Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suc and Bill plan to open an accounting firm and expect to work full time in the firm. They expect to incur a small

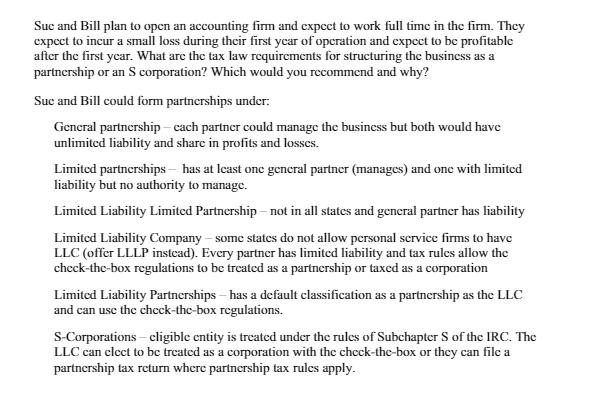

Suc and Bill plan to open an accounting firm and expect to work full time in the firm. They expect to incur a small loss during their first ycar of operation and expect to be profitable after the first ycar. What are the tax law requirements for structuring the busincss as a partncrship or an S corporation? Which would you recommend and why? Suc and Bill could form partnerships under: General partnership - cach partner could manage the business but both would have unlimited liability and share in profits and losses. Limited partnerships - has at least onc gencral partner (manages) and one with limitcd liability but no authority to manage. Limited Liability Limited Partnership not in all states and general partner has liability Limited Liability Company - some states do not allow personal scrvice firms to have LLC (offer LLLP instead). Every partner has limited liability and tax rules allow the chcck-the-box regulations to be treated as a partnership or taxed as a corporation Limited Liability Partnerships has a default classification as a partnership as the LLC and can use the check-the-box regulations. S-Corporations cligible cntity is treated under the rules of Subchapter S of the IRC. The LLC can clect to be treated as a corporation with the check-the-box or they can file a partnership tax return where partnership tax rules apply.

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

In the case of Sue and Bill the partnership form of business stru...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started