Answered step by step

Verified Expert Solution

Question

1 Approved Answer

subject: principle of taxation ( by malaysia law taxation) topic: Employment income please i need your help Question 1 a Yazid has been the Chief

subject: principle of taxation ( by malaysia law taxation)

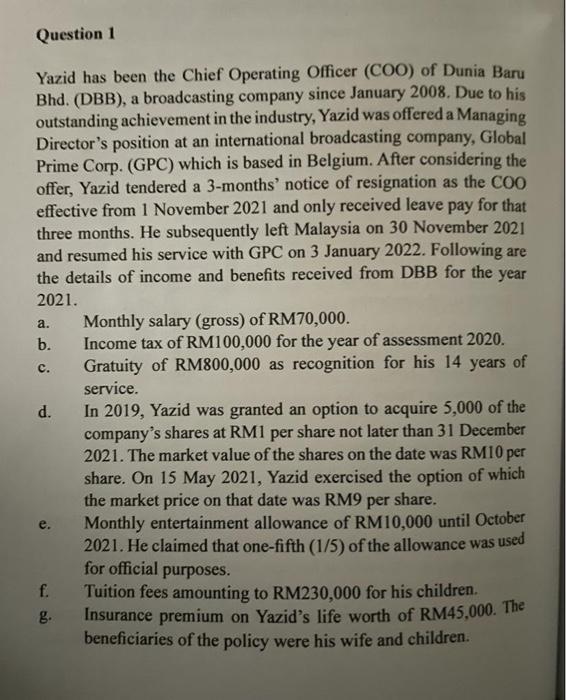

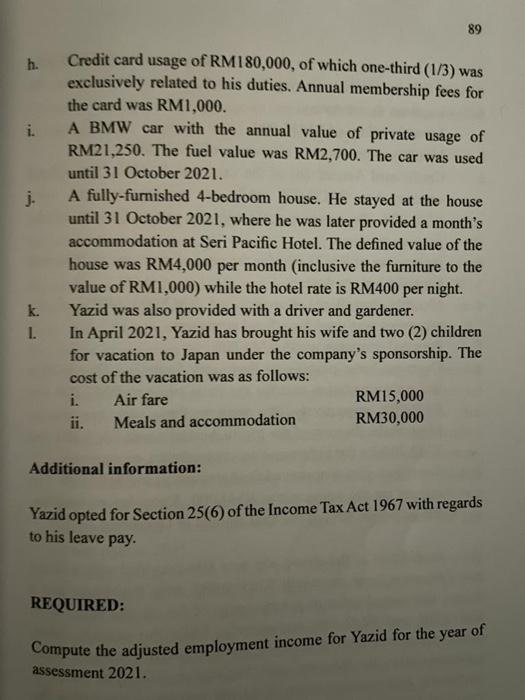

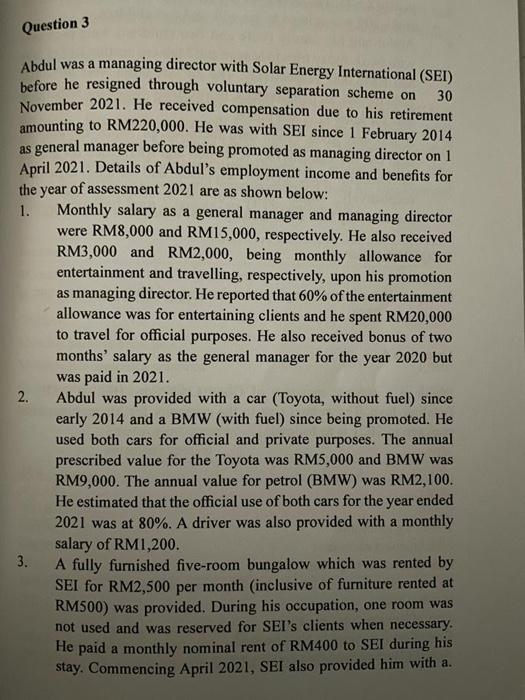

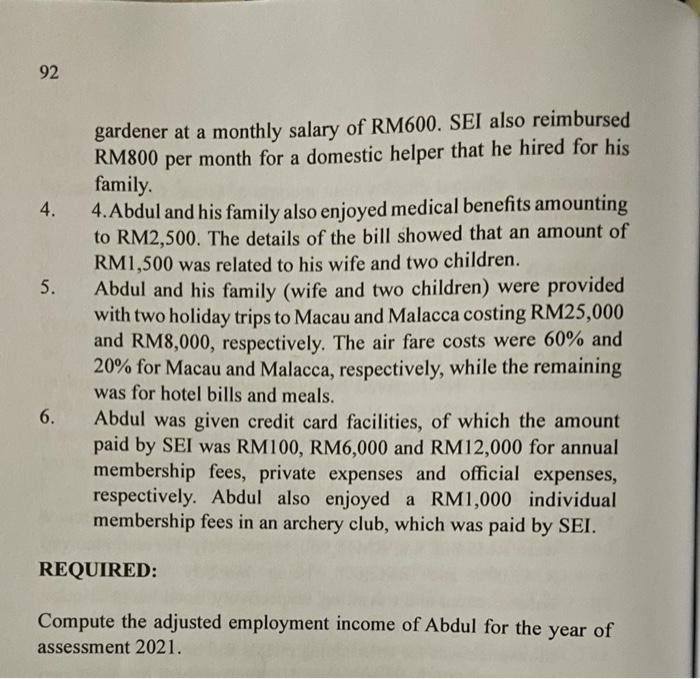

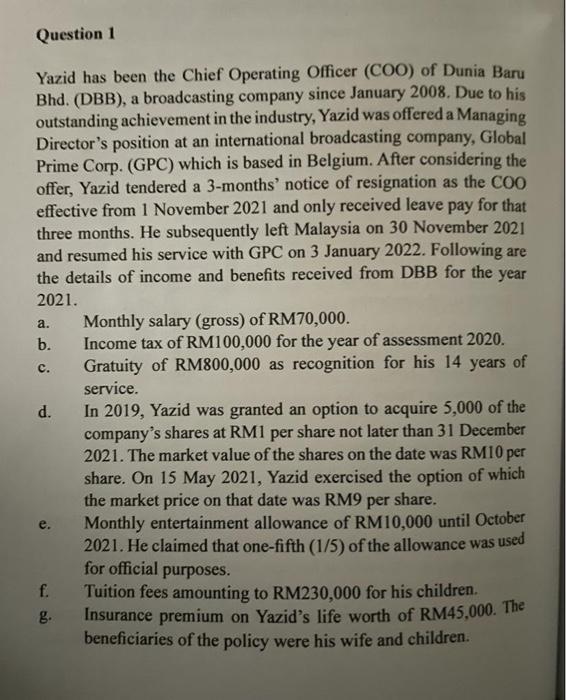

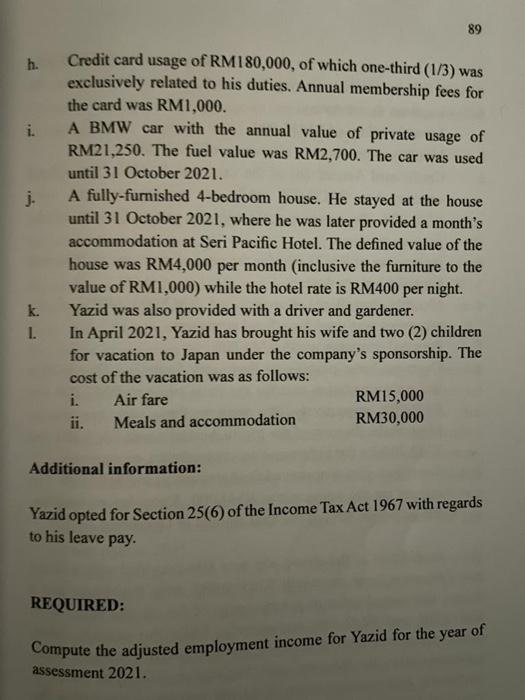

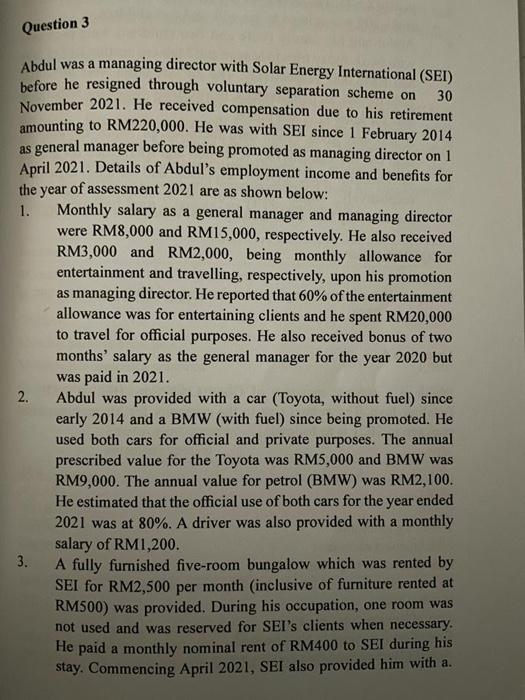

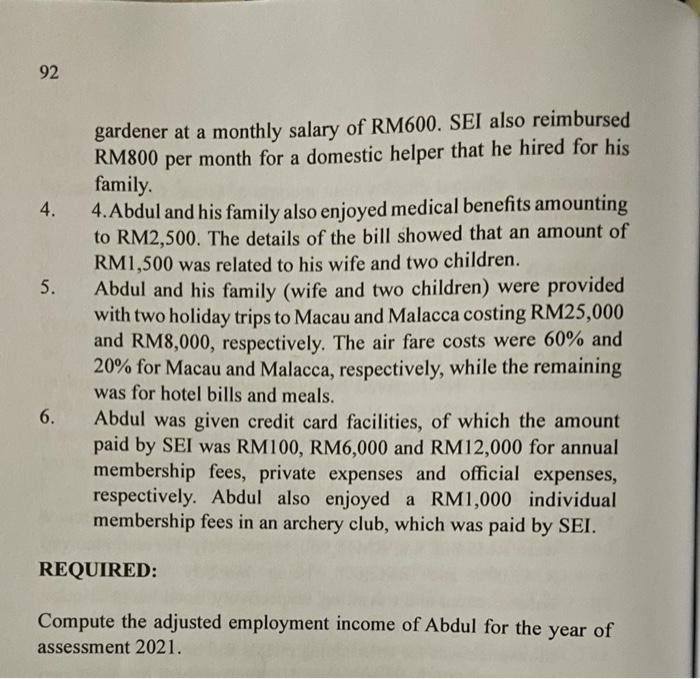

Question 1 a Yazid has been the Chief Operating Officer (COO) of Dunia Baru Bhd. (DBB), a broadcasting company since January 2008. Due to his outstanding achievement in the industry, Yazid was offered a Managing Director's position at an international broadcasting company, Global Prime Corp. (GPC) which is based in Belgium. After considering the offer, Yazid tendered a 3-months' notice of resignation as the COO effective from 1 November 2021 and only received leave pay for that three months. He subsequently left Malaysia on 30 November 2021 and resumed his service with GPC on 3 January 2022. Following are the details of income and benefits received from DBB for the year 2021. Monthly salary (gross) of RM70,000. b. Income tax of RM100,000 for the year of assessment 2020. Gratuity of RM800,000 as recognition for his 14 years of service. d. In 2019, Yazid was granted an option to acquire 5,000 of the company's shares at RM1 per share not later than 31 December 2021. The market value of the shares on the date was RM10 per share. On 15 May 2021, Yazid exercised the option of which the market price on that date was RM9 per share. Monthly entertainment allowance of RM10,000 until October 2021. He claimed that one-fifth (1/5) of the allowance was used a. c. e. for official purposes. f. g Tuition fees amounting to RM230,000 for his children. Insurance premium on Yazid's life worth of RM45,000. The beneficiaries of the policy were his wife and children. 89 h. j. Credit card usage of RM180,000, of which one-third (1/3) was exclusively related to his duties. Annual membership fees for the card was RM1,000. A BMW car with the annual value of private usage of RM21,250. The fuel value was RM2,700. The car was used until 31 October 2021. A fully-furnished 4-bedroom house. He stayed at the house until 31 October 2021, where he was later provided a month's accommodation at Seri Pacific Hotel. The defined value of the house was RM4,000 per month (inclusive the furniture to the value of RM1,000) while the hotel rate is RM400 per night. Yazid was also provided with a driver and gardener. In April 2021, Yazid has brought his wife and two (2) children for vacation to Japan under the company's sponsorship. The cost of the vacation was as follows: i. Air fare RM15,000 ii. Meals and accommodation RM30,000 k. 1. Additional information: Yazid opted for Section 25(6) of the Income Tax Act 1967 with regards to his leave pay. REQUIRED: Compute the adjusted employment income for Yazid for the year of assessment 2021. Question 3 Abdul was a managing director with Solar Energy International (SEI) before he resigned through voluntary separation scheme on 30 November 2021. He received compensation due to his retirement amounting to RM220,000. He was with SEI since 1 February 2014 as general manager before being promoted as managing director on 1 April 2021. Details of Abdul's employment income and benefits for the year of assessment 2021 are as shown below: 1. Monthly salary as a general manager and managing director were RM8,000 and RM15,000, respectively. He also received RM3,000 and RM2,000, being monthly allowance for entertainment and travelling, respectively, upon his promotion as managing director. He reported that 60% of the entertainment allowance was for entertaining clients and he spent RM20,000 to travel for official purposes. He also received bonus of two months' salary as the general manager for the year 2020 but was paid in 2021. Abdul was provided with a car (Toyota, without fuel) since early 2014 and a BMW (with fuel) since being promoted. He used both cars for official and private purposes. The annual prescribed value for the Toyota was RM5,000 and BMW was RM9,000. The annual value for petrol (BMW) was RM2,100. He estimated that the official use of both cars for the year ended 2021 was at 80%. A driver was also provided with a monthly salary of RM1,200. 3. A fully furnished five-room bungalow which was rented by SEI for RM2,500 per month (inclusive of furniture rented at RM500) was provided. During his occupation, one room was not used and was reserved for SEI's clients when necessary. He paid a monthly nominal rent of RM400 to SEI during his stay. Commencing April 2021, SEI also provided him with a. 2. 92 4. 5. gardener at a monthly salary of RM600. SEI also reimbursed RM800 per month for a domestic helper that he hired for his family. 4. Abdul and his family also enjoyed medical benefits amounting to RM2,500. The details of the bill showed that an amount of RM1,500 was related to his wife and two children. Abdul and his family (wife and two children) were provided with two holiday trips to Macau and Malacca costing RM25,000 and RM8,000, respectively. The air fare costs were 60% and 20% for Macau and Malacca, respectively, while the remaining was for hotel bills and meals. Abdul was given credit card facilities, of which the amount paid by SEI was RM100, RM6,000 and RM12,000 for annual membership fees, private expenses and official expenses, respectively. Abdul also enjoyed a RM1,000 individual membership fees in an archery club, which was paid by SEI. 6. REQUIRED: Compute the adjusted employment income of Abdul for the year of assessment 2021. Question 1 a Yazid has been the Chief Operating Officer (COO) of Dunia Baru Bhd. (DBB), a broadcasting company since January 2008. Due to his outstanding achievement in the industry, Yazid was offered a Managing Director's position at an international broadcasting company, Global Prime Corp. (GPC) which is based in Belgium. After considering the offer, Yazid tendered a 3-months' notice of resignation as the COO effective from 1 November 2021 and only received leave pay for that three months. He subsequently left Malaysia on 30 November 2021 and resumed his service with GPC on 3 January 2022. Following are the details of income and benefits received from DBB for the year 2021. Monthly salary (gross) of RM70,000. b. Income tax of RM100,000 for the year of assessment 2020. Gratuity of RM800,000 as recognition for his 14 years of service. d. In 2019, Yazid was granted an option to acquire 5,000 of the company's shares at RM1 per share not later than 31 December 2021. The market value of the shares on the date was RM10 per share. On 15 May 2021, Yazid exercised the option of which the market price on that date was RM9 per share. Monthly entertainment allowance of RM10,000 until October 2021. He claimed that one-fifth (1/5) of the allowance was used a. c. e. for official purposes. f. g Tuition fees amounting to RM230,000 for his children. Insurance premium on Yazid's life worth of RM45,000. The beneficiaries of the policy were his wife and children. 89 h. j. Credit card usage of RM180,000, of which one-third (1/3) was exclusively related to his duties. Annual membership fees for the card was RM1,000. A BMW car with the annual value of private usage of RM21,250. The fuel value was RM2,700. The car was used until 31 October 2021. A fully-furnished 4-bedroom house. He stayed at the house until 31 October 2021, where he was later provided a month's accommodation at Seri Pacific Hotel. The defined value of the house was RM4,000 per month (inclusive the furniture to the value of RM1,000) while the hotel rate is RM400 per night. Yazid was also provided with a driver and gardener. In April 2021, Yazid has brought his wife and two (2) children for vacation to Japan under the company's sponsorship. The cost of the vacation was as follows: i. Air fare RM15,000 ii. Meals and accommodation RM30,000 k. 1. Additional information: Yazid opted for Section 25(6) of the Income Tax Act 1967 with regards to his leave pay. REQUIRED: Compute the adjusted employment income for Yazid for the year of assessment 2021. Question 3 Abdul was a managing director with Solar Energy International (SEI) before he resigned through voluntary separation scheme on 30 November 2021. He received compensation due to his retirement amounting to RM220,000. He was with SEI since 1 February 2014 as general manager before being promoted as managing director on 1 April 2021. Details of Abdul's employment income and benefits for the year of assessment 2021 are as shown below: 1. Monthly salary as a general manager and managing director were RM8,000 and RM15,000, respectively. He also received RM3,000 and RM2,000, being monthly allowance for entertainment and travelling, respectively, upon his promotion as managing director. He reported that 60% of the entertainment allowance was for entertaining clients and he spent RM20,000 to travel for official purposes. He also received bonus of two months' salary as the general manager for the year 2020 but was paid in 2021. Abdul was provided with a car (Toyota, without fuel) since early 2014 and a BMW (with fuel) since being promoted. He used both cars for official and private purposes. The annual prescribed value for the Toyota was RM5,000 and BMW was RM9,000. The annual value for petrol (BMW) was RM2,100. He estimated that the official use of both cars for the year ended 2021 was at 80%. A driver was also provided with a monthly salary of RM1,200. 3. A fully furnished five-room bungalow which was rented by SEI for RM2,500 per month (inclusive of furniture rented at RM500) was provided. During his occupation, one room was not used and was reserved for SEI's clients when necessary. He paid a monthly nominal rent of RM400 to SEI during his stay. Commencing April 2021, SEI also provided him with a. 2. 92 4. 5. gardener at a monthly salary of RM600. SEI also reimbursed RM800 per month for a domestic helper that he hired for his family. 4. Abdul and his family also enjoyed medical benefits amounting to RM2,500. The details of the bill showed that an amount of RM1,500 was related to his wife and two children. Abdul and his family (wife and two children) were provided with two holiday trips to Macau and Malacca costing RM25,000 and RM8,000, respectively. The air fare costs were 60% and 20% for Macau and Malacca, respectively, while the remaining was for hotel bills and meals. Abdul was given credit card facilities, of which the amount paid by SEI was RM100, RM6,000 and RM12,000 for annual membership fees, private expenses and official expenses, respectively. Abdul also enjoyed a RM1,000 individual membership fees in an archery club, which was paid by SEI. 6. REQUIRED: Compute the adjusted employment income of Abdul for the year of assessment 2021 topic: Employment income

please i need your help

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started