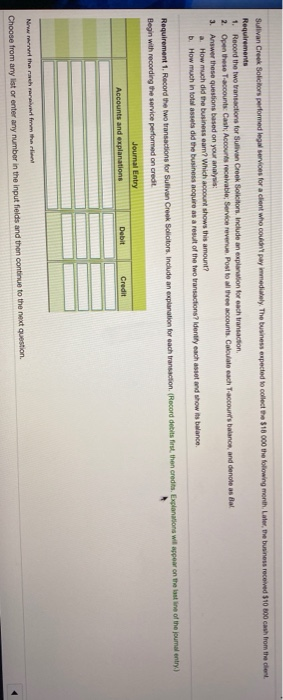

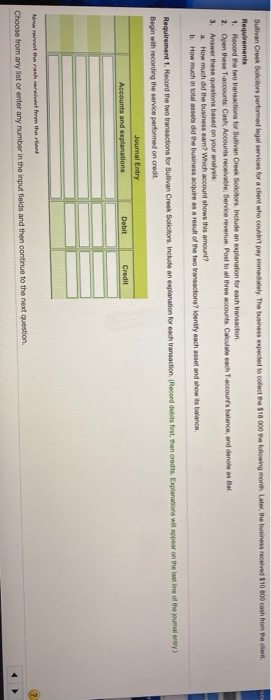

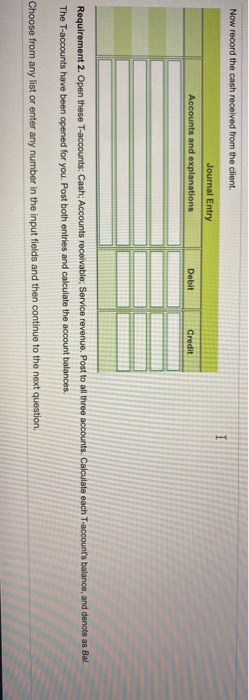

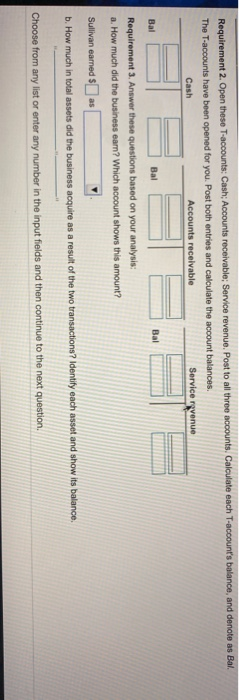

Sullivan Creek Solicitors performed in services for a client who couldn't pay wmediately. The business expected to collect the $18000 the following month. Later, the business received $10 800 cash from the cont Requirements 1. Record the two transactions for Sullivan Creek Solors, include an explanation for each transaction 2. Open these account Carly Accounts receivable Service revenue Post to all three accounts. Cakulato each account's balance, and denoteas Bal 3. Answer these questions based on your analysis a. How much did the business cam? Which account shows this amount? b. How much in total assets did the business acquire as a result of the two transactions? Identity each asset and how its balance Requirement 1. Record the two transactions for Sutivan Creek Solicitors, include an explanation for each transaction. (Record debit first, then credits. Explanations will appear on the last ine of the joumal entry) Begin with recording the service performed on credit Journal Entry Accounts and explanations Debit Credit Nirwantha rach rent from the man Choose from any list or enter any number in the input fields and then continue to the next question Sutivan Croek Bokhors performed Mgal services for a cient who couldn't pay inmedonly. The business expected to collecte $18.000 folowng mont, Later, the business received 510 800 cash from the dem Requirements 1. Record the two transactions for Sullivan Creek Boltors include an explanation for each transaction 2. Open these T-accounts: Cash Accounts receivable Service revenue Post to all three accounts Calculate each T-account's balance, and denotes Bal 3. Answer these questions based on your analysis # How much did the business cam? Which account shows this amount? b. How much in total assets did the business acquire as a result of the two transactions? Intly each asset and how its balance Requirement 1. Record the two transactions for Sullivan Creek Solicitors include an explanation for each transaction Record debits first, then credits. Explanations will appear on the last line of the journal entry) Begin with recording the service performed on credit Journal Entry Accounts and explanations Debit Credit Now are the rachmaralar from the plant Choose from any list or enter any number in the input fields and then continue to the next question Now record the cash received from the client. 1 Journal Entry Accounts and explanations Debit Credit Requirement 2. Open these T-accounts: Cash; Accounts receivable; Service revenue. Post to all three accounts. Calculato each T-account's balance, and denote as Bal. The T-accounts have been opened for you. Post both entries and calculate the account balances Choose from any list or enter any number in the input fields and then continue to the next question. Requirement 2. Open these T-accounts: Cash; Accounts receivable; Service revenue. Post to all three accounts, Calculate each T-account's balance, and denote as Bal The T-accounts have been opened for you. Post both entries and calculate the account balances Cash Accounts receivable Service rovenue Bal Bal Bal Requirement 3. Answer these questions based on your analysis: a. How much did the business eam? Which account shows this amount? Sullivan earned $as b. How much in total assets did the business acquire as a result of the two transactions? Identity each asset and show its balance. Choose from any list or enter any number in the input fields and then continue to the next