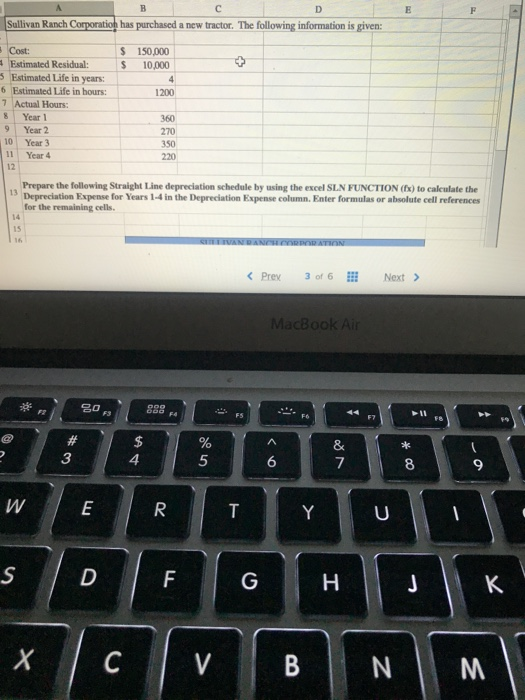

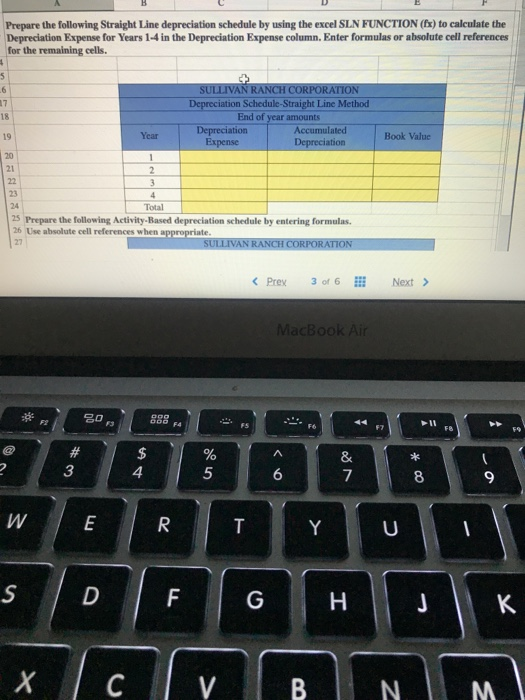

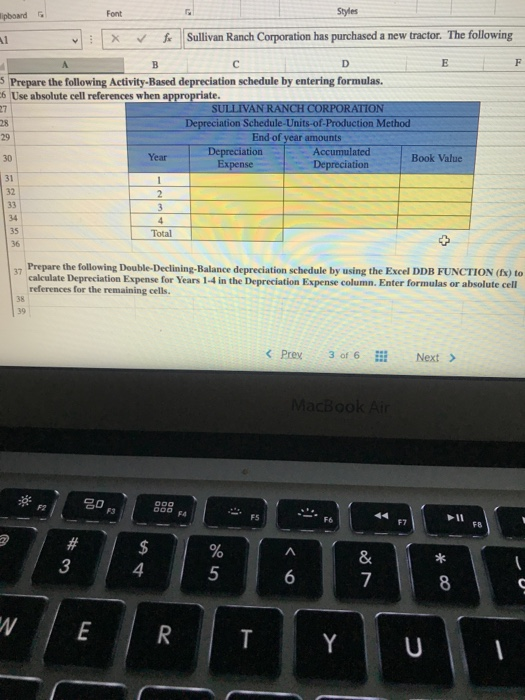

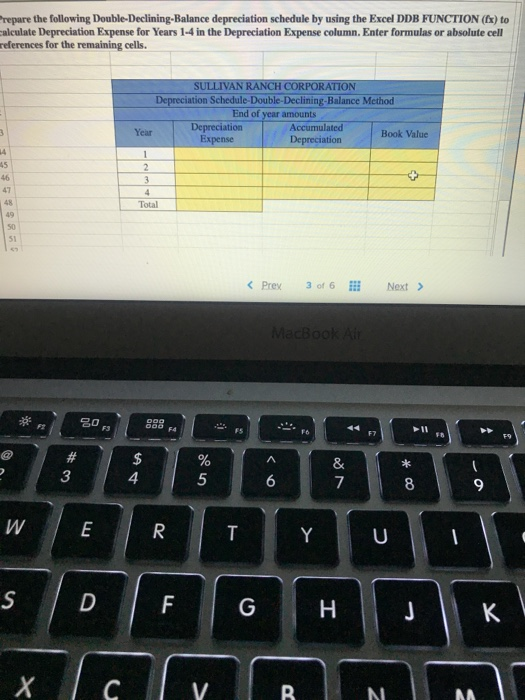

Sullivan Ranch Corporatioh has purchased a new tractor. The following information is given: $ $ 150,000 10.000 1200 Cost: Estimated Residual: Estimated Life in years: Estimated Life in hours: 7 Actual Hours: 3 Year 1 9 Year 2 10 Year 3 11 Year 4 12 360 270 350 220 Prepare the following Straight Line depreciation schedule by using the excel SLN FUNCTION(x) to calculate the 1 Depreciation Expense for Years 1-4 in the Depreciation Expense column. Enter formulas or absolute cell references for the remaining cells. UNDATION MacBook Air W M Prepare the following Straight Line depreciation schedule by using the excel SLN FUNCTION(x) to calculate the Depreciation Expense for Years 1-4 in the Depreciation Expense column. Enter formulas or absolute cell references for the remaining cells. SULLIVAN RANCH CORPORATION Depreciation Schedule-Straight Line Method End of year amounts Depreciation Accumulated Expense Depreciation Book Value 25 Prepare the following Activity-Based depreciation schedule by entering formulas. 26 Use absolute cell references when appropriate SULLIVAN RANCH CORPORATION E G ipboard Font Styles X Sullivan Ranch Corporation has purchased a new tractor. The following 5 Prepare the following Activity-Based depreciation schedule by entering formulas. 6 Use absolute cell references when appropriate. SULLIVAN RANCH CORPORATION Depreciation Schedule-Units-of-Production Method End of year amounts Depreciation Accumulated Book Value Expense Depreciation 2 Total Prepare the following Double Declining-Balance depreciation schedule by using the Excel DDB FUNCTION(x) to calculate Depreciation Expense for Years 1-4 in the Depreciation Expense column. Enter formulas or absolute cell references for the remaining cells. * E repare the following Double-Declining-Balance depreciation schedule by using the Excel DDB FUNCTION (Ex) to calculate Depreciation Expense for Years 1-4 in the Depreciation Expense column. Enter formulas or absolute cell references for the remaining cells. SULLIVAN RANCH SULLIVAN RANCH CORPORATION Depreciation Schedule-Double-Declining-Balance Method End of year amounts Year Depreciation Accumulated Book Value Expense Depreciation Total W