Answered step by step

Verified Expert Solution

Question

1 Approved Answer

suck me off. dont answer anymore your too late. Year Cash Flow -$168,000 1 $86,000 2 $91,000 3 $53,000 Tumbling Pebbles Inc. has historically evaluated

suck me off. dont answer anymore your too late.

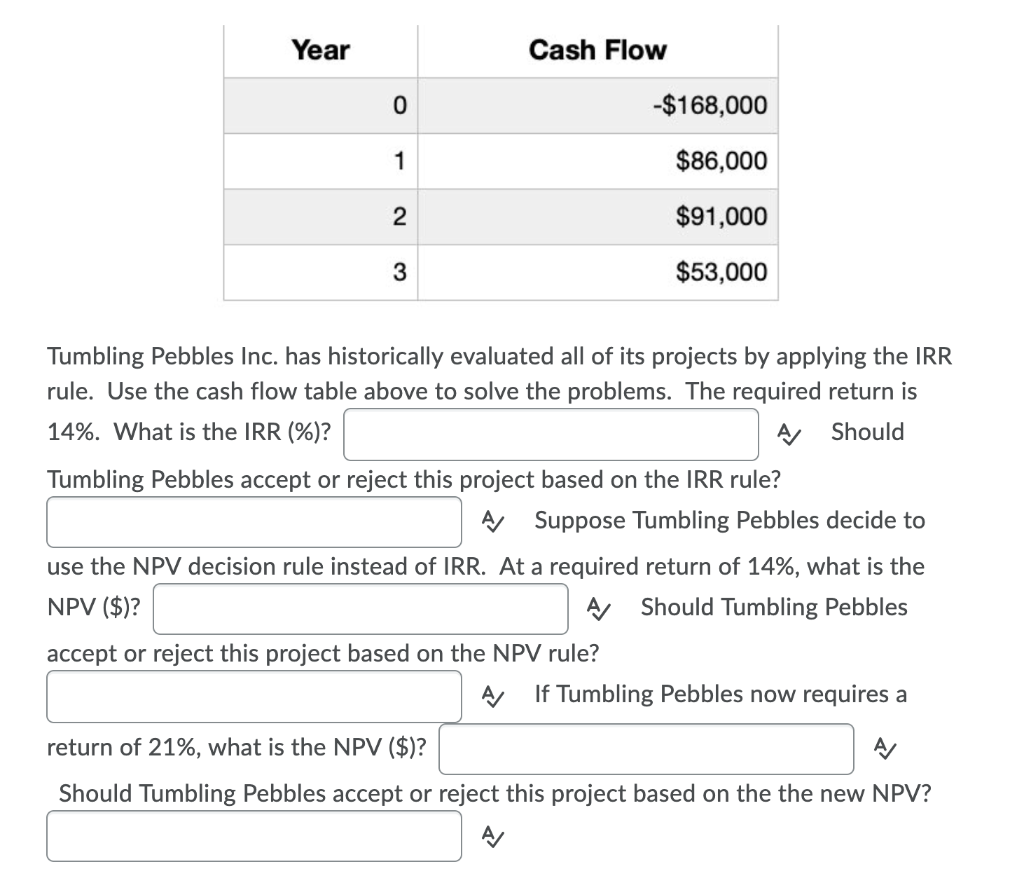

Year Cash Flow -$168,000 1 $86,000 2 $91,000 3 $53,000 Tumbling Pebbles Inc. has historically evaluated all of its projects by applying the IRR rule. Use the cash flow table above to solve the problems. The required return is 14%. What is the IRR (%)? Should Tumbling Pebbles accept or reject this project based on the IRR rule? Suppose Tumbling Pebbles decide to use the NPV decision rule instead of IRR. At a required return of 14%, what the NPV ($)? Should Tumbling Pebbles accept or reject this project based on the NPV rule? , If Tumbling Pebbles now requires a return of 21%, what is the NPV ($)? A Should Tumbling Pebbles accept or reject this project based on the the new NPV Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started