequential and timely manner. Respective dates and timing of execution of aforementioned documents are of vital importance and the presence of any inconsistency may lead to Shari'ah compliance issues, Murabaha documents that are required to be executed according to sequence are indicated below: waitia taastamine herwonn thr hinnerini anode and the currier det uiting the one coumtite and destination of the proda beli Sewi Can Case Studies in Islamic Finance and Shari'ah Compliance Figure 2: Sequencing of Mucabaha Documentation Master Murabaha Financing Agreement Agency Agreement Order Form Declaration Murabaha Contract b) Subject Matter of Murabaha It is verified by reviewing the support documents such as gate inwards, weight notes and bill of lading receipts, that subject matter of Murabaha existed and was identified at the time of signing of the declaration when Murabaha contract was executed. This is a point of crucial importance when Murabaha goods are mixed up with goods under client's ownership (such as instances where the subject matter in case of Murabaha is edible oil, petrol and diesel) and there is "Musha' Joint Ownership of both parties. c) Cost of Murabaha It is verified by reviewing the support documents such as invoices and stock ledgers that actual cost of Murabaha goods is properly communicated to buyer. Moreover, any change in actual cost is adjusted (where required) by revising the Murabaha contract price. d) Compliance with Defined Process Flow Deviations from approved process How requirements are identified and reported by Shari'ah Audit Team e) Proper Utilization of Disbursed Funds It is verified that the funds disbursed to client for purchase of Murabaha goods (as an agent of Islamic Bank) are actually utilized for purchasing the Murabaha goods and are not used for any personal purpose by the client. This is ensured by reviewing supplier's invoices and client's account statement Sered with Can Case Studies in Islamic Finance and Shari'ah Compliance Case # 1: M.Q. Processing Company - Murabaha Financing for Purchase of Edible Oil Transaction Overview Ace Islamic Bank extended Murabaha facility for the purchase of edible oil to a Small and Medium Sized (SME) client M.Q. Processing Company. After signing the Master Murabaha Financing Agreement (MMFA) and Agency Agreement, the client was appointed as an agent to procure goods on behalf of the bank. The client was using his own funds for the purchase of edible oil from the same supplier in addition to bank's funds. Multiple trucks were delivered, unloaded and processed at client's premises in a single day. Some of these trucks received at client's premises were carrying goods purchased by the client using his own funds, while the others were carrying Murabaha goods owned by Ace Islamic Bank purchased by the client in the capacity of bank's agent. The client-specific process How approved by RSBM specified the following mechanism to be implemented in order to ensure Shari'ah compliant execution of the transaction: a) After signing Agency Agreement and order form, the client will purchase edible oil from the supplier on behalf of the bank. b) Upon arrival of edible oil (Murabaha goods) at client's premises, gate inward notes will be generated before the trucks are forwarded for weighing, After the loaded truck is weighed, the goods will be unloaded into client's reservoir tank. The empty truck will be weighed again and the difference between gross and tare weight (weight indicated on weight note) will be considered as actual weight/ quantity of oil supplied to customer which will be used as the basis for goods declaration c) Offloaded oil will go into production unit of client immediately after being transferred to the reservoir. Thus oil purchased is required to be immediately declared. f) Murabaha cost will be calculated by multiplying quantity of oil in kilograms (once it is ascertained by measuring the difference between gross and tare weight) with cost of oil per kilogram. The agreed profit margin shall be added to the cost and goods will be sold to the customer on Murabaha basis by executing the contract c) d) a Shari'ah Audit Observations It was identified during the audit that the date stated on gate inwards for Truck # C7591 was 25th March 2016. However, declaration (of Murabaha goods) for the same truck was signed on 24th March 2016. b) Shari'ah Audit Team observed for multiple trucks that the net weight of edible oil declared differed from that mentioned on weight notes of client difference in gross and tare weight). It was later revealed by the business unit that due to some issues with customer's weight machine, edible oil was actually declared on basis of bill of lading receipts rather than weight notes It was observed that actual weight of edible oil delivered in Truck # C-7997 vas 27,050 kilograms according to the weight note. The truck was declared and sold in two portions le 18,000 kilograms and 9,050 kilograms respectively on a single day by signing two separate declarations and Murabaha contracts on 25th and 26th March 2016 respectively Suwih Cancerit Case Studies in Islamic Finance and Shari'ah Compliance 1 Questions Please identify the basis of concerns raised by Shari'ah Audit Team pertaining to Murabaha financing extended to 3 companies discussed in the case study. Which Shari'ah principles were being violated in your opinion? 2 In your opinion which observations can be classified of minor nature and which issues may lead to charity income cleansing)? 3. What do you think will be the opinion of RSBM after reviewing the observations highlighted above? mudwil i Case Studies in Islamic Finance and Shari'ah Compliance Shari'ah Audit of Murabaha Based Transactions Asfand Zubair Malik Abstract Shari'ah Audit is an independent review of financial and operational information of the bank. It is conducted by qualified professionals to express an opinion on the bank's compliance with Shari'ah guidelines and principles. Shari'ah Auditors suggest remedial/consequential measures if non-compliance is observed. A separate Shari'ah Audit Department is usually present in Islamic Financial Institutions which conducts Shari'ah audits in conformity with Shari'ah rules and principles, guidelines and instructions issued by the Shari'ah Supervisory Board, Resident Shari'ah Board Member (RSBM) of the bank, and according to directives issued by the Central Bank. Murabaha based transactions represent a significant proportion of asset side of Islamic Banks in Pakistan. Several issues are encountered in Shari'ah compliant execution of Murabaha transactions undertaken to meet diverse financing needs of SME and corporate clients. These issues are screened out by an effective Shari'ah audit review of Murabaha transactions. Continuous improvement and product re-structuring is required since it is often argued that Islamic banking products are yet in the developmental phase of their life cycle. For this purpose, product development & Shari'ah compliance functions of Islamic Banks continuously take input from Shari'ah Audit Department to resolve practical issues and implernentation gaps that are identified during the audit exercise. The case study is focused on Shariah compliance issues identified and problems encountered during Shari'ah audit of Murabaha transactions . Issues related to identification and proper declaration of goods , identification of cost in Import Murabaha transactions and Murabaha transactions involving change in actual cost of goods (borne by the bank) once the same are sold to customers, will be discussed in this case study. Keywords: Murabaha, Shari'ah Supervisory Board, Sharah Audit De Theo depicted in the study is but names have bect did for the purpose of content in Anyumlar on and personlig ur dad is mentidental. Some material al location and is Mind Mated as Team Lead Sash Radit & Acy Department of Men Bank Suwih Cancun Case Studies in Islamic Finance and Shari'ah Compliance Introduction Shari'ah Audit Team of Ace Islamic Bank has been assigned the task of reviewing transaction files pertaining to Murabaha transactions executed during the year 2016, at a corporate branch located in Gulberg, Lahore Following the risk based audit approach, complex transactions were selected in audit sample and detailed testing was carried out. Once the auditis concluded, following close-out meeting with Business Team (auditees), major audit observations along with recommended remedial actions will be discussed with the Resident Shari'ah Board Member (RSBM) who has the authority to take final decision. The decision of RSBM may include purifying of Shari'ah non-compliant income by way of charity and/or refinement of existing process flow. Shari'ah Audit Team observed that majority of Murabaha transactions selected in the audit sample seemed to be executed appropriately as key documents were properly signed at different stages of the transaction; Shari'ah rulings were observed and process flow guidelines were generally followed. However, some issues in Murabaha transactions carried out with M.Q Processing Company, Iqra Feeds and Saleem Power were identified. Murabaha In a Murabaha transaction, contract of the seller expressly mentions the cost of commodity and sells it to the buyer by adding some profit thereon. Under this principle, Islamic Banks provide financing to customers for purchase of raw materials, vehicles and consumer goods in addition to import and export facilities. Being a kind of sale, Murabaha must meet basic requirements of a valid sale, such as the requirement that subject matter of Murabaha be: A property of value; Maal e Mutaqawamma (A thing used for Shari'ah compliant purpose); In ownership and possession (physical or constructive) of seller; and Specifically known and identified to buyer at the time of sale. Murabaha transactions represent a major proportion of asset side of Islamic Banks in Pakistan. Murabaha is generally employed to meet working capital needs of various industries in a Shari'ah compliant manner. . . Serwih Cancer Case Studies in Islamic Finance and Shari'ah Compliance Figure 1: Industries where Murabaha is Applied for Financing Food and Beverage Oil and Gas Chemicals Pharmaceuticals Textiles Energy Agriculture Murabaha The issues faced by Islamic Banks in Shari'ah-compliant execution of Murabaha transactions may be linked to the fact that the Islamic Banking industry is in its growth stage where products, processes and antes are still being developed. There is arguably a shortage of experienced professionals required to conda Shari'ah Compliant transactions. 1 Key Considerations in Murabaha Financing Comenon observations identified during Shari'ah audit of Murabaha transactions are related to: proper declaration of Murabaha goods; Communication of actual cost in Murabaha; and 3. Revision of cost requirement because the actual cost borne by an Islamic Bank changes after the Identification 2 execution of Murabaha contract. Swth Cance Case Studies in Islamic Finance and Shari'ah Compliance The customer in Murabaha mostly purchases goods directly from the supplier (as an agent of an Islamic Bank). As a result, goods mostly arrive at customer's premises where they are stored. It is a pre-requisite for a valid Murabaha contract, that the goods must be existent at the time of sale. Hence, it must be ensured that Murabaha goods are declared in a timely manner and are not consumed by the customer before the signing of Murabaha contract and execution of sale. In addition, identification of goods at the time of sale requires that the goods purchased by the customer as an agent of the Islamic Bank must be separately stored in customer's premises before the execution of Murabaha contract. For the transactions where separate storage is not possible, percentage ownership in goods of an Islamic Bank must be disclosed in the declaration so that risk of each party is identified. Communication of actual cost in a Murabaha transaction is one of the requirements of Shari'ah for the validity of the contract. Similarly, adjustment/revision of Murabaha contract price is a Shari'ah pre requisite for such transactions when the seller becomes aware of any changes in cost actually borne by him (for purchase of goods after the goods are sold to the ultimate customer(s). In other words, when the actual cost of Murabaha goods borne by the seller changes the seller gets any discount for the purchase of goods (for onward sale to ultimate buyer), he must adjust the changes by way of adjusting total Murabaha contract price. Islamic Banks draft specific process flows for each client after taking into account a number of factors such as subject matter of Murabaha, storage, supplier's location & delivery mechanism, client's business processes and minimum inventory holding period. This is done to ensure smooth flow and Shari'ah compliant execution of Murabaha transactions since business specific circumstances and processes vary from client to client. Checkpoints in Murabaha Transactions Shari'ah Audit Team members focus on a number of checkpoints while reviewing Murabaha transactions. A client specific review mechanism is adopted since the type of support documents (such as gate inwards, bill of lading (B/L) receipts, invoices, etc.) and related checkpoints may vary from one clicnt to another. Some of the common points that are normally taken into consideration during review of Murabaha transactions are as follows: a) Proper Sequencing of Documents It is verified by the audit team that Murabaha documents such as Master Murabaha Financing Agreement (MMFA), agency agreement, order form, declaration and Murabaha contract are executed in a sequential and timely manner. Respective dates and timing of execution of aforementioned documents are of vital importance and the presence of any inconsistency may lead to Shari'ah compliance issues, Murabaha documents that are required to be executed according to sequence are indicated below: waitia taastamine herwonn thr hinnerini anode and the currier det uiting the one coumtite and destination of the proda beli Sewi Can Case Studies in Islamic Finance and Shari'ah Compliance Figure 2: Sequencing of Mucabaha Documentation Master Murabaha Financing Agreement Agency Agreement Order Form Declaration Murabaha Contract b) Subject Matter of Murabaha It is verified by reviewing the support documents such as gate inwards, weight notes and bill of lading receipts, that subject matter of Murabaha existed and was identified at the time of signing of the declaration when Murabaha contract was executed. This is a point of crucial importance when Murabaha goods are mixed up with goods under client's ownership (such as instances where the subject matter in case of Murabaha is edible oil, petrol and diesel) and there is "Musha' Joint Ownership of both parties. c) Cost of Murabaha It is verified by reviewing the support documents such as invoices and stock ledgers that actual cost of Murabaha goods is properly communicated to buyer. Moreover, any change in actual cost is adjusted (where required) by revising the Murabaha contract price. d) Compliance with Defined Process Flow Deviations from approved process How requirements are identified and reported by Shari'ah Audit Team e) Proper Utilization of Disbursed Funds It is verified that the funds disbursed to client for purchase of Murabaha goods (as an agent of Islamic Bank) are actually utilized for purchasing the Murabaha goods and are not used for any personal purpose by the client. This is ensured by reviewing supplier's invoices and client's account statement Sered with Can Case Studies in Islamic Finance and Shari'ah Compliance Case # 1: M.Q. Processing Company - Murabaha Financing for Purchase of Edible Oil Transaction Overview Ace Islamic Bank extended Murabaha facility for the purchase of edible oil to a Small and Medium Sized (SME) client M.Q. Processing Company. After signing the Master Murabaha Financing Agreement (MMFA) and Agency Agreement, the client was appointed as an agent to procure goods on behalf of the bank. The client was using his own funds for the purchase of edible oil from the same supplier in addition to bank's funds. Multiple trucks were delivered, unloaded and processed at client's premises in a single day. Some of these trucks received at client's premises were carrying goods purchased by the client using his own funds, while the others were carrying Murabaha goods owned by Ace Islamic Bank purchased by the client in the capacity of bank's agent. The client-specific process How approved by RSBM specified the following mechanism to be implemented in order to ensure Shari'ah compliant execution of the transaction: a) After signing Agency Agreement and order form, the client will purchase edible oil from the supplier on behalf of the bank. b) Upon arrival of edible oil (Murabaha goods) at client's premises, gate inward notes will be generated before the trucks are forwarded for weighing, After the loaded truck is weighed, the goods will be unloaded into client's reservoir tank. The empty truck will be weighed again and the difference between gross and tare weight (weight indicated on weight note) will be considered as actual weight/ quantity of oil supplied to customer which will be used as the basis for goods declaration c) Offloaded oil will go into production unit of client immediately after being transferred to the reservoir. Thus oil purchased is required to be immediately declared. f) Murabaha cost will be calculated by multiplying quantity of oil in kilograms (once it is ascertained by measuring the difference between gross and tare weight) with cost of oil per kilogram. The agreed profit margin shall be added to the cost and goods will be sold to the customer on Murabaha basis by executing the contract c) d) a Shari'ah Audit Observations It was identified during the audit that the date stated on gate inwards for Truck # C7591 was 25th March 2016. However, declaration (of Murabaha goods) for the same truck was signed on 24th March 2016. b) Shari'ah Audit Team observed for multiple trucks that the net weight of edible oil declared differed from that mentioned on weight notes of client difference in gross and tare weight). It was later revealed by the business unit that due to some issues with customer's weight machine, edible oil was actually declared on basis of bill of lading receipts rather than weight notes It was observed that actual weight of edible oil delivered in Truck # C-7997 vas 27,050 kilograms according to the weight note. The truck was declared and sold in two portions le 18,000 kilograms and 9,050 kilograms respectively on a single day by signing two separate declarations and Murabaha contracts on 25th and 26th March 2016 respectively Suwih Cancerit Case Studies in Islamic Finance and Shari'ah Compliance 1 Questions Please identify the basis of concerns raised by Shari'ah Audit Team pertaining to Murabaha financing extended to 3 companies discussed in the case study. Which Shari'ah principles were being violated in your opinion? 2 In your opinion which observations can be classified of minor nature and which issues may lead to charity income cleansing)? 3. What do you think will be the opinion of RSBM after reviewing the observations highlighted above? mudwil i

(Subject- Islamic Finance & Banking) Please write detailed Answers given at the end of this case.

(Subject- Islamic Finance & Banking) Please write detailed Answers given at the end of this case.