Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is a case study two part question A mortgage agent is doing a needs analysis for her borrowers. To determine if the proposed mortgage

This is a case study two part question

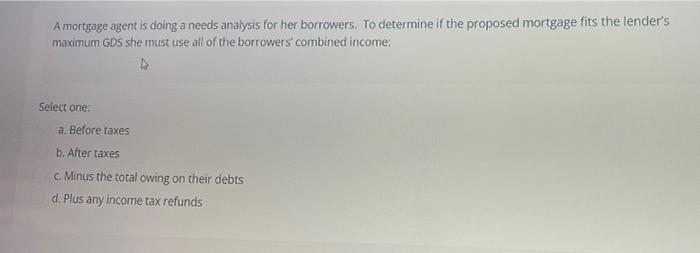

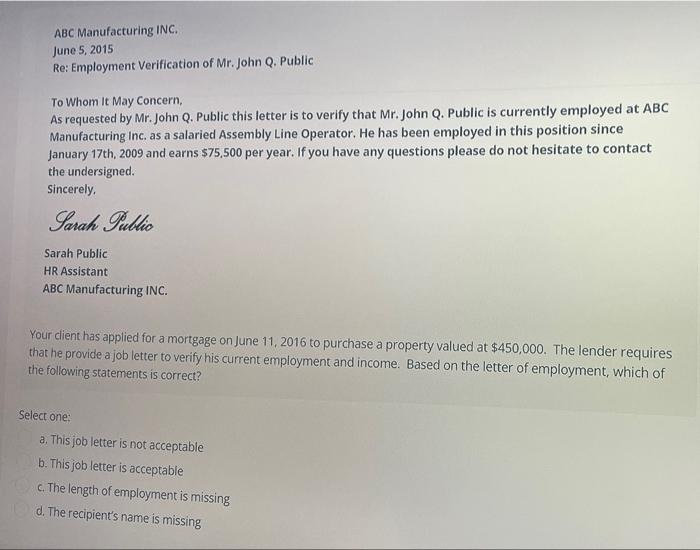

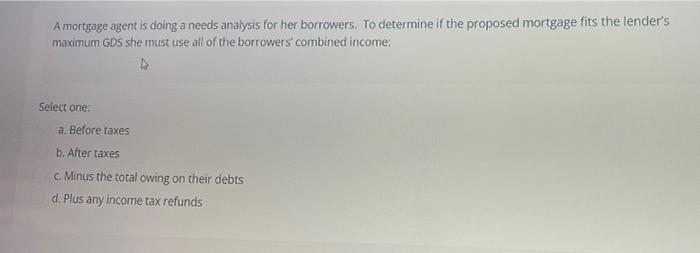

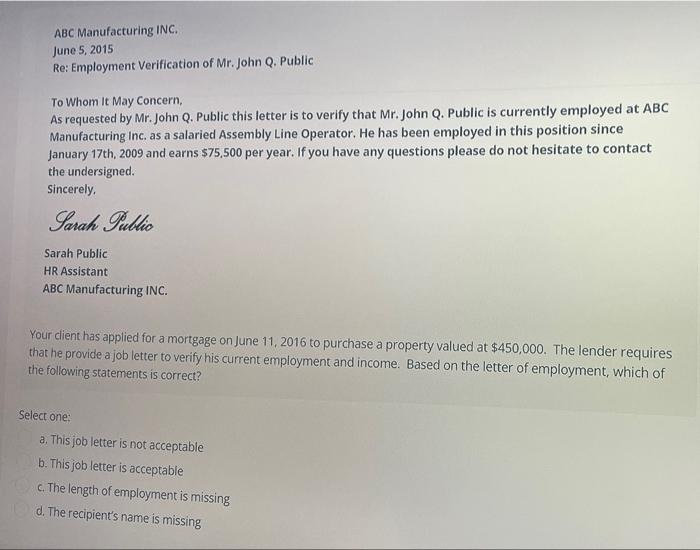

A mortgage agent is doing a needs analysis for her borrowers. To determine if the proposed mortgage fits the lender's maximum GDS she must use all of the borrowers combined income: Select one: a Before taxes b. After taxes c Minus the total owing on their debts d. Plus any income tax refunds ABC Manufacturing INC. June 5, 2015 Re: Employment Verification of Mr. John Q. Public To Whom It May Concern, As requested by Mr. John Q. Public this letter is to verify that Mr. John Q. Public is currently employed at ABC Manufacturing Inc. as a salaried Assembly Line Operator. He has been employed in this position since January 17th, 2009 and earns $75,500 per year. If you have any questions please do not hesitate to contact the undersigned Sincerely, Sarah Public Sarah Public HR Assistant ABC Manufacturing INC. Your client has applied for a mortgage on June 11, 2016 to purchase a property valued at $450,000. The lender requires that he provide a job letter to verify his current employment and income. Based on the letter of employment, which of the following statements is correct? Select one: a. This job letter is not acceptable b. This job letter is acceptable c. The length of employment is missing d. The recipient's name is missing

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started